Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering...Read more

Variable Appreciable Life Insurance Policy, or VAL, is a type of life insurance policy that has gained popularity in recent times. It is a type of permanent life insurance policy that offers both a death benefit as well as an investment component. Unlike traditional life insurance policies, VAL policies allow policyholders to invest a portion of their premiums in various investment options such as stocks, bonds, mutual funds, and ETFs.

The investment component of a VAL policy allows the policyholder to accumulate cash value over time, which can be withdrawn or borrowed against. This cash value grows tax-deferred, meaning that the policyholder does not have to pay taxes on it until they withdraw the money. With a Variable Appreciable Life Insurance Policy, policyholders can enjoy both the benefits of life insurance coverage and investment growth, making it an attractive option for those who want to secure their financial future while also building wealth.

Contents

- Understanding Variable Appreciable Life Insurance

- Frequently Asked Questions

- What is a Variable Appreciable Life Insurance Policy?

- Who should consider a Variable Appreciable Life Insurance Policy?

- What are the benefits of a Variable Appreciable Life Insurance Policy?

- What are the risks of a Variable Appreciable Life Insurance Policy?

- How do I know if a Variable Appreciable Life Insurance Policy is right for me?

- Can I Keep Medicaid If My Job Offers Insurance?

- Does Smile Direct Club Take Medicaid Insurance?

- Does Life Insurance Payout Affect Medicaid?

Understanding Variable Appreciable Life Insurance

Are you looking for life insurance policies that offer both protection and investment opportunities? If so, then you might want to consider a variable appreciable life insurance policy. This type of life insurance policy provides you with the security of a traditional life insurance policy while also giving you the flexibility to invest your premiums in various investment options.

What is Variable Appreciable Life Insurance?

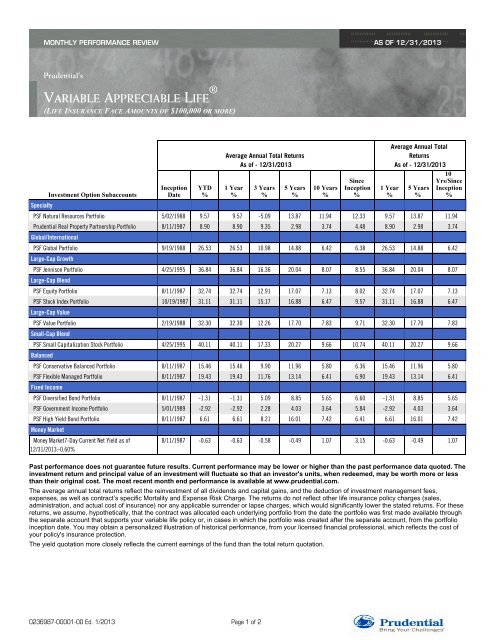

Variable appreciable life insurance (VAL) is a type of permanent life insurance policy that allows policyholders to invest their premiums in a variety of investment options, such as stocks, bonds, and mutual funds. The policy’s cash value grows based on the performance of the investments, and policyholders have the flexibility to switch their investments as desired.

Variable appreciable life insurance policies are typically more expensive than traditional life insurance policies due to the investment component. However, they can offer higher returns and greater tax benefits over time.

How Does VAL Work?

When you purchase a variable appreciable life insurance policy, you will pay premiums that are used to both cover the cost of insurance and invest in various investment options. The premiums are divided into two parts: the cost of insurance and the cash value investment component.

The cash value investment component is invested in various investment options, such as stocks, bonds, and mutual funds. The policy’s cash value grows based on the performance of these investments. Policyholders have the flexibility to switch their investments as desired, allowing them to adjust their investment strategy based on their risk tolerance and market conditions.

Benefits of Variable Appreciable Life Insurance

Variable appreciable life insurance policies offer several benefits, including:

- Investment opportunities: VAL policies allow policyholders to invest their premiums in a variety of investment options.

- Tax benefits: The cash value of VAL policies grows tax-deferred, and policyholders can withdraw their cash value tax-free.

- Flexibility: Policyholders have the flexibility to switch their investments as desired, allowing them to adjust their investment strategy based on their risk tolerance and market conditions.

- Death benefit: Like traditional life insurance policies, VAL policies provide a death benefit to beneficiaries in the event of the policyholder’s death.

Variable Appreciable Life Insurance Vs. Traditional Life Insurance

Variable appreciable life insurance policies differ from traditional life insurance policies in several ways:

| Variable Appreciable Life Insurance | Traditional Life Insurance |

|---|---|

| Investment component | No investment component |

| Cash value growth based on investment performance | Cash value growth based on a fixed interest rate |

| Flexibility to switch investments | No flexibility to switch investments |

| Higher premiums | Lower premiums |

Is Variable Appreciable Life Insurance Right for You?

Whether or not a variable appreciable life insurance policy is right for you depends on your financial goals and risk tolerance. VAL policies can offer higher returns and greater tax benefits over time, but they also come with higher premiums and greater investment risk.

If you’re interested in a VAL policy, it’s important to work with a financial advisor who can help you determine if it’s the right option for your financial situation. They can help you understand the risks and benefits of VAL policies and develop an investment strategy that aligns with your financial goals.

Frequently Asked Questions

Here are the most commonly asked questions about Variable Appreciable Life Insurance Policy:

What is a Variable Appreciable Life Insurance Policy?

A Variable Appreciable Life Insurance Policy is a type of life insurance policy that combines the features of both term life insurance and investment. This policy allows you to invest your premiums in a variety of investment options such as stocks, bonds, and mutual funds. The investment portion of the policy has the potential to grow over time, while the death benefit can provide financial security for your loved ones in the event of your death.

Unlike traditional life insurance policies, the cash value of a Variable Appreciable Life Insurance Policy is not guaranteed and can fluctuate based on the performance of the underlying investments. This means that there is a higher level of risk involved, but also the potential for greater returns.

Who should consider a Variable Appreciable Life Insurance Policy?

A Variable Appreciable Life Insurance Policy may be a good option for individuals who are looking for both life insurance coverage and the potential for investment growth. This type of policy is typically more expensive than traditional life insurance policies, so it may not be the best choice for those who are on a tight budget.

Additionally, because the cash value of the policy is not guaranteed, it is important to carefully consider your investment options and risk tolerance before investing in a Variable Appreciable Life Insurance Policy.

What are the benefits of a Variable Appreciable Life Insurance Policy?

One of the main benefits of a Variable Appreciable Life Insurance Policy is the potential for investment growth. By investing your premiums in a variety of investment options, you have the opportunity to earn greater returns than you would with a traditional life insurance policy.

Additionally, because the policy combines both life insurance and investment features, it can provide greater flexibility in financial planning. The death benefit can provide financial security for your loved ones, while the investment portion of the policy can be used to supplement retirement income or other financial goals.

What are the risks of a Variable Appreciable Life Insurance Policy?

One of the main risks of a Variable Appreciable Life Insurance Policy is the potential for investment losses. Because the cash value of the policy is not guaranteed, it can fluctuate based on the performance of the underlying investments. This means that there is a higher level of risk involved than with traditional life insurance policies.

Additionally, because the policy is more expensive than traditional life insurance policies, it may not be the best choice for those who are on a tight budget. It is important to carefully consider your investment options and risk tolerance before investing in a Variable Appreciable Life Insurance Policy.

How do I know if a Variable Appreciable Life Insurance Policy is right for me?

Deciding whether a Variable Appreciable Life Insurance Policy is right for you depends on your individual financial situation and goals. If you are looking for both life insurance coverage and the potential for investment growth, a Variable Appreciable Life Insurance Policy may be a good option.

However, it is important to carefully consider the risks involved and your investment options before making a decision. Speaking with a financial advisor can help you determine whether a Variable Appreciable Life Insurance Policy is the right choice for your specific needs.

Variable Appreciable Life Insurance Policy is a type of life insurance policy that provides a combination of investment options and life coverage. It is a policy that allows you to invest in a range of investment options, such as stocks, bonds, and mutual funds, while also providing life insurance coverage. It is a policy that is designed to provide flexibility and options to policyholders, allowing them to choose the amount of coverage they need and invest in various investment options to build wealth over time.

In conclusion, Variable Appreciable Life Insurance Policy is a great option for those who want to invest in their future while also securing life insurance coverage. It provides policyholders with the flexibility and options they need to tailor their policy to their specific needs and goals. If you are looking for a life insurance policy that offers investment options and life coverage, then Variable Appreciable Life Insurance Policy may be the right choice for you. With the right investment strategy and policy options, you can build wealth over time and provide financial security for yourself and your loved ones.

Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering individuals to make well-informed decisions. Guided by his passion, he has assembled a team of seasoned insurance professionals committed to simplifying the intricate world of insurance for you.

- Latest Posts by Rakibul Hasan

-

Can I Keep Medicaid If My Job Offers Insurance?

- -

Does Smile Direct Club Take Medicaid Insurance?

- -

Does Life Insurance Payout Affect Medicaid?

- All Posts