Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering...Read more

As we go through life, we often find ourselves contemplating the future and considering what steps we can take to protect ourselves and our loved ones. One of the most common ways to do so is by investing in a whole life insurance policy. With this type of coverage, you can rest assured that your family will be taken care of financially in the event of your unexpected passing.

If you’re considering purchasing whole life insurance, one of the key questions on your mind is likely how much it will cost. Specifically, you may be wondering what the cost would be for a policy with a $500,000 death benefit. In this article, we’ll delve into the factors that impact the cost of whole life insurance, as well as provide you with an estimate of what you can expect to pay for this type of coverage. So whether you’re just starting to consider whole life insurance or you’re ready to take the plunge and purchase a policy, read on to learn more about the costs associated with this important form of protection.

The cost of a $500,000 whole life insurance policy can vary depending on several factors, such as your age, health, and lifestyle choices. On average, a healthy 35-year-old non-smoker can expect to pay around $400-500 per month for a whole life insurance policy. However, rates can increase significantly for older individuals or those with pre-existing health conditions. It’s best to speak with a licensed insurance agent to get an accurate quote based on your specific situation.

How Much Does 500,000 Whole Life Insurance Cost?

If you are considering purchasing whole life insurance, you may be wondering how much it will cost for a $500,000 policy. The cost of whole life insurance can vary depending on several factors, such as your age, health, and lifestyle. In this article, we will explore the average cost of 500,000 whole life insurance and what factors can affect the price.

Factors Affecting Whole Life Insurance Cost

The cost of whole life insurance is determined by several factors, including:

- Age

- Gender

- Health

- Lifestyle

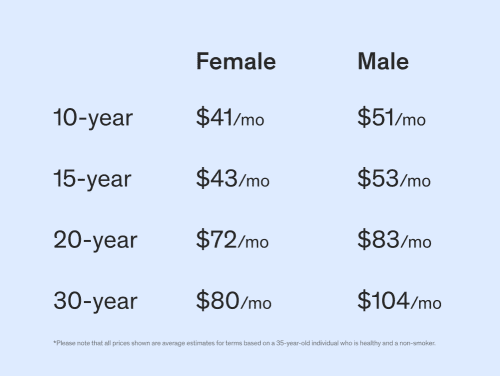

Age is one of the most significant factors in determining the cost of whole life insurance. Generally, the younger you are when you purchase whole life insurance, the lower your premiums will be. Gender can also affect the cost of whole life insurance, with women generally paying less than men. Your health and lifestyle can also play a role in determining your premiums. If you have a pre-existing medical condition or engage in high-risk activities, such as smoking or extreme sports, you may pay more for whole life insurance.

Average Cost of 500,000 Whole Life Insurance

The cost of 500,000 whole life insurance can vary depending on the factors mentioned above. However, according to industry estimates, the average cost of a $500,000 whole life insurance policy for a healthy 35-year-old non-smoker is around $500 per month. This premium will remain constant throughout the life of the policy, and the policy will pay out a death benefit of $500,000 upon the insured’s death.

It’s important to note that the cost of whole life insurance is generally higher than term life insurance, which provides coverage for a specific period, such as 10 or 20 years. However, whole life insurance offers several benefits, such as cash value accumulation and guaranteed death benefits, that term life insurance does not.

Benefits of Whole Life Insurance

Whole life insurance offers several benefits that make it an attractive option for many individuals. These benefits include:

- Cash value accumulation

- Guaranteed death benefits

- Fixed premiums

- Protection for life

- Option to borrow against the policy

One of the most significant benefits of whole life insurance is cash value accumulation. A portion of each premium payment goes towards building cash value, which can be borrowed against or used to pay premiums in the future. Whole life insurance also provides guaranteed death benefits, which means that your beneficiaries will receive a payout upon your death, regardless of when it occurs.

Additionally, whole life insurance offers fixed premiums, which means that your premiums will remain constant throughout the life of the policy. This can provide peace of mind and predictability when it comes to budgeting for insurance costs. Whole life insurance also provides protection for life, as long as premiums are paid, and can be an excellent way to leave a legacy for your loved ones.

Whole Life Insurance vs Term Life Insurance

While whole life insurance offers several benefits, it may not be the best option for everyone. Term life insurance provides coverage for a specific period, such as 10 or 20 years, and is generally more affordable than whole life insurance. While term life insurance does not offer cash value accumulation or guaranteed death benefits, it can provide excellent coverage for a specific need, such as paying off a mortgage or providing for children’s education.

When deciding between whole life insurance and term life insurance, it’s essential to consider your individual needs and circumstances. A financial advisor or insurance professional can help you determine which type of policy is best for you.

Conclusion

The cost of 500,000 whole life insurance can vary depending on several factors, such as your age, health, and lifestyle. However, according to industry estimates, the average cost of a $500,000 whole life insurance policy for a healthy 35-year-old non-smoker is around $500 per month. While whole life insurance may be more expensive than term life insurance, it offers several benefits, such as cash value accumulation and guaranteed death benefits, that may make it an attractive option for some individuals.

Contents

- Frequently Asked Questions

- How much does a $500,000 whole life insurance policy cost?

- What are the factors that affect the cost of a $500,000 whole life insurance policy?

- Can I get a $500,000 whole life insurance policy with no medical exam?

- Is whole life insurance worth the cost for a $500,000 policy?

- Can I Keep Medicaid If My Job Offers Insurance?

- Does Smile Direct Club Take Medicaid Insurance?

- Does Life Insurance Payout Affect Medicaid?

Frequently Asked Questions

Are you considering purchasing a whole life insurance policy, but wondering how much it will cost? Here are some frequently asked questions about the cost of a $500,000 whole life insurance policy.

How much does a $500,000 whole life insurance policy cost?

The cost of a $500,000 whole life insurance policy will vary based on several factors. These factors include your age, health, and lifestyle habits such as smoking. On average, a 30-year-old non-smoker in good health can expect to pay around $3,500-$4,500 per year for a $500,000 whole life insurance policy. However, if you are older or have health issues, the cost will be higher.

It’s important to note that whole life insurance policies are more expensive than term life insurance policies because they offer lifelong coverage and have a cash value component. The cash value component means that a portion of your premium payments goes towards building up a cash value that you can borrow against or use to pay your premiums.

What are the factors that affect the cost of a $500,000 whole life insurance policy?

The cost of a $500,000 whole life insurance policy is affected by several factors. These include your age, health, lifestyle habits such as smoking, and the type of policy you choose. For example, a policy with a higher death benefit will be more expensive than one with a lower death benefit. Additionally, policies with more features, such as a long-term care rider, will also be more expensive.

It’s important to remember that the cost of a whole life insurance policy is calculated based on your individual risk factors. This means that while one person may pay $3,500 per year for a $500,000 policy, another person with different risk factors may pay significantly more.

Can I get a $500,000 whole life insurance policy with no medical exam?

Yes, it is possible to get a $500,000 whole life insurance policy with no medical exam. These policies are typically referred to as “guaranteed issue” policies and are designed for people who may have difficulty getting traditional life insurance due to health issues. However, these policies are more expensive than traditional policies and may have lower death benefits. Additionally, they may have a waiting period before the death benefit is paid out.

It’s important to carefully research and compare the different types of whole life insurance policies before making a decision. A licensed insurance agent can help you understand your options and find the right policy for your needs.

Is whole life insurance worth the cost for a $500,000 policy?

Whether or not whole life insurance is worth the cost for a $500,000 policy depends on your individual circumstances and financial goals. Whole life insurance policies are more expensive than term life insurance policies, but they offer lifelong coverage and a cash value component. If you want to ensure that your loved ones are financially protected after you pass away and you want to build up cash value over time, a whole life insurance policy may be worth the cost.

However, if you only need coverage for a specific period of time, such as until your children are grown or until you retire, a term life insurance policy may be a more cost-effective option. It’s important to carefully consider your financial goals and budget before making a decision.

As a professional writer, I understand that financial planning is essential, and life insurance plays a pivotal role in securing one’s family’s future. The cost of whole life insurance is a significant concern for many individuals who want to ensure that their family is financially protected in case of their untimely demise. While the cost of whole life insurance can vary based on several factors, such as age, health, and coverage amount, it is safe to say that a $500,000 whole life insurance policy can cost anywhere between $5000 to $15000 annually.

It is crucial to note that the cost of whole life insurance may seem high compared to term life insurance. However, whole life insurance provides lifelong coverage and has cash value savings that can be used in emergencies or for retirement. Therefore, investing in whole life insurance is a wise financial decision that can secure your family’s future and provide peace of mind. In conclusion, while the cost of whole life insurance may seem daunting, it is a valuable investment that can provide lifelong security and financial stability to your loved ones.

Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering individuals to make well-informed decisions. Guided by his passion, he has assembled a team of seasoned insurance professionals committed to simplifying the intricate world of insurance for you.

- Latest Posts by Rakibul Hasan

-

Can I Keep Medicaid If My Job Offers Insurance?

- -

Does Smile Direct Club Take Medicaid Insurance?

- -

Does Life Insurance Payout Affect Medicaid?

- All Posts