Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering...Read more

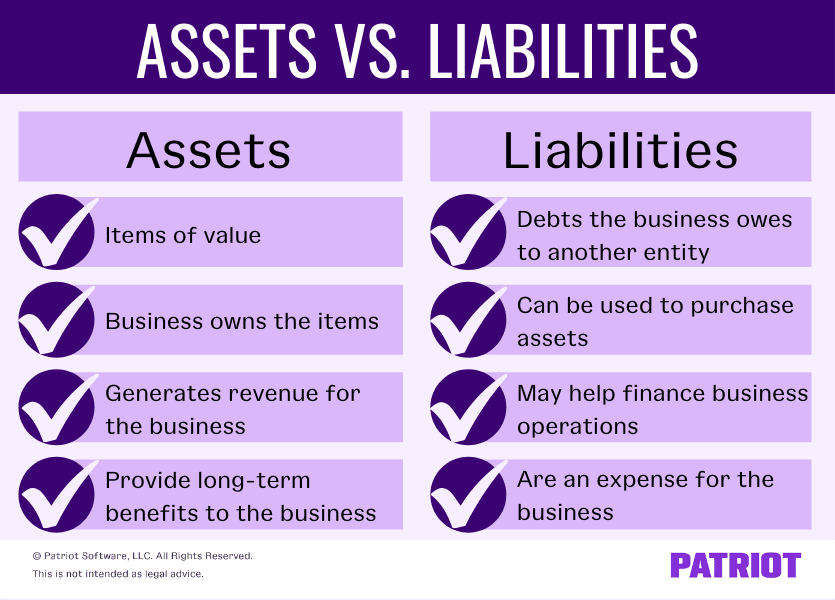

Auto insurance is a crucial aspect of car ownership. It’s a financial safety net that can protect you from losses that may arise in the event of an accident or theft. However, the question that often arises is whether auto insurance is a liability or asset. While some people may view it as an unnecessary expense, others argue that it’s a valuable investment that provides peace of mind and protection.

There are various factors to consider when determining whether auto insurance is a liability or asset. These include the type of coverage you have, your driving record, the age and condition of your car, and the cost of the insurance policy. In this article, we will explore the different perspectives on this topic and help you understand the role of auto insurance in your financial life.

Contents

- Is Auto Insurance a Liability or Asset?

- Frequently Asked Questions

- What is auto insurance and why is it important?

- Is auto insurance a liability or an asset?

- What factors affect the cost of auto insurance?

- How can I save money on auto insurance?

- What should I do if I am in an accident?

- Liability Auto Insurance 101

- Can I Keep Medicaid If My Job Offers Insurance?

- Does Smile Direct Club Take Medicaid Insurance?

- Does Life Insurance Payout Affect Medicaid?

Is Auto Insurance a Liability or Asset?

Auto insurance is a necessary expense for car owners. However, many people wonder whether it is a liability or an asset. The truth is that it can be both, depending on how you use it. In this article, we will explore the various aspects of auto insurance and determine whether it is a liability or asset.

Liability Protection

Auto insurance provides liability protection, which means that it covers the damages and injuries you cause to others in an accident. Liability protection is mandatory in most states in the US, and the minimum coverage varies from state to state.

Liability protection is a liability in the sense that you have to pay a premium for it. However, it is also an asset because it protects you from financial ruin in case of an accident. Without liability protection, you would have to pay for the damages and injuries out of your pocket, which can be a significant financial burden.

Asset Protection

Auto insurance can also provide asset protection. Comprehensive and collision coverage are optional coverages that protect your car from damages caused by accidents, theft, vandalism, and natural disasters.

Comprehensive and collision coverage are assets because they protect your car, which is a valuable asset. Without these coverages, you would have to pay for the damages to your car out of your pocket, which can be expensive.

Benefits of Auto Insurance

Auto insurance has several benefits, which make it an asset. First, it provides peace of mind. Knowing that you have insurance coverage can give you peace of mind, especially when you are driving on busy roads.

Second, auto insurance can save you money in the long run. Accidents can be expensive, and without insurance, you would have to pay for the damages out of your pocket. However, with insurance, you only have to pay your deductible, and the insurance company will cover the rest of the damages.

Third, auto insurance can provide legal protection. If you are involved in an accident, you may need legal representation. Auto insurance can provide legal representation, which can save you time and money.

Liability vs. Asset

Auto insurance can be both a liability and an asset, depending on how you use it. Liability protection is a liability in the sense that you have to pay a premium for it. However, it is also an asset because it protects you from financial ruin in case of an accident.

Comprehensive and collision coverage are assets because they protect your car, which is a valuable asset. Without these coverages, you would have to pay for the damages to your car out of your pocket, which can be expensive.

Types of Auto Insurance

Auto insurance comes in several types, including liability, collision, comprehensive, and personal injury protection. Liability insurance is mandatory in most states and covers damages and injuries you cause to others in an accident. Collision coverage covers damages to your car caused by an accident. Comprehensive coverage covers damages to your car caused by theft, vandalism, and natural disasters. Personal injury protection covers medical expenses and lost wages in case of an accident.

Factors Affecting Auto Insurance Premiums

Several factors affect auto insurance premiums, including your driving record, age, gender, location, type of car, and coverage limits. If you have a clean driving record, you will likely pay lower premiums than someone with a history of accidents or tickets. Younger drivers and male drivers typically pay higher premiums than older drivers and female drivers.

The location where you live can also affect your premiums. If you live in a high-crime area or an area with a high incidence of accidents, you will likely pay higher premiums. The type of car you drive can also affect your premiums. Sports cars are typically more expensive to insure than sedans or SUVs. Finally, the coverage limits you choose can also affect your premiums. Higher coverage limits will result in higher premiums.

How to Save Money on Auto Insurance

Auto insurance can be expensive, but there are ways to save money on it. First, shop around and compare quotes from different insurance companies. Second, raise your deductible, which will lower your premiums. Third, ask for discounts, such as safe driver discounts, multi-car discounts, and bundling discounts.

Fourth, maintain a good credit score, as insurance companies use it to determine your premiums. Finally, drive safely and avoid accidents and tickets, as a clean driving record can lower your premiums.

Conclusion

In conclusion, auto insurance can be both a liability and an asset, depending on how you use it. Liability protection is a liability in the sense that you have to pay a premium for it. However, it is also an asset because it protects you from financial ruin in case of an accident. Comprehensive and collision coverage are assets because they protect your car, which is a valuable asset. Auto insurance has several benefits, including peace of mind, cost savings, and legal protection. By understanding the different types of auto insurance, the factors that affect premiums, and how to save money on it, you can make informed decisions about your coverage.

Frequently Asked Questions

What is auto insurance and why is it important?

Auto insurance is a type of insurance policy that provides financial protection to the policyholder in case of an accident, theft, or damage to the vehicle. It is important because it can help cover the cost of repairs, medical bills, and legal fees that may arise from an accident. Without auto insurance, you could be held personally responsible for these costs, which could be financially devastating.

Additionally, many states require drivers to have a minimum amount of auto insurance coverage in order to legally operate a vehicle. Failing to have the required coverage could result in fines, license suspension, or even legal trouble.

Is auto insurance a liability or an asset?

Auto insurance can be both a liability and an asset, depending on how you look at it. On one hand, it is a liability because it is an expense that you have to pay every month or year. However, it is also an asset because it provides financial protection and peace of mind in case of an accident or other incident.

Furthermore, having auto insurance can actually be beneficial to your overall financial health. If you are ever in an accident, you may be able to receive compensation from your insurance company, which can help cover the cost of repairs, medical bills, and other expenses. This can help prevent you from going into debt or having to dip into your savings to cover these costs.

What factors affect the cost of auto insurance?

There are many factors that can affect the cost of auto insurance, including your age, driving record, location, type of vehicle, and more. Generally, younger drivers and those with a poor driving record will have higher insurance rates than older, more experienced drivers with a clean record.

The type of vehicle you drive can also affect your insurance rates. Cars that are more expensive to repair or replace, or that are more likely to be stolen, may have higher insurance rates. Additionally, your location can play a role in your insurance rates, as some areas may have higher rates of accidents or thefts.

How can I save money on auto insurance?

There are several ways to save money on auto insurance. One of the most effective ways is to shop around and compare rates from different insurance companies. You may be able to find a better deal by switching providers or adjusting your coverage.

Other ways to save money on auto insurance include maintaining a clean driving record, choosing a higher deductible, and taking advantage of any discounts that may be available to you. Some insurance companies offer discounts for things like bundling multiple policies, completing a defensive driving course, or having certain safety features on your vehicle.

What should I do if I am in an accident?

If you are in an accident, the first thing you should do is make sure that everyone involved is safe and call for medical help if needed. Then, exchange contact and insurance information with the other driver(s) and take photos of the damage if possible.

Next, contact your insurance company to report the accident and start the claims process. Your insurance company will guide you through the process and may provide assistance with things like arranging for repairs, getting a rental car, and dealing with medical bills. Be sure to cooperate fully with your insurance company and provide all necessary information and documentation.

Liability Auto Insurance 101

As a professional writer, it is clear that auto insurance is both a liability and an asset. On one hand, auto insurance is a liability as it is an added expense to one’s monthly budget. However, on the other hand, auto insurance is an asset as it provides financial protection and peace of mind in the event of an accident or theft.

It is important to note that having auto insurance is not just a legal requirement, but a responsible decision as well. Without it, the financial consequences of an accident or theft can be devastating. By paying a relatively small amount each month, drivers can protect themselves and their assets from potentially life-changing events. In this sense, auto insurance can be seen as a valuable asset that offers protection and financial security.

In conclusion, while auto insurance may be viewed as a liability due to its added cost, it is ultimately an asset that provides essential protection and peace of mind. It is crucial for drivers to recognize the importance of having auto insurance and to invest in a policy that meets their needs and offers adequate coverage. By doing so, drivers can rest easy knowing that they are prepared for any situation that may arise on the road.

Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering individuals to make well-informed decisions. Guided by his passion, he has assembled a team of seasoned insurance professionals committed to simplifying the intricate world of insurance for you.

- Latest Posts by Rakibul Hasan

-

Can I Keep Medicaid If My Job Offers Insurance?

- -

Does Smile Direct Club Take Medicaid Insurance?

- -

Does Life Insurance Payout Affect Medicaid?

- All Posts