Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering...Read more

Life insurance is a vital financial tool that provides peace of mind to individuals and their families. It serves as a safety net for unforeseen circumstances and ensures that loved ones are financially secure in the event of the policyholder’s death. However, for non-US citizens, the process of obtaining life insurance can be confusing and overwhelming. Many wonder if they are even eligible for coverage in the United States.

The good news is that non-US citizens can obtain life insurance in the United States under certain conditions. However, the process and requirements may differ from those for US citizens. In this article, we will explore the options available to non-US citizens seeking life insurance and provide valuable insights into the process. Whether you are a permanent resident, a foreign national, or an expatriate, this article will help you understand the eligibility criteria and the steps involved in acquiring life insurance in the US.

Contents

- Can a Non US Citizen Get Life Insurance?

- Frequently Asked Questions

- Can non-US citizens get life insurance?

- What types of life insurance policies are available to non-US citizens?

- Do non-US citizens need a social security number to get life insurance?

- Can non-US citizens get life insurance if they have a pre-existing medical condition?

- What should non-US citizens consider when choosing a life insurance policy?

- Can I Keep Medicaid If My Job Offers Insurance?

- Does Smile Direct Club Take Medicaid Insurance?

- Does Life Insurance Payout Affect Medicaid?

Can a Non US Citizen Get Life Insurance?

Life insurance is an important financial tool that helps individuals protect their loved ones and assets in case of an unexpected death. However, for non-US citizens, getting life insurance can be a bit more complicated. In this article, we will explore whether non-US citizens can get life insurance and what options are available to them.

1. Types of Life Insurance Available for Non-US Citizens

There are two main types of life insurance policies available for non-US citizens: term life insurance and permanent life insurance. Term life insurance provides coverage for a specific period of time, while permanent life insurance provides coverage for the lifetime of the insured individual.

Term life insurance policies are generally easier to obtain for non-US citizens, as they have lower premiums and fewer underwriting requirements. Permanent life insurance policies, on the other hand, may require more extensive underwriting and documentation.

Term Life Insurance for Non-US Citizens

Term life insurance policies for non-US citizens typically have a maximum coverage amount of $2 million and a maximum term of 20 years. The premiums for these policies are generally higher than those for US citizens due to the increased risk associated with insuring non-US citizens.

Permanent Life Insurance for Non-US Citizens

Permanent life insurance policies for non-US citizens can be more difficult to obtain, as they often require more extensive underwriting and documentation. Additionally, these policies may have higher premiums and lower coverage amounts than those for US citizens.

2. Requirements for Non-US Citizens to Get Life Insurance

To qualify for life insurance as a non-US citizen, you will typically need to meet certain requirements. These requirements may vary by insurance company and policy type, but generally include the following:

– A valid visa or green card

– A US-based mailing address

– A US-based bank account

– A valid US driver’s license or state ID

– A social security number or taxpayer identification number

Documentation Requirements

In addition to meeting the above requirements, non-US citizens will also need to provide documentation to verify their identity and residency. This may include:

– Passport or visa

– Proof of residency, such as a utility bill or lease agreement

– Bank statements or other financial documentation

– Tax returns or other income verification

3. Benefits of Life Insurance for Non-US Citizens

While obtaining life insurance as a non-US citizen may be more challenging, the benefits of having coverage can be significant. Some of the key benefits of life insurance for non-US citizens include:

– Protecting loved ones and assets in case of an unexpected death

– Providing financial security for dependents and heirs

– Covering final expenses, such as funeral costs

– Potentially reducing estate taxes for non-US citizens with US-based assets

4. Life Insurance for Non-US Citizens vs US Citizens

There are some key differences between life insurance policies for non-US citizens and US citizens. Some of the main differences include:

– Non-US citizens may have more limited policy options and higher premiums

– Non-US citizens may need to meet additional documentation and underwriting requirements

– Non-US citizens may have lower coverage amounts and shorter terms than US citizens

– US citizens may have more flexibility in choosing a policy type and coverage amount

Conclusion

In summary, non-US citizens can obtain life insurance in the US, but they may have more limited policy options and higher premiums than US citizens. To qualify for life insurance, non-US citizens will need to meet certain requirements and provide documentation to verify their identity and residency. Despite the challenges, obtaining life insurance as a non-US citizen can provide important financial protection for loved ones and assets.

Frequently Asked Questions

Life insurance is an important decision to make for anyone, regardless of citizenship status. For non-US citizens, however, the process of obtaining life insurance can be a bit more complicated. Here are some common questions and answers about whether non-US citizens can get life insurance.

Can non-US citizens get life insurance?

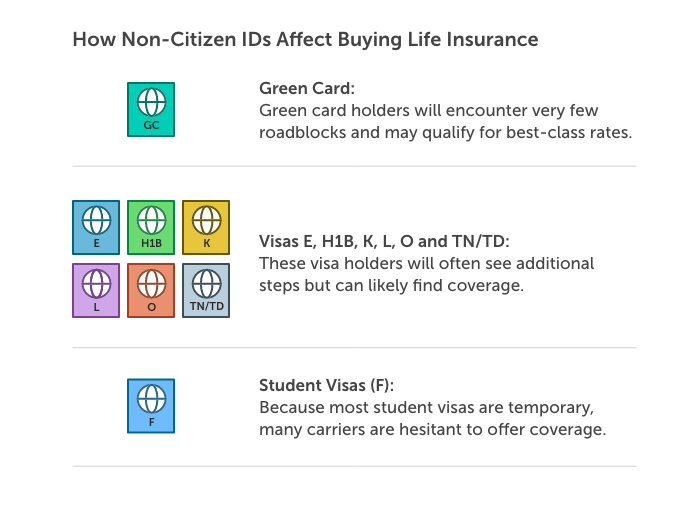

Yes, non-US citizens can get life insurance. However, the process of obtaining life insurance as a non-US citizen may be more difficult than it is for US citizens. Insurance companies may require additional documentation, such as proof of residency or a work visa, and may limit the types of policies available to non-US citizens.

Additionally, non-US citizens may face higher premiums than US citizens due to their perceived higher risk. Some insurance companies may also require non-US citizens to undergo a medical exam before being approved for a policy.

What types of life insurance policies are available to non-US citizens?

Non-US citizens may have limited options when it comes to life insurance policies. Some insurance companies may only offer term life insurance policies to non-US citizens, while others may offer both term and permanent life insurance options.

It’s important to shop around and compare policies from different insurance companies to find the best coverage for your needs. Working with an insurance agent who specializes in working with non-US citizens may also be helpful.

No, non-US citizens do not need a social security number to get life insurance. However, insurance companies may ask for other forms of identification, such as a passport or an Individual Taxpayer Identification Number (ITIN).

If you do not have a social security number or ITIN, you may still be able to get life insurance as a non-US citizen. Working with an insurance agent who has experience working with non-US citizens can help you navigate this process.

Can non-US citizens get life insurance if they have a pre-existing medical condition?

It is possible for non-US citizens with pre-existing medical conditions to get life insurance, but it may be more difficult to find a policy that meets their needs. Insurance companies may consider pre-existing conditions when determining premiums and coverage options.

It’s important to disclose any pre-existing medical conditions when applying for life insurance as a non-US citizen. Some insurance companies may require a medical exam or additional documentation to determine eligibility for coverage.

What should non-US citizens consider when choosing a life insurance policy?

When choosing a life insurance policy as a non-US citizen, it’s important to consider your unique needs and circumstances. Factors to consider may include the length of the policy, the amount of coverage, and the premiums you can afford.

Working with an insurance agent who specializes in working with non-US citizens can be helpful in finding the right policy for your needs. It’s also important to carefully review and understand the terms and conditions of any policy before signing on.

As a professional writer, the question of whether a non-US citizen can obtain life insurance is an important one. The answer is yes, with some limitations. Non-US citizens may face additional requirements, such as providing proof of residency or citizenship in their home country. Additionally, some insurance companies may require non-US citizens to have a US-based co-signer or a valid US visa.

It’s important to note that the availability and terms of life insurance policies for non-US citizens can vary greatly between insurance companies. As such, it is crucial to do your research and shop around to find the best policy that meets your needs. With the right policy, non-US citizens can obtain life insurance to protect themselves and their loved ones from financial hardship in the event of an unexpected tragedy.

Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering individuals to make well-informed decisions. Guided by his passion, he has assembled a team of seasoned insurance professionals committed to simplifying the intricate world of insurance for you.

- Latest Posts by Rakibul Hasan

-

Can I Keep Medicaid If My Job Offers Insurance?

- -

Does Smile Direct Club Take Medicaid Insurance?

- -

Does Life Insurance Payout Affect Medicaid?

- All Posts