Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering...Read more

Life insurance is an essential financial safety net that can provide peace of mind for your loved ones after you pass away. However, if you have been diagnosed with cirrhosis of the liver, you may be concerned about your ability to obtain life insurance coverage. Cirrhosis of the liver is a chronic and progressive disease that can result from various factors, including excessive alcohol consumption, viral hepatitis, and fatty liver disease. It can lead to serious complications, such as liver failure and even death, which can make it challenging to secure life insurance coverage.

While it’s true that having cirrhosis of the liver can impact your ability to obtain life insurance, it’s not necessarily impossible. There are several factors that insurers consider when assessing your eligibility for life insurance, including the severity of your condition, your age, and your overall health. As a professional writer, I will delve into the world of life insurance and cirrhosis of the liver to help you better understand your options and make informed decisions about securing coverage for your loved ones.

Can You Get Life Insurance With Cirrhosis of the Liver?

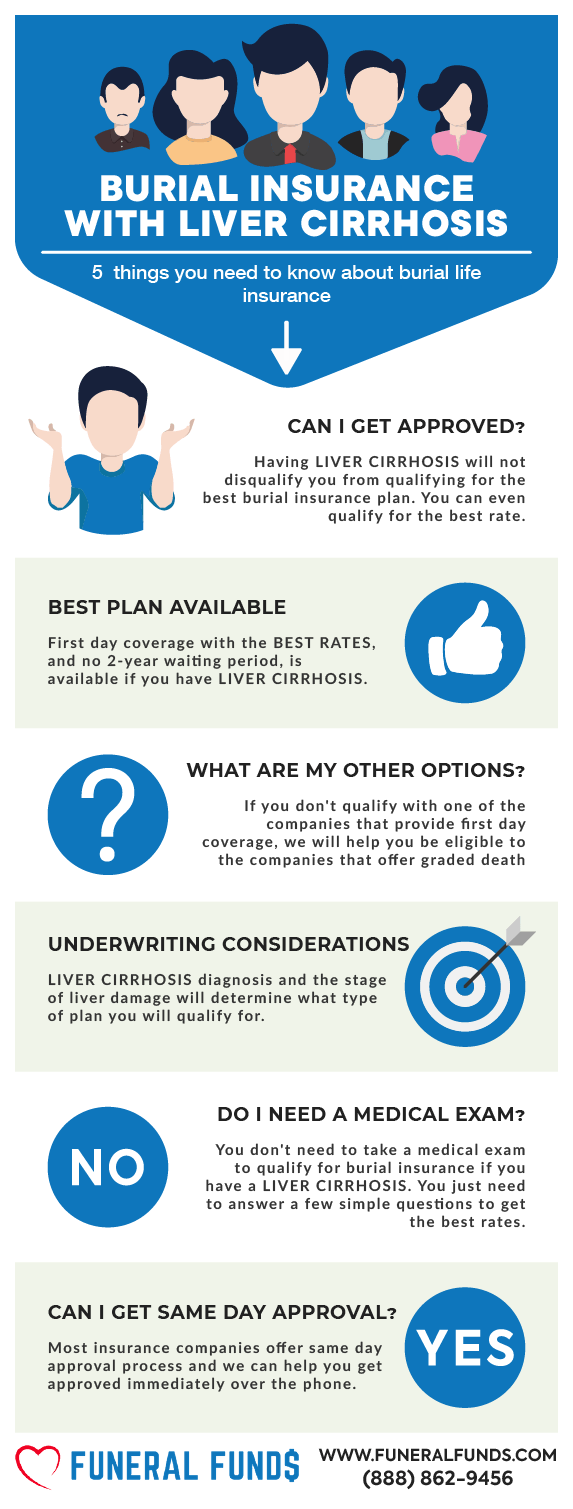

It is possible to get life insurance with cirrhosis of the liver, but it may be more difficult and expensive. Insurance companies will want to know the severity of the condition, the cause of the cirrhosis, and the treatment plan. They may also require a medical exam and access to medical records. It’s important to shop around and compare policies from different companies to find the best coverage and rates.

Contents

- Can You Get Life Insurance With Cirrhosis of the Liver?

- Frequently Asked Questions

- Can You Get Life Insurance With Cirrhosis of the Liver?

- What Information Will I Need to Provide When Applying for Life Insurance With Cirrhosis of the Liver?

- Will My Premiums Be Higher if I Have Cirrhosis of the Liver?

- Can I Get Life Insurance With Cirrhosis of the Liver if I’m Currently Undergoing Treatment?

- What Should I Look for When Shopping for Life Insurance With Cirrhosis of the Liver?

- Can I Keep Medicaid If My Job Offers Insurance?

- Does Smile Direct Club Take Medicaid Insurance?

- Does Life Insurance Payout Affect Medicaid?

Can You Get Life Insurance With Cirrhosis of the Liver?

If you have cirrhosis of the liver, you may be wondering if it is possible to get life insurance. Cirrhosis is a serious medical condition that affects the liver, and it can make it difficult to obtain life insurance coverage. However, it is not impossible to get life insurance if you have cirrhosis. In this article, we will explore the options available to you.

What is Cirrhosis of the Liver?

Cirrhosis is a condition that occurs when the liver is damaged and scarred. This damage can occur due to a variety of factors, including alcohol abuse, viral infections, and autoimmune disorders. As the liver scar tissue builds up, it becomes difficult for the liver to function properly. This can lead to a variety of health problems, including liver failure.

Causes of Cirrhosis of the Liver

There are several causes of cirrhosis of the liver. The most common causes include:

- Alcohol abuse

- Hepatitis B and C infections

- Nonalcoholic fatty liver disease

- Autoimmune hepatitis

Symptoms of Cirrhosis of the Liver

The symptoms of cirrhosis of the liver can vary depending on the severity of the condition. Some common symptoms include:

- Fatigue

- Yellowing of the skin and eyes (jaundice)

- Itchy skin

- Abdominal pain and swelling

- Easy bruising and bleeding

Can You Get Life Insurance with Cirrhosis of the Liver?

It is possible to get life insurance if you have cirrhosis of the liver, but it can be difficult. Life insurance companies typically consider cirrhosis to be a high-risk condition, which means that they may charge higher premiums or deny coverage altogether.

Factors That Affect Life Insurance Coverage with Cirrhosis

When you apply for life insurance with cirrhosis of the liver, the insurance company will consider several factors, including:

- The cause and severity of your cirrhosis

- Your overall health and medical history

- Your age and gender

- Whether you have any other medical conditions

Types of Life Insurance Coverage

There are several types of life insurance coverage available, including:

- Term life insurance

- Whole life insurance

- Universal life insurance

Benefits of Life Insurance Coverage

Life insurance coverage can provide several benefits, including:

- Financial protection for your loved ones

- Paying for final expenses, such as funeral costs

- Leaving a legacy for your family

Alternatives to Life Insurance Coverage

If you are unable to get life insurance coverage due to cirrhosis of the liver, there are several alternatives available, including:

- Guaranteed issue life insurance

- Accidental death and dismemberment insurance

- Final expense insurance

Final Thoughts

If you have cirrhosis of the liver, you may be able to get life insurance coverage, but it may be more difficult and expensive. It is important to shop around and compare quotes from multiple insurance companies to find the best coverage for your needs. Additionally, consider alternatives to traditional life insurance coverage if necessary.

Frequently Asked Questions

Can You Get Life Insurance With Cirrhosis of the Liver?

It is possible to get life insurance with cirrhosis of the liver, but it can be challenging. Cirrhosis is a serious medical condition that can significantly impact your life expectancy, and insurers may be hesitant to offer coverage. However, some companies specialize in providing coverage for people with pre-existing conditions, and they may be more willing to work with you.

When applying for life insurance with cirrhosis of the liver, you will likely be required to provide detailed medical information and undergo a medical exam. The insurer will use this information to assess your risk and determine your premiums. Your premiums may be higher than someone without a pre-existing condition, but it is still possible to obtain coverage.

What Information Will I Need to Provide When Applying for Life Insurance With Cirrhosis of the Liver?

When applying for life insurance with cirrhosis of the liver, you will need to provide detailed medical information, including your diagnosis, treatment history, and current medications. You may also need to provide information about your lifestyle, such as whether you smoke or drink alcohol.

In addition to medical information, you will also need to provide personal and financial information. This may include your age, occupation, income, and any debts you have. The insurer will use this information to assess your risk and determine your premiums.

Will My Premiums Be Higher if I Have Cirrhosis of the Liver?

Yes, your premiums are likely to be higher if you have cirrhosis of the liver. Insurers use a variety of factors to determine premiums, including age, health history, and lifestyle. Having a pre-existing condition like cirrhosis of the liver can increase your risk of premature death, which means insurers will charge you higher premiums to compensate for this risk.

However, the exact amount you will pay in premiums will depend on a variety of factors. These may include the severity of your condition, your age, and your overall health. It is important to shop around and compare quotes from multiple insurers to find the best coverage at the most affordable price.

Can I Get Life Insurance With Cirrhosis of the Liver if I’m Currently Undergoing Treatment?

It is possible to get life insurance with cirrhosis of the liver if you are currently undergoing treatment. However, your premiums may be higher than someone without a pre-existing condition. Insurers will want to see that you are taking steps to manage your condition and that your treatment is working effectively.

When applying for life insurance with cirrhosis of the liver, you will need to provide detailed medical information, including information about your treatment plan. The insurer will use this information to assess your risk and determine your premiums. It is important to be honest and transparent about your medical history to ensure you get the coverage you need.

What Should I Look for When Shopping for Life Insurance With Cirrhosis of the Liver?

When shopping for life insurance with cirrhosis of the liver, you should look for insurers that specialize in providing coverage for people with pre-existing conditions. These companies are more likely to understand your unique needs and be willing to work with you to find coverage that meets your needs.

You should also compare quotes from multiple insurers to find the best coverage at the most affordable price. Look for policies with reasonable premiums and coverage that meets your needs. It is important to read the fine print and understand the terms and conditions of your policy before signing up to ensure you get the coverage you need.

In today’s world, where health risks are ubiquitous, one of the most significant concerns is the possibility of being diagnosed with a critical illness. Cirrhosis of the liver is one such illness that can be debilitating, both physically and mentally. However, the good news is that despite this diagnosis, it is still possible to obtain life insurance coverage.

While it’s true that obtaining life insurance with cirrhosis of the liver may be challenging, it’s not impossible. Many insurance companies offer policies to people with pre-existing conditions, including cirrhosis of the liver. It’s essential to do your research and compare policies from different companies to find the best coverage at the most affordable price. With the right insurance policy, you can have peace of mind knowing that your loved ones will be financially protected if something were to happen to you. Remember, the key is to be honest about your health condition and work with a reputable insurance agent who can help you navigate the process.

Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering individuals to make well-informed decisions. Guided by his passion, he has assembled a team of seasoned insurance professionals committed to simplifying the intricate world of insurance for you.

- Latest Posts by Rakibul Hasan

-

Can I Keep Medicaid If My Job Offers Insurance?

- -

Does Smile Direct Club Take Medicaid Insurance?

- -

Does Life Insurance Payout Affect Medicaid?

- All Posts