Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering...Read more

Life insurance is a crucial investment for individuals who want to secure their family’s future. It provides financial protection for beneficiaries in the event of the policyholder’s death. However, have you ever wondered where life insurance companies invest the premiums they collect? This is a question that many people may not have considered, but it is an important aspect to understand as it can affect the stability and profitability of the company.

Life insurance companies are financial institutions that make money by investing the premiums they receive from policyholders. These investments generate income that is used to pay out claims and cover operating expenses. The investments made by these companies are diverse and can vary based on the company’s risk tolerance, investment goals, and market conditions. In this article, we will explore the various investment vehicles that life insurance companies use to grow their money and secure their financial stability in the long run.

Contents

- Where Do Life Insurance Companies Invest Their Money?

- Frequently Asked Questions

- What is life insurance?

- Where do life insurance companies invest their money?

- How do life insurance companies manage investment risk?

- What happens to a life insurance policy if the company goes bankrupt?

- What should I consider when choosing a life insurance policy?

- How Do Insurance Companies Invest Their Money?

- Can I Keep Medicaid If My Job Offers Insurance?

- Does Smile Direct Club Take Medicaid Insurance?

- Does Life Insurance Payout Affect Medicaid?

Where Do Life Insurance Companies Invest Their Money?

Life insurance companies collect premiums from policyholders to provide coverage and protection in case of unexpected events such as death, disability or critical illness. But where do these companies invest the money collected from policyholders to ensure they can meet their obligations in the future?

1. Bonds

Life insurance companies invest a large portion of their portfolios in bonds. Bonds are a type of debt security issued by governments, corporations or other organizations. They pay interest to the bondholder and have a fixed maturity date when the principal is repaid. Bonds are considered a relatively safe investment that provides steady income.

Life insurance companies typically invest in high-quality bonds such as government bonds or investment-grade corporate bonds. These bonds have a lower risk of default and provide a steady stream of income.

Benefits of investing in bonds:

- Relatively low risk

- Steady income

- Diversification of portfolio

VS Stocks:

Compared to stocks, bonds are considered a safer investment option as they offer a fixed rate of return and have a lower risk of losing money. However, the returns on bonds are typically lower than those on stocks.

2. Stocks

Life insurance companies also invest in stocks, which represent ownership in a company. Stocks can provide high returns but also come with higher risk. Companies with a strong track record of growth and profitability are typically preferred by life insurance companies.

Benefits of investing in stocks:

- Potentially high returns

- Ownership in a company

- Diversification of portfolio

VS Bonds:

Compared to bonds, stocks are riskier and can be more volatile. However, they also have the potential to provide higher returns over the long term.

3. Real Estate

Life insurance companies may also invest in real estate, such as commercial properties or apartment buildings. Real estate can provide a steady stream of rental income and the potential for appreciation over time.

Benefits of investing in real estate:

- Steady rental income

- Potential for appreciation over time

- Diversification of portfolio

VS Bonds and Stocks:

Compared to bonds and stocks, real estate is a tangible asset that can provide a steady stream of income with the potential for appreciation. However, it also requires a higher initial investment and can be more difficult to liquidate.

4. Alternative Investments

In addition to traditional investments such as bonds, stocks, and real estate, life insurance companies may also invest in alternative investments such as private equity, hedge funds, or commodities. These investments can provide diversification and potentially higher returns, but also come with higher risk.

Benefits of investing in alternative investments:

- Potentially higher returns

- Diversification of portfolio

VS Traditional Investments:

Compared to traditional investments, alternative investments can provide higher returns but also come with higher risk and may be more difficult to value and liquidate.

5. Cash and Cash Equivalents

Life insurance companies may also hold a portion of their portfolios in cash and cash equivalents such as money market funds, certificates of deposit, or short-term government bonds. These investments provide liquidity and can be used to meet obligations such as policyholder payouts.

Benefits of holding cash and cash equivalents:

- Liquidity

- Low risk

VS Other Investments:

Compared to other investments, cash and cash equivalents typically provide lower returns but are considered lower risk and more liquid.

6. Structured Settlements

Life insurance companies may also invest in structured settlements, which are financial agreements that provide a series of payments over time. Structured settlements are typically used to settle legal claims or as part of a settlement in a personal injury or wrongful death case.

Benefits of investing in structured settlements:

- Steady stream of payments over time

- Predictable cash flow

VS Other Investments:

Compared to other investments, structured settlements provide a predictable stream of income but may be more difficult to liquidate and can come with legal and regulatory risks.

7. Annuities

Life insurance companies may also offer annuities, which are financial products that provide a series of payments over time in exchange for a lump-sum payment. Annuities can provide a steady stream of income in retirement and may offer tax benefits.

Benefits of offering annuities:

- Steady stream of payments over time

- Predictable cash flow

- Tax benefits

VS Other Investments:

Compared to other investments, annuities provide a predictable stream of income but may come with higher fees and surrender charges.

8. Reinsurance

Life insurance companies may also invest in reinsurance, which is a type of insurance that provides coverage to insurance companies. Reinsurance can help manage risk and reduce exposure to large losses.

Benefits of investing in reinsurance:

- Reduced exposure to large losses

- Helps manage risk

VS Other Investments:

Compared to other investments, reinsurance is a unique investment that provides protection against large losses but may require significant capital and expertise.

9. International Investments

Life insurance companies may also invest in international investments, such as foreign stocks or bonds. International investments can provide diversification and potentially higher returns but also come with higher risk due to currency fluctuations and political instability.

Benefits of investing in international investments:

- Potentially higher returns

- Diversification of portfolio

VS Domestic Investments:

Compared to domestic investments, international investments can provide diversification and potentially higher returns but also come with higher risk and may require expertise in foreign markets.

10. Impact Investing

Finally, some life insurance companies may also invest in impact investing, which is a type of investment that seeks to generate a social or environmental impact in addition to financial returns. Impact investing can provide a way for life insurance companies to align their investments with their values and mission.

Benefits of impact investing:

- Generates social or environmental impact

- Aligns investments with values and mission

VS Other Investments:

Compared to other investments, impact investing seeks to generate a social or environmental impact in addition to financial returns and may require expertise in the specific area of impact.

In conclusion, life insurance companies invest their money in a variety of assets including bonds, stocks, real estate, alternative investments, cash and cash equivalents, structured settlements, annuities, reinsurance, international investments, and impact investing. Each investment has its own benefits and risks, and life insurance companies must carefully manage their portfolios to ensure they can meet their obligations to policyholders over the long term.

Frequently Asked Questions

What is life insurance?

Life insurance is a contract between an individual and an insurance company. The individual pays premiums to the insurance company in exchange for a death benefit to be paid to their beneficiaries upon their death.

There are different types of life insurance policies such as term life, whole life, and universal life. The type of policy chosen depends on the individual’s needs and financial situation.

Where do life insurance companies invest their money?

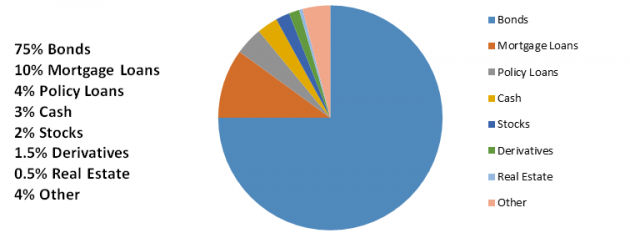

Life insurance companies invest their money in a variety of assets such as bonds, stocks, real estate, and alternative investments. These investments are chosen based on the company’s investment strategy and risk tolerance.

Bonds are the most common investment for life insurance companies as they provide a steady stream of income and are considered less risky than stocks. Stocks are also a common investment as they have the potential for higher returns but come with more risk. Real estate and alternative investments such as private equity and hedge funds may also be included in a company’s investment portfolio.

How do life insurance companies manage investment risk?

Life insurance companies manage investment risk through diversification and asset allocation. Diversification is the practice of spreading investments across a variety of assets to reduce risk. Asset allocation is the practice of dividing investments among different asset classes such as stocks, bonds, and real estate.

Life insurance companies also use risk management tools such as hedging and derivatives to manage investment risk. Hedging involves taking a position in the market that offsets potential losses from another investment. Derivatives are financial instruments that allow companies to manage risk by betting on the future price of an asset.

What happens to a life insurance policy if the company goes bankrupt?

If a life insurance company goes bankrupt, policyholders are protected by state guaranty associations. These associations provide a safety net for policyholders by paying out claims up to a certain amount.

The amount of coverage provided by the guaranty association varies by state and policy type. It is important for policyholders to understand the coverage limits in their state and to choose a financially stable insurance company.

What should I consider when choosing a life insurance policy?

When choosing a life insurance policy, it is important to consider your financial situation, current and future expenses, and the needs of your beneficiaries. You should also consider the type and amount of coverage you need.

It is also important to choose a reputable insurance company with a strong financial rating. This ensures that the company will be able to pay out claims in the event of your death. You should also compare rates and shop around to find the best policy for your needs and budget.

How Do Insurance Companies Invest Their Money?

Life insurance companies are responsible for managing the financial risks associated with providing life insurance policies to their clients. One of the primary ways they do this is by investing the premiums they collect in various financial instruments. This investment strategy is crucial because it not only ensures that the company can pay out claims but also generates profits that can be used to expand their business.

So, where do life insurance companies invest their money? The answer is that they invest in a diverse range of financial instruments such as bonds, stocks, and real estate. However, the exact mix of investments depends on a variety of factors, including the company’s risk tolerance, investment objectives, and market conditions. By carefully managing their investments, life insurance companies can ensure that they provide their clients with the financial security they need while also generating profits that help them grow and thrive in an increasingly competitive marketplace.

Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering individuals to make well-informed decisions. Guided by his passion, he has assembled a team of seasoned insurance professionals committed to simplifying the intricate world of insurance for you.

- Latest Posts by Rakibul Hasan

-

Can I Keep Medicaid If My Job Offers Insurance?

- -

Does Smile Direct Club Take Medicaid Insurance?

- -

Does Life Insurance Payout Affect Medicaid?

- All Posts