Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering...Read more

Whole life insurance is a type of permanent life insurance that offers lifelong coverage, unlike term life insurance, which only provides coverage for a set period. Whole life insurance policies come with a guaranteed death benefit, as well as a cash value component that accumulates over time. However, many policyholders wonder if their premiums can go up and if so, what factors can cause an increase in premiums.

The short answer is yes, whole life insurance premiums can go up, but the reasons for the increase vary based on the policyholder’s age, health, and lifestyle. In this article, we will explore the different factors that can cause an increase in whole life insurance premiums, as well as ways you can manage your premiums to avoid unexpected cost increases. So, if you are considering purchasing whole life insurance or currently have a policy, read on to learn more about the factors that can impact your premiums.

Can Whole Life Insurance Premiums Go Up?

When you buy a whole life insurance policy, you expect to pay a set premium for the rest of your life. This means that you will always know what your policy will cost, and you can budget accordingly. However, there are some situations where your premiums may go up unexpectedly. In this article, we will explore the different scenarios that can cause your whole life insurance premiums to increase.

Changes in Risk Factors

One of the primary reasons that your whole life insurance premiums may go up is because of changes in risk factors. Risk factors are the variables that insurance companies use to determine how likely you are to die. Some common risk factors include age, health, and lifestyle habits. If any of these risk factors change over time, your premiums may go up to reflect the increased risk. For example, if you develop a chronic illness or start smoking, your premiums may increase.

To avoid unexpected premium increases, it’s important to be honest and upfront about your health and lifestyle habits when you apply for your policy. This will help the insurance company accurately assess your risk and set your premiums accordingly. Additionally, you should try to maintain a healthy lifestyle and manage any chronic conditions to keep your risk factors low.

Economic Factors

Another factor that can cause your whole life insurance premiums to go up is economic factors. Insurance companies invest the premiums they collect in order to generate returns, which they use to pay out claims and cover administrative costs. If the economy experiences a downturn or the investment markets perform poorly, the insurance company may need to raise premiums to maintain profitability.

While you can’t control economic factors, you can minimize their impact on your premiums by choosing an insurance company with a strong financial rating. A company with a strong rating is more likely to weather economic fluctuations without needing to raise premiums. Additionally, you should review your policy regularly to ensure that you are getting the best value for your money.

Poor Investment Performance

In addition to economic factors, poor investment performance can also cause your whole life insurance premiums to go up. Insurance companies invest the premiums they collect in a variety of assets, including stocks, bonds, and real estate. If these investments perform poorly, the insurance company may need to raise premiums to offset the losses.

To minimize the impact of poor investment performance on your premiums, you should choose a policy with a guaranteed minimum interest rate. This will ensure that your policy will earn a minimum return regardless of market conditions. Additionally, you should review your policy regularly to ensure that your premiums are still competitive and that you are getting the best value for your money.

Benefits of Whole Life Insurance

Despite the risk of premium increases, whole life insurance offers several benefits that make it an attractive option for many people. One of the biggest benefits is that whole life insurance provides coverage for your entire life, as long as you pay your premiums. This means that you don’t have to worry about your coverage expiring or needing to renew your policy.

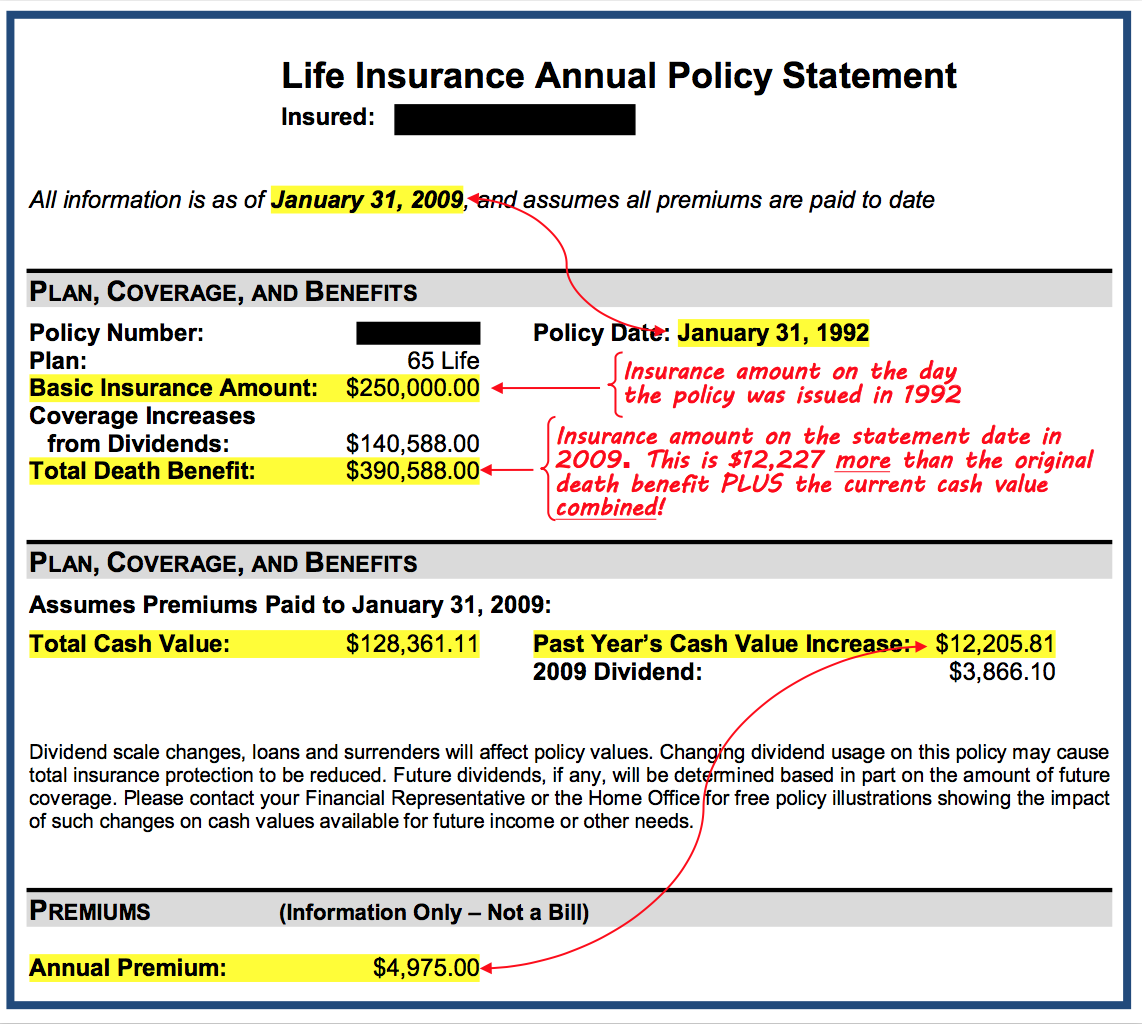

Whole life insurance also offers a cash value component, which allows you to accumulate savings over time. The cash value grows tax-deferred, which means that you don’t have to pay taxes on the growth until you withdraw the money. Additionally, you can borrow against the cash value or use it to pay your premiums if you are unable to make payments.

Term Life Insurance vs. Whole Life Insurance

When considering life insurance, many people wonder whether they should choose term life insurance or whole life insurance. Term life insurance is a type of insurance that provides coverage for a set period of time, usually between 10 and 30 years. Whole life insurance, on the other hand, provides coverage for your entire life.

The main advantage of term life insurance is that it is usually less expensive than whole life insurance. This makes it a good option for people who need coverage for a specific period of time, such as when they have young children or a mortgage. However, term life insurance does not offer a cash value component, and your coverage will expire at the end of the term.

Whole life insurance, on the other hand, is more expensive than term life insurance, but it offers lifelong coverage and a cash value component. This makes it a good option for people who want permanent coverage and the ability to accumulate savings over time.

Conclusion

While it is possible for whole life insurance premiums to go up, there are steps you can take to minimize the risk of unexpected increases. By choosing an insurance company with a strong financial rating, maintaining a healthy lifestyle, and reviewing your policy regularly, you can ensure that you are getting the best value for your money. Additionally, whole life insurance offers several benefits, including lifelong coverage and a cash value component, that make it a good option for many people.

Frequently Asked Questions

Can Whole Life Insurance Premiums Go Up?

Yes, whole life insurance premiums can go up. Unlike term life insurance, which guarantees a fixed premium for a set period, whole life insurance premiums are typically adjustable. There are several reasons why your premiums may increase:

Firstly, if you purchased a participating whole life insurance policy, your premiums may be tied to the insurer’s investment performance. If the insurer’s investments perform poorly, premiums may increase to offset the shortfall.

Secondly, if you purchased a universal life insurance policy, your premiums may be adjustable based on your policy’s cash value. If your policy’s cash value does not grow as quickly as expected, you may need to pay higher premiums to keep the policy in force.

Is it common for Whole Life Insurance Premiums to increase?

While it is not uncommon for whole life insurance premiums to increase, it is not guaranteed. The likelihood of premium increases depends on the type of policy you purchased and the insurer’s investment performance.

Participating whole life insurance policies, which pay dividends to policyholders based on the insurer’s investment performance, are more likely to experience premium increases. On the other hand, non-participating whole life insurance policies typically have fixed premiums that do not increase over time.

As a professional writer, the question of whether whole life insurance premiums can go up is a complex one that requires a nuanced answer. The short answer is yes, whole life insurance premiums can go up, but it’s not as simple as that. There are a variety of factors that can influence whether or not your premiums will increase.

One of the main factors that can cause whole life insurance premiums to go up is changes in your health. If you develop a health condition or experience a significant change in your health status, your insurer may increase your premiums to reflect the increased risk. Additionally, changes in the insurance market or economic conditions can also impact your premiums. While it’s impossible to predict every factor that might cause your premiums to increase, working with a reputable insurance provider and regularly reviewing your policy can help you stay informed and prepared for any changes that may occur. Overall, while whole life insurance premiums can go up, taking steps to mitigate risk and staying informed can help ensure that your coverage remains affordable and effective over time.

Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering individuals to make well-informed decisions. Guided by his passion, he has assembled a team of seasoned insurance professionals committed to simplifying the intricate world of insurance for you.

- Latest Posts by Rakibul Hasan

-

Can I Keep Medicaid If My Job Offers Insurance?

- -

Does Smile Direct Club Take Medicaid Insurance?

- -

Does Life Insurance Payout Affect Medicaid?

- All Posts