Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering...Read more

Auto insurance is undoubtedly an essential aspect of driving a car, but sometimes you may need to cancel it for various reasons. If you are a State Farm policyholder and want to cancel your auto insurance, then you are at the right place. In this comprehensive guide, we will walk you through the entire process of canceling auto insurance with State Farm.

Whether you have found a better deal or have sold your car, canceling your auto insurance with State Farm can be a daunting task. However, with the right approach and proper understanding of the cancellation process, you can easily cancel your policy and move on to your next adventure. So, let’s dive into the step-by-step guide on how to cancel auto insurance with State Farm.

- Call your State Farm agent and request to cancel your auto insurance policy.

- Provide the agent with your policy number and effective date of cancellation.

- Verify if there are any fees or penalties for cancelling your policy before the renewal date.

- Return any insurance cards, documents, and license plates to your agent.

- Ask for a confirmation letter or email for your records.

How to Cancel Auto Insurance State Farm?

If you are a State Farm auto insurance policyholder and are thinking of canceling your policy, you might be wondering how to go about it. Canceling an auto insurance policy can be a daunting task, but with a little preparation and knowledge, it can be done quickly and easily. In this article, we will discuss the steps you can take to cancel your State Farm auto insurance policy.

Step 1: Review your policy

Before canceling your State Farm auto insurance policy, it is important to review your policy to understand the terms and conditions. Look for any cancellation fees or penalties that may apply. You can find this information on your policy documents or by contacting your State Farm agent.

Once you have reviewed your policy, you should also consider if you have any outstanding claims or if you have paid your premiums in advance. Cancelling your policy mid-term may result in a refund of your unused premiums, but it may also result in a penalty or fee.

Benefits:

- Understanding the terms and conditions of your policy can help you avoid unexpected fees or penalties.

- Reviewing your policy can also help you determine if canceling your policy is the best option for you.

Step 2: Contact your State Farm agent

The next step in canceling your State Farm auto insurance policy is to contact your agent. You can do this by calling them or visiting their office. Your agent will be able to guide you through the cancellation process and answer any questions you may have.

When you contact your agent, be prepared to provide them with your policy number and the date you want your policy to be canceled. Your agent may also ask you for a reason why you are canceling your policy.

Benefits:

- Contacting your agent can help you understand the cancellation process and any fees or penalties that may apply.

- Your agent can also answer any questions you may have about canceling your policy.

Step 3: Confirm the cancellation

After you have contacted your agent and provided them with the necessary information, they will confirm the cancellation of your policy. You should receive a confirmation letter or email from State Farm stating that your policy has been canceled.

It is important to keep this confirmation letter or email for your records. You may need it in the future if you have any questions or concerns about your policy cancellation.

Benefits:

- Confirming the cancellation of your policy can give you peace of mind that your policy has been canceled.

- Keeping the confirmation letter or email can be useful if you need to reference it in the future.

Step 4: Return your insurance card and plates

If you have received an insurance card or license plates from State Farm, you will need to return them to your agent. Your agent will provide you with instructions on how to return them.

It is important to return your insurance card and plates as soon as possible to avoid any penalties or fees.

Benefits:

- Returning your insurance card and plates can help you avoid any penalties or fees.

- Following your agent’s instructions can help make the process smoother and faster.

Step 5: Consider your insurance needs

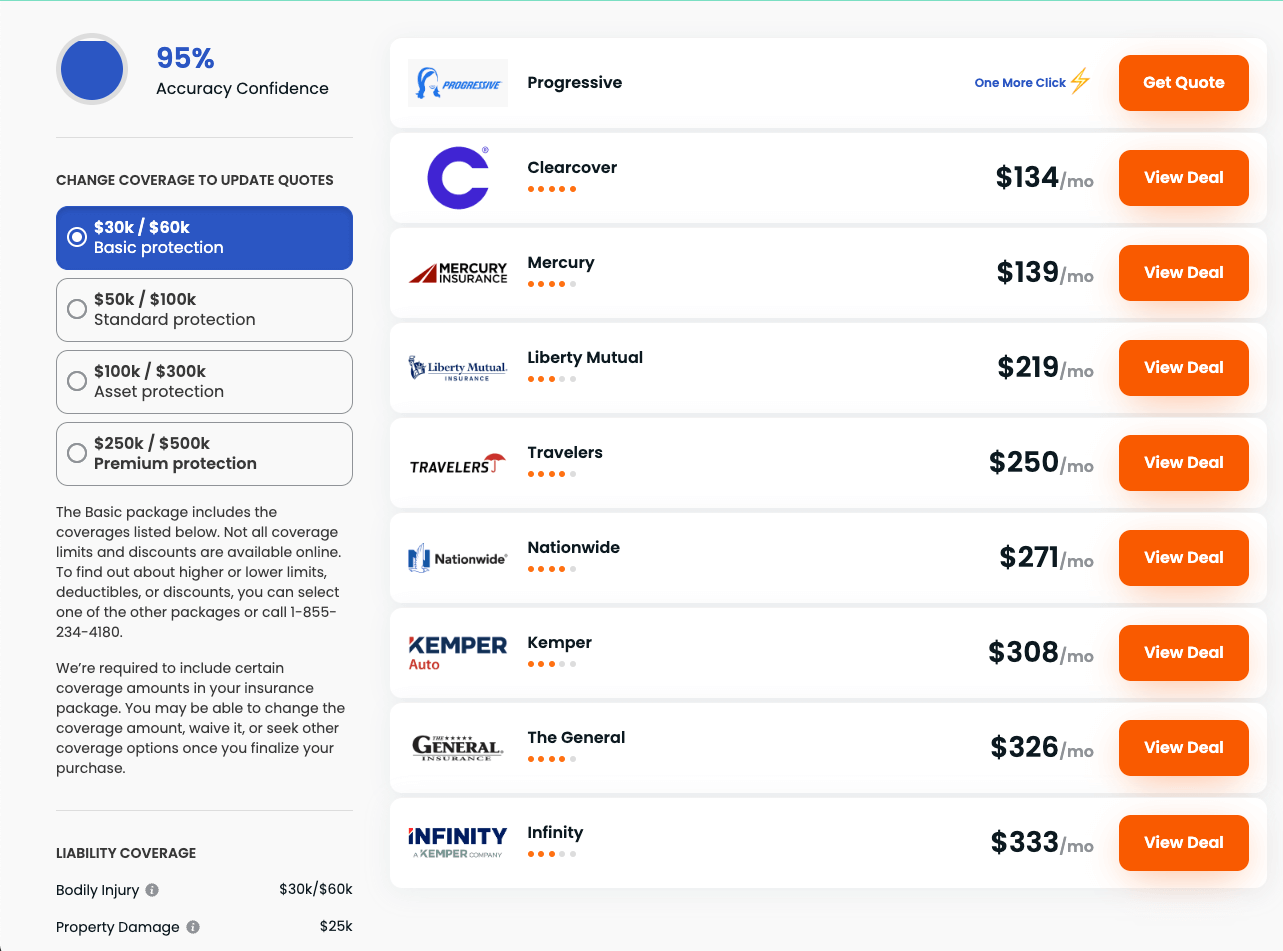

After canceling your State Farm auto insurance policy, it is important to consider your insurance needs. If you still need auto insurance, you may want to start shopping for a new policy.

When shopping for a new policy, consider factors such as coverage options, deductibles, and premiums. You may also want to consider getting quotes from multiple insurance providers to compare prices.

Benefits:

- Considering your insurance needs can help you find the best policy for your situation.

- Shopping around for a new policy can help you find the best price and coverage options.

Step 6: Know your rights

As a consumer, you have certain rights when it comes to canceling your auto insurance policy. These rights may vary depending on the state you live in.

For example, some states require insurance companies to provide you with a notice of cancellation and a reason for the cancellation. Other states may require insurance companies to give you a grace period before canceling your policy.

Benefits:

- Knowing your rights can help you understand your options when it comes to canceling your policy.

- Understanding your rights can also help you avoid any unexpected fees or penalties.

Step 7: Consider a non-renewal

If you are thinking of canceling your auto insurance policy because of a rate increase or other issue, you may want to consider a non-renewal instead.

A non-renewal means that your policy will not be renewed at the end of the term. This is different from canceling your policy mid-term. If you choose a non-renewal, you will not be charged any fees or penalties.

Benefits:

- A non-renewal can be a good option if you are unhappy with your policy but do not want to cancel mid-term.

- Choosing a non-renewal can help you avoid any fees or penalties.

Step 8: Consider a policy suspension

If you are thinking of canceling your auto insurance policy because you will not be driving your car for a period of time, you may want to consider a policy suspension instead.

A policy suspension means that your policy will be temporarily suspended while you are not using your car. This can be a good option if you are not using your car for an extended period of time but plan to use it again in the future.

Benefits:

- A policy suspension can be a good option if you are not using your car for a period of time but plan to use it again in the future.

- Choosing a policy suspension can help you avoid canceling your policy mid-term and any fees or penalties that may apply.

Step 9: Understand the consequences of canceling your policy

Before canceling your State Farm auto insurance policy, it is important to understand the consequences. If you cancel mid-term, you may be charged a fee or penalty. You may also lose any discounts or benefits you had with State Farm.

If you cancel your policy without having a new policy in place, you may be driving without insurance. This can result in fines, license suspension, or other penalties.

Benefits:

- Understanding the consequences of canceling your policy can help you make an informed decision.

- Knowing the consequences can help you avoid any unexpected fees or penalties.

Step 10: Follow up with your agent

After canceling your State Farm auto insurance policy, it is important to follow up with your agent to ensure that your policy has been canceled and any refunds have been processed.

You may also want to ask your agent for a letter confirming the cancellation of your policy. This can be useful if you need to provide proof of cancellation to another insurance provider or agency.

Benefits:

- Following up with your agent can help ensure that your policy has been canceled and any refunds have been processed.

- Getting a confirmation letter can be useful if you need to provide proof of cancellation in the future.

In conclusion, canceling your State Farm auto insurance policy can be a simple process if you follow the steps outlined in this article. Remember to review your policy, contact your agent, confirm the cancellation, return your insurance card and plates, consider your insurance needs, know your rights, consider a non-renewal or policy suspension, understand the consequences of canceling your policy, and follow up with your agent. By doing so, you can cancel your policy with confidence and ease.

Contents

- Freequently Asked Questions

- 1. How can I cancel my auto insurance policy with State Farm?

- 2. Can I cancel my State Farm auto insurance policy online?

- 3. Will I be charged a fee for cancelling my State Farm auto insurance policy?

- 4. How long does it take to cancel my State Farm auto insurance policy?

- 5. Can I cancel my State Farm auto insurance policy at any time?

- How to Cancel an Auto Insurance Policy : Auto Insurance Basics

- Can I Keep Medicaid If My Job Offers Insurance?

- Does Smile Direct Club Take Medicaid Insurance?

- Does Life Insurance Payout Affect Medicaid?

Freequently Asked Questions

1. How can I cancel my auto insurance policy with State Farm?

To cancel your auto insurance policy with State Farm, you have several options. You can call your State Farm agent directly and request that they cancel your policy. Alternatively, you can call State Farm’s customer service number to cancel your policy. You will need to provide your policy number and personal information to confirm your identity. Once you have cancelled your policy, State Farm will send you a confirmation of cancellation letter.

It’s important to note that if you cancel your policy before the end of your policy term, you may be subject to a cancellation fee. Additionally, if you have already paid for your policy in advance, you may be eligible for a refund of the unused portion of your premium.

2. Can I cancel my State Farm auto insurance policy online?

Unfortunately, State Farm does not provide an option to cancel your auto insurance policy online. You will need to call your State Farm agent or customer service to cancel your policy. This is to ensure that your identity is confirmed and that the cancellation process is handled correctly. Remember to have your policy number and personal information on hand when you call to cancel your policy.

If you are cancelling your policy because you are switching to a new insurance provider, you may be able to cancel your policy online through your new provider’s website. Check with your new provider to see if this is an option.

3. Will I be charged a fee for cancelling my State Farm auto insurance policy?

If you cancel your State Farm auto insurance policy before the end of your policy term, you may be subject to a cancellation fee. The amount of the fee will vary based on your specific policy and state regulations. It’s important to review your policy documents or check with your State Farm agent to determine if a cancellation fee will apply to your policy.

If you have already paid for your policy in advance, you may be eligible for a refund of the unused portion of your premium. However, if a cancellation fee applies, it will be deducted from the refund amount.

4. How long does it take to cancel my State Farm auto insurance policy?

The amount of time it takes to cancel your State Farm auto insurance policy will depend on several factors. If you call your State Farm agent directly to cancel your policy, they may be able to process the cancellation immediately. If you call State Farm’s customer service number, you may need to wait on hold for a period of time before a representative is available to assist you.

Once you have cancelled your policy, State Farm will send you a confirmation of cancellation letter. This letter should arrive within a few days of your cancellation request. If you do not receive the confirmation letter within a reasonable amount of time, you should follow up with State Farm to ensure that your policy has been cancelled.

5. Can I cancel my State Farm auto insurance policy at any time?

Yes, you can cancel your State Farm auto insurance policy at any time. However, if you cancel your policy before the end of your policy term, you may be subject to a cancellation fee. Additionally, if you have already paid for your policy in advance, you may be eligible for a refund of the unused portion of your premium.

It’s important to review your policy documents or check with your State Farm agent to determine if a cancellation fee will apply to your policy. If you are cancelling your policy because you are switching to a new insurance provider, be sure to coordinate the cancellation and start dates of your policies to ensure that you have continuous coverage.

How to Cancel an Auto Insurance Policy : Auto Insurance Basics

Canceling your auto insurance with State Farm can be a daunting task, but with the right information and approach, it can be a smooth and hassle-free process. It’s important to understand the steps involved in cancelling your policy and any potential fees or penalties that may apply. By taking the time to research and prepare, you can ensure a successful cancellation and potentially save money in the process.

Remember to communicate clearly and effectively with your State Farm agent or representative. Be honest about your reasons for cancelling and ask any questions you may have about the process. By maintaining a positive and respectful attitude, you can make the experience as stress-free as possible. With these tips in mind, you can confidently cancel your auto insurance with State Farm and move forward with a new policy or provider.

Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering individuals to make well-informed decisions. Guided by his passion, he has assembled a team of seasoned insurance professionals committed to simplifying the intricate world of insurance for you.

- Latest Posts by Rakibul Hasan

-

Can I Keep Medicaid If My Job Offers Insurance?

- -

Does Smile Direct Club Take Medicaid Insurance?

- -

Does Life Insurance Payout Affect Medicaid?

- All Posts