Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering...Read more

As a car owner, you know that auto insurance is a must-have. It’s a way to protect yourself and your vehicle against any unforeseen circumstances that may arise while driving. However, with so many different types of insurance policies available, it can be overwhelming to choose the right one for your needs. Comprehensive auto insurance is one of the most popular types of coverage, but many people wonder how much it costs.

Comprehensive auto insurance provides coverage for a wide range of risks, including theft, vandalism, fire, and weather-related damage. It’s often considered the most complete type of car insurance, and many drivers choose it for the peace of mind it provides. However, the cost of comprehensive auto insurance can vary depending on a number of factors, including your driving record, the make and model of your car, and the level of coverage you choose. In this article, we’ll explore the average cost of comprehensive auto insurance, and what you can do to keep your premiums as low as possible.

How Much Does Comprehensive Auto Insurance Cost?

Comprehensive auto insurance is a type of insurance that covers damage to your vehicle that is not caused by a collision. This can include theft, vandalism, weather-related damage, and more. While comprehensive coverage can provide valuable protection, many drivers are curious about how much it will cost them. In this article, we’ll explore the factors that can influence the cost of comprehensive auto insurance.

Factors That Affect the Cost of Comprehensive Auto Insurance

The cost of comprehensive auto insurance can vary widely depending on a number of factors. The following are some of the most significant factors that can influence the cost of your comprehensive coverage:

1. Your Vehicle

The type of vehicle you drive can have a significant impact on the cost of your comprehensive coverage. Generally speaking, more expensive vehicles will require more expensive coverage. This is because it will cost more to replace or repair a high-end vehicle if it is damaged or stolen.

2. Your Driving Record

Your driving record can also have an impact on the cost of your comprehensive coverage. Drivers with a history of accidents or traffic violations may be considered higher-risk by insurance companies, which can result in higher premiums.

3. Your Location

Where you live can also influence the cost of your comprehensive coverage. Areas with higher rates of theft or vandalism may have higher insurance premiums to reflect the increased risk.

4. Your Deductible

Your deductible is the amount you pay out of pocket before your insurance coverage kicks in. Generally speaking, higher deductibles will result in lower premiums, but you’ll need to be prepared to pay more out of pocket if something happens to your vehicle.

How Much Does Comprehensive Auto Insurance Cost?

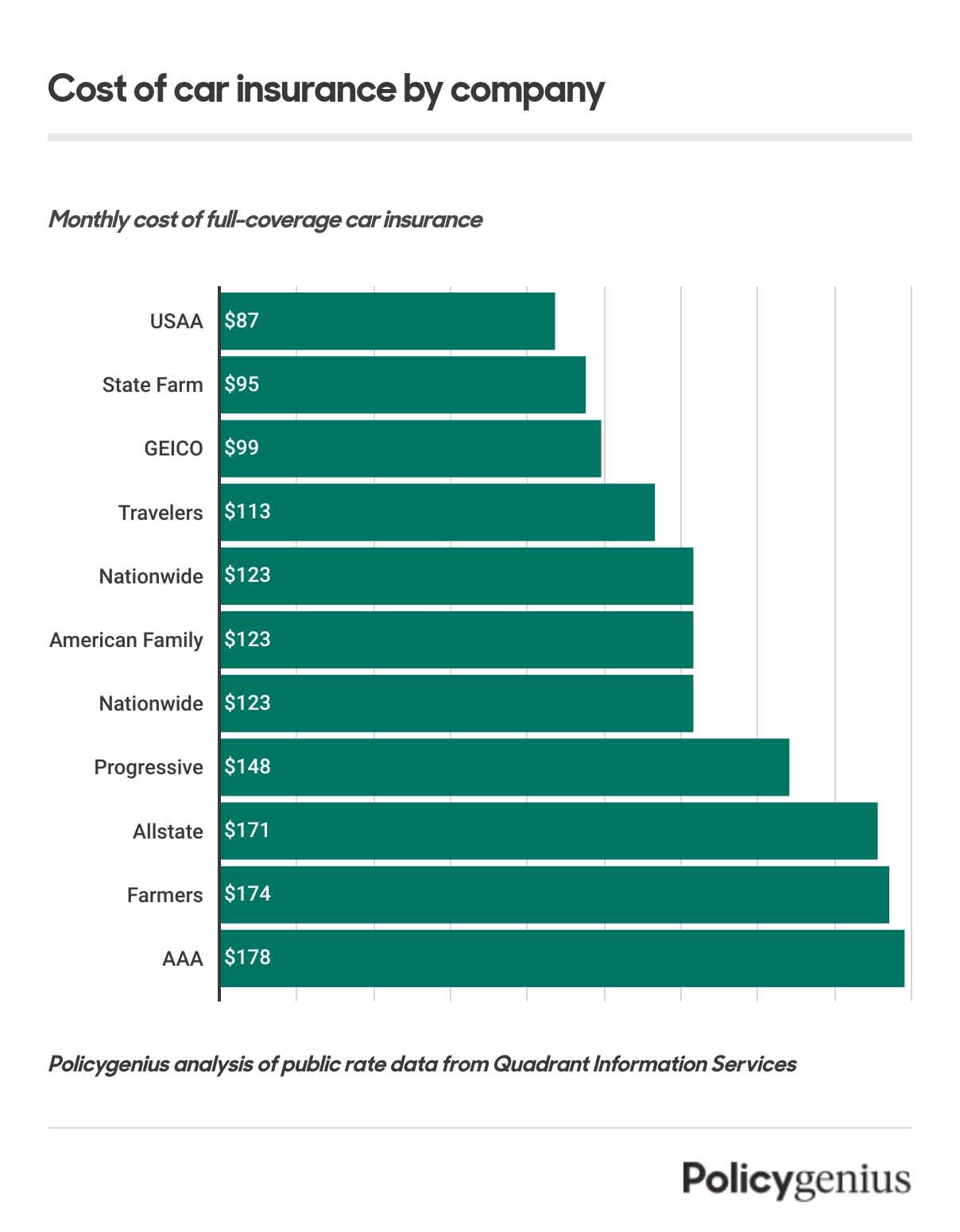

Now that we’ve explored some of the factors that can influence the cost of comprehensive auto insurance, let’s take a closer look at the actual numbers. According to recent data from the National Association of Insurance Commissioners, the average cost of comprehensive auto insurance in the United States is around $160 per year.

Of course, this is just an average, and your own costs may be higher or lower depending on your specific circumstances. Some drivers may pay as little as $50 per year for comprehensive coverage, while others may pay hundreds or even thousands of dollars.

The Benefits of Comprehensive Auto Insurance

While the cost of comprehensive auto insurance may be a concern for some drivers, it’s important to remember the benefits of having this coverage. Comprehensive insurance can provide valuable protection against theft, vandalism, weather-related damage, and more. Without this coverage, you could be on the hook for expensive repairs or replacement costs.

In addition, some lenders may require drivers to carry comprehensive insurance as a condition of their auto loan. This is because the lender wants to protect its investment in the vehicle.

Comprehensive vs. Collision Insurance

It’s also worth mentioning the difference between comprehensive and collision insurance. While comprehensive insurance covers damage to your vehicle that is not caused by a collision, collision insurance covers damage that results from a collision with another vehicle or object.

Some drivers may choose to carry both types of coverage for maximum protection, while others may opt for one or the other depending on their needs and budget.

How to Save Money on Comprehensive Auto Insurance

If you’re concerned about the cost of comprehensive auto insurance, there are a few things you can do to save money. These include:

– Comparison shopping: Be sure to get quotes from multiple insurance companies to find the best rates.

– Increasing your deductible: As mentioned earlier, higher deductibles can result in lower premiums.

– Bundling your coverage: Some insurance companies offer discounts for customers who bundle multiple types of coverage (such as auto and home insurance).

– Taking advantage of discounts: Many insurance companies offer discounts for things like safe driving, anti-theft devices, and more.

Conclusion

Comprehensive auto insurance can provide valuable protection against a range of unexpected events, from theft to weather-related damage. While the cost of this coverage can vary depending on a number of factors, it’s important to remember the benefits of having it. By understanding the factors that can influence the cost of comprehensive coverage and taking steps to save money, you can find the right coverage for your needs and budget.

Contents

- Frequently Asked Questions

- 1. What is comprehensive auto insurance?

- 2. How much does comprehensive auto insurance cost?

- 3. Is comprehensive auto insurance worth the cost?

- 4. What factors affect the cost of comprehensive auto insurance?

- 5. How can I save money on comprehensive auto insurance?

- How much does car insurance cost and how can you lower your rates

- Can I Keep Medicaid If My Job Offers Insurance?

- Does Smile Direct Club Take Medicaid Insurance?

- Does Life Insurance Payout Affect Medicaid?

Frequently Asked Questions

1. What is comprehensive auto insurance?

Comprehensive auto insurance is a type of coverage that protects your vehicle from damage caused by events other than a collision. This can include damage from natural disasters, theft, vandalism, and more.

The cost of comprehensive auto insurance can vary depending on a number of factors, including the make and model of your vehicle, your driving history, and your location. Typically, comprehensive coverage is more expensive than basic liability coverage, but it provides greater protection for your vehicle.

2. How much does comprehensive auto insurance cost?

The cost of comprehensive auto insurance can vary widely depending on your individual circumstances. On average, comprehensive coverage costs around $150-$300 per year. However, this can vary widely depending on factors such as your driving record, the make and model of your vehicle, and your location.

To get an accurate estimate of how much comprehensive auto insurance will cost you, it’s important to shop around and get quotes from multiple insurance providers. This will help you compare rates and find the best coverage at the most affordable price.

3. Is comprehensive auto insurance worth the cost?

Whether or not comprehensive auto insurance is worth the cost depends on your individual circumstances. If you have a newer or more expensive vehicle, comprehensive coverage may be worth the extra cost to protect your investment.

On the other hand, if you have an older vehicle that is not worth as much, it may not make sense to pay for comprehensive coverage. Ultimately, the decision to purchase comprehensive auto insurance should be based on your individual needs and budget.

4. What factors affect the cost of comprehensive auto insurance?

Several factors can affect the cost of comprehensive auto insurance, including your driving record, the make and model of your vehicle, your age and location, and the deductible you choose.

If you have a clean driving record and a newer or more expensive vehicle, you can expect to pay more for comprehensive coverage. Additionally, choosing a higher deductible can help lower your premium, but it also means you’ll pay more out of pocket if you need to file a claim.

5. How can I save money on comprehensive auto insurance?

There are several ways to save money on comprehensive auto insurance. One of the most effective is to shop around and compare rates from multiple insurance providers.

Additionally, you can consider raising your deductible, which can lower your premium but also means you’ll pay more out of pocket if you need to file a claim. You may also be eligible for discounts based on factors such as your driving record, the safety features of your vehicle, and more.

How much does car insurance cost and how can you lower your rates

After conducting thorough research and analyzing data from various sources, one thing is clear – the cost of comprehensive auto insurance varies significantly. Factors such as the make and model of your vehicle, your driving record, location, and coverage limits all play a role in determining your insurance premiums.

While the cost of comprehensive auto insurance may seem daunting, it’s important to remember that it’s a necessary investment in protecting yourself and your vehicle. By carefully considering your coverage needs and shopping around for the best rates, you can find a policy that fits your budget and provides you with peace of mind on the road. So, take the time to research your options and make an informed decision – your wallet and your safety will thank you in the long run.

Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering individuals to make well-informed decisions. Guided by his passion, he has assembled a team of seasoned insurance professionals committed to simplifying the intricate world of insurance for you.

- Latest Posts by Rakibul Hasan

-

Can I Keep Medicaid If My Job Offers Insurance?

- -

Does Smile Direct Club Take Medicaid Insurance?

- -

Does Life Insurance Payout Affect Medicaid?

- All Posts