Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering...Read more

Life insurance is a crucial investment for those who want to ensure that their loved ones are financially protected in the event of their untimely demise. However, if you are one of the many people living with chronic kidney disease and undergoing dialysis, you may have concerns about whether or not you can qualify for life insurance. The good news is that while it may be more challenging, it is still possible to secure coverage even if you are on dialysis.

In this article, we will explore the ins and outs of life insurance for those undergoing dialysis. We will discuss the factors that insurance companies consider when assessing your eligibility for coverage, the types of policies that may be available to you, and tips for finding the right coverage to meet your needs. By the end of this article, you will have a better understanding of how to secure life insurance that provides peace of mind for both you and your loved ones.

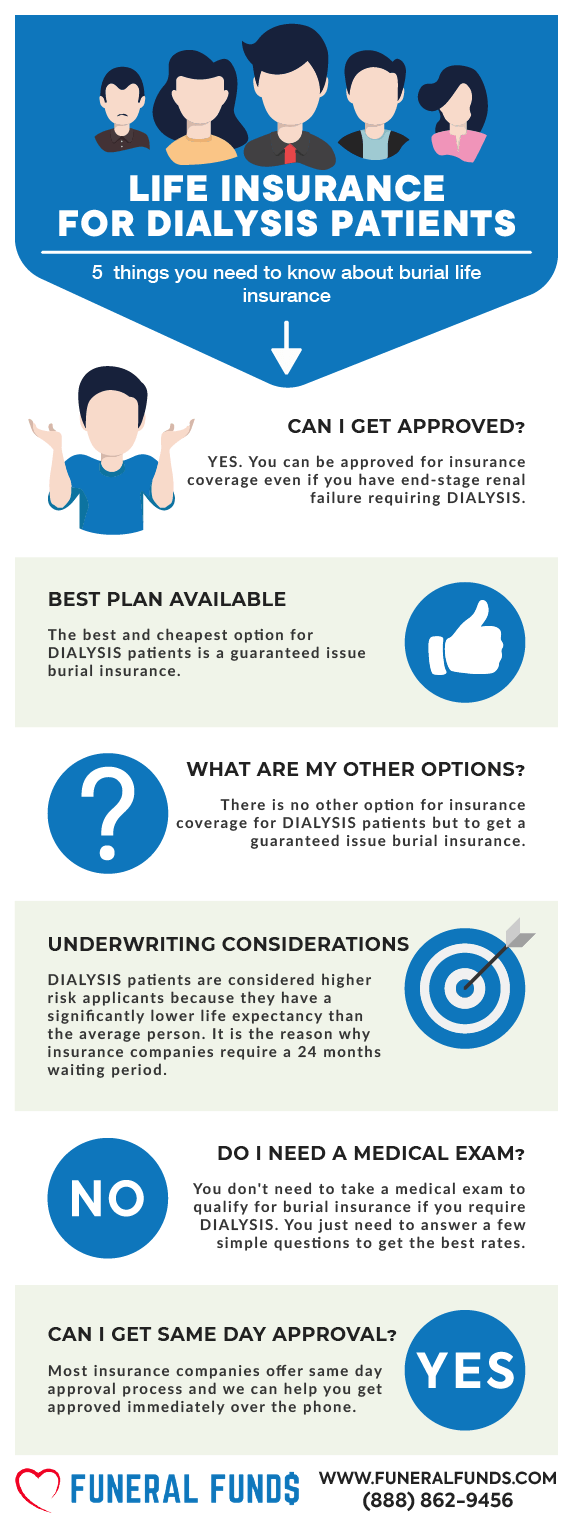

Can You Get Life Insurance if You Are on Dialysis?

If you are on dialysis, you may be wondering if you can still get life insurance. The answer is yes, but it may be more difficult and expensive compared to those who do not have kidney disease. In this article, we will discuss the process of obtaining life insurance while on dialysis and the factors that may affect your coverage.

Understanding Dialysis and Life Insurance

Dialysis is a medical treatment used to remove waste and excess water from the blood in individuals with kidney failure. It is a long-term treatment that requires regular appointments and can impact your overall health. When applying for life insurance, dialysis is considered a pre-existing condition, which means it may affect your coverage and premium rates.

Insurance companies will generally ask questions about your health history, including any pre-existing conditions, before approving your application. If you are on dialysis, you will likely be asked to provide more detailed information about your condition and treatment. This is because dialysis patients are considered high-risk individuals and may be more likely to have other medical conditions.

The Process of Obtaining Life Insurance

When applying for life insurance on dialysis, the first step is to research and compare different insurance providers. It is important to find a company that specializes in high-risk individuals and has experience working with individuals on dialysis.

Once you have found a suitable insurance provider, the next step is to complete an application form. The form will include questions about your health history, medications, and lifestyle factors such as smoking and alcohol consumption.

After submitting your application, the insurance company may request additional medical information such as lab results, doctor’s notes, and treatment records. This information will help the insurance company assess your risk and determine your coverage and premium rates.

Factors That May Affect Your Coverage

Several factors may affect your coverage and premium rates when applying for life insurance on dialysis. These include:

Age:

Your age is an important factor when applying for life insurance. Older individuals on dialysis may face higher premiums compared to younger individuals.

Health History:

Your health history will also impact your coverage and premium rates. If you have other medical conditions in addition to dialysis, it may affect your coverage or result in higher premiums.

Treatment Duration:

The length of time you have been on dialysis may also affect your coverage and premium rates. Individuals who have been on dialysis for a longer period may face higher premiums compared to those who have just started treatment.

Type of Dialysis:

The type of dialysis you are receiving may also affect your coverage and premium rates. Individuals receiving hemodialysis may face higher premiums compared to those receiving peritoneal dialysis.

The Benefits of Life Insurance on Dialysis

While obtaining life insurance on dialysis may be more difficult and expensive, it is still important to consider the benefits. Life insurance can provide financial security for your loved ones in the event of your death. This can help cover expenses such as funeral costs, outstanding debts, and living expenses.

Additionally, some life insurance policies may offer living benefits, which can provide financial support if you become disabled or critically ill. This can help cover medical expenses and other costs associated with your condition.

Life Insurance vs. Other Options

There are other options available to individuals on dialysis who are looking for financial protection. These include:

Accidental Death and Dismemberment Insurance:

This type of insurance provides coverage in the event of accidental death or injury. It is generally less expensive compared to traditional life insurance but may have more restrictions on coverage.

Critical Illness Insurance:

This type of insurance provides coverage in the event of a critical illness such as cancer, heart attack, or stroke. It can provide financial support for medical expenses and other costs associated with your condition.

Group Life Insurance:

Group life insurance is typically offered through an employer and provides coverage for employees and their dependents. It may be easier to obtain compared to individual life insurance and may have lower premiums.

Conclusion

Obtaining life insurance on dialysis may be more difficult and expensive compared to those without kidney disease. However, it is still possible to get coverage and provide financial security for your loved ones. By researching and comparing different insurance providers and understanding the factors that may affect your coverage, you can find the best life insurance policy to meet your needs.

Contents

- Frequently Asked Questions

- Can you get life insurance if you are on dialysis?

- What types of life insurance are available for people on dialysis?

- How much does life insurance cost for people on dialysis?

- What should I consider when shopping for life insurance on dialysis?

- Can I get life insurance on dialysis without a medical exam?

- Can I Keep Medicaid If My Job Offers Insurance?

- Does Smile Direct Club Take Medicaid Insurance?

- Does Life Insurance Payout Affect Medicaid?

Frequently Asked Questions

Can you get life insurance if you are on dialysis?

Yes, it is possible to get life insurance if you are on dialysis. However, it may be more difficult and expensive than for someone who is not on dialysis. Dialysis is a treatment for kidney failure, which is a serious health condition that can affect life expectancy. Life insurance companies will take this into account when determining your premiums and coverage.

There are several factors that will be considered when applying for life insurance on dialysis. These may include your age, overall health, and the underlying cause of your kidney failure. Additionally, your insurance company may require you to undergo a medical exam and provide detailed medical records before approving your policy.

What types of life insurance are available for people on dialysis?

There are several types of life insurance policies available for people on dialysis, including term life, whole life, and guaranteed issue life insurance. Term life insurance provides coverage for a specific period of time, such as 10 or 20 years. Whole life insurance provides coverage for your entire life and includes a savings component. Guaranteed issue life insurance does not require a medical exam and is available to individuals with serious health conditions, such as kidney failure.

The type of life insurance policy that is best for you will depend on your individual needs and circumstances. It is important to discuss your options with a licensed insurance agent who has experience working with individuals on dialysis.

How much does life insurance cost for people on dialysis?

The cost of life insurance for people on dialysis will vary depending on several factors, including your age, overall health, and the type of policy you choose. Generally, life insurance premiums for individuals with health conditions are higher than for those without. This is because the insurance company views the person as a higher risk.

To get an accurate estimate of how much life insurance will cost for someone on dialysis, it is best to get quotes from several different insurance companies. A licensed insurance agent can help you compare policies and find the most affordable option.

What should I consider when shopping for life insurance on dialysis?

When shopping for life insurance on dialysis, there are several things to consider. First, you should make sure that the insurance company is reputable and financially stable. You can check the company’s ratings with independent rating agencies such as A.M. Best, Moody’s, or Standard & Poor’s.

Next, you should consider the type of policy that is best for your needs. This may depend on factors such as your age, overall health, and financial situation. You should also consider the amount of coverage you need to protect your loved ones.

Finally, it is important to be honest and transparent about your medical condition when applying for life insurance on dialysis. This will ensure that you get an accurate quote and that your policy is valid in the event of your death.

Can I get life insurance on dialysis without a medical exam?

Yes, it is possible to get life insurance on dialysis without a medical exam. Guaranteed issue life insurance policies do not require a medical exam and are available to individuals with serious health conditions, such as kidney failure.

However, these policies typically have higher premiums and lower coverage amounts than traditional life insurance policies. Additionally, there may be a waiting period before the policy takes effect.

If you are interested in getting life insurance on dialysis without a medical exam, it is important to speak with a licensed insurance agent who can help you understand your options and find the best policy for your needs.

In today’s world, health issues are becoming increasingly prevalent, and many people may find themselves in situations where they require continuous medical treatment. Dialysis is one such medical treatment that is necessary for those with kidney failure. However, the question of whether one can get life insurance while on dialysis continues to be a concern for many.

Fortunately, the answer is yes, you can get life insurance while on dialysis. While it may be more challenging to secure a policy, it is not impossible. The key is to work with a reputable insurance company that specializes in high-risk cases such as this. They will help you understand the options available to you and guide you through the process of securing a policy that suits your needs and budget. With the right support and guidance, you can ensure that your loved ones are protected, even if you are on dialysis.

Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering individuals to make well-informed decisions. Guided by his passion, he has assembled a team of seasoned insurance professionals committed to simplifying the intricate world of insurance for you.

- Latest Posts by Rakibul Hasan

-

Can I Keep Medicaid If My Job Offers Insurance?

- -

Does Smile Direct Club Take Medicaid Insurance?

- -

Does Life Insurance Payout Affect Medicaid?

- All Posts