Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering...Read more

As we go through life, we are faced with different challenges and uncertainties. It is important to prepare for any eventualities that may arise, especially when it comes to our loved ones. One way to do this is by purchasing life insurance. But the question remains, how much is 2 million life insurance?

The answer to this question is not straightforward as it depends on several factors. These include your age, health status, occupation, and lifestyle choices. In this article, we will delve into the world of life insurance and explore the different factors that affect the cost of a 2 million life insurance policy. We will also help you understand how to choose the right policy for your needs and budget. So, keep reading to learn more.

The cost of a 2 million dollar life insurance policy depends on many factors, including age, health, and lifestyle. Generally, the younger and healthier you are, the lower your premiums will be. On average, a 35-year-old non-smoker can expect to pay around $75 per month for a 20-year term policy with a $2 million death benefit. However, rates vary widely depending on individual circumstances and insurance providers.

Contents

- How Much is 2 Million Life Insurance?

- Frequently Asked Questions

- What is 2 Million Life Insurance?

- Who should consider getting 2 Million Life Insurance?

- How do I apply for 2 Million Life Insurance?

- What happens if I pass away during the policy term?

- Can I change or cancel my 2 Million Life Insurance policy?

- Can I Keep Medicaid If My Job Offers Insurance?

- Does Smile Direct Club Take Medicaid Insurance?

- Does Life Insurance Payout Affect Medicaid?

How Much is 2 Million Life Insurance?

If you are considering purchasing life insurance, you probably have a lot of questions about the process. One of the most common questions is how much coverage you should get. In particular, you may be wondering how much 2 million dollars in life insurance would cost. In this article, we will break down the factors that influence the cost of life insurance and give you an idea of what you can expect to pay for a 2 million dollar policy.

Factors That Influence the Cost of Life Insurance

There are several factors that will influence the cost of your life insurance policy. These include your age, your health, your occupation, and your lifestyle. Let’s take a closer look at each of these factors:

- Age: Generally speaking, the younger you are when you purchase life insurance, the cheaper your policy will be. This is because younger people are statistically less likely to die than older people.

- Health: Your health is a major factor in determining the cost of your life insurance policy. If you have a pre-existing medical condition or engage in risky behaviors (such as smoking), you can expect to pay more for coverage.

- Occupation: If you have a dangerous or physically demanding job, you may be considered a higher risk and have to pay more for coverage.

- Lifestyle: Your lifestyle habits (such as drinking or engaging in extreme sports) can also impact the cost of your policy.

Keep in mind that these factors are just a few of the many that can influence the cost of your policy. Your insurance provider will take a comprehensive look at your risk profile before determining your premium.

How Much Does 2 Million Dollars in Life Insurance Cost?

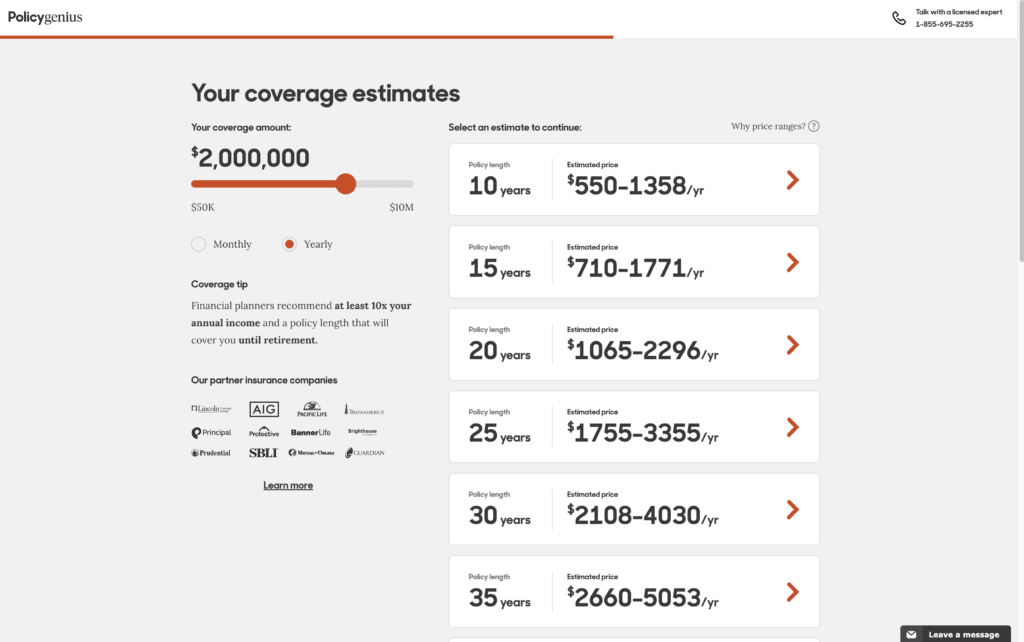

Now that we have a better understanding of the factors that influence life insurance premiums, let’s take a look at how much a 2 million dollar policy might cost.

The cost of a life insurance policy can vary significantly depending on your age, health, and other factors. However, as a general rule of thumb, you can expect to pay between $100 and $200 per month for a 2 million dollar policy.

It’s important to remember that this is just an estimate. The cost of your policy may be higher or lower depending on your individual circumstances. The only way to get an accurate quote is to contact an insurance provider and provide them with your personal information.

Benefits of a 2 Million Dollar Life Insurance Policy

So, why would someone need a 2 million dollar life insurance policy? There are several reasons:

- Provide for your family: If you have a spouse and children who rely on your income, a 2 million dollar policy can ensure that they are taken care of financially if something happens to you.

- Pay off debts: If you have significant debts (such as a mortgage or student loans), a 2 million dollar policy can help ensure that your loved ones are not burdened with these expenses if you pass away.

- Leave a legacy: Some people choose to purchase a 2 million dollar policy as a way to leave a financial legacy for their loved ones or a charity.

2 Million Dollar Life Insurance vs. Other Coverage Amounts

How does a 2 million dollar policy compare to other coverage amounts? Here’s a quick breakdown:

- $500,000: A $500,000 policy is a common choice for young families. It can provide enough coverage to pay off debts and provide for your family’s basic needs.

- $1 million: A $1 million policy is often recommended for families with young children. It can provide a higher level of financial security and cover expenses such as college tuition.

- $5 million or more: If you have a high net worth or a large estate, you may need a policy with a higher coverage amount.

Ultimately, the right coverage amount for you will depend on your individual circumstances. It’s important to speak with an insurance provider to determine what level of coverage makes the most sense for your needs.

Conclusion

A 2 million dollar life insurance policy can provide financial security for your loved ones in the event of your untimely death. However, the cost of your policy will depend on a variety of factors, including your age, health, and lifestyle. To get an accurate quote, be sure to contact an insurance provider and provide them with your personal information.

Frequently Asked Questions

Here are some answers to common questions about 2 Million Life Insurance:

What is 2 Million Life Insurance?

2 Million Life Insurance is a type of life insurance policy that pays out a lump sum of $2 million to your beneficiaries upon your death. This policy is designed to provide financial security for your loved ones in the event of your unexpected passing.

The cost of 2 Million Life Insurance depends on various factors such as your age, health, and lifestyle. Generally, the younger and healthier you are, the lower your premiums will be. It’s important to shop around for different policies and compare rates to find the best option for you.

Who should consider getting 2 Million Life Insurance?

2 Million Life Insurance may be a good option for individuals with high net worth or those who have large financial obligations such as mortgages, business loans, or dependents with special needs. It can also benefit those who want to leave a substantial inheritance for their loved ones or charitable organizations.

However, it’s important to evaluate your financial situation and needs before purchasing a policy. If you have limited financial resources or no dependents, a smaller policy may be more suitable for your needs.

How do I apply for 2 Million Life Insurance?

To apply for 2 Million Life Insurance, you typically need to fill out an application with a life insurance company and undergo a medical exam. The insurance company will review your application and medical history to determine your premiums and coverage.

It’s important to be honest and accurate in your application, as any discrepancies or omissions can invalidate your policy or result in denied claims. Working with a licensed insurance agent can help you navigate the application process and find the best policy for your needs.

What happens if I pass away during the policy term?

If you pass away during the policy term, your beneficiaries will receive a lump sum of $2 million from the insurance company. They can use the money for any purpose, such as paying off debts, covering living expenses, or investing for the future.

It’s important to keep your beneficiaries informed about your policy and ensure that your contact information and payment details are up to date. This can help prevent delays or complications in the claims process.

Can I change or cancel my 2 Million Life Insurance policy?

Yes, you can change or cancel your 2 Million Life Insurance policy at any time. However, the terms and conditions of your policy may vary depending on the insurance company and type of policy.

If you want to make changes to your policy, such as increasing or decreasing your coverage, you may need to undergo a new medical exam or provide updated information. If you want to cancel your policy, you may receive a refund of premiums or a surrender value depending on the terms of your policy.

As a professional writer, I can say that 2 million life insurance is a significant investment that can provide financial security to your loved ones in the event of an unexpected tragedy. Although the cost of this type of insurance may vary depending on several factors, such as age, health, and lifestyle, it is essential to consider the benefits it provides.

If you are the primary breadwinner in your family, having 2 million life insurance can ensure that your spouse and children can maintain their standard of living if something were to happen to you. It can also cover expenses such as mortgage payments, education costs, and other significant expenses that your family may face. Ultimately, 2 million life insurance is a valuable investment that can provide peace of mind knowing that your loved ones are protected financially.

Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering individuals to make well-informed decisions. Guided by his passion, he has assembled a team of seasoned insurance professionals committed to simplifying the intricate world of insurance for you.

- Latest Posts by Rakibul Hasan

-

Can I Keep Medicaid If My Job Offers Insurance?

- -

Does Smile Direct Club Take Medicaid Insurance?

- -

Does Life Insurance Payout Affect Medicaid?

- All Posts