Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering...Read more

Life insurance is an essential tool for protecting your loved ones financially in case of your unexpected demise. It’s a wise decision to invest in a life insurance policy that covers your family for an extended period. But how long can a life insurance policy last? What is the longest term life insurance policy available in the market? This is an important question every policyholder should ask before purchasing a plan.

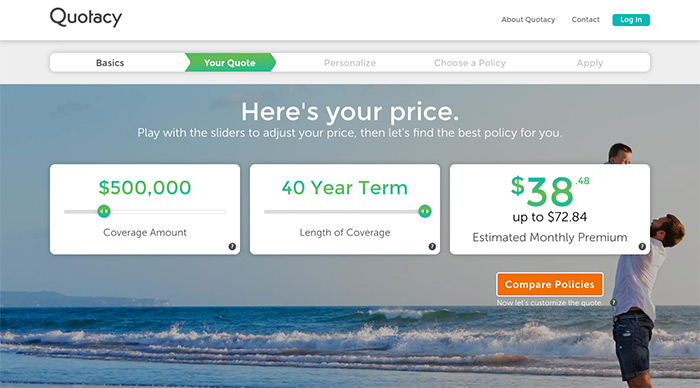

A term life insurance policy is a type of life insurance that provides coverage for a specific period, usually ranging from 10 to 30 years. The length of the policy term depends on your needs and budget. However, for those who want to ensure their family’s financial security for an extended period, the longest term life insurance policy available in the market is 40 years. In this article, we’ll explore the benefits of a 40-year term life insurance policy and its suitability for different life stages.

Contents

- What is the Longest Term Life Insurance Policy?

- Frequently Asked Questions

- What is the longest term life insurance policy?

- What are the benefits of a longest term life insurance policy?

- Can a longest term life insurance policy be renewed?

- Can a longest term life insurance policy be converted to a permanent policy?

- How can I determine the length of term I need for a longest term life insurance policy?

- Can I Keep Medicaid If My Job Offers Insurance?

- Does Smile Direct Club Take Medicaid Insurance?

- Does Life Insurance Payout Affect Medicaid?

What is the Longest Term Life Insurance Policy?

Term life insurance is a popular type of life insurance that provides coverage for a specific period of time, typically 10, 20, or 30 years. However, some insurance companies offer longer term life insurance policies that can provide coverage for up to 40 or even 50 years. These policies are known as the longest term life insurance policies.

What is Long Term Life Insurance Policy?

Long term life insurance policies are designed to provide coverage for a longer period of time than traditional term life insurance policies. These policies can provide coverage for up to 50 years, depending on the insurance company and the policy terms.

Long term life insurance policies are typically more expensive than traditional term life insurance policies, but they can provide more comprehensive coverage and greater peace of mind for the policyholder. These policies can be especially beneficial for those who are looking for long-term financial protection for their loved ones.

Benefits of Long Term Life Insurance

One of the main benefits of long term life insurance is the peace of mind it provides. With a longer term policy, you can be sure that your loved ones will be financially protected for a longer period of time. This can be especially important if you have young children or dependents who will need financial support for many years to come.

Long term life insurance policies can also provide more comprehensive coverage than traditional term life insurance policies. Some policies offer features such as accelerated death benefits, which allow you to access a portion of your policy’s death benefit if you are diagnosed with a terminal illness.

Long Term Life Insurance Vs Traditional Term Life Insurance

While long term life insurance policies can provide greater coverage and peace of mind than traditional term life insurance policies, they can also be more expensive. Traditional term life insurance policies are typically more affordable and can provide coverage for shorter periods of time.

When deciding between long term life insurance and traditional term life insurance, it is important to consider your financial needs and goals. If you are looking for long-term financial protection for your loved ones, a long term life insurance policy may be the best option. However, if you are looking for more affordable coverage for a shorter period of time, a traditional term life insurance policy may be a better choice.

What to Look for in a Long Term Life Insurance Policy

When shopping for a long term life insurance policy, there are several key factors to consider. These include the length of the policy, the amount of coverage, the premiums, and any additional features or riders that may be available.

It is important to choose a policy that provides adequate coverage for your needs and fits within your budget. You should also consider the financial stability and reputation of the insurance company, as well as any customer service or claims handling issues that may be important to you.

How to Get a Long Term Life Insurance Policy

Getting a long term life insurance policy is similar to getting any other type of life insurance policy. You will need to fill out an application and provide information about your health, lifestyle, and other factors that may affect your eligibility for coverage.

Once you have been approved for coverage, you will need to pay premiums on a regular basis to keep your policy in force. If you pass away during the policy term, your beneficiaries will receive the death benefit specified in your policy.

Conclusion

Long term life insurance policies can provide valuable financial protection for your loved ones for up to 50 years. While these policies can be more expensive than traditional term life insurance policies, they can also provide more comprehensive coverage and greater peace of mind. When shopping for a long term life insurance policy, it is important to consider your needs and goals, as well as the financial stability and reputation of the insurance company.

Frequently Asked Questions

Here are some of the most frequently asked questions about the longest term life insurance policy.

What is the longest term life insurance policy?

The longest term life insurance policy typically lasts for 30 years. This type of policy is designed to provide coverage for a specific period of time, allowing you to choose the length of the term based on your needs. Term life insurance policies are often purchased by individuals who want to provide financial protection to their loved ones in the event of their unexpected death.

The premiums for a term life insurance policy are typically lower than those of a permanent life insurance policy, as the coverage is only provided for a specific period of time. However, if you outlive the term of your policy, you will not receive any benefits. It is important to carefully consider the length of the term when purchasing life insurance to ensure that it meets your needs.

What are the benefits of a longest term life insurance policy?

A longest term life insurance policy provides a number of benefits, including financial protection for your loved ones in the event of your unexpected death. This type of policy is typically less expensive than a permanent life insurance policy, making it a more affordable option for many individuals.

Additionally, a longest term life insurance policy can be a good option for those who want coverage for a specific period of time. For example, if you have children who will be attending college in 20 years, a 30-year term policy can provide coverage until they are able to support themselves financially. It is important to carefully consider your needs and the length of time you will require coverage when selecting a life insurance policy.

Can a longest term life insurance policy be renewed?

Many term life insurance policies, including the longest term policies, can be renewed at the end of the term. However, the premiums for a renewed policy may be higher than those for a new policy, as your age and health may have changed during the initial term.

It is important to carefully review the terms of your policy to determine whether it can be renewed and what the premiums will be if you choose to renew. If you are concerned about the cost of renewing your policy, you may want to consider purchasing a new policy at the end of the term.

Can a longest term life insurance policy be converted to a permanent policy?

Many term life insurance policies, including the longest term policies, offer the option to convert to a permanent policy. This can be a good option if you want to continue your coverage beyond the initial term, as a permanent policy provides coverage for your entire life.

The cost of converting to a permanent policy will depend on a number of factors, including your age, health, and the type of policy you choose. It is important to carefully review the terms of your policy to determine whether conversion is an option and what the cost will be.

How can I determine the length of term I need for a longest term life insurance policy?

The length of term you need for a longest term life insurance policy will depend on a number of factors, including your age, health, and financial situation. You may want to consider factors such as the age of your children, the amount of debt you have, and your retirement savings when selecting the length of your policy.

It is important to carefully review your needs and the length of time you will require coverage when selecting a life insurance policy. A financial advisor or insurance professional can help you determine the length of term that is right for you.

In conclusion, it’s critical to understand that life insurance is a crucial investment that can safeguard your loved ones’ financial future. A long-term policy is an excellent option for those seeking coverage that lasts for a considerable period. With several options available, it’s crucial to weigh your needs and financial goals before settling on a long-term policy.

Ultimately, the benefits of a long-term policy outweigh the costs, especially if you’re looking to ensure your family’s financial security for an extended period. By selecting a policy that matches your needs, you’ll have peace of mind knowing that your loved ones are protected even after you’re gone. So take your time, do your research, and make an informed decision about the best long-term life insurance policy for you and your family’s future.

Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering individuals to make well-informed decisions. Guided by his passion, he has assembled a team of seasoned insurance professionals committed to simplifying the intricate world of insurance for you.

- Latest Posts by Rakibul Hasan

-

Can I Keep Medicaid If My Job Offers Insurance?

- -

Does Smile Direct Club Take Medicaid Insurance?

- -

Does Life Insurance Payout Affect Medicaid?

- All Posts