Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering...Read more

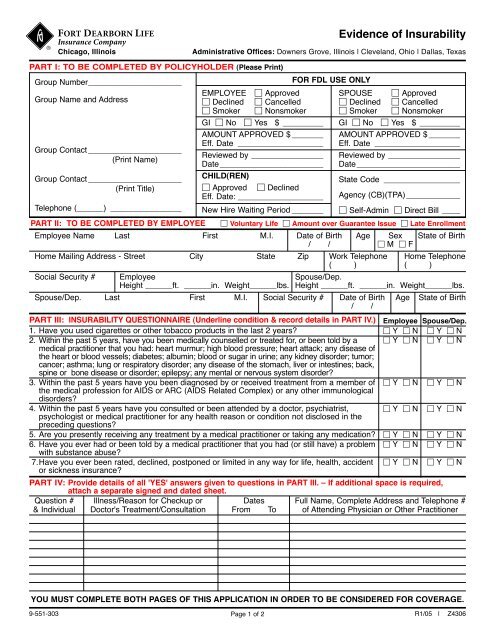

When it comes to life insurance, there are many different terms and phrases that can be confusing for those who are not familiar with the industry. One such term is “proof of insurability.” This refers to the process by which an insurance company evaluates an individual’s health and medical history to determine if they are eligible for coverage and at what premium rate.

Proof of insurability is an important factor in the life insurance application process, as it helps insurers to assess the level of risk that an individual presents. Depending on the results of the evaluation, an individual may be offered coverage at a standard premium rate, or they may be required to pay a higher premium to offset the increased risk they pose. In this article, we will take a closer look at what proof of insurability entails and why it is important for those seeking life insurance coverage.

What is Proof of Insurability for Life Insurance?

Proof of insurability is a requirement that life insurance companies may impose on an individual before issuing a life insurance policy. The proof of insurability ensures that the individual is in good health and poses a low risk of dying prematurely. Proof of insurability is typically required for policies with higher coverage amounts or for individuals who have a history of health problems.

Why is Proof of Insurability Required?

When you apply for a life insurance policy, the insurance company will ask you a series of health-related questions. These questions help the insurance company assess your risk level and determine whether or not to offer you coverage. If you are applying for a policy with a high coverage amount, the insurance company may require you to provide additional proof of insurability to ensure that you are in good health.

Proof of insurability may be required if you have a history of health problems or if you have a family history of certain medical conditions. The insurance company may require you to undergo a medical exam or provide medical records to prove that you are in good health.

- Proof of insurability ensures that the individual is in good health

- It helps the insurance company assess your risk level

- It is required for policies with higher coverage amounts

- It may be required if you have a history of health problems

- The insurance company may require you to undergo a medical exam or provide medical records

Types of Proof of Insurability

There are several types of proof of insurability that an insurance company may require. These include a medical exam, medical records, and a personal statement.

A medical exam is a physical exam performed by a licensed medical professional. The exam typically includes a review of your medical history, blood work, and other diagnostic tests. The medical exam helps the insurance company assess your overall health and determine your risk level.

Medical records are your personal medical history. The insurance company may request your medical records from your healthcare provider to ensure that you are in good health.

A personal statement is a written statement in which you provide details about your health history. The insurance company may ask you to answer questions about your medical history, lifestyle, and habits to assess your risk level.

- Medical exam

- Medical records

- Personal statement

Benefits of Proof of Insurability

Having proof of insurability can provide several benefits for individuals seeking life insurance coverage.

First, it ensures that you are in good health and poses a low risk of dying prematurely. This can give you peace of mind knowing that your loved ones will be taken care of financially if something were to happen to you.

Second, having proof of insurability can make it easier to obtain life insurance coverage. Insurance companies are more likely to offer coverage to individuals who can prove that they are in good health and pose a low risk of dying prematurely.

Lastly, having proof of insurability can help you obtain a policy with better coverage and lower premiums. Insurance companies are more likely to offer better coverage and lower premiums to individuals who are in good health and pose a low risk of dying prematurely.

- Provides peace of mind

- Makes it easier to obtain life insurance coverage

- Helps obtain a policy with better coverage and lower premiums

Proof of Insurability vs. Guaranteed Issue Life Insurance

There are two types of life insurance policies: proof of insurability and guaranteed issue.

Proof of insurability policies require you to provide proof that you are in good health and pose a low risk of dying prematurely. These policies typically offer better coverage and lower premiums.

Guaranteed issue policies, on the other hand, do not require proof of insurability. These policies are typically offered to individuals who have a history of health problems or who are unable to obtain coverage through traditional means. Guaranteed issue policies typically offer lower coverage amounts and higher premiums.

- Proof of insurability policies require proof of good health

- Offer better coverage and lower premiums

- Guaranteed issue policies do not require proof of insurability

- Offered to individuals who have a history of health problems or who cannot obtain traditional coverage

- Offer lower coverage amounts and higher premiums

Conclusion

Proof of insurability is a requirement that life insurance companies may impose on an individual before issuing a life insurance policy. It ensures that the individual is in good health and poses a low risk of dying prematurely. Proof of insurability may be required for policies with higher coverage amounts or for individuals who have a history of health problems. Having proof of insurability can provide several benefits, including peace of mind, easier access to coverage, and better coverage and lower premiums.

Contents

- Frequently Asked Questions

- What is proof of insurability for life insurance?

- When do I need to provide proof of insurability?

- What happens if I don’t pass the proof of insurability test?

- Can I skip the proof of insurability requirement?

- How can I improve my insurability?

- Can I Keep Medicaid If My Job Offers Insurance?

- Does Smile Direct Club Take Medicaid Insurance?

- Does Life Insurance Payout Affect Medicaid?

Frequently Asked Questions

Life insurance policies require a proof of insurability before you can be approved for coverage. Here are some common questions about what this means and how it works.

What is proof of insurability for life insurance?

Proof of insurability is evidence that you are in good health and insurable. It typically involves completing a medical exam and providing details about your health history, such as any pre-existing conditions or medications you take. This information helps the insurance company determine your risk level and determine whether to approve your application for coverage.

If you have a pre-existing condition or have had health issues in the past, you may need to provide additional information or undergo additional testing to demonstrate your insurability. In some cases, you may be denied coverage altogether if the insurance company determines you are too high of a risk to insure.

When do I need to provide proof of insurability?

You typically need to provide proof of insurability when applying for a new life insurance policy or when requesting an increase in coverage on an existing policy. If you already have a policy in place, you may not need to provide proof of insurability if you are simply renewing or maintaining your current coverage.

However, if you let your policy lapse and then try to reinstate it later, you may need to provide proof of insurability again to demonstrate that you are still insurable.

What happens if I don’t pass the proof of insurability test?

If you don’t pass the proof of insurability test, you may be denied coverage or offered coverage with higher premiums or other restrictions. The insurance company may also require you to undergo additional testing or provide more detailed medical records before making a final decision.

It’s important to note that being denied coverage or offered less favorable terms based on your health status is not uncommon. Insurance companies are in the business of managing risk, and they may determine that certain health conditions or risk factors make you too high of a risk to insure at a reasonable cost.

Can I skip the proof of insurability requirement?

In some cases, you may be able to skip the proof of insurability requirement if you are applying for a policy that does not require a medical exam or health questionnaire. These policies are typically more expensive and offer lower coverage amounts than traditional life insurance policies, but they can be a good option if you have health issues that make it difficult to qualify for coverage through traditional means.

However, it’s important to understand that these policies may not offer the same level of protection or benefits as traditional policies, and they may have other restrictions or limitations that you should be aware of before signing up.

How can I improve my insurability?

If you are concerned about whether you will pass the proof of insurability test or want to improve your chances of getting approved for coverage, there are several steps you can take. These may include improving your overall health and fitness, managing any chronic health conditions, quitting smoking, and maintaining a healthy weight.

You may also want to work with an insurance agent or broker who can help you find a policy that fits your needs and budget and guide you through the application process. They may be able to provide advice on how to present your health history and other information in a way that maximizes your chances of being approved for coverage.

In today’s world, life insurance has become an essential part of financial planning. It provides a sense of security to the policyholder and their loved ones in the event of any unforeseen circumstances. However, when it comes to purchasing a life insurance policy, the concept of proof of insurability can be confusing.

Proof of insurability is a requirement that some insurance companies impose on policyholders to ensure their eligibility for coverage. This proof often involves undergoing a medical examination or providing medical records to determine the applicant’s health status. It is important to note that not all insurance policies require proof of insurability, and the requirements may vary depending on the policy and the insurance company. As a professional writer, it is crucial to educate people about the concept of proof of insurability so that they can make informed decisions when purchasing a life insurance policy.

Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering individuals to make well-informed decisions. Guided by his passion, he has assembled a team of seasoned insurance professionals committed to simplifying the intricate world of insurance for you.

- Latest Posts by Rakibul Hasan

-

Can I Keep Medicaid If My Job Offers Insurance?

- -

Does Smile Direct Club Take Medicaid Insurance?

- -

Does Life Insurance Payout Affect Medicaid?

- All Posts