Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering...Read more

Health insurance is a crucial aspect of modern-day life, and it is essential to have the right coverage to protect oneself from unexpected medical expenses. While the Affordable Care Act (ACA) has made it easier for individuals to purchase health insurance through the Marketplace, some people may still prefer to buy individual health insurance outside of the Marketplace. But is it possible to do so? In this article, we will explore the question, “can I buy individual health insurance outside of the Marketplace?” and provide a comprehensive answer.

For many people, the idea of purchasing health insurance outside of the Marketplace can seem daunting, especially with the complex healthcare landscape in the United States. However, there are several options available for individuals who seek to purchase individual health insurance outside of the Marketplace. From private insurers to insurance brokers, this article will guide you through the different avenues available and help you make an informed decision about your health insurance coverage. So, let’s dive in and explore the world of individual health insurance!

Can I Buy Individual Health Insurance Outside of the Marketplace?

Individual health insurance can be a valuable asset for those who are not covered under employer-sponsored health insurance plans. While the Affordable Care Act (ACA) created the Health Insurance Marketplace to make it easier for individuals to purchase affordable health insurance coverage, many people wonder if they can buy individual health insurance outside of the Marketplace. In this article, we will explore the options available for purchasing individual health insurance outside of the Marketplace.

Understanding the Health Insurance Marketplace

The Health Insurance Marketplace, also known as the ACA Marketplace or Obamacare, is a website where individuals can shop for and purchase health insurance. The Marketplace allows individuals to compare health insurance plans and choose the one that best fits their needs and budget. The Marketplace also offers financial assistance to help individuals pay for their health insurance premiums.

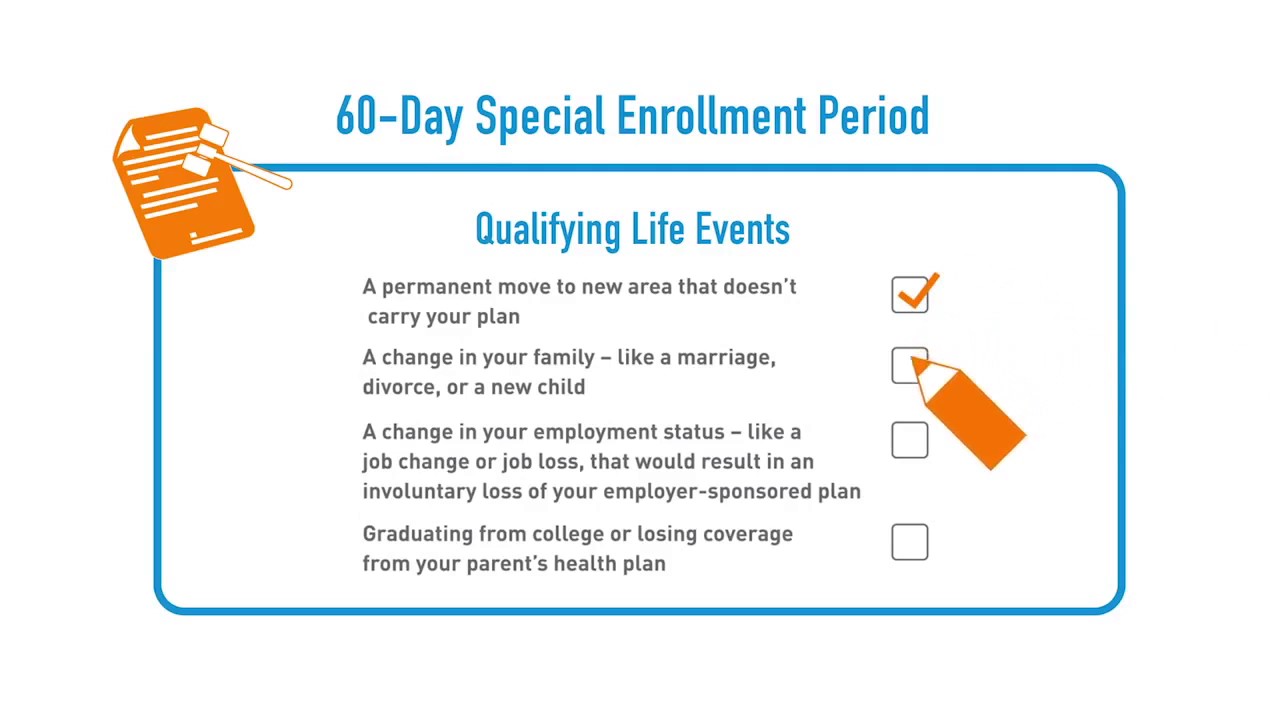

However, not everyone is eligible to purchase health insurance through the Marketplace. To be eligible, you must live in the United States, be a U.S. citizen or legal resident, and not have access to affordable health insurance through your employer. If you do not meet these requirements, you may need to purchase individual health insurance outside of the Marketplace.

Options for Purchasing Individual Health Insurance Outside of the Marketplace

If you are not eligible to purchase health insurance through the Marketplace or if you simply prefer to purchase health insurance outside of the Marketplace, there are several options available to you. Some of these options include:

1. Health Insurance Brokers

Health insurance brokers are licensed professionals who can help you find and purchase individual health insurance. Brokers work with several different insurance companies and can help you compare plans and prices. They can also provide expert advice on which plan is best for your needs and budget.

2. Insurance Companies

Most insurance companies offer individual health insurance plans that you can purchase directly from them. You can visit an insurance company’s website or call their customer service department to learn more about their plans and prices.

3. Private Health Insurance Exchanges

Private health insurance exchanges are similar to the Marketplace, but they are run by private companies instead of the government. These exchanges allow you to shop for and purchase health insurance from several different insurance companies.

Benefits of Purchasing Individual Health Insurance Outside of the Marketplace

While the Marketplace can be a great resource for purchasing health insurance, there are also benefits to purchasing individual health insurance outside of the Marketplace. Some of these benefits include:

1. More Plan Options

When you purchase health insurance outside of the Marketplace, you have access to a wider range of plan options. This can be especially beneficial if you have specific health care needs or preferences.

2. Lower Premiums

In some cases, you may be able to find a health insurance plan with a lower premium if you purchase outside of the Marketplace. This is because insurance companies can offer different prices and discounts outside of the Marketplace.

3. More Flexibility

When you purchase health insurance outside of the Marketplace, you have more flexibility in choosing your plan and coverage. You can choose a plan that fits your specific needs and budget, rather than being limited to the plans offered by the Marketplace.

Purchasing Individual Health Insurance Outside of the Marketplace vs the Marketplace

While there are benefits to purchasing individual health insurance outside of the Marketplace, there are also some drawbacks to consider. Here are some of the key differences between purchasing health insurance outside of the Marketplace and through the Marketplace:

Purchasing Outside of the Marketplace:

– More plan options

– Lower premiums

– More flexibility

– No financial assistance

Purchasing Through the Marketplace:

– Financial assistance available

– Guaranteed coverage for pre-existing conditions

– Standardized plan options

– No medical underwriting

Ultimately, the decision to purchase individual health insurance through the Marketplace or outside of the Marketplace will depend on your individual needs and preferences. It is important to carefully consider your options and do your research before making a decision.

Frequently Asked Questions

Can I Buy Individual Health Insurance Outside of the Marketplace?

Yes, you can purchase individual health insurance outside of the Health Insurance Marketplace. The Marketplace is designed to help individuals and families who are not eligible for employer-sponsored insurance to find and purchase affordable health insurance. However, if you do not qualify for subsidies or tax credits through the Marketplace, you may be able to find a better deal by purchasing insurance directly from a private insurer.

It’s important to note that insurance policies sold outside of the Marketplace may not offer the same benefits and protections as those sold through the Marketplace. For example, they may not be required to cover essential health benefits or provide financial assistance if you have a pre-existing condition. Be sure to carefully review the terms of any policy you are considering before making a purchase.

What are the Benefits of Buying Individual Health Insurance Outside of the Marketplace?

One of the main benefits of purchasing individual health insurance outside of the Marketplace is that you may be able to find a better deal on premiums. Insurance companies are not required to offer the same plans or pricing through the Marketplace as they do outside of it, so it’s worth shopping around to compare your options.

Additionally, purchasing insurance outside of the Marketplace may give you more flexibility in terms of the benefits and coverage you need. If you have specific health needs or preferences, you may be able to find a policy that better meets your needs by working directly with an insurance provider. However, it’s important to carefully review the terms and coverage of any policy you are considering before making a purchase.

In today’s dynamic healthcare landscape, purchasing individual health insurance outside of the marketplace is a common concern for many Americans. The good news is that there are options available for those who do not qualify for subsidies or prefer to purchase coverage outside of the marketplace. While navigating the complex world of health insurance can be daunting, it is important to do your research, compare plans, and work with a licensed insurance agent to find the right coverage that meets your needs and budget.

Before making any decision, it is essential to understand the potential risks and benefits of purchasing individual health insurance outside of the marketplace. While you may have more flexibility and choice when it comes to selecting a plan, you may also face higher premiums, limited benefits, and fewer consumer protections. Ultimately, the decision to buy individual health insurance outside of the marketplace depends on your personal circumstances, including your health status, income, and preferences. With careful consideration and a thorough understanding of your options, you can find the right coverage to protect your health and financial well-being.

Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering individuals to make well-informed decisions. Guided by his passion, he has assembled a team of seasoned insurance professionals committed to simplifying the intricate world of insurance for you.

- Latest Posts by Rakibul Hasan

-

Can I Keep Medicaid If My Job Offers Insurance?

- -

Does Smile Direct Club Take Medicaid Insurance?

- -

Does Life Insurance Payout Affect Medicaid?

- All Posts