Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering...Read more

As the number of illegal immigrants in the United States continues to rise, many are left wondering if these individuals are eligible for life insurance. The answer to this question is not a simple one, as it depends on various factors such as the insurance company’s policies and the individual’s legal status.

While some insurance companies may offer life insurance policies to illegal immigrants, others may not. Some companies require applicants to have a valid social security number or a green card, which can be a barrier for those without legal documentation. However, there are also insurance companies that do not require these documents and may offer policies to individuals regardless of their legal status. In this article, we will explore the various factors that can impact an illegal immigrant’s ability to obtain life insurance and what options may be available to them.

Generally, illegal immigrants cannot get life insurance in the United States as they do not have a Social Security number. Insurers require a Social Security number to verify the identity and assess the risk of an applicant. However, some insurance companies offer policies specifically designed for non-U.S. citizens or those without a Social Security number. It’s best to consult with an insurance agent to understand the options available.

Can Illegal Immigrants Get Life Insurance?

Illegal immigration has been a topic of debate for many years. While some consider it as a serious issue, others view it as an opportunity to provide a better life for those seeking refuge. One of the questions that arise is whether illegal immigrants can get life insurance or not. In this article, we will explore this topic in detail.

What is life insurance?

Life insurance is a contract between an individual and an insurance company. The purpose of life insurance is to provide financial support to the family or beneficiaries of the policyholder upon their death. The policyholder pays a premium to the insurance company, which then pays out the benefit in case of the policyholder’s death.

There are different types of life insurance policies, such as term life insurance, whole life insurance, and universal life insurance. Each policy has its own terms and conditions, and the premium depends on factors such as the policyholder’s age, health, and lifestyle.

Can illegal immigrants get life insurance?

The short answer is yes, illegal immigrants can get life insurance. However, it is not as straightforward as it is for legal residents or citizens. Most insurance companies require the policyholder to have a valid social security number, which illegal immigrants do not have.

Moreover, insurance companies require the policyholder to have a permanent address and a valid identification document, which illegal immigrants may not have. Therefore, it may be challenging for illegal immigrants to get life insurance, but not impossible.

How can illegal immigrants get life insurance?

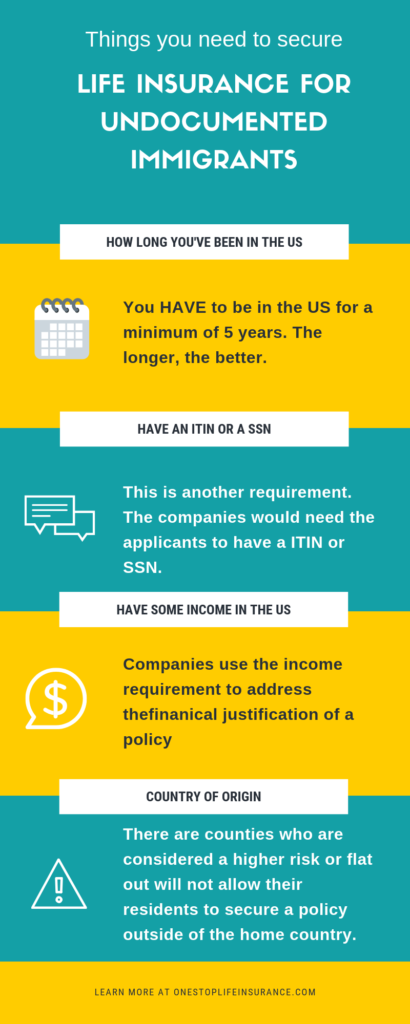

There are some insurance companies that offer life insurance to illegal immigrants, but the policies may come with higher premiums and fewer benefits. Moreover, the policyholder may need to provide additional documents, such as a tax identification number or an individual taxpayer identification number (ITIN).

Some insurance companies may also require the policyholder to have a valid work permit or visa. Therefore, it is important for illegal immigrants to do their research and find insurance companies that offer policies that cater to their needs.

Benefits of life insurance for illegal immigrants

Life insurance can provide financial security to the family or beneficiaries of the policyholder in case of their death. For illegal immigrants, life insurance can be a way to ensure that their family members are taken care of if they are deported or detained by the authorities.

Moreover, life insurance can help illegal immigrants to build their credit history and provide a sense of stability in an uncertain situation. Therefore, getting life insurance can be a wise decision for illegal immigrants who want to secure their future and that of their loved ones.

Life insurance vs. other forms of insurance

Life insurance is different from other forms of insurance, such as health insurance or car insurance. Health insurance covers medical expenses in case of illness or injury, while car insurance covers damages to the vehicle in case of an accident.

Life insurance, on the other hand, provides financial support to the family or beneficiaries of the policyholder in case of their death. Therefore, life insurance is a way to ensure that the family members of the policyholder are taken care of in case of a tragic event.

Conclusion

In conclusion, illegal immigrants can get life insurance, but the process may be challenging. It is important for illegal immigrants to do their research and find insurance companies that offer policies that cater to their needs. Life insurance can provide financial security to the family or beneficiaries of the policyholder in case of their death and can be a wise decision for illegal immigrants who want to secure their future and that of their loved ones.

Contents

- Frequently Asked Questions

- Can illegal immigrants get life insurance?

- What types of life insurance policies are available to illegal immigrants?

- How much does life insurance cost for illegal immigrants?

- What happens if an illegal immigrant dies without life insurance?

- Can an illegal immigrant’s life insurance policy be canceled if they are deported?

- Can I Keep Medicaid If My Job Offers Insurance?

- Does Smile Direct Club Take Medicaid Insurance?

- Does Life Insurance Payout Affect Medicaid?

Frequently Asked Questions

Life insurance is an essential financial tool that provides financial protection to the policyholder’s family in case of their untimely death. However, many immigrants have questions about whether they can obtain life insurance if they are in the country illegally. Here are the answers to the most frequently asked questions about life insurance for illegal immigrants.

Can illegal immigrants get life insurance?

Yes, illegal immigrants can obtain life insurance policies. However, the process of getting life insurance for illegal immigrants is slightly different from that of legal residents or citizens. Life insurance companies typically require policyholders to provide a valid Social Security number or Individual Taxpayer Identification Number (ITIN) to purchase a policy. As illegal immigrants cannot obtain a Social Security number, they can use their ITIN instead.

Furthermore, some insurance companies may require proof of insurable interest, which means that the policyholder must demonstrate that their death would cause a financial hardship to their family members. This requirement ensures that the policy is not being purchased for illegal or nefarious purposes. Overall, while it may be more challenging for illegal immigrants to obtain life insurance, it is not impossible.

What types of life insurance policies are available to illegal immigrants?

Illegal immigrants can choose from a variety of life insurance policies, including term life insurance, whole life insurance, and universal life insurance. Term life insurance policies provide coverage for a specific period, usually between 10 and 30 years. Whole life insurance policies provide coverage for the policyholder’s entire life and accumulate cash value over time. Universal life insurance policies offer flexibility in premium payments and death benefits.

The type of policy that an illegal immigrant can obtain depends on the insurance company’s policies and the policyholder’s individual circumstances. It is essential to compare policies from different insurance providers to find the best coverage options and rates.

How much does life insurance cost for illegal immigrants?

Life insurance premiums for illegal immigrants are typically higher than those for legal residents or citizens. This is because insurance companies consider illegal immigrants a higher risk due to their lack of legal status and financial stability. However, the cost of life insurance for illegal immigrants varies depending on their age, health, and the type of policy they choose.

It is essential to shop around and compare quotes from different insurance providers to find affordable life insurance coverage. Some insurance companies may offer discounts or special rates for illegal immigrants, so it is worth exploring all options.

What happens if an illegal immigrant dies without life insurance?

If an illegal immigrant dies without life insurance, their family members may face significant financial hardship. Without life insurance, the family may struggle to cover funeral expenses, pay off debts, or support themselves financially. In some cases, the family may need to rely on government assistance or charitable organizations to meet their basic needs.

Therefore, it is essential for illegal immigrants to consider purchasing life insurance to protect their families in case of their untimely death. Even a small life insurance policy can provide significant financial relief to the policyholder’s loved ones during a difficult time.

Can an illegal immigrant’s life insurance policy be canceled if they are deported?

If an illegal immigrant is deported, their life insurance policy may be canceled or terminated depending on the insurance company’s policies. Some insurance companies may allow the policy to continue if the policyholder’s premium payments are up to date and they have designated a U.S.-based beneficiary. However, other insurance companies may consider deportation a material change in the policyholder’s circumstances and cancel the policy.

It is important to read the policy terms and conditions carefully and to notify the insurance company of any changes in the policyholder’s status or circumstances. If an illegal immigrant is concerned about their life insurance policy being canceled due to deportation, they may consider purchasing a policy from an insurance company that operates in their home country.

As a professional writer, the question of whether illegal immigrants can obtain life insurance is a complex and sensitive issue. While the topic may seem straightforward, the reality is that there are a myriad of factors that come into play. Firstly, it is important to note that there is no federal law prohibiting the purchase of life insurance by non-citizens, including those who are in the US without legal documentation. However, the issue of insurability is a different matter altogether.

Life insurance companies use a number of factors to determine whether an individual is eligible for coverage, including age, health, and occupation. Additionally, they may also consider an individual’s immigration status when determining their risk profile. This means that while some companies may be willing to offer coverage to illegal immigrants, they may charge higher premiums or offer limited coverage options. Ultimately, the decision to purchase life insurance as an illegal immigrant is a personal one that should be made after careful consideration of all the factors involved.

Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering individuals to make well-informed decisions. Guided by his passion, he has assembled a team of seasoned insurance professionals committed to simplifying the intricate world of insurance for you.

- Latest Posts by Rakibul Hasan

-

Can I Keep Medicaid If My Job Offers Insurance?

- -

Does Smile Direct Club Take Medicaid Insurance?

- -

Does Life Insurance Payout Affect Medicaid?

- All Posts