Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering...Read more

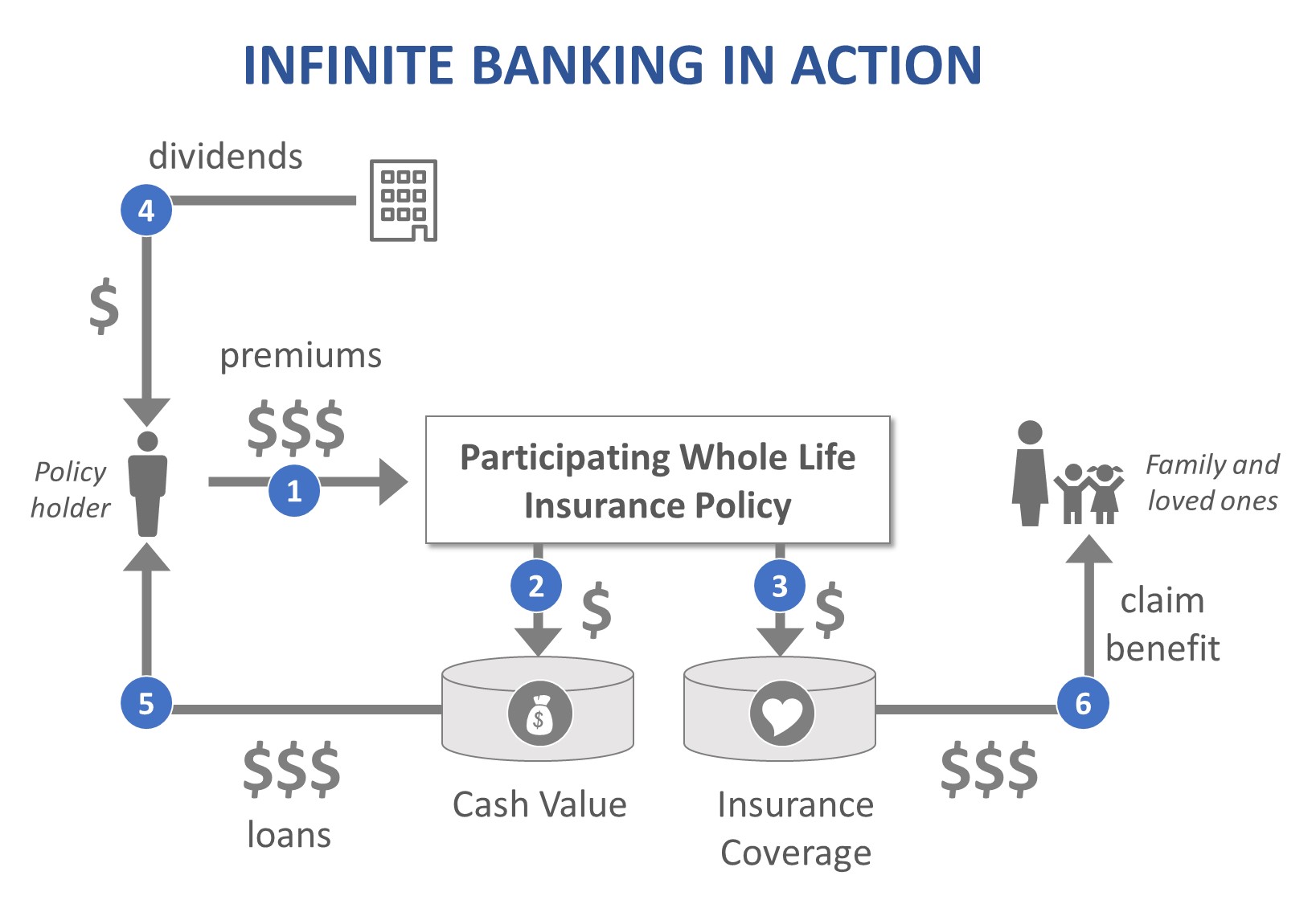

Whole life insurance is a type of insurance policy that provides coverage for the entire life of the policyholder. It is an investment vehicle that allows policyholders to accumulate cash value over time. While whole life insurance is primarily designed to provide financial security to beneficiaries in the event of the policyholder’s death, it can also be used as a bank.

Using whole life insurance as a bank involves borrowing from the policy’s cash value. This strategy can provide policyholders with a low-cost source of financing for various purposes, such as funding a business, paying for education, or purchasing a home. However, it is important to understand the potential risks and drawbacks of using whole life insurance as a bank, as it can have significant implications for the policy’s overall performance and the policyholder’s financial situation. In this article, we will explore how to use whole life insurance as a bank, the advantages and disadvantages of this strategy, and how to determine if it is the right choice for you.

Whole life insurance can be used as a bank by taking out a policy loan against the cash value of the policy. The loan can be used for any purpose, such as paying off debt or making a large purchase. The loan must be paid back with interest, but the interest rate is usually lower than other forms of loans. Keep in mind that borrowing against the policy will reduce the death benefit, so it should only be used as a last resort.

Contents

- Using Whole Life Insurance as a Bank

- Frequently Asked Questions

- Question 1: What is whole life insurance?

- Question 2: How can I use whole life insurance as a bank?

- Question 3: What are the advantages of using whole life insurance as a bank?

- Question 4: What are the risks of using whole life insurance as a bank?

- Question 5: Is using whole life insurance as a bank right for me?

- How to Use Whole Life Insurance to Get Rich

- Can I Keep Medicaid If My Job Offers Insurance?

- Does Smile Direct Club Take Medicaid Insurance?

- Does Life Insurance Payout Affect Medicaid?

Using Whole Life Insurance as a Bank

Whole life insurance is a type of permanent life insurance that offers both death benefits and cash value accumulation. One of the lesser-known benefits of whole life insurance is its potential to act as a bank. By borrowing from the cash value of your policy, you can access funds for various expenses, such as buying a home, paying for college, or starting a business. In this article, we’ll explore how to use whole life insurance as a bank and the benefits and drawbacks of doing so.

How Does Whole Life Insurance Work?

Whole life insurance is a type of insurance that provides coverage for the entire duration of your life, as long as you pay your premiums. In addition to the death benefit, which pays out to your beneficiaries when you pass away, whole life insurance also has a cash value component. This cash value accumulates over time, and you can borrow against it or withdraw it if needed.

When you purchase a whole life insurance policy, a portion of your premium goes towards the death benefit, while the rest goes towards the cash value. The cash value grows tax-deferred and earns interest over time, which means it can act as a savings vehicle.

How to Use Whole Life Insurance as a Bank

If you need to access funds for any reason, you can borrow against the cash value of your whole life insurance policy. This is known as a policy loan, and it works similarly to a loan from a traditional bank. You can borrow up to the amount of cash value you have in your policy, and you’ll typically pay interest on the loan.

The advantage of using your whole life insurance policy as a bank is that the process is often faster and easier than getting a loan from a traditional lender. You don’t need to go through a credit check, and you don’t need to provide collateral. Additionally, the interest rates on policy loans are often lower than those of traditional bank loans.

The Benefits of Using Whole Life Insurance as a Bank

Using your whole life insurance policy as a bank can have several benefits.

Firstly, it can provide you with immediate access to funds when you need them. This can be especially useful if you have an emergency expense or need to make a large purchase.

Secondly, policy loans are often tax-free. This means that you won’t need to pay taxes on the loan amount, as long as you pay it back within the terms of the policy.

Thirdly, policy loans don’t affect your credit score. Since you’re borrowing against your own policy, there’s no need for a credit check. This means that taking out a policy loan won’t impact your credit in any way.

The Drawbacks of Using Whole Life Insurance as a Bank

While using your whole life insurance policy as a bank can have several benefits, there are also some drawbacks to consider.

Firstly, borrowing against your policy reduces the death benefit. If you pass away before paying back the loan, the amount owed will be deducted from the death benefit paid out to your beneficiaries.

Secondly, policy loans do accrue interest. While the interest rates are often lower than those of traditional bank loans, you will still need to pay interest on the loan amount.

Thirdly, policy loans can affect the growth of your cash value. If you don’t pay back the loan, the interest owed will be added to the loan amount, which can reduce the amount of cash value you have in your policy.

Using Whole Life Insurance as a Bank vs. Traditional Banking

Using your whole life insurance policy as a bank can be a convenient option for accessing funds quickly and easily. However, it’s important to compare the benefits and drawbacks of using your policy to traditional banking options.

Traditional bank loans may offer higher loan amounts and longer repayment terms, but they often require collateral and credit checks. Additionally, the interest rates on traditional bank loans can be higher than those of policy loans.

Ultimately, the decision to use your whole life insurance policy as a bank will depend on your individual financial situation and needs. It’s important to weigh the pros and cons and consult with a financial advisor before making a decision.

Conclusion

Whole life insurance can provide not only death benefits but also a cash value component that can be used as a savings vehicle or as a source of funds for various expenses. Using your policy as a bank can be a convenient option, but it’s important to consider the benefits and drawbacks before making a decision. If you’re considering using your whole life insurance policy as a bank, consult with a financial advisor to ensure that it’s the right choice for you.

Frequently Asked Questions

In this section, we will answer some of the frequently asked questions about how to use whole life insurance as a bank.

Question 1: What is whole life insurance?

Whole life insurance is a type of life insurance that provides lifetime coverage for the insured person. It also has a savings component known as cash value, which grows over time and can be borrowed against or withdrawn.

Using whole life insurance as a bank involves borrowing against the cash value of the policy instead of taking out a traditional loan from a financial institution.

Question 2: How can I use whole life insurance as a bank?

To use whole life insurance as a bank, you need to have a whole life insurance policy with a cash value component. You can borrow against the cash value of the policy by taking out a policy loan or making a withdrawal.

The loan or withdrawal can be used for any purpose, including paying off debt, making a large purchase, or investing in a new business.

Question 3: What are the advantages of using whole life insurance as a bank?

There are several advantages to using whole life insurance as a bank. Firstly, the loan or withdrawal is tax-free and does not require a credit check. Additionally, the interest rate on a policy loan is generally lower than that of a traditional bank loan.

Furthermore, the cash value of the policy continues to grow even while you have a policy loan outstanding, which means you can continue to build wealth while accessing the funds you need.

Question 4: What are the risks of using whole life insurance as a bank?

While there are many advantages to using whole life insurance as a bank, there are also risks involved. Firstly, if you do not repay the loan or make timely interest payments, the cash value of your policy could be reduced, or the policy could lapse.

Additionally, borrowing against the cash value of your policy could reduce the death benefit, which means that your beneficiaries may receive less money when you pass away.

Question 5: Is using whole life insurance as a bank right for me?

Using whole life insurance as a bank can be a useful financial strategy for some people, but it is not right for everyone. It is important to consider your financial goals and needs and to consult with a financial professional before making any decisions.

If you have a whole life insurance policy with a cash value component and need access to funds, using whole life insurance as a bank could be a good option for you.

How to Use Whole Life Insurance to Get Rich

As a professional writer, it is clear that using whole life insurance as a bank can be a smart financial move. By leveraging the cash value of your policy, you can access funds for various purposes such as paying off debt, funding a business venture or supplementing retirement income. However, it is important to keep in mind that this strategy requires careful planning and consideration of potential risks.

One key advantage of using whole life insurance as a bank is the tax benefits it offers. Unlike traditional bank accounts, your policy’s cash value grows tax-deferred, meaning you won’t owe taxes on the growth until you withdraw the funds. Additionally, you can borrow against the cash value at a relatively low interest rate, and any interest you pay goes back into your policy, further increasing its value. With proper management and a long-term approach, using whole life insurance as a bank can be a valuable tool in achieving your financial goals.

Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering individuals to make well-informed decisions. Guided by his passion, he has assembled a team of seasoned insurance professionals committed to simplifying the intricate world of insurance for you.

- Latest Posts by Rakibul Hasan

-

Can I Keep Medicaid If My Job Offers Insurance?

- -

Does Smile Direct Club Take Medicaid Insurance?

- -

Does Life Insurance Payout Affect Medicaid?

- All Posts