Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering...Read more

As we grow older, we start to realize the importance of having a safety net in place for our loved ones. Life insurance is one such safety net that can provide financial security to our nearest and dearest, should the worst happen. But what about our grandparents? They too deserve the same level of protection in their golden years. In this article, we will explore how to get life insurance on grandparents and what steps you can take to ensure their future financial stability.

Getting life insurance on grandparents can be a sensitive topic, but it is a conversation worth having. Many seniors are living on fixed incomes and may be concerned about the cost of premiums. However, with the right approach and knowledge, it is possible to find a policy that suits their needs and budget. Whether you are a grandchild looking to secure your grandparent’s future, or a grandparent considering life insurance for yourself, this guide will provide you with the essential information you need to make an informed decision. So, let’s dive in and discover the world of life insurance for grandparents.

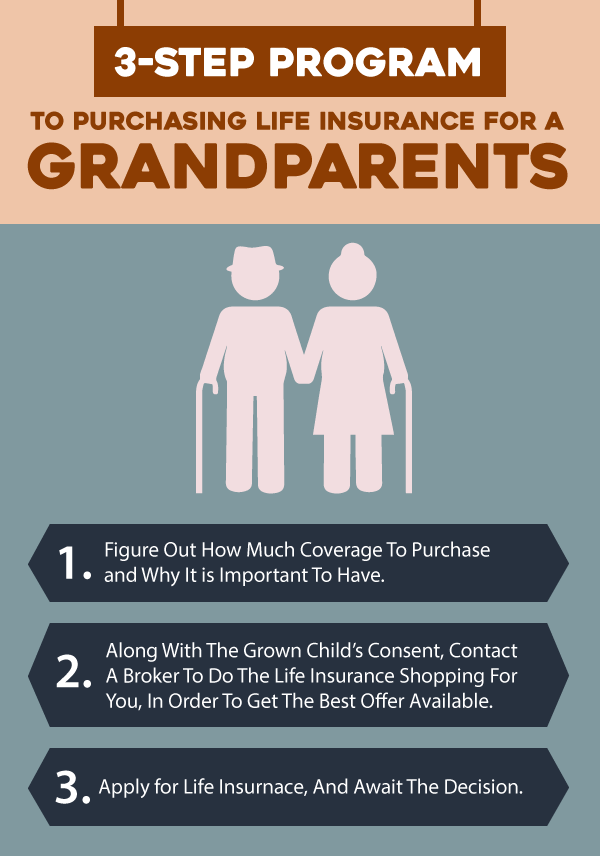

Getting life insurance for your grandparents is a wise decision to ensure their financial security. Here is how to get life insurance on grandparents:

- First, determine the type of coverage required.

- Next, check the eligibility criteria for your grandparents.

- Compare the policies and quotes from different insurance companies.

- Select a policy that best suits your needs and budget.

- Fill out the application form and submit it along with the required documents.

- Once approved, pay the premium and get the policy document.

Contents

- How to Get Life Insurance on Grandparents?

- Step 1: Determine the Need for Life Insurance

- Step 2: Research Different Types of Policies

- Step 3: Determine the Insurability of Your Grandparents

- Step 4: Shop Around for Quotes

- Step 5: Apply for Life Insurance

- Step 6: Wait for Underwriting

- Step 7: Receive Policy Offer

- Step 8: Accept or Decline Policy

- Step 9: Make Premium Payments

- Step 10: Review and Update Policy

- Frequently Asked Questions

- What is life insurance for grandparents?

- Can you get life insurance on grandparents without their consent?

- What types of life insurance policies are available for grandparents?

- How much does life insurance for grandparents cost?

- What should you look for in a life insurance policy for grandparents?

- Can I Keep Medicaid If My Job Offers Insurance?

- Does Smile Direct Club Take Medicaid Insurance?

- Does Life Insurance Payout Affect Medicaid?

How to Get Life Insurance on Grandparents?

Getting life insurance for grandparents is a crucial step in ensuring their financial security and protecting your family’s future. However, finding the right policy can be challenging, as there are several factors to consider. In this article, we will discuss some essential steps that can help you get life insurance on grandparents.

Step 1: Determine the Need for Life Insurance

Before purchasing life insurance for your grandparents, it is essential to determine why you need it. It could be to cover funeral expenses, pay off debts or mortgages, or provide financial support to your family members in case of their unexpected death. Once you have identified the need, you can select the right policy that offers adequate coverage.

Benefits of Life Insurance on Grandparents:

- Financial protection for your family

- Coverage for funeral expenses

- Peace of mind knowing your loved ones are protected

Step 2: Research Different Types of Policies

There are different types of life insurance policies available in the market, such as term life, whole life, and universal life insurance. Each policy has its own benefits and drawbacks. It is crucial to understand the policy’s terms and conditions, the premiums, and the coverage amount before making a decision.

Term Life vs. Whole Life vs. Universal Life Insurance:

| Type of Insurance | Benefits | Drawbacks |

|---|---|---|

| Term Life Insurance | Low premiums, temporary coverage | No cash value, coverage expires after the term |

| Whole Life Insurance | Lifetime coverage, cash value accumulation | Higher premiums, less flexible |

| Universal Life Insurance | Flexible premiums, cash value accumulation | Complex policies, higher fees |

Step 3: Determine the Insurability of Your Grandparents

Before applying for life insurance, you need to determine your grandparents’ insurability. Insurability is the likelihood that they will qualify for life insurance coverage. Several factors such as age, health, and lifestyle habits can impact insurability. It is essential to gather information about your grandparents’ medical history and habits before applying for coverage.

Factors That Affect Insurability:

- Age

- Health conditions

- Smoking habits

- Family medical history

Step 4: Shop Around for Quotes

Once you have determined the need, researched the types of policies, and determined your grandparents’ insurability, it’s time to shop around for quotes. You can get quotes from different insurance providers and compare the coverage, premiums, and other terms and conditions.

Tips for Shopping Around for Quotes:

- Compare policies from different providers

- Consider the coverage amount and premiums

- Look for discounts or special offers

Step 5: Apply for Life Insurance

After you have gathered quotes and compared policies, it’s time to apply for life insurance. The application process typically involves filling out a form, providing medical information, and undergoing a medical exam.

Benefits of Applying for Life Insurance:

- Financial protection for your family

- Peace of mind knowing your loved ones are protected

- Ability to cover funeral expenses and debts

Step 6: Wait for Underwriting

Once you have applied for life insurance, the insurance provider will review your application and medical information. This process is called underwriting. The underwriter will determine your grandparents’ insurability and decide on the policy’s terms and conditions.

What to Expect During the Underwriting Process:

- Review of medical information

- Assessment of insurability

- Determination of policy terms and conditions

Step 7: Receive Policy Offer

After the underwriting process, the insurance provider will offer you a policy. The policy will outline the coverage amount, premiums, and other terms and conditions.

What to Look for in a Policy Offer:

- Coverage amount

- Premiums

- Policy terms and conditions

Step 8: Accept or Decline Policy

Once you have received the policy offer, you can accept or decline the policy. If you accept the policy, you will need to sign the policy documents and make the first premium payment.

Tips for Accepting or Declining a Policy:

- Review the policy terms and conditions carefully

- Consider the coverage amount and premiums

- Ask questions if you have any doubts

Step 9: Make Premium Payments

After accepting the policy, you will need to make premium payments regularly. It is crucial to make these payments on time to ensure that the policy remains in force.

Benefits of Regular Premium Payments:

- Policy remains in force

- Continued financial protection for your family

- Peace of mind knowing your loved ones are protected

Step 10: Review and Update Policy

It is essential to review the policy regularly and update it if necessary. Life events such as marriage, childbirth, or divorce can impact the policy’s coverage needs. It is crucial to ensure that the policy remains adequate to cover your grandparents’ financial needs.

When to Review and Update a Policy:

- After major life events

- At least once a year

- If there are changes in your grandparents’ financial situation

In conclusion, getting life insurance on grandparents is an important step in securing their financial future and protecting your family’s financial stability. By following these steps, you can select the right policy that offers adequate coverage and peace of mind.

Frequently Asked Questions

If you’re considering getting life insurance for your grandparents, you probably have a lot of questions. Here are some of the most frequently asked questions to help you get started.

What is life insurance for grandparents?

Life insurance for grandparents is a type of policy that provides financial protection for your grandparents in the event of their death. This type of policy can help cover funeral expenses, outstanding debts, and provide a financial cushion for their loved ones. The policyholder is typically a grandchild or other family member who wants to ensure their grandparents are taken care of.

In most cases, the grandchild or family member pays the premiums on the policy and is the beneficiary of the policy. However, the grandparents can also be the policyholders and beneficiaries if they choose.

Can you get life insurance on grandparents without their consent?

No, you cannot get life insurance on your grandparents without their consent. In order to purchase a life insurance policy, the insured person must be aware of and consent to the policy. This means you will need to discuss the policy with your grandparents and have them agree to be insured.

It’s important to have an open and honest conversation with your grandparents about the benefits of life insurance and how it can help protect their loved ones. Be sure to explain the policy in detail and answer any questions they may have before they agree to be insured.

What types of life insurance policies are available for grandparents?

There are several types of life insurance policies available for grandparents, including term life insurance, whole life insurance, and universal life insurance. Term life insurance provides coverage for a specific period of time, while whole life insurance and universal life insurance provide coverage for the insured’s lifetime.

It’s important to consider your grandparents’ specific needs and budget when choosing a policy. Term life insurance may be a more affordable option, while whole life insurance and universal life insurance provide more comprehensive coverage.

How much does life insurance for grandparents cost?

The cost of life insurance for grandparents can vary depending on several factors, including the type of policy, the insured’s age and health, and the amount of coverage needed. In general, term life insurance policies are more affordable than whole life insurance or universal life insurance policies.

To get an accurate quote for life insurance for your grandparents, it’s best to speak with an insurance agent who can evaluate their specific needs and provide a personalized quote.

What should you look for in a life insurance policy for grandparents?

When choosing a life insurance policy for your grandparents, it’s important to consider their specific needs and budget. Look for a policy that provides adequate coverage for funeral expenses and outstanding debts, as well as a financial cushion for their loved ones.

Consider the length of the policy, the amount of the premiums, and any additional riders or benefits that may be included. It’s also important to choose a reputable insurance company with a strong financial rating and a history of excellent customer service.

Obtaining life insurance for grandparents may seem like an overwhelming task, but it is a necessary step to ensure their financial stability and secure their legacy. It can provide a sense of comfort knowing that they will be taken care of in the event of an unexpected death. To get life insurance for grandparents, it is important to do thorough research, compare policies, and work with a reputable insurance agent who specializes in this type of coverage.

In conclusion, getting life insurance for grandparents is a thoughtful and practical way to show your love and care for them. It is an investment in their future and can provide peace of mind for both you and your loved ones. Remember to take the time to carefully consider all options and work with a knowledgeable professional to ensure that you find the best policy to fit your unique needs and circumstances.

Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering individuals to make well-informed decisions. Guided by his passion, he has assembled a team of seasoned insurance professionals committed to simplifying the intricate world of insurance for you.

- Latest Posts by Rakibul Hasan

-

Can I Keep Medicaid If My Job Offers Insurance?

- -

Does Smile Direct Club Take Medicaid Insurance?

- -

Does Life Insurance Payout Affect Medicaid?

- All Posts