Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering...Read more

Life insurance is a crucial financial tool that can provide financial security for your loved ones in the event of your untimely death. However, for those who rely on Medicaid for their healthcare needs, there may be concerns about how life insurance payouts can impact their eligibility for this important program. In this article, we will explore the relationship between life insurance payouts and Medicaid eligibility, and provide some important information that can help you make informed decisions for yourself and your family.

Medicaid is a federal and state-funded program that provides health insurance to millions of low-income Americans, including seniors, children, and people with disabilities. However, to qualify for Medicaid, individuals must meet certain income and asset requirements, which can sometimes be strict. One question that frequently arises is whether a life insurance payout can affect Medicaid eligibility, and if so, how much of an impact it can have. Let’s dive deeper into this important topic and explore some key considerations for those who rely on Medicaid.

Yes, a life insurance payout can affect Medicaid eligibility if the payout amount exceeds Medicaid’s asset limit. Medicaid is a means-tested program, and eligibility is determined based on income and assets. If the payout amount puts an individual’s assets over the limit, they may lose their Medicaid coverage. However, there are certain types of life insurance policies that are exempt from Medicaid’s asset calculation, such as burial or final expense policies.

Does Life Insurance Payout Affect Medicaid?

Understanding Medicaid Eligibility

Medicaid is a federal and state-funded program that provides healthcare coverage for low-income individuals and families. Eligibility for Medicaid is based on income and assets, and each state has its own set of rules and regulations for determining eligibility. In general, individuals with limited income and assets are eligible for Medicaid coverage.

Income and Asset Limits

To qualify for Medicaid, individuals must meet income and asset limits. These limits vary by state, but in general, individuals must have an income below a certain threshold and have limited assets. In some cases, the value of a person’s home, car, and other assets are not counted towards the asset limit.

Life Insurance and Medicaid Eligibility

When it comes to life insurance, Medicaid eligibility can be affected by the amount of the payout. If the payout from a life insurance policy pushes an individual’s income or assets above the Medicaid limit, they may no longer be eligible for Medicaid coverage. However, there are ways to ensure that life insurance payouts do not affect Medicaid eligibility.

How to Protect Medicaid Eligibility with Life Insurance

There are several ways to protect Medicaid eligibility while still having life insurance coverage. One option is to assign the policy to a trust. This keeps the policy out of the individual’s name and therefore does not count towards their assets. Another option is to name a beneficiary other than the individual themselves. This ensures that the payout goes directly to the beneficiary and does not count towards the individual’s income or assets.

Irrevocable Life Insurance Trust

An Irrevocable Life Insurance Trust (ILIT) is a type of trust that is specifically designed to hold life insurance policies. By creating an ILIT, the policy is removed from the individual’s name and is therefore not counted towards their assets. The policy can still be used to provide financial support to the individual’s beneficiaries.

Beneficiary Designation

Naming a beneficiary other than the individual themselves is another way to protect Medicaid eligibility. By doing this, the payout goes directly to the beneficiary and does not count towards the individual’s assets. It is important to note that this option only works if the beneficiary is someone other than the individual themselves.

Benefits of Having Life Insurance

Life insurance provides financial protection for loved ones in the event of the policyholder’s death. The payout from a life insurance policy can be used to cover funeral expenses, pay off debts, and provide ongoing financial support for dependents.

Term Life Insurance vs. Permanent Life Insurance

There are two main types of life insurance: term life insurance and permanent life insurance. Term life insurance provides coverage for a specific period of time, while permanent life insurance provides coverage for the policyholder’s entire life. Term life insurance is typically less expensive than permanent life insurance, but it does not provide the same level of financial protection.

Choosing the Right Life Insurance Policy

Choosing the right life insurance policy depends on individual needs and financial goals. Term life insurance is a good option for those who want affordable coverage for a specific period of time. Permanent life insurance is a good option for those who want lifelong coverage and a guaranteed payout.

Conclusion

While life insurance payouts can affect Medicaid eligibility, there are ways to protect eligibility while still having life insurance coverage. Creating an ILIT or naming a beneficiary other than the individual themselves are two options to consider. It is also important to choose the right life insurance policy for individual needs and financial goals.

Contents

- Frequently Asked Questions

- 1. Does life insurance payout affect Medicaid?

- 2. How does life insurance payout affect Medicaid eligibility?

- 3. Can I have life insurance and still qualify for Medicaid?

- 4. What happens to life insurance when on Medicaid?

- 5. Can I transfer my life insurance policy to a trust to protect it from Medicaid?

- How Does Life Insurance Affect Medicaid

- Can I Keep Medicaid If My Job Offers Insurance?

- Does Smile Direct Club Take Medicaid Insurance?

- Does Medicaid Cover Car Insurance?

Frequently Asked Questions

1. Does life insurance payout affect Medicaid?

Yes, life insurance payout can affect Medicaid eligibility if the amount received exceeds the Medicaid asset limit. Medicaid is a need-based program that provides healthcare services to low-income individuals. To qualify for Medicaid, an individual must have limited assets and income. If the life insurance payout exceeds the allowed asset limit, the individual may become ineligible for Medicaid.

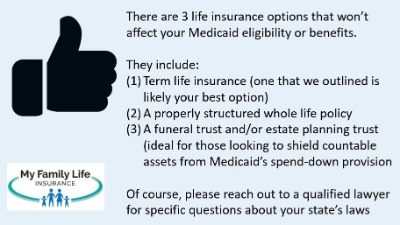

However, there are certain types of life insurance policies that are exempt from Medicaid asset calculations, such as term life insurance policies with no cash value. It is important to consult with a Medicaid planning professional to determine the best course of action when it comes to life insurance and Medicaid eligibility.

2. How does life insurance payout affect Medicaid eligibility?

Life insurance payout can affect Medicaid eligibility when the amount received exceeds the Medicaid asset limit. Medicaid asset limit varies by state but generally ranges from $2,000 to $15,000. If the life insurance payout exceeds the allowed asset limit, the individual may become ineligible for Medicaid.

It is important to note that life insurance payouts are considered income in the month they are received. This means that the individual may become ineligible for Medicaid in the month they receive the payout but may become eligible again in the following months. It is important to consult with a Medicaid planning professional to determine the best course of action when it comes to life insurance and Medicaid eligibility.

3. Can I have life insurance and still qualify for Medicaid?

Yes, it is possible to have life insurance and still qualify for Medicaid. However, the type of life insurance policy and the amount of the payout can affect Medicaid eligibility. Term life insurance policies with no cash value are generally exempt from Medicaid asset calculations. The payout from these policies will not affect Medicaid eligibility.

Whole life insurance policies with cash value may affect Medicaid eligibility if the cash value exceeds the Medicaid asset limit. However, the death benefit from these policies is generally exempt from Medicaid asset calculations. It is important to consult with a Medicaid planning professional to determine the best course of action when it comes to life insurance and Medicaid eligibility.

4. What happens to life insurance when on Medicaid?

When an individual is on Medicaid, the life insurance policy is generally not affected. The policy remains in force, and the individual continues to pay the premiums. However, the payout from the policy may affect Medicaid eligibility if it exceeds the allowed asset limit.

It is important to consult with a Medicaid planning professional to determine the best course of action when it comes to life insurance and Medicaid eligibility. The professional can help the individual navigate the complex rules and regulations surrounding Medicaid and life insurance.

5. Can I transfer my life insurance policy to a trust to protect it from Medicaid?

Yes, it is possible to transfer a life insurance policy to a trust to protect it from Medicaid. The trust becomes the owner of the policy, and the individual is no longer considered the owner. This means that the policy is not considered an asset for Medicaid purposes.

However, there are certain rules and regulations surrounding the transfer of life insurance policies to trusts. It is important to consult with a Medicaid planning professional and an attorney to determine the best course of action when it comes to protecting life insurance policies from Medicaid.

How Does Life Insurance Affect Medicaid

After a thorough analysis of the relationship between life insurance payouts and Medicaid, it is evident that receiving a substantial payout can potentially affect one’s eligibility for Medicaid. This is due to the fact that Medicaid is a means-tested program, meaning it takes into account an individual’s income and assets when determining eligibility. A significant payout from a life insurance policy can be considered an asset and could potentially disqualify an individual from receiving Medicaid benefits.

It is important for individuals to understand the potential consequences of life insurance payouts on their Medicaid eligibility. One option to mitigate this risk is to work with a financial advisor to set up a trust that can hold the life insurance policy proceeds and exclude it from the individual’s assets when determining Medicaid eligibility. By taking a proactive approach and understanding the potential impact of life insurance payouts on Medicaid eligibility, individuals can make informed decisions and ensure they have the necessary resources to meet their healthcare needs.

Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering individuals to make well-informed decisions. Guided by his passion, he has assembled a team of seasoned insurance professionals committed to simplifying the intricate world of insurance for you.

- Latest Posts by Rakibul Hasan

-

Can I Keep Medicaid If My Job Offers Insurance?

- -

Does Smile Direct Club Take Medicaid Insurance?

- -

Does Medicaid Cover Car Insurance?

- All Posts