Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering...Read more

Bipolar disorder is a mental illness that affects millions of people worldwide. It is a condition that causes extreme mood swings, from periods of high energy and elation to periods of deep depression and hopelessness. Individuals with bipolar disorder often face a variety of challenges in their daily lives, and one of these challenges is obtaining life insurance. If you or someone you know has bipolar disorder and is looking for life insurance coverage, you may be wondering if it’s possible to get coverage despite the condition.

The good news is that it is possible to get life insurance coverage if you have bipolar disorder, but it can be challenging. Insurance companies consider many factors when determining whether to offer coverage, and bipolar disorder is one of the conditions that can make it more difficult to obtain coverage. In this article, we’ll explore the ins and outs of getting life insurance coverage with bipolar disorder, including what factors insurance companies consider, what types of policies are available, and what steps you can take to increase your chances of getting coverage.

Yes, it is possible to obtain life insurance if you have bipolar disorder. However, the cost and availability of coverage may vary depending on the severity of your condition, treatment plan, and overall health. It is important to disclose your bipolar disorder diagnosis and any related medical information to the insurance company to ensure that you are getting the appropriate coverage for your needs.

Can You Get Life Insurance if You Have Bipolar Disorder?

Bipolar Disorder: What is it?

Bipolar disorder is a mental health condition that affects a person’s mood, energy, and ability to function. It is characterized by extreme mood swings that range from highs (mania or hypomania) to lows (depression). People with bipolar disorder may experience intense periods of euphoria, increased energy, racing thoughts, and impulsive behavior during manic episodes. During depressive episodes, they may feel sadness, hopelessness, lack of energy, and difficulty concentrating.

What are the Types of Bipolar Disorder?

There are different types of bipolar disorder, including:

– Bipolar I disorder: characterized by at least one manic episode that lasts for at least a week or requires hospitalization.

– Bipolar II disorder: characterized by at least one hypomanic episode and one depressive episode.

– Cyclothymic disorder: characterized by many periods of hypomanic and depressive symptoms that last for at least two years.

How Does Bipolar Disorder Affect Life Insurance?

Life insurance is a contract between the policyholder and the insurer, where the insurer promises to pay a sum of money to the policyholder’s beneficiaries upon their death. The policyholder pays premiums to the insurer, and the insurer assesses the risk of the policyholder’s death. When it comes to bipolar disorder, insurers may consider it a high-risk condition due to the potential for suicide or self-harm during manic or depressive episodes.

Can You Get Life Insurance with Bipolar Disorder?

Yes, it is possible to get life insurance with bipolar disorder, but it may be more challenging and expensive. Insurers may require a medical exam, review medical records, and ask questions about your mental health history during the application process. They may also require a higher premium or limit coverage, depending on the severity of your condition.

How Can You Improve Your Chances of Getting Life Insurance?

Here are a few tips to improve your chances of getting life insurance with bipolar disorder:

1. Be honest: Disclose your bipolar disorder diagnosis and any relevant medical information to the insurer. Honesty is the best policy when it comes to life insurance.

2. Seek treatment: Get treatment for bipolar disorder and follow your doctor’s recommendations. Insurers may be more willing to provide coverage if you are managing your condition effectively.

3. Shop around: Compare policies and premiums from multiple insurers to find the best coverage and price for your needs.

4. Work with an agent: An insurance agent who specializes in high-risk cases like bipolar disorder can help you navigate the application process and find the best policy for you.

What Are the Benefits of Life Insurance for People with Bipolar Disorder?

Life insurance can provide peace of mind and financial security for people with bipolar disorder and their loved ones. It can help cover funeral expenses, outstanding debts, and provide income replacement for dependents in the event of the policyholder’s death.

What Are the Drawbacks of Life Insurance for People with Bipolar Disorder?

The main drawback of life insurance for people with bipolar disorder is the higher cost of premiums or limited coverage. Some insurers may also require a waiting period or exclude coverage for suicide or self-harm.

Bipolar Disorder and Accidental Death Insurance

Accidental death insurance is a type of life insurance that pays a benefit if the policyholder dies as a result of an accident. This type of insurance may be easier to obtain for people with bipolar disorder, as it excludes death related to illness or suicide. However, accidental death insurance may not provide adequate coverage for other causes of death.

What are the Pros and Cons of Accidental Death Insurance for People with Bipolar Disorder?

Pros:

– Easier to obtain than traditional life insurance.

– May provide coverage for accidental death.

Cons:

– May not provide coverage for other causes of death.

– Limited coverage compared to traditional life insurance.

Conclusion

While it is possible to get life insurance with bipolar disorder, it may be more challenging and expensive. People with bipolar disorder should be honest about their condition, seek treatment, shop around for policies, and work with an agent to find the best coverage. Accidental death insurance may be an alternative option for those who cannot obtain traditional life insurance. Ultimately, life insurance can provide peace of mind and financial security for people with bipolar disorder and their loved ones.

Contents

- Frequently Asked Questions

- Question 1: Can I Get Life Insurance if I Have Bipolar Disorder?

- Question 2: What Factors Will the Insurance Company Consider?

- Question 3: What Types of Life Insurance Policies Are Available?

- Question 4: How Can I Improve My Chances of Getting Approved for Life Insurance?

- Question 5: Should I Consider Guaranteed Issue Life Insurance?

- Can I Keep Medicaid If My Job Offers Insurance?

- Does Smile Direct Club Take Medicaid Insurance?

- Does Life Insurance Payout Affect Medicaid?

Frequently Asked Questions

Many people with bipolar disorder worry about whether they can get life insurance. It’s a common concern, but the answer is not always straightforward. Here are some frequently asked questions about getting life insurance with bipolar disorder.

Question 1: Can I Get Life Insurance if I Have Bipolar Disorder?

Yes, you can get life insurance if you have bipolar disorder. However, it may be more difficult to get approved for coverage, and you may have to pay higher premiums. When you apply for life insurance, the insurance company will ask you questions about your medical history, including whether you have been diagnosed with bipolar disorder. They may also ask you to provide medical records or to take a medical exam.

The insurance company will use this information to assess your risk and determine whether to approve your application for life insurance. If you have bipolar disorder, the insurance company may view you as a higher risk than someone without the condition, which could result in higher premiums or a denial of coverage.

Question 2: What Factors Will the Insurance Company Consider?

When you apply for life insurance with bipolar disorder, the insurance company will consider several factors, including the severity of your condition, your treatment plan, and your overall health. They may also consider your age, gender, and lifestyle factors like whether you smoke or engage in risky behaviors.

If you have bipolar disorder, it’s important to be open and honest with the insurance company about your condition and treatment. You may also want to work with a licensed insurance agent who has experience working with people with pre-existing conditions like bipolar disorder.

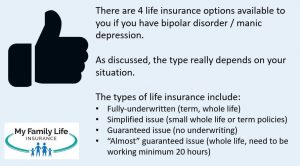

Question 3: What Types of Life Insurance Policies Are Available?

There are several types of life insurance policies available, including term life insurance, whole life insurance, and universal life insurance. Term life insurance provides coverage for a specific period of time, while whole life insurance and universal life insurance provide coverage for your entire life.

If you have bipolar disorder, you may be able to get approved for term life insurance, but you may have difficulty getting approved for whole life or universal life insurance. These types of policies may be more expensive and may require a medical exam or more extensive underwriting.

Question 4: How Can I Improve My Chances of Getting Approved for Life Insurance?

If you have bipolar disorder, there are several things you can do to improve your chances of getting approved for life insurance. First, be honest and open about your condition and treatment. Provide the insurance company with as much information as possible about your medical history and treatment plan.

You may also want to work with a licensed insurance agent who can help you find a policy that meets your needs and budget. They can also help you navigate the application process and provide tips for improving your chances of getting approved for coverage.

Question 5: Should I Consider Guaranteed Issue Life Insurance?

If you have bipolar disorder and have been denied coverage by traditional life insurance companies, you may want to consider guaranteed issue life insurance. This type of policy does not require a medical exam or health questions, so you are guaranteed to be approved for coverage.

However, guaranteed issue life insurance policies are typically more expensive and provide lower coverage amounts than traditional life insurance policies. They may also have a waiting period before the death benefit is paid out, so it’s important to understand the terms of the policy before you buy.

In today’s world, more and more people are being diagnosed with mental health conditions like bipolar disorder. While this can be difficult to manage, it doesn’t mean that individuals should be denied access to important products like life insurance. The good news is that it is possible to secure life insurance coverage even if you have bipolar disorder, but it is important to do your research and find the right provider.

When searching for life insurance with bipolar disorder, it is crucial to disclose your condition honestly and upfront. This can help ensure that you are matched with a provider who understands the unique challenges that come with bipolar disorder and can offer a policy that meets your specific needs. By working with a reputable provider, you can have peace of mind knowing that you and your loved ones are protected financially, no matter what the future may bring.

Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering individuals to make well-informed decisions. Guided by his passion, he has assembled a team of seasoned insurance professionals committed to simplifying the intricate world of insurance for you.

- Latest Posts by Rakibul Hasan

-

Can I Keep Medicaid If My Job Offers Insurance?

- -

Does Smile Direct Club Take Medicaid Insurance?

- -

Does Life Insurance Payout Affect Medicaid?

- All Posts