Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering...Read more

In the world of insurance, life insurance is often seen as the most important type of coverage. It provides financial security for loved ones in the event of an unexpected death. However, despite its importance, life insurance can be a difficult product to market effectively. That’s where social media comes in. With its vast reach and ability to target specific demographics, social media can be a game-changer for life insurance companies looking to expand their customer base.

But how do you effectively market life insurance on social media? It’s a question that many insurance companies are grappling with. In this article, we’ll explore some strategies that can help you reach your target audience, build brand awareness, and ultimately boost your sales. From crafting engaging content to leveraging social media influencers, we’ll cover all the tactics that can help you succeed in the competitive world of life insurance marketing on social media. So, if you’re an insurance marketer looking to up your game, keep reading to learn how to market life insurance on social media like a pro.

To market life insurance on social media, follow these steps:

- Create a social media strategy that targets your ideal audience.

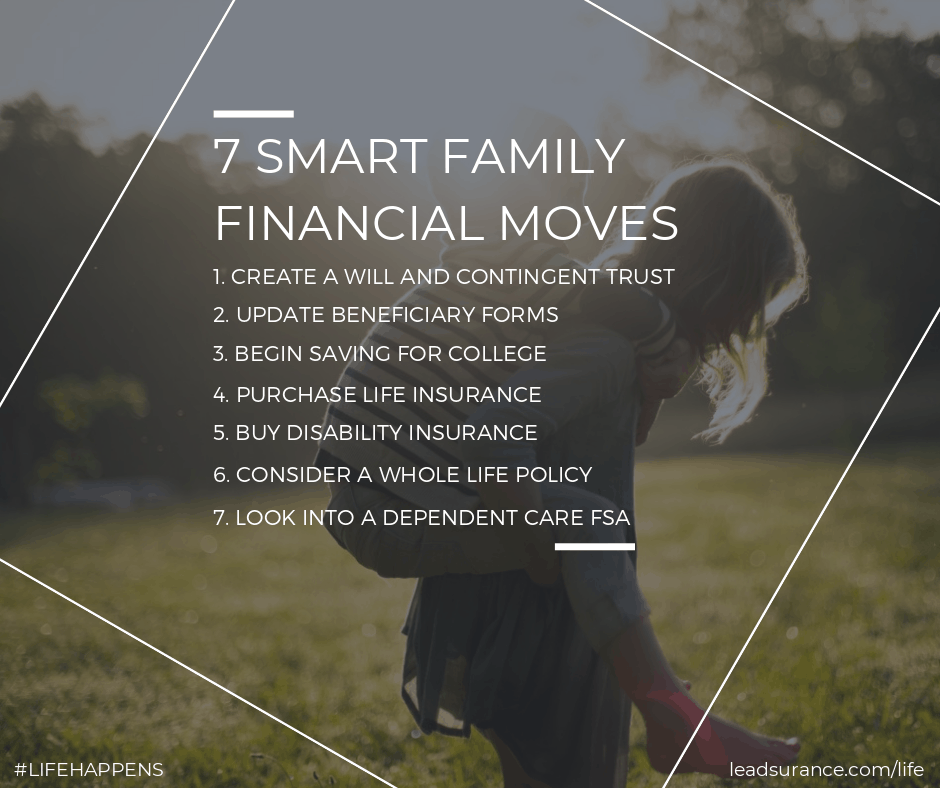

- Use visual content such as images and videos to grab attention.

- Focus on the benefits of life insurance, such as financial security and peace of mind.

- Engage with your audience by responding to comments and messages.

- Measure your success using analytics to adjust your strategy as needed.

Contents

- Marketing Life Insurance on Social Media: A Comprehensive Guide

- Understanding Your Target Audience

- Choose the Right Social Media Platform

- Create Engaging Content

- Use Targeted Advertising

- Build Relationships with Your Audience

- Measure and Analyze Your Results

- Benefits of Marketing Life Insurance on Social Media

- Challenges of Marketing Life Insurance on Social Media

- Conclusion

- Frequently Asked Questions

- How can social media help in marketing life insurance?

- What are some effective social media strategies for marketing life insurance?

- How can I measure the success of my social media marketing efforts?

- What are some common mistakes to avoid when marketing life insurance on social media?

- How can I stay up-to-date on the latest social media marketing trends for life insurance?

- Can I Keep Medicaid If My Job Offers Insurance?

- Does Smile Direct Club Take Medicaid Insurance?

- Does Life Insurance Payout Affect Medicaid?

Marketing Life Insurance on Social Media: A Comprehensive Guide

In today’s digital age, social media has become an integral part of our lives. It is a powerful tool that allows businesses to connect with their target audience and potential customers. In this article, we will discuss how to effectively market life insurance on social media.

Understanding Your Target Audience

The first step in marketing life insurance on social media is to understand your target audience. You need to identify who your potential customers are and what their needs and wants are. This will help you create relevant and engaging content that resonates with them.

One way to understand your target audience is to conduct market research. You can use social media analytics tools to gather data on your audience’s demographics, interests, and behavior. This information will help you create targeted content that speaks directly to their needs.

Choose the Right Social Media Platform

Choosing the right social media platform is crucial for the success of your life insurance marketing campaign. Each platform has its unique features, audience, and communication style. You need to select the platform that aligns with your marketing goals and target audience.

For example, if your target audience is young adults, then Instagram and Snapchat may be the best platforms to reach them. On the other hand, if your target audience is professionals and business owners, then LinkedIn may be the most effective platform to connect with them.

Create Engaging Content

Creating engaging content is the key to a successful social media marketing campaign. You need to create content that is relevant, informative, and entertaining. Your content should also be visually appealing and shareable.

You can create different types of content, such as blog posts, videos, infographics, and images. You can also use user-generated content to engage your audience and build trust.

Use Targeted Advertising

Social media advertising allows you to target specific audiences based on their demographics, interests, and behavior. This means that you can reach potential customers who are most likely to be interested in your life insurance products.

You can create different types of ads, such as sponsored posts, display ads, and video ads. You can also use retargeting ads to reach people who have already shown an interest in your products.

Build Relationships with Your Audience

Social media is all about building relationships with your audience. You need to engage with your followers, answer their questions, and provide them with value. This will help you build trust and establish yourself as an authority in the life insurance industry.

You can also use social media to provide customer support and address any concerns or issues your customers may have. This will help you improve your customer service and build a loyal customer base.

Measure and Analyze Your Results

Measuring and analyzing your results is crucial for the success of your social media marketing campaign. You need to track your metrics, such as engagement rate, reach, and conversions, to see how your campaign is performing.

You can use social media analytics tools to gather data and insights about your audience’s behavior and preferences. This information will help you optimize your campaign and improve your results.

Benefits of Marketing Life Insurance on Social Media

Marketing life insurance on social media has many benefits. It allows you to reach a wider audience, build trust and credibility, and generate leads and conversions. It also allows you to provide value to your customers and establish yourself as an authority in the industry.

Challenges of Marketing Life Insurance on Social Media

Marketing life insurance on social media also has its challenges. One of the main challenges is to create content that is engaging and informative without being too salesy. Another challenge is to comply with the regulatory requirements of the insurance industry.

Conclusion

In conclusion, social media is a powerful tool for marketing life insurance. By understanding your target audience, choosing the right platform, creating engaging content, using targeted advertising, building relationships with your audience, and measuring your results, you can create a successful social media marketing campaign. Keep in mind the benefits and challenges of marketing life insurance on social media and always stay compliant with the regulatory requirements of the industry.

Frequently Asked Questions

Social media is a powerful tool for marketing life insurance. As a life insurance agent, you can use social media platforms to reach out to potential customers, build brand awareness, and establish a strong online presence. By creating engaging content, sharing informative posts, and responding to customer queries, you can establish yourself as an expert in the field and build a loyal following.

However, it is important to remember that social media marketing is not a one-size-fits-all approach. Each platform has its own strengths and weaknesses, and you need to tailor your strategy accordingly. For instance, Facebook is great for building a community of followers, while LinkedIn is better suited for B2B marketing. By understanding the nuances of each platform, you can create a targeted social media strategy that maximizes your reach and boosts your sales.

There are several social media strategies that can be effective for marketing life insurance. One approach is to create educational content that helps people understand the importance of life insurance and how it can protect their loved ones. This could include blog posts, infographics, or videos that explain the different types of life insurance policies and their benefits.

Another strategy is to leverage the power of social proof. By sharing testimonials and success stories from satisfied customers, you can build trust and credibility with your audience. You can also use social media to showcase your expertise by sharing industry news, thought leadership content, and updates on the latest trends in life insurance.

Finally, it is important to engage with your audience on social media. Respond to comments and messages promptly, and participate in relevant groups and discussions. By building relationships with your followers, you can create a loyal customer base that will help you grow your business over time.

Measuring the success of your social media marketing efforts is essential to understanding what is working and what is not. Some key metrics to track include engagement rates, reach, and conversion rates. Engagement measures how many people are interacting with your content, while reach measures how many people are seeing it. Conversion rates measure how many people are taking action based on your social media content, such as filling out a quote form or requesting more information.

To track these metrics, you can use social media analytics tools such as Hootsuite, Buffer, or Sprout Social. These tools can provide detailed reports on your social media performance, including data on your audience demographics, engagement rates, and top-performing content. By analyzing this data regularly, you can refine your social media strategy and optimize your results over time.

One common mistake to avoid when marketing life insurance on social media is being too salesy. People do not want to be bombarded with sales pitches on their social media feeds. Instead, focus on creating valuable content that educates and informs your audience. This will help build trust and establish you as an expert in the field.

Another mistake to avoid is neglecting your audience. Social media is a two-way conversation, and it is important to engage with your followers and respond to their comments and questions. Failure to do so can make your brand appear unapproachable and unresponsive.

Finally, it is important to be mindful of compliance when marketing life insurance on social media. Make sure you are following all regulations and guidelines set forth by your state and the insurance industry. This can include properly disclosing your affiliation with your insurance carrier, avoiding misleading claims or advertising, and providing accurate information about your products and services.

Staying up-to-date on the latest social media marketing trends for life insurance is essential to creating a successful social media strategy. One way to do this is to follow industry thought leaders and influencers on social media. This can include insurance carriers, industry associations, and individual agents who are active on social media.

You can also attend industry conferences and events, such as the National Association of Insurance Commissioners (NAIC) conference, to learn about the latest trends and best practices in social media marketing. Additionally, subscribing to industry publications and blogs, such as Insurance Journal, can provide you with valuable insights and updates on the latest industry news and trends. Finally, networking with other agents and industry professionals can also help you stay up-to-date on the latest social media marketing trends and strategies.

After exploring the various strategies for marketing life insurance on social media, it’s clear that this avenue holds immense potential for insurance agents and companies. With the right approach, social media can be used to build relationships with potential clients, establish credibility and trust, and ultimately convert leads into sales.

The key to success on social media lies in understanding the platforms you’re using and the people you’re trying to reach. By creating engaging, informative content that speaks directly to your target audience, you can position yourself as a trusted advisor and build a loyal following. Additionally, by leveraging the power of visual media and social proof, you can create a sense of urgency and drive conversions. Overall, the opportunities for marketing life insurance on social media are vast, and those who take advantage of them are sure to see significant growth in their business.

Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering individuals to make well-informed decisions. Guided by his passion, he has assembled a team of seasoned insurance professionals committed to simplifying the intricate world of insurance for you.

- Latest Posts by Rakibul Hasan

-

Can I Keep Medicaid If My Job Offers Insurance?

- -

Does Smile Direct Club Take Medicaid Insurance?

- -

Does Life Insurance Payout Affect Medicaid?

- All Posts