Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering...Read more

Commercial auto liability insurance is a crucial coverage for businesses that rely on vehicles for their operations. Whether you own a single delivery truck or manage a fleet of vehicles, commercial auto liability insurance can protect your company from financial losses in case of an accident. But what exactly does this type of insurance cover, and why is it important for your business?

In simple terms, commercial auto liability insurance provides coverage for damages and injuries caused by your business vehicles to other people and their property. This includes bodily injury, property damage, and legal fees associated with the accident. In this article, we’ll dive deeper into the specifics of commercial auto liability insurance and why it’s essential to have this coverage for your business. So, let’s get started!

Contents

- What Does Commercial Auto Liability Insurance Cover?

- Frequently Asked Questions

- What is commercial auto liability insurance?

- What does commercial auto liability insurance cover?

- Who needs commercial auto liability insurance?

- What is the difference between commercial auto liability insurance and personal auto insurance?

- How much does commercial auto liability insurance cost?

- Can I Keep Medicaid If My Job Offers Insurance?

- Does Smile Direct Club Take Medicaid Insurance?

- Does Life Insurance Payout Affect Medicaid?

What Does Commercial Auto Liability Insurance Cover?

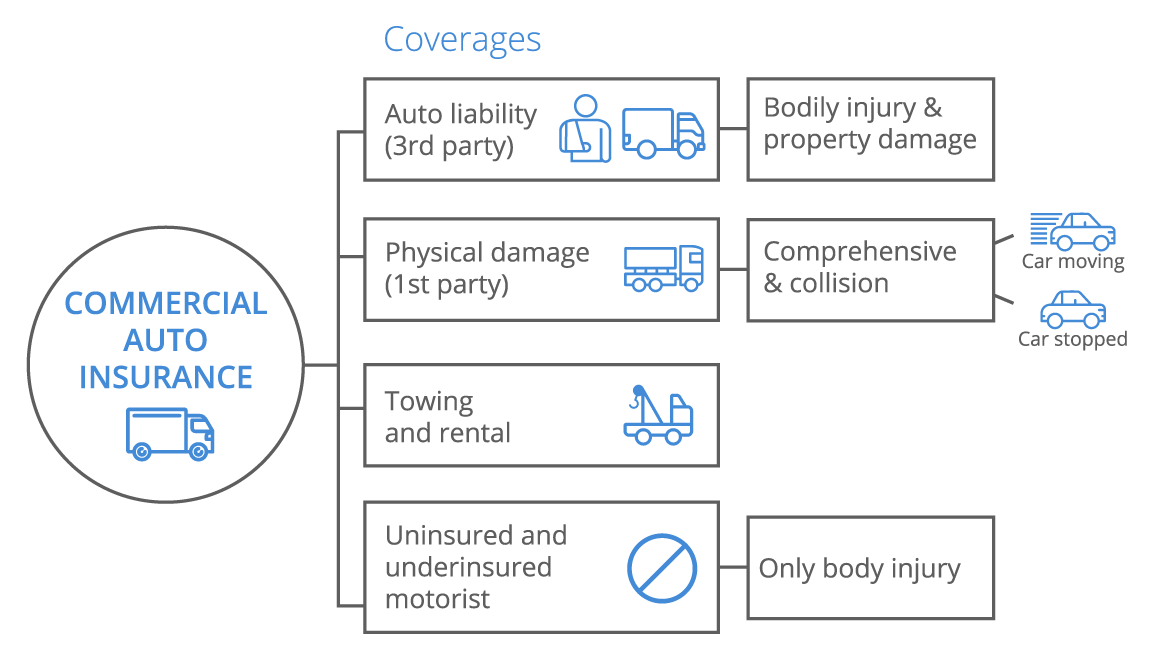

Commercial auto liability insurance is an essential coverage for businesses that use vehicles to conduct their operations. This type of insurance protects businesses from financial loss resulting from auto accidents that occur during work-related activities. In this article, we will explore the details of commercial auto liability insurance coverage.

Liability Coverage

Liability coverage is the fundamental component of any commercial auto liability insurance policy. This coverage protects businesses from financial loss if their employees are found to be at fault for an accident. Liability coverage will pay for damages and injuries sustained by third parties, including other drivers, passengers, and pedestrians.

Liability coverage is typically divided into two categories: bodily injury liability and property damage liability. Bodily injury liability covers the medical expenses, lost wages, and pain and suffering of the other party involved in the accident. Property damage liability covers the repair or replacement costs of the other party’s vehicle or property.

Collision Coverage

Collision coverage is an optional coverage that can be added to a commercial auto liability insurance policy. This coverage pays for the repair or replacement of the insured vehicle if it is damaged in an accident. Collision coverage is especially important for businesses that rely heavily on their vehicles to operate.

Collision coverage typically has a deductible, which is the amount the business must pay before the insurance coverage kicks in. The higher the deductible, the lower the premium. However, businesses should choose a deductible that they can afford in the event of an accident.

Comprehensive Coverage

Comprehensive coverage is another optional coverage that can be added to a commercial auto liability insurance policy. This coverage pays for damages to the insured vehicle that are not caused by an accident, such as theft, vandalism, or a natural disaster.

Comprehensive coverage also has a deductible, which is typically higher than the deductible for collision coverage. However, businesses that operate in areas with high rates of vehicle theft or vandalism may find comprehensive coverage to be a worthwhile investment.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist coverage is an optional coverage that protects businesses from financial loss if they are involved in an accident with a driver who does not have insurance or does not have enough insurance to cover the damages.

Uninsured/underinsured motorist coverage will pay for the medical expenses, lost wages, and pain and suffering of the insured party. This coverage can also be extended to cover passengers in the insured vehicle.

Rental Reimbursement Coverage

Rental reimbursement coverage is an optional coverage that can be added to a commercial auto liability insurance policy. This coverage pays for the cost of a rental vehicle if the insured vehicle is being repaired or replaced after an accident.

Rental reimbursement coverage typically has a daily limit and a maximum limit. Businesses should choose a daily limit that is sufficient to cover the cost of a rental vehicle in their area.

Towing and Labor Coverage

Towing and labor coverage is another optional coverage that can be added to a commercial auto liability insurance policy. This coverage pays for the cost of towing the insured vehicle to a repair facility and the cost of labor to repair the vehicle.

Towing and labor coverage typically has a limit, which is the maximum amount the insurance company will pay for these services. Businesses should choose a limit that is sufficient to cover the cost of towing and labor in their area.

Benefits of Commercial Auto Liability Insurance

Commercial auto liability insurance provides businesses with several benefits, including:

– Protection from financial loss resulting from auto accidents

– Peace of mind knowing that their vehicles and employees are covered

– Compliance with state and federal laws regarding auto insurance

Commercial Auto Liability Insurance vs. Personal Auto Insurance

There are several differences between commercial auto liability insurance and personal auto insurance, including:

– Commercial auto liability insurance covers vehicles that are used for business purposes, while personal auto insurance covers vehicles that are used for personal purposes.

– Commercial auto liability insurance typically has higher coverage limits than personal auto insurance.

– Commercial auto liability insurance may cover multiple drivers or vehicles under one policy, while personal auto insurance covers only one driver and one vehicle.

Conclusion

Commercial auto liability insurance is an essential coverage for businesses that use vehicles to conduct their operations. This coverage protects businesses from financial loss resulting from auto accidents and provides peace of mind knowing that their vehicles and employees are covered. Businesses should carefully consider the optional coverages available and choose the ones that best fit their needs and budget.

Frequently Asked Questions

Commercial auto liability insurance is a type of coverage that protects businesses from financial loss in case of an accident involving a company-owned vehicle. Here are five frequently asked questions and answers about what commercial auto liability insurance covers:

What is commercial auto liability insurance?

Commercial auto liability insurance is a type of insurance coverage that provides financial protection to businesses in case of accidents involving company-owned vehicles. It covers the costs of property damage, bodily injury, and legal fees that may arise due to the accident. This insurance is mandatory in most states, and the coverage and requirements vary depending on the state and the type of vehicle.

Commercial auto liability insurance is essential for businesses that own or use vehicles for work purposes. It protects both the business owner and the employees who operate the vehicles. Without this insurance, a business may face huge financial losses in case of an accident or lawsuit.

What does commercial auto liability insurance cover?

Commercial auto liability insurance covers the costs of property damage and bodily injury that result from an accident involving a company-owned vehicle. It also covers the legal fees and court costs if the business is sued for the accident. The coverage may vary depending on the policy, but it typically includes:

- Medical expenses for injured parties

- Property damage costs

- Legal fees and court costs if the business is sued

- Lost wages and other economic damages

Some policies may also cover the costs of a rental vehicle while the damaged vehicle is being repaired. However, commercial auto liability insurance does not cover the costs of damage to the business-owned vehicle itself.

Who needs commercial auto liability insurance?

Any business that owns or uses vehicles for work purposes should have commercial auto liability insurance. This includes businesses that own vehicles such as trucks, vans, and cars, as well as businesses that rent or lease vehicles. If a business uses personal vehicles for work purposes, the business owner should consider purchasing hired and non-owned auto liability insurance.

Commercial auto liability insurance is especially important for businesses that transport goods or people, as they are more likely to be involved in accidents. It is also mandatory in most states, so businesses that do not have this insurance may face legal penalties.

What is the difference between commercial auto liability insurance and personal auto insurance?

The main difference between commercial auto liability insurance and personal auto insurance is the purpose of the vehicle. Personal auto insurance covers vehicles used for personal purposes, such as commuting to work or running errands. Commercial auto liability insurance covers vehicles used for business purposes, such as transporting goods, making deliveries, or driving to job sites.

Commercial auto liability insurance typically provides higher coverage limits than personal auto insurance, as businesses are more likely to be involved in accidents that result in higher costs. Personal auto insurance may not cover accidents that occur while using the vehicle for work purposes, so businesses should have separate commercial auto liability insurance.

How much does commercial auto liability insurance cost?

The cost of commercial auto liability insurance depends on several factors, such as the type of vehicle, the number of vehicles, the coverage limits, the business’s location, and the driving records of the employees who operate the vehicles. Generally, the cost of this insurance ranges from several hundred to several thousand dollars per year.

The best way to get an accurate estimate of the cost of commercial auto liability insurance is to get a quote from an insurance provider. Business owners should compare quotes from different providers and choose the policy that provides the best coverage at the most affordable price.

From delivery vans to semi-trucks, commercial vehicles are an essential part of many businesses. However, with the privilege of operating these vehicles comes a significant amount of risk. That’s where commercial auto liability insurance comes in. This type of insurance provides coverage for bodily injury and property damage caused by your commercial vehicle. It’s essential to understand what commercial auto liability insurance covers to protect your business from financial ruin in case of an accident.

In summary, commercial auto liability insurance is a crucial protection for businesses that use commercial vehicles. It covers damages and injuries caused by commercial vehicles that could result in lawsuits, medical bills, and property damage. As a professional writer, I highly recommend that businesses with commercial vehicles invest in this insurance to mitigate risks and protect their finances. Whether you’re a small business owner or a large corporation, it’s important to be prepared for the unexpected by having adequate insurance coverage.

Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering individuals to make well-informed decisions. Guided by his passion, he has assembled a team of seasoned insurance professionals committed to simplifying the intricate world of insurance for you.

- Latest Posts by Rakibul Hasan

-

Can I Keep Medicaid If My Job Offers Insurance?

- -

Does Smile Direct Club Take Medicaid Insurance?

- -

Does Life Insurance Payout Affect Medicaid?

- All Posts