Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering...Read more

As a car owner, it’s essential to have an insurance policy that covers you in case of accidents, theft, or damage to your vehicle. One of the most comprehensive options available is State Farm Comprehensive Auto Insurance. However, understanding what this insurance policy covers can be a bit confusing, leaving many car owners unsure if it’s the right choice for them.

In this article, we’ll take a closer look at State Farm Comprehensive Auto Insurance and break down what it covers, so you can make an informed decision about your insurance needs. From accidents to natural disasters, we’ll explore the various scenarios where State Farm Comprehensive Auto Insurance can provide you with the protection you need to drive with peace of mind. So, buckle up and let’s dive into the world of State Farm Comprehensive Auto Insurance.

Contents

- State Farm Comprehensive Auto Insurance Coverage

- Frequently Asked Questions

- What does State Farm Comprehensive Auto Insurance cover?

- Does State Farm Comprehensive Auto Insurance cover rental cars?

- Does State Farm Comprehensive Auto Insurance cover windshield damage?

- Does State Farm Comprehensive Auto Insurance cover personal belongings in the car?

- Does State Farm Comprehensive Auto Insurance cover me if I hit a deer?

- what is comprehensive coverage state farm?

- Can I Keep Medicaid If My Job Offers Insurance?

- Does Smile Direct Club Take Medicaid Insurance?

- Does Life Insurance Payout Affect Medicaid?

State Farm Comprehensive Auto Insurance Coverage

State Farm is one of the leading insurance providers in the United States. Their comprehensive auto insurance coverage is designed to protect drivers from a wide range of risks and hazards. In this article, we will discuss what State Farm’s comprehensive auto insurance covers and why it is essential for every car owner to have.

What is Comprehensive Auto Insurance?

Comprehensive auto insurance is a type of coverage that protects you from damages to your car that are not caused by a collision. It covers a wide range of risks, including theft, vandalism, natural disasters, and animal collisions. Comprehensive insurance is typically an optional coverage, but it is highly recommended for car owners who want to protect their investment.

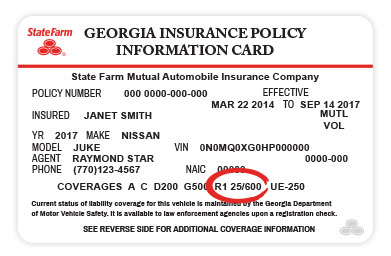

When you purchase comprehensive auto insurance from State Farm, you will be covered for the following:

- Theft and vandalism: If your car is stolen or vandalized, State Farm will cover the cost of repairs or replacement.

- Natural disasters: Comprehensive coverage also protects you from damages caused by natural disasters, such as floods, hurricanes, and earthquakes.

- Animal collisions: If you hit a deer, raccoon, or any other animal while driving, State Farm will cover the cost of repairs.

- Falling objects: If your car is damaged by a falling object, such as a tree branch or hail, State Farm will cover the cost of repairs.

Benefits of State Farm Comprehensive Auto Insurance

There are several benefits to purchasing comprehensive auto insurance from State Farm. First and foremost, it gives you peace of mind knowing that you are protected from a wide range of risks. If your car is damaged or stolen, you won’t have to worry about paying for repairs or replacement out of pocket.

In addition to this, State Farm offers several discounts that can help you save money on your insurance premiums. For example, if you have multiple cars insured with State Farm, you may be eligible for a multi-car discount. You can also save money by bundling your auto insurance with other types of insurance, such as homeowners or renters insurance.

Comprehensive Auto Insurance Vs. Collision

It’s essential to understand the difference between comprehensive and collision auto insurance. Collision insurance covers damages to your car that are caused by a collision with another car or object. Comprehensive insurance, on the other hand, covers damages to your car that are not caused by a collision.

If you have a newer car or a car that is financed, you may be required to have both collision and comprehensive coverage. However, if you have an older car that is paid off, you may be able to save money by only purchasing comprehensive coverage.

What is Not Covered by State Farm Comprehensive Auto Insurance?

It’s important to note that there are some things that are not covered by State Farm’s comprehensive auto insurance. For example, if you are in an accident that is your fault, your comprehensive coverage will not cover the cost of repairs. Additionally, if you have aftermarket parts or accessories on your car, they may not be covered by your comprehensive insurance.

It’s essential to read your policy carefully and understand what is and isn’t covered by your insurance. If you have any questions, don’t hesitate to contact your State Farm agent for clarification.

How to Purchase State Farm Comprehensive Auto Insurance

If you are interested in purchasing comprehensive auto insurance from State Farm, the first step is to get a quote. You can get a quote online or by contacting a State Farm agent. Once you have a quote, you can customize your coverage to meet your specific needs and budget.

In conclusion, State Farm comprehensive auto insurance is an essential coverage for every car owner. It protects you from a wide range of risks and gives you peace of mind knowing that you are covered in the event of an accident or theft. If you are interested in purchasing comprehensive auto insurance from State Farm, contact your local agent today.

Frequently Asked Questions

State Farm Comprehensive Auto Insurance provides protection for your vehicle against damages caused by non-collision events. Below are some common questions and answers about what is covered under this insurance policy.

What does State Farm Comprehensive Auto Insurance cover?

State Farm Comprehensive Auto Insurance provides coverage for damages to your vehicle caused by non-collision events such as theft, fire, natural disasters, falling objects, and vandalism. It also covers damages caused by hitting an animal.

Comprehensive coverage does not cover damages caused by collisions with other vehicles or objects. For that, you would need collision coverage, which is typically purchased in addition to comprehensive coverage.

Does State Farm Comprehensive Auto Insurance cover rental cars?

If you have comprehensive and collision coverage on your policy, State Farm Comprehensive Auto Insurance will cover the cost of a rental car while your vehicle is being repaired due to a covered claim. However, if you only have liability coverage, rental car coverage is not included.

It’s important to note that rental car coverage is subject to limits, so it’s a good idea to check with your State Farm agent to determine how much coverage you have.

Does State Farm Comprehensive Auto Insurance cover windshield damage?

Yes, State Farm Comprehensive Auto Insurance covers windshield damage caused by non-collision events such as flying debris, hail, or a fallen tree branch. However, if the damage is caused by a collision, you would need collision coverage to cover the cost of repairs or replacement.

It’s important to note that some states have specific rules regarding windshield repair or replacement, so it’s a good idea to check with your State Farm agent to determine what is covered in your state.

Does State Farm Comprehensive Auto Insurance cover personal belongings in the car?

State Farm Comprehensive Auto Insurance does not cover personal belongings that are stolen or damaged in your vehicle. However, your homeowners or renters insurance policy may provide coverage for personal belongings that are stolen or damaged while in your car.

It’s a good idea to check with your State Farm agent to determine what coverage you have for personal belongings both in and outside of your vehicle.

Does State Farm Comprehensive Auto Insurance cover me if I hit a deer?

Yes, State Farm Comprehensive Auto Insurance covers damages caused by hitting an animal such as a deer, moose, or elk. This coverage also includes damages caused by hitting a dog or cat.

It’s important to note that if you swerve to avoid hitting an animal and end up in a collision with another vehicle or object, the damages would not be covered under comprehensive coverage. For that, you would need collision coverage.

what is comprehensive coverage state farm?

In summary, State Farm Comprehensive Auto Insurance provides extensive coverage for drivers who want to protect their vehicles against unforeseen events that could cause damage or loss. From accidents, theft, and natural disasters to vandalism and falling objects, the policy offers peace of mind for drivers who want to be prepared for anything.

Whether you’re driving a new or used car, State Farm Comprehensive Auto Insurance can help you keep your investment safe. With a range of coverage options and deductibles to choose from, you can customize your policy to fit your unique needs and budget. So why wait? Contact State Farm today to learn more about how their comprehensive auto insurance can help you stay protected on the road.

Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering individuals to make well-informed decisions. Guided by his passion, he has assembled a team of seasoned insurance professionals committed to simplifying the intricate world of insurance for you.

- Latest Posts by Rakibul Hasan

-

Can I Keep Medicaid If My Job Offers Insurance?

- -

Does Smile Direct Club Take Medicaid Insurance?

- -

Does Life Insurance Payout Affect Medicaid?

- All Posts