Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering...Read more

Life insurance is a crucial investment in today’s world. It provides financial protection to your loved ones in case of an unfortunate event. However, what many people don’t know is that life insurance is also taxable, and the amount you pay for it can affect your overall tax liability. This is where imputed income comes into play. Imputed income is the value of benefits provided by your employer that are not included in your regular salary. In the case of life insurance, it refers to the value of the life insurance coverage provided by your employer that exceeds $50,000.

Calculating imputed income for life insurance can be complex, and it is essential to understand the process to ensure you are not paying more tax than necessary. In this article, we will dive into the details of calculating imputed income for life insurance. We will break down the steps involved, explain the formula used, and provide examples to help you understand the process better. So, if you want to reduce your tax liability and ensure you are not overpaying for your life insurance coverage, keep reading to learn how to calculate imputed income for life insurance.

To calculate imputed income for life insurance, add up the total cost of the premiums paid by the employer and any additional coverage provided to the employee. Then divide that total by 12 to get the monthly imputed income amount. This imputed income is added to the employee’s taxable income for the year. It’s important to note that imputed income may also apply to other benefits, such as health insurance or company cars.

Contents

- How to Calculate Imputed Income for Life Insurance?

- Frequently Asked Questions

- What is imputed income for life insurance?

- Do all employees have imputed income for life insurance?

- Can imputed income be avoided?

- Is imputed income for life insurance subject to Social Security and Medicare taxes?

- How does imputed income for life insurance affect my overall taxable income?

- Can I Keep Medicaid If My Job Offers Insurance?

- Does Smile Direct Club Take Medicaid Insurance?

- Does Life Insurance Payout Affect Medicaid?

How to Calculate Imputed Income for Life Insurance?

Imputed income is the amount of money that is added to an employee’s taxable income due to the provision of life insurance coverage by their employer. This is a common practice in many organizations that provide group life insurance coverage to their employees. The process of calculating imputed income for life insurance can be complex, but it is important to understand the factors that affect the calculation to ensure compliance with tax regulations. In this article, we will discuss how to calculate imputed income for life insurance.

What is Imputed Income for Life Insurance?

When an employer provides group life insurance coverage to its employees, the premiums paid for the coverage are considered a taxable benefit. This is because the Internal Revenue Service (IRS) considers the coverage to be a form of income. The amount of imputed income for life insurance is the difference between the cost of the insurance coverage and the amount paid by the employee.

For example, if an employee receives $50,000 in group life insurance coverage and the cost of the coverage is $100, the imputed income for that employee would be $50,000 – $100 = $49,900. This amount is added to the employee’s taxable income and is subject to federal and state income taxes, Social Security taxes, and Medicare taxes.

How to Calculate Imputed Income for Life Insurance?

To calculate imputed income for life insurance, you need to know the cost of the coverage and the amount of coverage provided to the employee. The cost of the coverage is determined by the insurance company based on the age and health of the employee, the amount of coverage, and the length of the coverage period.

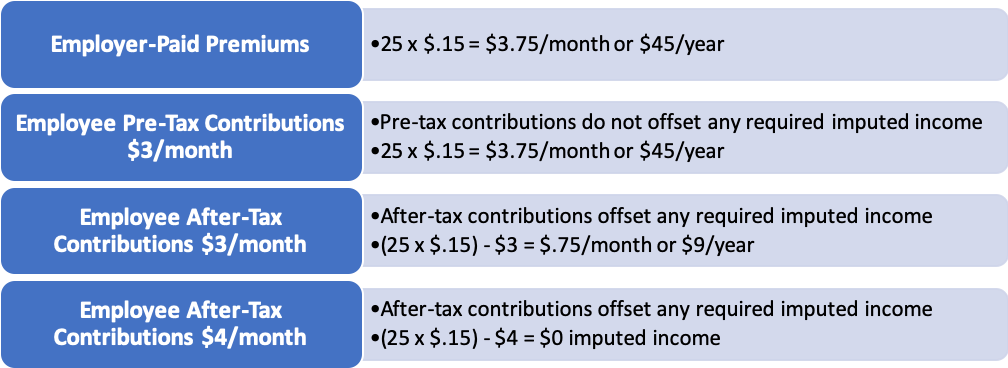

Once you have the cost of the coverage, you need to subtract the amount paid by the employee for the coverage. This amount is usually deducted from the employee’s paycheck on a pre-tax basis. The difference between the cost of the coverage and the amount paid by the employee is the imputed income.

It is important to note that imputed income is calculated on an annual basis. This means that if an employee receives $50,000 in group life insurance coverage for one year, the imputed income for that year would be based on the cost of the coverage for that year.

Benefits of Imputed Income for Life Insurance

While imputed income for life insurance may seem like a disadvantage to employees, there are some benefits to this arrangement. For one, employees get the benefit of having life insurance coverage without having to pay the full cost of the coverage. Additionally, imputed income for life insurance is typically less expensive than purchasing an individual policy on the open market.

Furthermore, group life insurance policies typically do not require a medical exam, which means that employees with pre-existing conditions or health issues may still be able to get coverage. Finally, group life insurance policies may also offer additional benefits, such as accidental death and dismemberment coverage, which can provide additional financial protection for employees and their families.

Imputed Income for Life Insurance vs. Individual Policies

While group life insurance policies have their benefits, they may not be the best option for everyone. For those who are young and healthy, individual life insurance policies may be a better choice. Individual policies offer more flexibility in terms of coverage amount and length of coverage, and they are not subject to imputed income.

However, individual policies can be more expensive than group policies, and they may require a medical exam or other underwriting requirements. Additionally, individual policies may not offer the same level of additional benefits as group policies, such as accidental death and dismemberment coverage.

Conclusion

In conclusion, imputed income for life insurance is a common practice in many organizations that provide group life insurance coverage to their employees. It is important to understand how imputed income is calculated and the factors that affect the calculation to ensure compliance with tax regulations. While imputed income may seem like a disadvantage to employees, it offers some benefits, such as providing life insurance coverage at a lower cost than individual policies. However, individual policies may be a better choice for those who are young and healthy and want more flexibility in their coverage.

Frequently Asked Questions

Imputed income for life insurance is an important concept to understand for those who receive life insurance benefits from their employer. Here are some commonly asked questions and answers on how to calculate imputed income for life insurance:

What is imputed income for life insurance?

Imputed income for life insurance refers to the value of the life insurance coverage provided by an employer that exceeds the cost of the coverage paid by the employee. This excess value is considered taxable income to the employee, even though they do not receive the excess value in cash. The imputed income is reported on the employee’s W-2 form and is subject to income and payroll taxes.

The amount of imputed income is calculated using the IRS Premium Table for Group-Term Life Insurance. This table provides a monthly cost per $1,000 of coverage based on the employee’s age and the amount of coverage provided by the employer. The excess value of the coverage is then multiplied by this monthly cost to determine the imputed income for the year.

Do all employees have imputed income for life insurance?

No, not all employees have imputed income for life insurance. The imputed income only applies to employees who receive life insurance coverage from their employer that exceeds $50,000. If the coverage provided by the employer is $50,000 or less, there is no imputed income for the employee.

It is important for employees to be aware of the imputed income for life insurance, as it can affect their overall taxable income and potentially result in a higher tax liability. Employers should also inform their employees of the imputed income and provide guidance on how to calculate it.

Can imputed income be avoided?

Imputed income for life insurance cannot be avoided if an employee receives coverage from their employer that exceeds $50,000. However, there are some strategies that employees can use to minimize the impact of imputed income on their taxes. For example, employees can choose to waive some or all of the excess coverage provided by their employer in order to avoid imputed income.

It is important for employees to carefully consider their options and consult with a tax professional before making any decisions regarding their life insurance coverage and imputed income.

Is imputed income for life insurance subject to Social Security and Medicare taxes?

Yes, imputed income for life insurance is subject to both Social Security and Medicare taxes. The value of the excess life insurance coverage is considered taxable income, just like regular wages or salary, and is therefore subject to all applicable payroll taxes.

Employers are responsible for withholding and remitting payroll taxes on imputed income for life insurance, just as they would for regular wages or salary. Employees should review their pay stubs and W-2 forms to ensure that the correct amount of payroll taxes are being withheld.

How does imputed income for life insurance affect my overall taxable income?

Imputed income for life insurance is added to an employee’s regular wages or salary to determine their overall taxable income for the year. This means that imputed income can potentially push an employee into a higher tax bracket, resulting in a higher tax liability.

Employees should be aware of the impact of imputed income on their overall taxable income and consult with a tax professional to understand their options for minimizing their tax liability.

As a professional writer, I understand the importance of financial planning and the role life insurance plays in securing your family’s future. However, calculating imputed income for life insurance can be a daunting task for many. But don’t worry, with the right guidance and tools, you can easily determine the imputed income of your life insurance policy and make informed decisions.

In conclusion, calculating imputed income for life insurance is crucial for individuals and businesses alike. By understanding the imputed income of your life insurance policy, you can make informed decisions about your finances and ensure that your family or business is secure in case of any unfortunate events. Therefore, it is essential to seek professional advice and use online calculators to determine the imputed income of your life insurance policy accurately. Remember, planning for the future starts today, and with the right financial planning, you can secure a better tomorrow.

Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering individuals to make well-informed decisions. Guided by his passion, he has assembled a team of seasoned insurance professionals committed to simplifying the intricate world of insurance for you.

- Latest Posts by Rakibul Hasan

-

Can I Keep Medicaid If My Job Offers Insurance?

- -

Does Smile Direct Club Take Medicaid Insurance?

- -

Does Life Insurance Payout Affect Medicaid?

- All Posts