Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering...Read more

As we go through life, we are constantly faced with the need to plan for the future. One of the most important aspects of financial planning is ensuring that our loved ones are taken care of in the event of our passing. This is where a whole life insurance policy comes in handy. With its guaranteed death benefit and cash value accumulation, it offers a level of financial security that can provide peace of mind to those left behind. But what does a million-dollar whole life insurance policy really cost?

While the idea of a million-dollar life insurance policy may seem excessive to some, it can actually be a smart investment for those with dependents or large estates. However, the cost of such a policy can vary greatly depending on a number of factors, including age, health status, and lifestyle habits. In this article, we will explore the ins and outs of whole life insurance policies and provide you with an idea of how much you can expect to pay for a million-dollar policy. So, if you’re considering purchasing a whole life insurance policy, read on to find out what you can expect to pay for a million-dollar policy.

The cost of a million-dollar whole life insurance policy varies depending on several factors, such as age, health, lifestyle, and the type of policy. On average, a healthy 35-year-old non-smoker male can expect to pay around $12,000-$15,000 annually for a million-dollar whole life policy. However, the premium can go up significantly for older and less healthy individuals. It’s best to consult with a licensed insurance agent to get a personalized quote for your specific situation.

Contents

- How Much is a Million Dollar Whole Life Insurance Policy?

- Frequently Asked Questions

- What is a million dollar whole life insurance policy?

- How much does a million dollar whole life insurance policy cost?

- What are the benefits of a million dollar whole life insurance policy?

- How do I apply for a million dollar whole life insurance policy?

- What should I consider before purchasing a million dollar whole life insurance policy?

- Can I Keep Medicaid If My Job Offers Insurance?

- Does Smile Direct Club Take Medicaid Insurance?

- Does Life Insurance Payout Affect Medicaid?

How Much is a Million Dollar Whole Life Insurance Policy?

If you are considering purchasing a whole life insurance policy with a face value of $1 million, you may be wondering how much it will cost you. The answer is not straightforward, as there are several factors that can affect the price of a million-dollar whole life insurance policy. In this article, we will explore these factors and provide you with an estimate of how much you can expect to pay for a million-dollar whole life insurance policy.

Factors that Affect the Cost of a Million Dollar Whole Life Insurance Policy

The cost of a million-dollar whole life insurance policy can vary widely depending on several factors, including:

Age

Age is one of the most significant factors that can affect the cost of a whole life insurance policy. Generally, the younger you are when you purchase a policy, the lower your premiums will be. This is because younger individuals are considered lower risk due to their longer life expectancy.

Health

Your health is another critical factor that can impact the cost of your whole life insurance policy. If you have a pre-existing medical condition or a history of chronic illness, you may be considered a higher risk, which can lead to higher premiums.

Gender

Gender can also play a role in determining the cost of a million-dollar whole life insurance policy. Women tend to live longer than men, which means they are considered lower risk and may pay lower premiums.

Smoking Status

If you are a smoker, you can expect to pay higher premiums for a whole life insurance policy. This is because smoking is associated with several health risks that can increase your overall risk profile.

Occupation

Your occupation can also impact the cost of your whole life insurance policy. If you work in a high-risk profession, such as construction or law enforcement, you may be considered a higher risk and may pay higher premiums.

How Much Will a Million Dollar Whole Life Insurance Policy Cost?

The cost of a million-dollar whole life insurance policy can vary widely depending on the factors listed above. However, as a general rule, you can expect to pay anywhere from $5,000 to $20,000 per year for a million-dollar whole life insurance policy.

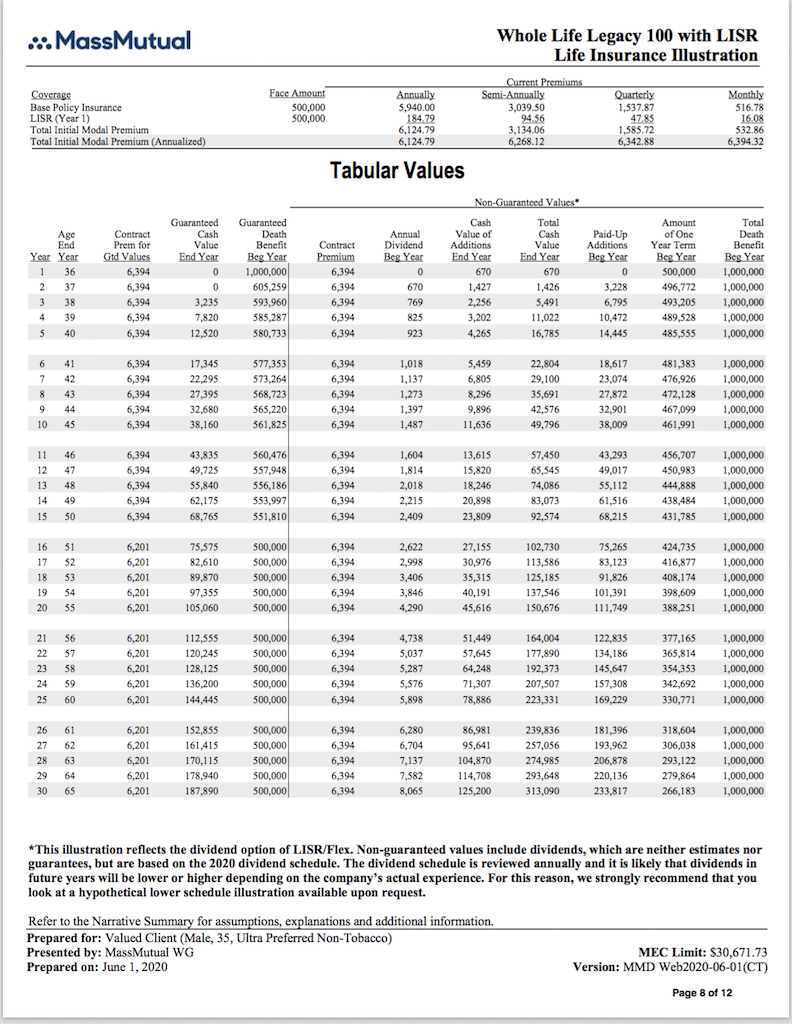

To give you a better idea of what you can expect to pay, we’ve provided a table below that outlines the average annual premiums for a million-dollar whole life insurance policy based on age and gender.

| Age | Female | Male |

|---|---|---|

| 30 | $6,200 | $7,400 |

| 40 | $8,800 | $10,500 |

| 50 | $12,800 | $15,200 |

| 60 | $19,500 | $23,300 |

Benefits of a Million Dollar Whole Life Insurance Policy

A million-dollar whole life insurance policy can provide you with several benefits, including:

Guaranteed Death Benefit

A whole life insurance policy provides a guaranteed death benefit, which means that your beneficiaries will receive a payout when you pass away, regardless of when that occurs.

Cash Value Accumulation

Whole life insurance policies also have a cash value component, which means that a portion of your premium payments will be set aside in a savings account that accumulates interest over time.

Fixed Premiums

Whole life insurance policies also have fixed premiums, which means that your premiums will remain the same for the life of the policy, regardless of your age or health status.

Whole Life Insurance vs. Term Life Insurance

When considering a million-dollar life insurance policy, you may also be wondering whether to choose whole life insurance or term life insurance. Here are some key differences between the two:

Duration

Term life insurance provides coverage for a specified period, typically 10, 20, or 30 years, while whole life insurance provides coverage for your entire life.

Premiums

Term life insurance typically has lower premiums than whole life insurance, but the premiums can increase significantly when you renew the policy.

Cash Value

Term life insurance policies do not have a cash value component, which means that you cannot borrow against the policy or use it as collateral.

Ultimately, the choice between whole life insurance and term life insurance will depend on your individual needs and preferences. If you are looking for lifelong coverage and a guaranteed death benefit, whole life insurance may be the right choice for you. However, if you are looking for lower premiums and coverage for a specific period, term life insurance may be a better option.

Frequently Asked Questions

Here are some frequently asked questions about million dollar whole life insurance policy:

What is a million dollar whole life insurance policy?

A million dollar whole life insurance policy is a type of life insurance that provides coverage for the entire life of the insured person. It pays a death benefit of one million dollars to the beneficiaries upon the death of the insured person. The premium for this type of policy is typically higher than for other types of life insurance policies, but it also offers more benefits and guarantees.

Whole life insurance policies are designed to offer both protection and savings. They typically have a fixed premium that remains the same throughout the life of the policy. They also have a cash value component that grows over time and can be used to pay premiums or to borrow against.

How much does a million dollar whole life insurance policy cost?

The cost of a million dollar whole life insurance policy depends on several factors, including the age, health, and lifestyle of the insured person. The premium for this type of policy is typically higher than for other types of life insurance policies, due to the higher death benefit and additional benefits and guarantees provided.

On average, a million dollar whole life insurance policy can cost anywhere from $10,000 to $20,000 per year. However, the cost can vary significantly depending on the individual circumstances of the insured person.

What are the benefits of a million dollar whole life insurance policy?

A million dollar whole life insurance policy offers several benefits, including a guaranteed death benefit of one million dollars, a fixed premium that remains the same throughout the life of the policy, and a cash value component that grows over time and can be used to pay premiums or to borrow against.

Additionally, whole life insurance policies offer tax-deferred growth on the cash value component, meaning that the policyholder does not have to pay taxes on the growth until they withdraw the funds. They also offer protection against inflation, as the death benefit and cash value component increase over time.

How do I apply for a million dollar whole life insurance policy?

To apply for a million dollar whole life insurance policy, you will need to contact an insurance agent or broker who specializes in this type of policy. They will ask you a series of questions about your age, health, lifestyle, and financial situation to determine your eligibility for the policy.

You will also need to undergo a medical exam and provide medical records and other documentation to support your application. The insurance company will then review your application and determine whether to approve or deny your request for coverage.

What should I consider before purchasing a million dollar whole life insurance policy?

Before purchasing a million dollar whole life insurance policy, you should consider your financial situation, your health and lifestyle, and your long-term goals. You should also consider the cost of the policy and whether you can afford the premiums.

You should also consider whether a million dollar whole life insurance policy is the best option for your needs. There are other types of life insurance policies available that may offer lower premiums or different benefits and guarantees, depending on your individual circumstances.

In summary, a million-dollar whole life insurance policy can provide peace of mind and financial security for your loved ones in the event of your passing. While the cost of such a policy can vary depending on factors such as age, health history, and lifestyle, it is important to consider the long-term benefits and protection it can provide.

When considering a million-dollar whole life insurance policy, it is important to consult with a professional insurance agent to determine the best options for your unique needs and budget. With the right coverage in place, you can rest assured that your loved ones will be taken care of and have the financial resources to navigate life without you. Investing in a whole life insurance policy is a smart decision that can provide lasting peace of mind for you and your family.

Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering individuals to make well-informed decisions. Guided by his passion, he has assembled a team of seasoned insurance professionals committed to simplifying the intricate world of insurance for you.

- Latest Posts by Rakibul Hasan

-

Can I Keep Medicaid If My Job Offers Insurance?

- -

Does Smile Direct Club Take Medicaid Insurance?

- -

Does Life Insurance Payout Affect Medicaid?

- All Posts