Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering...Read more

When it comes to purchasing life insurance, choosing the right provider can be a daunting task. There are numerous options available in the market, each with its own set of pros and cons. One of the companies that has been steadily gaining popularity in recent years is Waepa Life Insurance.

Waepa is a non-profit organization that offers life insurance policies exclusively to federal employees and their families. The company has been in business for over 75 years and has earned a reputation for providing affordable and reliable coverage. But is Waepa good life insurance? In this article, we will take a closer look at the company, its policies, and its overall performance to help you make an informed decision.

Contents

- Is Waepa Good Life Insurance?

- Frequently Asked Questions

- Is Waepa a reputable life insurance company?

- What types of life insurance does Waepa offer?

- How do I apply for Waepa life insurance?

- What are the premiums like for Waepa life insurance?

- Is Waepa a good choice for life insurance?

- Can I Keep Medicaid If My Job Offers Insurance?

- Does Smile Direct Club Take Medicaid Insurance?

- Does Life Insurance Payout Affect Medicaid?

Is Waepa Good Life Insurance?

When it comes to protecting your loved ones financially, life insurance is an essential investment. With so many providers available, it can be challenging to determine which one is the best for you. One such provider is Waepa, which provides life insurance exclusively for military members and their families. In this article, we will explore whether Waepa is a good life insurance provider.

Background of Waepa

Waepa, or Worldwide Assurance for Employees of Public Agencies, was established in 1943 as a non-profit organization to provide affordable life insurance to federal employees. In 2014, Waepa expanded its services to include military members and their families. Waepa is unique in that it is a member-owned organization, meaning that policyholders have a say in how the company is run.

Waepa offers term life insurance policies with coverage options ranging from $50,000 to $1.5 million. The policies are available in 10, 15, 20, and 30-year terms. Waepa’s policies also include a living benefit, which allows policyholders to access a portion of their death benefit if they are diagnosed with a terminal illness.

Benefits of Waepa

One of the most significant benefits of Waepa is that it is a non-profit organization, meaning that all profits are returned to its members in the form of dividends. This can result in lower premiums for policyholders. Additionally, Waepa’s policies are available without medical exams for policies under $500,000, making it an attractive option for those who may have pre-existing medical conditions.

Waepa also offers a “Waiver of Premium” option, which allows policyholders to waive their premiums if they become disabled and cannot work. This can help ensure that policyholders’ coverage remains intact, even if they are unable to make payments.

Waepa vs. Other Life Insurance Providers

Compared to other life insurance providers, Waepa has several unique advantages. For example, its policies are exclusively available to military members and their families, meaning that they may be better equipped to understand the unique needs of this demographic.

Additionally, as a non-profit organization, Waepa’s policies may be more affordable than those offered by for-profit companies. However, it’s important to compare rates and coverage options from multiple providers to determine which one is the best for you.

Waepa’s Customer Service

Waepa has a strong reputation for excellent customer service. Members can contact Waepa’s customer service team via phone or email with any questions or concerns. Waepa also has an online portal where policyholders can manage their policies and access resources.

Conclusion

Overall, Waepa is a good life insurance provider for military members and their families. Its non-profit status, living benefit, and waiver of premium options make it an attractive option for those in this demographic. However, as with any life insurance provider, it’s important to compare rates and coverage options from multiple providers to determine which one is the best for you.

Frequently Asked Questions

Here are some common questions about Waepa life insurance:

Is Waepa a reputable life insurance company?

Yes, Waepa is a reputable life insurance company that has been providing coverage to federal employees since 1943. The company is financially stable and has received high ratings from independent rating agencies.

Waepa is also committed to providing affordable coverage to its members, with rates that are typically lower than those offered by other insurance companies.

What types of life insurance does Waepa offer?

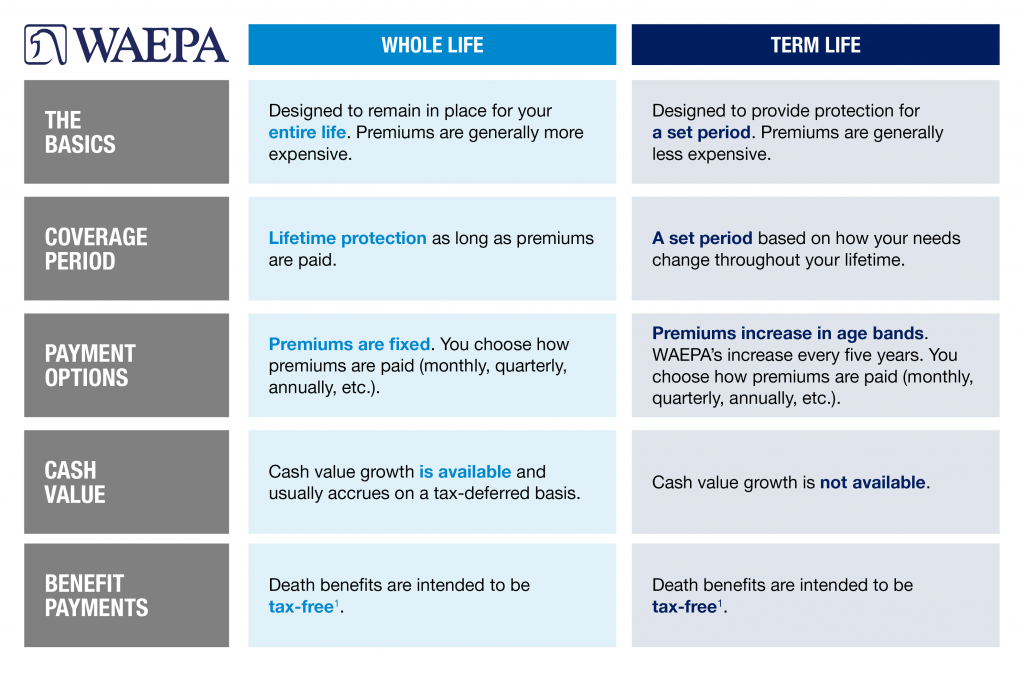

Waepa offers a variety of life insurance options to its members, including term life insurance, whole life insurance, and accidental death and dismemberment (AD&D) insurance. Term life insurance provides coverage for a specific period of time, while whole life insurance provides coverage for the policyholder’s entire life. AD&D insurance provides coverage in the event of accidental death or dismemberment.

Waepa also offers a variety of optional riders, such as waiver of premium and accelerated death benefit riders, that can provide additional coverage and benefits.

How do I apply for Waepa life insurance?

To apply for Waepa life insurance, you must be a federal employee or retiree, or an immediate family member of a current or retired federal employee. You can apply online or by mail, and you will need to provide basic information about yourself, such as your age, health status, and occupation. You will also need to choose the type and amount of coverage you want.

Once you have submitted your application, Waepa will review your information and may request additional medical information or exams. If you are approved, you will be issued a policy and will need to start paying premiums to maintain your coverage.

Waepa’s premiums are typically lower than those offered by other life insurance companies, thanks in part to the company’s non-profit status and commitment to keeping costs low. The exact cost of your premiums will depend on a variety of factors, such as your age, health status, and the type and amount of coverage you choose.

However, Waepa offers a variety of ways to save on premiums, such as by choosing a higher deductible or by bundling multiple types of coverage together. Additionally, Waepa provides discounts to members who maintain a healthy lifestyle and who participate in the company’s wellness programs.

Is Waepa a good choice for life insurance?

Whether Waepa is a good choice for life insurance depends on your individual needs and circumstances. However, many federal employees and retirees have found that Waepa offers affordable, high-quality coverage that meets their needs. Waepa’s non-profit status, commitment to keeping costs low, and variety of coverage options make it a strong choice for many people.

Ultimately, the best way to determine whether Waepa is a good choice for you is to compare its coverage and rates to those offered by other insurance companies, and to consider your own personal needs and preferences.

After conducting thorough research and reviewing the various aspects of Waepa Life Insurance, it’s safe to say that Waepa is a trustworthy and reliable life insurance company. Their unique offerings and lower premiums set them apart from other providers in the industry. Furthermore, their focus on providing benefits exclusively to military members and their families makes them a go-to choice for those seeking coverage in this community.

Waepa’s commitment to transparency and customer satisfaction is evident through their user-friendly website, informative resources, and responsive customer service. Their policies cater to the specific needs of military members, including active-duty servicemembers, veterans, and their families, providing them with comprehensive coverage and peace of mind. Overall, Waepa is a solid choice for anyone seeking affordable and comprehensive life insurance coverage.

In conclusion, Waepa Life Insurance is a reputable and reliable provider that offers affordable and comprehensive coverage to military members and their families. With their focus on transparency, customer satisfaction, and unique offerings, they have earned the trust of many in the military community. If you are seeking life insurance coverage and are a part of the military community, Waepa is certainly worth considering.

Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering individuals to make well-informed decisions. Guided by his passion, he has assembled a team of seasoned insurance professionals committed to simplifying the intricate world of insurance for you.

- Latest Posts by Rakibul Hasan

-

Can I Keep Medicaid If My Job Offers Insurance?

- -

Does Smile Direct Club Take Medicaid Insurance?

- -

Does Life Insurance Payout Affect Medicaid?

- All Posts