Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering...Read more

As an American citizen, accessing affordable healthcare is a basic need. Medicaid has been a crucial program that has helped many low-income families and individuals access healthcare they would have otherwise been unable to afford. However, for those who have jobs that offer health insurance, the question of whether they can keep Medicaid arises. It is a valid concern, and one that requires clarity and understanding.

The answer to whether you can keep Medicaid if your job offers insurance is not a simple one. It depends on several factors, including the type of insurance your employer offers, your income level, and the state you live in. In this article, we will explore these factors and provide you with clear and concise information that will help you make an informed decision about your healthcare coverage. So, let’s dive in and find out whether you can keep Medicaid if your job offers insurance.

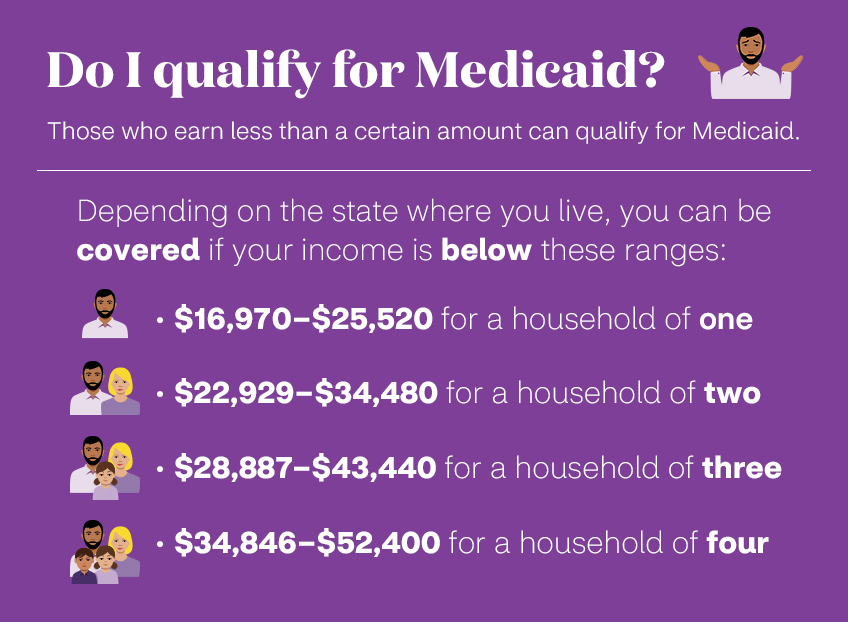

Yes, you can keep Medicaid if your job offers insurance, but it depends on your income. If your income is below a certain level, you may qualify to keep Medicaid as your primary insurance. However, if your income is above that level, you may need to enroll in your employer’s insurance plan and use Medicaid as a secondary insurance. It’s important to check with your state’s Medicaid office to see what options are available to you.

Contents

- Can I Keep Medicaid if My Job Offers Insurance?

- Frequently Asked Questions

- Can I keep Medicaid if my job offers insurance?

- What is the Medicaid buy-in program?

- What happens if I lose my job and my employer-sponsored health insurance?

- Can I enroll in both Medicaid and employer-sponsored health insurance?

- What should I do if I have questions about my Medicaid coverage?

- Can Life Insurance Affect Medicaid Eligibility?

- Does Smile Direct Club Take Medicaid Insurance?

- Does Life Insurance Payout Affect Medicaid?

- Does Medicaid Cover Car Insurance?

Can I Keep Medicaid if My Job Offers Insurance?

If you are currently enrolled in Medicaid but your job is now offering health insurance, you may be wondering if you can keep your Medicaid coverage. The answer is not a simple yes or no, as it depends on various factors. In this article, we will explore the options available to you and help you make an informed decision.

Understanding Medicaid

Medicaid is a government-funded health insurance program for low-income individuals and families. It covers a wide range of medical services, including doctor visits, hospital stays, prescription drugs, and more. To qualify for Medicaid, you must meet certain income requirements and other eligibility criteria set by your state.

Benefits of Medicaid

One of the main benefits of Medicaid is that it provides affordable healthcare to those who might otherwise not be able to afford it. Medicaid also covers many services that other health insurance plans may not, such as long-term care for the elderly and disabled. In addition, Medicaid has no deductibles or copays, which can save you a lot of money in out-of-pocket expenses.

Disadvantages of Medicaid

One of the main disadvantages of Medicaid is that it may not provide as much choice and flexibility as other health insurance plans. Some doctors and hospitals may not accept Medicaid, which can limit your options for healthcare providers. In addition, Medicaid may not cover certain services or treatments that you may need.

What Happens When Your Job Offers Health Insurance?

If you are enrolled in Medicaid and your job offers health insurance, you have a few options. You can choose to keep your Medicaid coverage and decline your employer’s insurance, or you can enroll in your employer’s insurance and drop your Medicaid coverage.

Benefits of Employer-Sponsored Health Insurance

Employer-sponsored health insurance plans often provide more options and flexibility than Medicaid. You can choose from a range of plans and providers, and you may have more control over your healthcare decisions. In addition, many employers offer wellness programs and other incentives to encourage healthy behavior.

Disadvantages of Employer-Sponsored Health Insurance

One of the main disadvantages of employer-sponsored health insurance is that it can be expensive. Even with employer subsidies, you may have to pay a significant portion of your healthcare costs out of pocket. In addition, your employer may change or eliminate your health insurance plan, which can be disruptive to your healthcare.

Can You Keep Both Medicaid and Employer-Sponsored Health Insurance?

In some cases, you may be able to keep both Medicaid and employer-sponsored health insurance. This is known as “dual coverage.” However, dual coverage is not always allowed, and it may not be the best option for everyone.

Benefits of Dual Coverage

If you have dual coverage, you can use both plans to pay for your healthcare expenses. This can be especially helpful if you have high medical costs or if your employer-sponsored plan has deductibles or copays. In addition, dual coverage can provide more flexibility and choice in healthcare providers.

Disadvantages of Dual Coverage

One of the main disadvantages of dual coverage is that it can be complicated and confusing. You may have to coordinate benefits between the two plans, which can be time-consuming and stressful. In addition, dual coverage may not be cost-effective if you do not have high medical expenses.

Conclusion

Deciding whether to keep Medicaid or enroll in your employer’s health insurance plan can be a difficult decision. Ultimately, the best choice depends on your individual circumstances and healthcare needs. Be sure to consider the benefits and drawbacks of each option before making a decision. If you are unsure, consider speaking with a healthcare professional or insurance expert to help you make an informed choice.

Frequently Asked Questions

Here are some of the frequently asked questions about keeping Medicaid if your job offers insurance:

Can I keep Medicaid if my job offers insurance?

Yes, you may be able to keep your Medicaid coverage even if your job offers insurance. However, it depends on your income and the cost of your employer-sponsored health insurance.

If the cost of the employer-sponsored health insurance is more than 9.5% of your household income, then you may be eligible to keep your Medicaid coverage. You should contact your state Medicaid agency to find out if you qualify for Medicaid while also having access to employer-sponsored health insurance.

What is the Medicaid buy-in program?

The Medicaid buy-in program is a program that allows people with disabilities to continue receiving Medicaid coverage even if they are employed and earning more than the Medicaid income limits. This program allows people with disabilities to continue receiving necessary medical care while also working and earning an income.

The eligibility requirements for the Medicaid buy-in program vary by state, so you should contact your state Medicaid agency to find out if you qualify for this program.

What happens if I lose my job and my employer-sponsored health insurance?

If you lose your job and your employer-sponsored health insurance, you may be eligible to reapply for Medicaid coverage. Losing your job and health insurance can be considered a qualifying life event, which allows you to enroll in a new health insurance plan outside of the regular open enrollment period.

You should contact your state Medicaid agency or the Health Insurance Marketplace to find out what options are available to you if you lose your job and health insurance.

Can I enroll in both Medicaid and employer-sponsored health insurance?

Yes, in some cases, you may be able to enroll in both Medicaid and employer-sponsored health insurance. However, you should check with your employer to see if they offer a plan that is compatible with Medicaid.

You should also check with your state Medicaid agency to see if they allow “dual enrollment,” which is when you are enrolled in both Medicaid and another health insurance plan.

What should I do if I have questions about my Medicaid coverage?

If you have questions about your Medicaid coverage, you should contact your state Medicaid agency. They can provide you with information about your eligibility, benefits, and any changes to your coverage.

You can also contact the Health Insurance Marketplace if you have questions about health insurance options outside of Medicaid.

Can Life Insurance Affect Medicaid Eligibility?

In summary, the answer to the question “Can I keep Medicaid if my job offers insurance?” depends on your income and the state you live in. If your job offers insurance that meets the Affordable Care Act’s minimum standards and is considered affordable, you may no longer be eligible for Medicaid. However, if your income is low enough, you may still qualify for Medicaid even if your job offers insurance.

It’s important to note that losing Medicaid coverage due to job-based insurance does not mean you will be left without any coverage. You may still be eligible for subsidized insurance through the Health Insurance Marketplace or your employer. It’s crucial to research and understand your options to ensure you have the best coverage for your needs and budget.

Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering individuals to make well-informed decisions. Guided by his passion, he has assembled a team of seasoned insurance professionals committed to simplifying the intricate world of insurance for you.

- Latest Posts by Rakibul Hasan

-

Does Smile Direct Club Take Medicaid Insurance?

- -

Does Life Insurance Payout Affect Medicaid?

- -

Does Medicaid Cover Car Insurance?

- All Posts