Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering...Read more

As a responsible adult, you know that life insurance is a smart investment to make for the future. But before you can start enjoying the peace of mind that comes with knowing your loved ones are protected, you’ll need to complete some paperwork. One of the most important documents you’ll need to fill out is the W9 form.

The W9 form is a tax document that provides your life insurance provider with your taxpayer information. It’s an essential element of the insurance application process, as it helps the insurer ensure that they comply with all relevant tax laws. However, filling out this form can be a bit daunting, especially if you’re not familiar with tax paperwork. In this guide, we’ll take you through everything you need to know to fill out a W9 form for your life insurance policy with confidence.

How to Fill Out a W9 for Life Insurance?

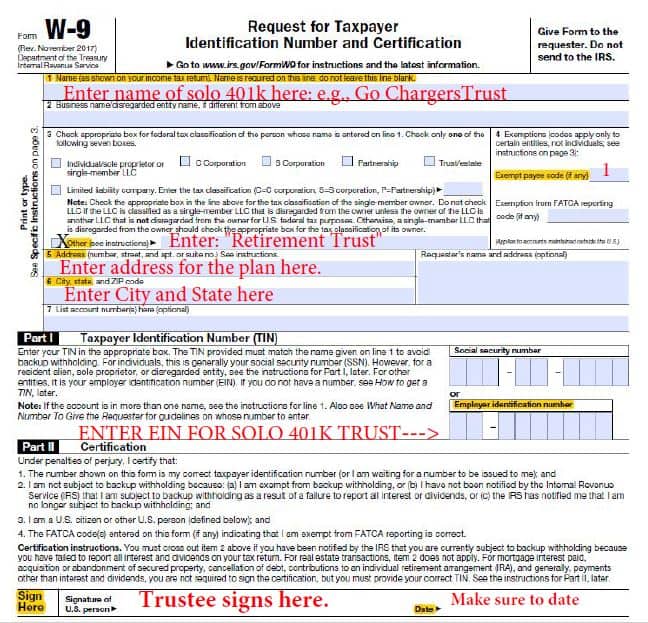

To fill out a W9 for life insurance, follow these steps:

- Enter your name, address, and taxpayer identification number (TIN).

- Check the appropriate box for federal tax classification.

- Sign and date the form.

How to Fill Out a W9 for Life Insurance?

Filling out a W9 form is essential when you are applying for life insurance. The W9 form is used to provide your tax identification number to the insurance company. It is important to fill out the form correctly and completely to avoid any delays in the processing of your application. In this article, we will guide you through the process of filling out a W9 form for life insurance.

Step 1: Fill out the Basic Information

The first section of the W9 form requires you to provide your basic information such as your name, address, and Social Security number. Ensure that you have entered your name exactly as it appears on your Social Security card. If you have recently changed your name, make sure to provide the updated information on the form.

Next, provide your address and ensure that it matches the address on your tax return. If you have recently moved, provide your new address.

Example:

- Name: John Smith

- Address: 123 Main St, Anytown, USA

- Social Security Number: 123-45-6789

Step 2: Provide Your Tax Classification

The next section of the W9 form requires you to provide your tax classification. You will have to select one of the following options:

- Individual/Sole proprietor

- C Corporation

- S Corporation

- Partnership

- Trust/Estate

- Limited liability company (LLC)

Select the option that best describes your tax classification. If you are not sure, consult with a tax professional.

Example:

My tax classification is an individual/sole proprietor.

Step 3: Provide Your Exemption Status

The third section of the W9 form requires you to provide your exemption status. If you are exempt from backup withholding, select the appropriate option and provide the reason for the exemption. If you are not exempt, leave this section blank.

Example:

I am not exempt from backup withholding.

Step 4: Provide Your Signature and Date

The final section of the W9 form requires you to sign and date the form. Your signature confirms that the information provided on the form is accurate and complete. You should also provide the date on which you signed the form.

Example:

I hereby certify that the information provided on this form is complete and accurate to the best of my knowledge. Signature: _________________________ Date: _____________

Benefits of Filling Out a W9 Form for Life Insurance

Filling out a W9 form for life insurance is a crucial step in the application process. By providing your tax identification number, you are helping the insurance company to comply with federal tax laws. This ensures that your life insurance policy is legal and valid.

Example:

- Compliance with federal tax laws

- Valid and legal life insurance policy

- Peace of mind

W9 Form vs W4 Form

The W9 form is often confused with the W4 form, which is used by employers to withhold taxes from their employees’ paychecks. The W4 form is not required when applying for life insurance, but it is important to ensure that your tax withholdings are accurate to avoid any surprises at tax time.

Example:

The W9 form is used for life insurance, while the W4 form is used by employers to withhold taxes from paychecks.

Conclusion

Filling out a W9 form for life insurance is a simple process that requires you to provide your basic information, tax classification, exemption status, signature, and date. By doing so, you are helping the insurance company comply with federal tax laws and ensuring that your life insurance policy is legal and valid. Remember to consult with a tax professional if you are unsure about your tax classification or exemption status.

Contents

- Frequently Asked Questions

- What is a W9 form?

- Why do I need to fill out a W9 for life insurance?

- How do I fill out a W9 form for life insurance?

- What if I don’t have a TIN?

- Is my W9 information kept confidential?

- Can I Keep Medicaid If My Job Offers Insurance?

- Does Smile Direct Club Take Medicaid Insurance?

- Does Life Insurance Payout Affect Medicaid?

Frequently Asked Questions

When applying for life insurance, you may be required to fill out a W9 form. This form is used by the insurance company to collect your taxpayer information for tax reporting purposes. Here are some commonly asked questions about filling out a W9 for life insurance:

What is a W9 form?

A W9 form is a tax form used by companies to collect the taxpayer identification number (TIN) of individuals or businesses for tax reporting purposes. When applying for life insurance, the insurance company may ask for your TIN to comply with federal and state tax reporting requirements.

The W9 form asks for your name, address, and TIN. If you are an individual, your TIN is typically your social security number (SSN). If you are a business, your TIN is typically your employer identification number (EIN).

Why do I need to fill out a W9 for life insurance?

The insurance company needs your TIN to comply with federal and state tax reporting requirements. By law, the insurance company must report certain payments made to you to the IRS. The W9 form provides the insurance company with your TIN so they can accurately report these payments.

Keep in mind that if you do not provide your TIN, the insurance company may be required to withhold a percentage of your payments and remit them to the IRS as backup withholding.

How do I fill out a W9 form for life insurance?

To fill out a W9 form for life insurance, you will need to provide your name, address, and TIN. If you are an individual, your TIN is typically your social security number (SSN). If you are a business, your TIN is typically your employer identification number (EIN).

Be sure to complete the form accurately and legibly. If you have any questions about how to fill out the form, contact the insurance company or consult with a tax professional.

What if I don’t have a TIN?

If you don’t have a TIN, you can apply for one with the IRS. Individuals can apply for a TIN by filling out Form SS-5 and businesses can apply for an EIN by filling out Form SS-4. It is important to obtain a TIN before applying for life insurance to avoid backup withholding.

If you are not eligible for a TIN, you may be able to provide a valid reason for exemption on the W9 form. Contact the insurance company or consult with a tax professional for guidance.

Is my W9 information kept confidential?

Your W9 information is kept confidential by the insurance company and is only used for tax reporting purposes. However, the insurance company may be required to disclose your information to the IRS or other government agencies as required by law.

Be sure to read the insurance company’s privacy policy to understand how they handle your information.

Now that you have a better understanding of how to fill out a W9 form for life insurance, you can confidently provide the necessary information to your insurance provider. Remember to provide accurate and up-to-date information to avoid any potential issues down the line. Filling out the W9 form may seem daunting at first, but with the right guidance and attention to detail, it can be a simple and straightforward process.

It’s important to have life insurance to protect yourself and your loved ones in the event of unexpected circumstances. By completing the W9 form, you are taking a proactive step towards securing your financial future. Don’t hesitate to reach out to your insurance provider if you have any questions or concerns about filling out the W9 form or your life insurance policy. With the right information and support, you can ensure that you are properly covered and prepared for whatever life may bring.

Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering individuals to make well-informed decisions. Guided by his passion, he has assembled a team of seasoned insurance professionals committed to simplifying the intricate world of insurance for you.

- Latest Posts by Rakibul Hasan

-

Can I Keep Medicaid If My Job Offers Insurance?

- -

Does Smile Direct Club Take Medicaid Insurance?

- -

Does Life Insurance Payout Affect Medicaid?

- All Posts