Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering...Read more

As an entrepreneur, one of the biggest challenges you face is finding affordable and comprehensive health insurance coverage for yourself and your employees. Many small business owners wonder whether it is cheaper to purchase health insurance plans for their employees as a group or for each employee individually. This is an important decision that can have a significant impact on the financial health of your business, as well as the well-being of your workforce.

In this article, we will explore the question of whether small business health insurance is cheaper than individual health insurance. We will examine the factors that influence the cost of health insurance, the advantages and disadvantages of purchasing group health insurance, and the potential cost savings of individual health insurance plans. Whether you’re a small business owner looking to provide health insurance for yourself and your employees, or an individual seeking affordable healthcare coverage, this article will provide you with the information you need to make an informed decision.

Small business health insurance can be cheaper than individual health insurance. This is because small businesses can negotiate better rates with insurance companies due to the number of employees they have. Additionally, small business health insurance plans often offer more comprehensive coverage options than individual plans. However, the cost of small business health insurance may vary depending on the size of the business, the location, and the type of coverage selected.

Contents

- Is Small Business Health Insurance Cheaper Than Individual?

- Frequently Asked Questions

- Is small business health insurance cheaper than individual?

- What are the benefits of small business health insurance?

- How do I qualify for small business health insurance?

- What is the difference between group health insurance and individual health insurance?

- What factors affect the cost of small business health insurance?

- How Much Does Small Business Health Insurance Cost?

- Can I Keep Medicaid If My Job Offers Insurance?

- Does Smile Direct Club Take Medicaid Insurance?

- Does Life Insurance Payout Affect Medicaid?

Is Small Business Health Insurance Cheaper Than Individual?

Small business owners are always looking for ways to cut costs and save money. One of the biggest expenses for any business is healthcare. As a result, many small business owners wonder if it’s cheaper to offer health insurance to their employees or to let them purchase individual plans. In this article, we will explore the pros and cons of each option and help you make an informed decision.

Cost Comparison

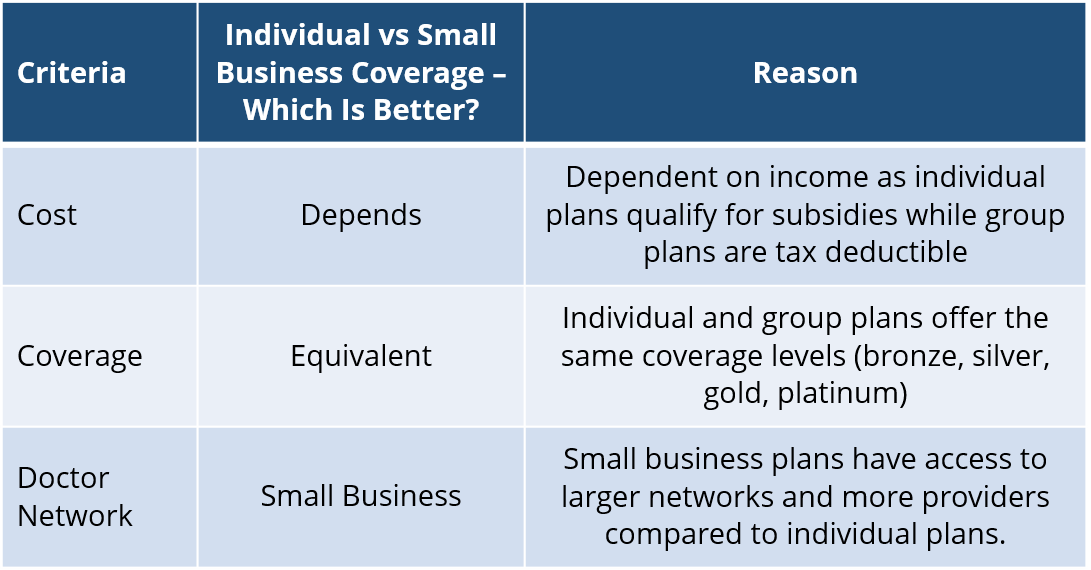

When comparing the cost of small business health insurance to individual plans, there are several factors to consider. Small business plans are typically more expensive than individual plans per person, but they can be more affordable when compared to the cost of purchasing individual plans for each employee.

Small business plans also offer tax benefits that can help offset the cost. Employers can deduct the cost of premiums as a business expense, and employees can pay their portion of the premium with pre-tax dollars, which can save them money.

Benefits of Small Business Health Insurance

Small business health insurance plans offer a variety of benefits to employees. They typically offer better coverage than individual plans, including coverage for pre-existing conditions and maternity care. They also often include perks like dental and vision coverage.

In addition, small business plans offer the convenience of having all employees under one plan, which can make it easier to manage and administer. This can also lead to better negotiating power with insurance companies, which can result in lower premiums.

Benefits of Individual Health Insurance

Individual health insurance plans also offer some benefits that small business plans do not. For example, individual plans offer more flexibility and choice in terms of providers and coverage options. Employees can shop around and choose the plan that best fits their needs and budget.

Individual plans also offer portability, meaning employees can take their coverage with them if they leave the company or start their own business. This can be a valuable benefit for employees who value their healthcare coverage and want to maintain continuity of care.

Factors to Consider

When deciding whether to offer small business health insurance or individual plans, there are several factors to consider. One of the biggest factors is the size of your business. Small businesses with fewer than 50 employees are not required by law to offer health insurance, but larger businesses may face penalties if they do not provide coverage.

Another factor to consider is the demographics of your workforce. If you have a younger workforce, individual plans may be more affordable and attractive to employees. However, if you have an older workforce or employees with pre-existing conditions, small business plans may offer better coverage and be more affordable.

Conclusion

In conclusion, the decision to offer small business health insurance or individual plans depends on several factors. While small business plans may be more expensive per person, they can be more affordable when compared to the cost of individual plans for each employee. Small business plans also offer better coverage and tax benefits.

Individual plans offer more flexibility and choice, as well as portability. Ultimately, the decision will depend on the needs and budget of your business and employees. By weighing the pros and cons of each option, you can make an informed decision that benefits everyone involved.

Frequently Asked Questions

Is small business health insurance cheaper than individual?

Small business health insurance and individual health insurance have different rates and costs. Typically, small business health insurance is cheaper than individual health insurance because of the group coverage. Insurers usually offer discounted rates for group coverage because they are spreading the risk across a larger number of people. This makes small business health insurance more affordable for employers and their employees.

However, there are many factors that can affect the cost of small business health insurance, such as the size of the company, location, and the level of coverage offered. It is important to compare quotes from different insurance providers to find the best deal for your business.

What are the benefits of small business health insurance?

Small business health insurance offers several benefits to both employers and employees. For employers, it can help attract and retain employees by offering competitive benefits packages. It can also improve the overall health and wellbeing of the workforce, which can lead to increased productivity and lower absenteeism.

For employees, small business health insurance provides access to affordable healthcare services and can help alleviate the financial burden of medical expenses. It can also provide peace of mind knowing that they are covered in case of unexpected illnesses or injuries.

How do I qualify for small business health insurance?

To qualify for small business health insurance, you must have a business with at least one full-time employee other than yourself. The number of employees required to qualify for small business health insurance varies by state and insurance provider. In general, businesses with 2-50 employees are eligible for small business health insurance.

It is important to note that some insurance providers may have additional eligibility requirements, such as minimum participation rates or contribution levels. It is best to consult with an insurance broker or provider to determine your eligibility for small business health insurance.

What is the difference between group health insurance and individual health insurance?

Group health insurance is coverage provided to a group of people, typically through an employer or other organization. The cost of the insurance is shared between the employer and the employees, and the coverage is usually more comprehensive and affordable than individual health insurance.

Individual health insurance is coverage purchased by an individual or family directly from an insurance provider. The cost of individual health insurance is usually higher than group health insurance because the insurer is assuming the risk for one person or family instead of spreading it across a larger group. Coverage options may also be more limited than group health insurance.

What factors affect the cost of small business health insurance?

The cost of small business health insurance can vary based on several factors, including the size of the company, location, industry, and the level of coverage offered. Other factors that can affect the cost include the age and health of the employees, the deductible and copay amounts, and the network of healthcare providers.

It is important to compare quotes from different insurance providers to find the best deal for your business. You may also want to consider offering a high-deductible health plan or a health savings account to help lower the cost of premiums.

How Much Does Small Business Health Insurance Cost?

As a professional writer, I can say that the answer to the question “Is small business health insurance cheaper than individual?” is not a straightforward one. It depends on several factors such as the size of the business, the number of employees, and the type of coverage required. In general, small business health insurance can be more cost-effective than individual plans, but it is not always the case.

Small businesses have the advantage of pooling their resources, which can result in lower premiums and better coverage options. Additionally, small business owners can take advantage of tax credits and deductions that are not available to individuals. However, if a business has only a few employees, the cost of providing health insurance may outweigh the benefits. Ultimately, it is important for small business owners to carefully consider their options and consult with an insurance professional to determine the best course of action for their specific situation.

Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering individuals to make well-informed decisions. Guided by his passion, he has assembled a team of seasoned insurance professionals committed to simplifying the intricate world of insurance for you.

- Latest Posts by Rakibul Hasan

-

Can I Keep Medicaid If My Job Offers Insurance?

- -

Does Smile Direct Club Take Medicaid Insurance?

- -

Does Life Insurance Payout Affect Medicaid?

- All Posts