Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering...Read more

Life insurance is a form of security that provides financial assistance to the loved ones of a policyholder in the event of their death. However, what happens if the policyholder takes their own life? This is a question that many people ask, and the answer may differ depending on where you live. In the state of Kansas, suicide is a complex issue when it comes to life insurance policies. It is essential to understand the laws surrounding suicide and life insurance in Kansas to ensure that you and your loved ones are adequately protected.

In this article, we will explore the intricacies of life insurance policies in Kansas when it comes to suicide. We will delve into the laws and regulations that govern life insurance policies and examine how they affect beneficiaries in the event of a policyholder’s suicide. By gaining a thorough understanding of these laws, you can make informed decisions when it comes to your life insurance policy and ensure that your loved ones are taken care of in the event of your untimely death.

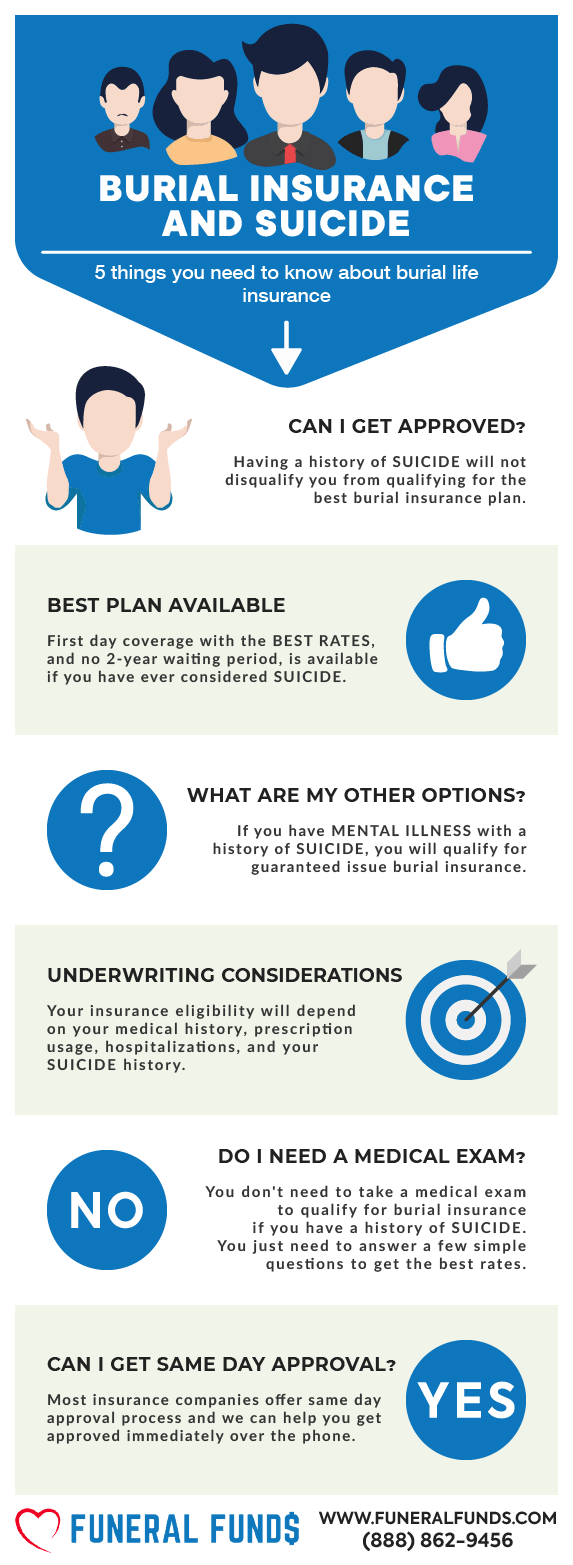

In Kansas, life insurance policies typically cover suicidal death, but there are some exceptions. If the policyholder dies by suicide within the first two years of the policy being in force, the death benefit may be denied. However, if the policy is more than two years old, the benefit will likely be paid out to the beneficiary. It’s important to review the terms of the policy and speak with the insurance provider for clarification.

Does Life Insurance Pay for Suicidal Death in Kansas?

Understanding Life Insurance Policies in Kansas

Life insurance is a financial product designed to provide financial support to the beneficiaries of the policyholder after their death. The policyholder pays a premium, and in exchange, the insurer pays out a death benefit to the designated beneficiaries. However, when it comes to suicide, things can get complicated. In Kansas, as in many other states, life insurance policies may have exclusions or limitations for suicide-related deaths.

Life insurance policies in Kansas may have a suicide clause that limits or excludes coverage for death by suicide. This clause typically states that if the policyholder dies as a result of suicide within a certain period after purchasing the policy, the insurer will not pay out the death benefit. The length of the exclusion period can vary, but it is usually two years.

Suicide and Life Insurance in Kansas

If a policyholder dies by suicide after the exclusion period has passed, the insurer will typically pay out the death benefit as stated in the policy. However, if the policyholder dies by suicide during the exclusion period, the insurer may conduct an investigation to determine whether the death was a suicide or an accidental death. If the investigation determines that the death was a suicide, the insurer will not pay out the death benefit.

It’s important to note that the insurer has the burden of proof in determining whether a death was a suicide or not. If the insurer cannot prove that the death was a suicide, they may be required to pay the death benefit. In addition, if the policyholder did not disclose a history of mental illness or suicidal tendencies when applying for the policy, the insurer may be required to pay the death benefit.

Benefits of Life Insurance in Kansas

Despite the suicide clause, life insurance can still be a valuable financial product for many people in Kansas. Life insurance can provide financial security for the policyholder’s loved ones in the event of their death. The death benefit can be used to pay for funeral expenses, outstanding debts, and living expenses for the beneficiaries.

In addition, some life insurance policies in Kansas offer living benefits. These benefits allow the policyholder to access a portion of the death benefit while they are still alive in the event of a terminal illness or other qualifying condition. This can provide financial support for the policyholder and their family during a difficult time.

Life Insurance vs. Accidental Death and Dismemberment Insurance

Accidental Death and Dismemberment (AD&D) insurance is a type of insurance that provides coverage in the event of accidental death or dismemberment. Unlike life insurance, AD&D insurance does not cover death by natural causes or illness. Instead, it only covers accidental death or dismemberment.

While AD&D insurance may be less expensive than life insurance, it provides more limited coverage. In addition, AD&D insurance does not typically have a suicide exclusion clause. This means that if the policyholder dies by suicide, the insurer will still pay out the death benefit.

Conclusion

In Kansas, life insurance policies may have exclusions or limitations for suicide-related deaths. If the policyholder dies by suicide within the exclusion period, the insurer will not pay out the death benefit. However, if the policyholder dies by suicide after the exclusion period has passed, the insurer will typically pay out the death benefit. It’s important to understand the terms of your life insurance policy and to disclose any relevant information when applying for coverage. Despite the suicide clause, life insurance can still provide valuable financial security for your loved ones in the event of your death.

Contents

- Frequently Asked Questions

- 1. Does life insurance pay for suicidal death in Kansas?

- 2. What is the waiting period for suicide under a life insurance policy in Kansas?

- 3. Is suicide covered under accidental death and dismemberment insurance in Kansas?

- 4. Is there any legal requirement to disclose suicidal tendencies while applying for life insurance in Kansas?

- 5. Can the beneficiaries of a life insurance policy be denied the payout in case of suicide in Kansas?

- Does Life Insurance Pay Out in the Event of Suicide?

- Can I Keep Medicaid If My Job Offers Insurance?

- Does Smile Direct Club Take Medicaid Insurance?

- Does Life Insurance Payout Affect Medicaid?

Frequently Asked Questions

Life insurance is an important financial product that provides financial security to your loved ones in case of your untimely demise. However, suicide is a delicate issue that raises questions about the validity of life insurance policies. Here are some frequently asked questions about whether life insurance pays for suicidal death in Kansas.

1. Does life insurance pay for suicidal death in Kansas?

Yes, life insurance policies usually pay for suicidal deaths in Kansas, provided the policy has been in force for a specific period, usually two years. Suicide is considered a covered cause of death under most life insurance policies. However, some policies may have a suicide exclusion clause that limits the payout in case of suicide. It’s important to read your policy documents carefully to understand the terms and conditions.

If the policy has a suicide exclusion clause, the payout may be limited to the premiums paid or a percentage of the sum assured. Some policies may have a graded benefit clause that pays a percentage of the sum assured if the policyholder dies by suicide during the first two years of the policy. After two years, the full sum assured is paid.

2. What is the waiting period for suicide under a life insurance policy in Kansas?

The waiting period for suicide under a life insurance policy in Kansas is usually two years. This means that if the policyholder dies by suicide within two years of the policy’s inception, the payout may be limited to the premiums paid or a percentage of the sum assured. After the waiting period, suicide is considered a covered cause of death, and the full sum assured is paid.

It’s important to note that the waiting period may vary depending on the policy and the insurance company. Some policies may have a longer waiting period, while others may have no waiting period at all. It’s essential to read the policy documents carefully and understand the terms and conditions.

3. Is suicide covered under accidental death and dismemberment insurance in Kansas?

No, suicide is not covered under accidental death and dismemberment (AD&D) insurance in Kansas. AD&D insurance provides coverage for accidental death or dismemberment, but suicide is not considered an accident. If the policyholder dies by suicide, the policy will not pay out any benefits.

It’s important to note that AD&D insurance is different from life insurance, and the terms and conditions may vary. It’s essential to read the policy documents carefully and understand the coverage provided.

4. Is there any legal requirement to disclose suicidal tendencies while applying for life insurance in Kansas?

Yes, there is a legal requirement to disclose any suicidal tendencies while applying for life insurance in Kansas. The insurance company may ask questions about the applicant’s health and medical history, and it’s essential to answer truthfully. Failure to disclose any material information may result in the policy being voided or the payout being denied.

It’s important to note that disclosing suicidal tendencies does not necessarily mean that the policy will be denied. The insurance company may consider other factors, such as the severity and frequency of the tendencies, before deciding on the policy’s terms and conditions.

5. Can the beneficiaries of a life insurance policy be denied the payout in case of suicide in Kansas?

Yes, the beneficiaries of a life insurance policy can be denied the payout in case of suicide in Kansas, if the policy has a suicide exclusion clause. The exclusion clause may limit the payout to the premiums paid or a percentage of the sum assured. It’s important to read the policy documents carefully and understand the terms and conditions.

However, if the policy does not have a suicide exclusion clause, the beneficiaries are entitled to the full sum assured in case of suicide, provided the policy has been in force for the waiting period. It’s essential to read the policy documents carefully and understand the coverage provided.

Does Life Insurance Pay Out in the Event of Suicide?

As a professional writer, it’s important to understand the sensitive nature of the topic of suicide and life insurance. Kansas state law has a provision that prohibits life insurance companies from denying a payout for a suicidal death if the policy has been active for at least two years. However, this does not mean that all policies will cover such deaths. It’s important to read the fine print of any policy to understand the terms and conditions.

It’s also essential to seek help if you or someone you know is struggling with suicidal thoughts. Suicide prevention hotlines and mental health resources are available to offer support and guidance. While life insurance can provide financial assistance to loved ones in the event of a tragic loss, it’s important to prioritize mental health and well-being above all else.

Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering individuals to make well-informed decisions. Guided by his passion, he has assembled a team of seasoned insurance professionals committed to simplifying the intricate world of insurance for you.

- Latest Posts by Rakibul Hasan

-

Can I Keep Medicaid If My Job Offers Insurance?

- -

Does Smile Direct Club Take Medicaid Insurance?

- -

Does Life Insurance Payout Affect Medicaid?

- All Posts