Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering...Read more

Auto insurance is a necessary expense for anyone who owns a car. While many drivers opt for comprehensive coverage, others may choose to go with just liability auto insurance. Liability insurance covers damages or injuries you cause to others if you are at fault in an accident. But just how much does this basic coverage cost?

The price of liability auto insurance varies depending on a number of factors, including the driver’s age, driving record, and location. In general, younger drivers and those with a history of accidents or traffic violations will pay more for liability insurance than older, safer drivers. Additionally, drivers living in areas with higher rates of accidents or theft may also see higher premiums. So, how much can you expect to pay for just liability auto insurance? Let’s explore this topic in more detail.

The cost of liability auto insurance varies depending on factors such as your age, location, driving record, and the type of car you drive. On average, you can expect to pay around $50 to $100 per month for just liability coverage. However, it’s important to note that this type of insurance only covers damages and injuries you may cause to others in an accident, not your own. It’s recommended to review your insurance needs with a licensed agent to determine the coverage that’s best for you.

Contents

- How Much is Just Liability Auto Insurance?

- Frequently Asked Questions

- What is just liability auto insurance?

- How much does just liability auto insurance cost?

- Do I need just liability auto insurance?

- Can I add other types of coverage to my just liability auto insurance?

- How do I purchase just liability auto insurance?

- Liability Auto Insurance 101

- Can I Keep Medicaid If My Job Offers Insurance?

- Does Smile Direct Club Take Medicaid Insurance?

- Does Life Insurance Payout Affect Medicaid?

How Much is Just Liability Auto Insurance?

If you’re looking for cheap car insurance, you may be wondering how much just liability coverage will cost you. Liability insurance is the most basic type of car insurance required by law in most states. It covers damage to other people’s property and injuries they sustain in an accident that you caused. However, it doesn’t cover damage to your own car or injuries you sustain in an accident. In this article, we’ll explore how much you can expect to pay for liability-only car insurance and some of the factors that affect the cost.

Factors that Affect the Cost of Liability-Only Car Insurance

The cost of liability-only car insurance can vary depending on a number of factors, including:

1. Your Driving Record

Your driving record is one of the biggest factors that can affect the cost of your car insurance. If you have a clean driving record with no accidents or tickets, you’ll likely pay less for car insurance than someone with a history of accidents or violations.

2. Your Age and Gender

Younger drivers and male drivers typically pay more for car insurance than older drivers and female drivers. This is because younger and male drivers are statistically more likely to get into accidents.

3. Your Location

Where you live can also affect the cost of your car insurance. Insurance companies look at factors like the crime rate and the number of accidents in your area when determining your rate.

4. The Type of Car You Drive

The type of car you drive can also affect the cost of your car insurance. Cars that are more expensive to repair or replace, or that have a higher likelihood of being stolen, will typically cost more to insure.

How Much Does Liability-Only Car Insurance Cost?

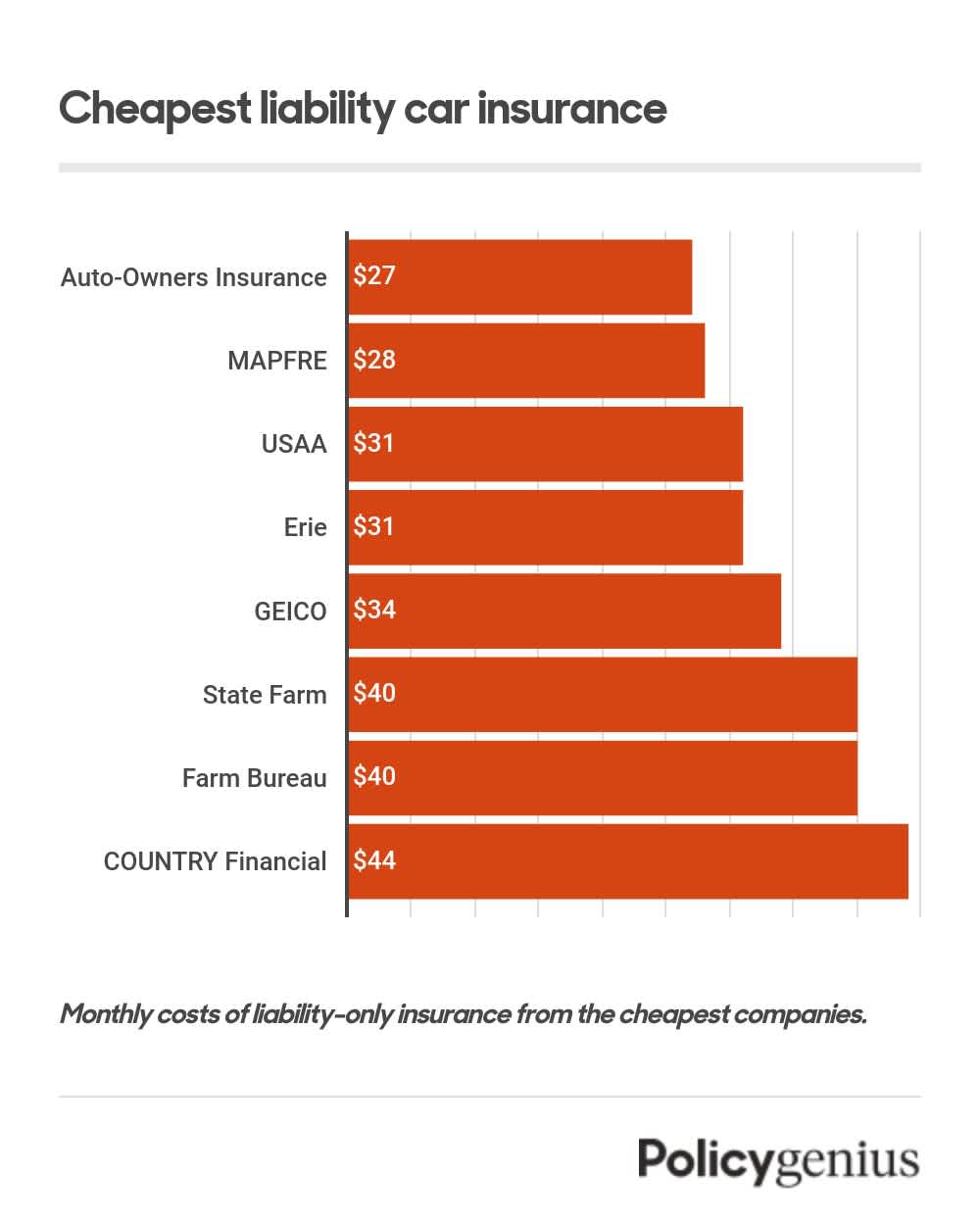

The cost of liability-only car insurance can vary widely depending on your individual circumstances. However, according to the National Association of Insurance Commissioners, the average cost of liability-only car insurance in the United States is around $600 per year.

It’s important to note that this is just an average, and your actual cost may be higher or lower depending on your individual circumstances. Factors like your driving record, age, gender, location, and the type of car you drive can all affect your rate.

The Benefits of Liability-Only Car Insurance

While liability-only car insurance may not provide as much coverage as a more comprehensive policy, there are still some benefits to opting for this type of coverage. Some of the benefits of liability-only car insurance include:

1. It’s Affordable

Liability-only car insurance is typically much more affordable than more comprehensive policies. If you’re on a tight budget, this type of coverage can help you meet your legal requirements without breaking the bank.

2. It Meets Legal Requirements

In most states, liability insurance is required by law. By opting for liability-only car insurance, you can meet your legal requirements without having to pay for more coverage than you need.

3. It Protects You from Liability

If you cause an accident that results in damage to someone else’s property or injuries to another person, liability insurance can help protect you from financial liability. Without this type of coverage, you could be on the hook for thousands of dollars in damages.

Liability-Only vs. Full Coverage Car Insurance

While liability-only car insurance can be a good option for some drivers, it’s not always the best choice. Here are some of the key differences between liability-only and full coverage car insurance to help you decide which option is right for you:

1. Coverage

Liability-only car insurance only covers damage to other people’s property and injuries they sustain in an accident that you caused. Full coverage car insurance, on the other hand, also covers damage to your own car and injuries you sustain in an accident.

2. Cost

Liability-only car insurance is typically much more affordable than full coverage car insurance. However, you may end up paying more out of pocket if you’re in an accident and don’t have enough coverage.

3. Peace of Mind

Full coverage car insurance can provide greater peace of mind because you know you’re fully protected in the event of an accident. With liability-only car insurance, you may be left with significant expenses if you’re in an accident and don’t have enough coverage.

Conclusion

Liability-only car insurance is the most basic type of car insurance you can purchase. While it may not provide as much coverage as a more comprehensive policy, it can help you meet your legal requirements and protect you from financial liability in the event of an accident. If you’re on a tight budget or don’t drive a valuable car, liability-only car insurance may be a good option for you. However, if you want greater peace of mind and more comprehensive coverage, full coverage car insurance may be a better choice.

Frequently Asked Questions

Auto insurance can be confusing, especially when it comes to understanding liability coverage. Here are some common questions and answers about just liability auto insurance.

What is just liability auto insurance?

Just liability auto insurance, also known as liability-only coverage, is the minimum amount of car insurance required by law in most states. This type of coverage only pays for damages you cause to other people and their property, not for your own injuries or damage to your own vehicle. If you cause an accident, your liability insurance will cover the cost of the other driver’s medical bills and car repairs.

Liability coverage is usually expressed as three numbers, such as 25/50/25. The first number represents the maximum amount your insurer will pay for bodily injury per person. The second number is the maximum amount they will pay for bodily injury per accident, and the third number is the maximum amount they will pay for property damage per accident.

How much does just liability auto insurance cost?

The cost of just liability auto insurance varies depending on several factors, including your age, gender, driving record, and location. On average, liability-only coverage costs about $500 per year, but this can be higher or lower depending on these factors. It is important to note that just liability coverage is usually the cheapest type of car insurance, but it also provides the least amount of protection.

If you are on a tight budget and need to save money on car insurance, just liability coverage may be a good option for you. However, if you can afford it, you may want to consider purchasing a more comprehensive policy that provides additional protection in case of an accident.

Do I need just liability auto insurance?

Yes, in most states, you are required by law to carry liability insurance on your car. The minimum coverage requirements vary by state, so be sure to check your state’s requirements to ensure you are properly covered. Even if your state does not require liability insurance, it is still a good idea to have this coverage to protect yourself in case of an accident.

If you are found to be at fault in an accident and do not have liability insurance, you could be held personally responsible for paying for the other driver’s medical bills, car repairs, and other damages. This could result in financial ruin, so it is important to have adequate insurance coverage.

Can I add other types of coverage to my just liability auto insurance?

Yes, you can add other types of coverage to your liability-only policy, such as collision coverage, comprehensive coverage, and uninsured/underinsured motorist coverage. Collision coverage pays for damages to your own vehicle if you are involved in an accident, regardless of who is at fault. Comprehensive coverage pays for damages to your vehicle caused by things like theft, vandalism, or natural disasters. Uninsured/underinsured motorist coverage pays for damages if you are in an accident with a driver who does not have enough insurance to cover the costs.

Adding these types of coverage to your liability policy will increase your premiums, but it will also provide you with more protection in case of an accident. Consider your driving habits and budget when deciding whether to add additional coverage to your policy.

How do I purchase just liability auto insurance?

You can purchase just liability auto insurance from any licensed insurance provider in your state. You can get quotes online or by calling insurance companies directly. Be sure to compare quotes from several companies to ensure you are getting the best price for the coverage you need.

When purchasing liability insurance, be sure to choose coverage limits that meet the minimum requirements in your state. You may also want to consider increasing your coverage limits for additional protection. Once you have chosen your coverage options, you can purchase your policy online or over the phone.

Liability Auto Insurance 101

As a professional writer, it is important to highlight the significance of understanding the cost of just liability auto insurance. This type of insurance is the bare minimum required by law, and it covers damages or injuries you may cause to other drivers in an accident. However, it is crucial to understand that liability insurance does not cover damages to your own vehicle or your personal injuries.

Therefore, it is important to weigh the potential risks and benefits of purchasing only liability insurance. While it may seem like a cost-effective option, the potential financial burden of covering damages to your own vehicle or personal injuries may outweigh the cost of a more comprehensive insurance plan. As a responsible driver, it is essential to evaluate your individual needs and risks and make an informed decision on the type of insurance coverage that best suits you. Ultimately, investing in a more comprehensive insurance plan may provide peace of mind and financial security in the long run.

Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering individuals to make well-informed decisions. Guided by his passion, he has assembled a team of seasoned insurance professionals committed to simplifying the intricate world of insurance for you.

- Latest Posts by Rakibul Hasan

-

Can I Keep Medicaid If My Job Offers Insurance?

- -

Does Smile Direct Club Take Medicaid Insurance?

- -

Does Life Insurance Payout Affect Medicaid?

- All Posts