Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering...Read more

As a business owner, you want to ensure that your employees are happy and healthy. One way to do that is by providing health insurance coverage. But what if you want to give your employees the option to choose their own insurance plan? Can you pay for their individual health insurance instead?

The answer is yes, you can pay for your employees’ individual health insurance, but there are some things you need to consider before doing so. In this article, we will explore the pros and cons of paying for individual health insurance, what the legal requirements are, and how to go about setting up this type of benefit for your employees. By the end of this article, you will have a better understanding of whether paying for individual health insurance is the right choice for your business and your employees.

Yes, you can pay for your employees’ individual health insurance. However, it’s important to note that if you do so, the payments would be considered taxable income for your employees. Alternatively, you could offer a group health insurance plan, which can provide tax benefits for both you and your employees. It’s best to consult with a licensed insurance agent or tax professional to determine the best option for your business and employees.

Contents

- Can I Pay for My Employees Individual Health Insurance?

- Frequently Asked Questions

- Can I Pay for My Employees Individual Health Insurance?

- What are the Benefits of Offering an Employer Payment Plan?

- What are the Risks of Offering an Employer Payment Plan?

- Can I Offer Both an Employer Payment Plan and a Group Health Plan?

- How Do I Set Up an Employer Payment Plan?

- Can I Keep Medicaid If My Job Offers Insurance?

- Does Smile Direct Club Take Medicaid Insurance?

- Does Life Insurance Payout Affect Medicaid?

Can I Pay for My Employees Individual Health Insurance?

As an employer, you may be wondering if it is possible to offer individual health insurance coverage to your employees. The answer is yes, but there are some important things to consider before making this decision.

What is Individual Health Insurance?

Individual health insurance is a type of health insurance coverage that is purchased by an individual, rather than being provided by an employer. This type of coverage can be purchased directly from an insurance company or through a health insurance exchange.

Individual health insurance plans vary in terms of coverage, cost, and benefits. They may include things like doctor visits, hospital stays, prescription drugs, and preventive care. Some plans may also offer additional benefits like dental or vision coverage.

Can Employers Pay for Individual Health Insurance?

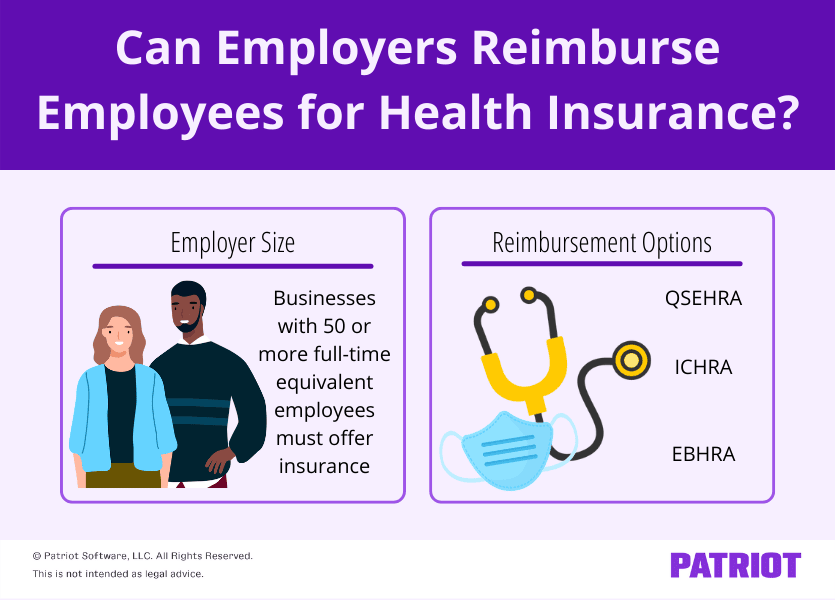

Yes, employers can pay for individual health insurance coverage for their employees. However, there are some important things to consider before doing so.

First, it is important to note that if an employer pays for individual health insurance for an employee, the employer cannot claim a tax deduction for that expense. This is because the expense is considered a personal expense, rather than a business expense.

Second, it is important to ensure that the individual health insurance plan meets certain requirements set forth by the Affordable Care Act (ACA). These requirements include things like providing essential health benefits, meeting certain cost-sharing limits, and offering coverage to individuals with pre-existing conditions.

Benefits of Offering Individual Health Insurance

There are several benefits to offering individual health insurance coverage to your employees. Here are a few:

- Increased flexibility: Offering individual health insurance allows employees to choose the plan that works best for their individual needs.

- Lower costs: Individual health insurance can often be less expensive than group health insurance, which can save both the employer and the employee money.

- Attract and retain talent: Offering individual health insurance can be a valuable perk that can help attract and retain top talent.

Overall, offering individual health insurance can be a great option for employers who want to provide their employees with more flexibility and choice when it comes to their health insurance coverage.

Group Health Insurance vs. Individual Health Insurance

It is important to understand the differences between group health insurance and individual health insurance before deciding which option is best for your employees.

Group health insurance is typically offered by employers and covers a group of individuals. This type of coverage can be less expensive than individual health insurance because the risk is spread across a larger group of people. Group health insurance may also offer more comprehensive coverage.

Individual health insurance, on the other hand, is purchased by an individual and covers only that individual and their dependents. This type of coverage can be more expensive than group health insurance, but it can also offer more flexibility and choice when it comes to coverage options.

Conclusion

Offering individual health insurance coverage can be a great option for employers who want to provide their employees with more flexibility and choice when it comes to their health insurance coverage. However, it is important to carefully consider the costs and requirements associated with offering this type of coverage before making a decision.

Ultimately, the decision of whether to offer individual health insurance or group health insurance will depend on a variety of factors, including the needs and preferences of your employees, your budget, and the requirements of the ACA.

Frequently Asked Questions

Can I Pay for My Employees Individual Health Insurance?

Yes, you can pay for your employees’ individual health insurance. It’s called an “employer payment plan” (EPP). Under an EPP, you reimburse employees for some or all of their premiums for individual health insurance policies or Medicare Part B or Part D premiums. However, you can’t offer an EPP if you have more than one employee.

It’s important to note that EPPs must comply with certain rules under the Affordable Care Act (ACA). For example, payments must be made on a non-discriminatory basis, and the EPP cannot reimburse employees for medical expenses other than insurance premiums. Additionally, EPPs are subject to annual dollar limits, which are adjusted for inflation each year.

What are the Benefits of Offering an Employer Payment Plan?

Offering an employer payment plan can have several benefits for both employers and employees. For employers, it can be a cost-effective way to provide health benefits to employees without the administrative burden of offering a group health plan. It can also help attract and retain talented employees who value health benefits.

For employees, an EPP can provide flexibility in choosing a health insurance plan that meets their individual needs. It can also be a tax-efficient way to pay for health insurance premiums, as the reimbursements are not subject to payroll taxes or income taxes (if the employee provides proof of insurance coverage).

What are the Risks of Offering an Employer Payment Plan?

While offering an EPP can have benefits, there are also risks that employers should be aware of. The biggest risk is non-compliance with ACA rules, which can result in penalties and lawsuits. Employers should ensure that their EPPs comply with all applicable rules and regulations.

Another risk is that an EPP may not provide the same level of coverage as a group health plan. Employees may be responsible for more out-of-pocket expenses, and they may not have access to the same network of providers. Employers should communicate these differences to employees and make sure they understand the limitations of the EPP.

Can I Offer Both an Employer Payment Plan and a Group Health Plan?

No, you cannot offer both an EPP and a group health plan to the same employees. The ACA prohibits employers from offering an EPP to employees who are eligible for a group health plan. However, you can offer an EPP to employees who are not eligible for your group health plan, such as part-time employees or employees who decline coverage under the group plan.

If you do offer both types of plans, you should make sure that employees are aware of their options and understand the differences between the plans. It’s also important to ensure that your EPP complies with all ACA rules and regulations.

How Do I Set Up an Employer Payment Plan?

Setting up an EPP can be complicated, and it’s important to ensure that you comply with all ACA rules and regulations. You may want to consult with a benefits consultant or attorney to help you set up your plan.

To set up an EPP, you’ll need to establish a written plan document that outlines the terms of the plan, such as the amount of reimbursement, eligibility requirements, and the process for submitting claims. You’ll also need to establish a process for verifying that employees have obtained health insurance coverage.

As a professional writer, I understand that health insurance is a critical consideration for employees. Given the current state of healthcare, more and more employers are looking for ways to provide their staff with affordable insurance options. One question that often arises is whether an employer can pay for their employees’ individual health insurance plans. The answer is yes, but it’s essential to understand the potential benefits and drawbacks before making any decisions.

While it may seem like a straightforward solution, there are several factors to consider when paying for individual health insurance. Employers who opt to pay for their staff’s coverage must keep in mind the cost, coverage options, and tax implications. However, providing this benefit can also increase employee satisfaction and loyalty, leading to a more productive workforce. Ultimately, it’s up to each employer to weigh the pros and cons and decide if paying for individual health insurance is the right choice for their business.

Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering individuals to make well-informed decisions. Guided by his passion, he has assembled a team of seasoned insurance professionals committed to simplifying the intricate world of insurance for you.

- Latest Posts by Rakibul Hasan

-

Can I Keep Medicaid If My Job Offers Insurance?

- -

Does Smile Direct Club Take Medicaid Insurance?

- -

Does Life Insurance Payout Affect Medicaid?

- All Posts