Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering...Read more

As a car owner, you may often wonder if getting comprehensive and collision auto insurance is really necessary. While it may seem like an extra expense, these types of coverage can provide you with much-needed protection in case of an accident or damage to your vehicle. Understanding the benefits and drawbacks of comprehensive and collision auto insurance can help you make an informed decision about whether or not to purchase them.

Comprehensive auto insurance covers damage to your car that is not a result of a collision, such as theft, vandalism, or natural disasters. Collision insurance, on the other hand, covers damage to your car that is a result of a collision with another vehicle or object. In this article, we will delve deeper into what comprehensive and collision auto insurance entails, their benefits and drawbacks, and how to determine if they are right for you.

Contents

- Do I Need Comprehensive and Collision Auto Insurance?

- Frequently Asked Questions

- What is Comprehensive and Collision Auto Insurance?

- Do I Need Comprehensive and Collision Auto Insurance?

- How Much Does Comprehensive and Collision Auto Insurance Cost?

- What Are the Benefits of Comprehensive and Collision Auto Insurance?

- How Can I Get Comprehensive and Collision Auto Insurance?

- Collision Vs Comprehensive Car Insurance – Full Guide

- Can I Keep Medicaid If My Job Offers Insurance?

- Does Smile Direct Club Take Medicaid Insurance?

- Does Life Insurance Payout Affect Medicaid?

Do I Need Comprehensive and Collision Auto Insurance?

Auto insurance is a necessary expense for anyone who owns a car. It not only provides financial protection in case of an accident but also helps you comply with state laws. However, when it comes to choosing the right coverage options, the process can be overwhelming. One question that often arises is whether you need comprehensive and collision auto insurance. In this article, we’ll explore the answer to that question and help you make an informed decision.

What is Comprehensive Auto Insurance?

Comprehensive auto insurance, also known as “other than collision” coverage, provides protection for your car in case of damage caused by non-collision events. This can include theft, vandalism, fire, natural disasters, and falling objects. Comprehensive insurance is not required by law, but it may be required by your lender or leasing company if you have a loan or lease on your car.

Comprehensive auto insurance is beneficial because it covers a wide range of events that could cause damage to your car, and it can provide peace of mind knowing that you’re protected in case of an unexpected event. However, it’s important to note that comprehensive insurance typically has a deductible, which is the amount you’ll have to pay out of pocket before your insurance kicks in.

What is Collision Auto Insurance?

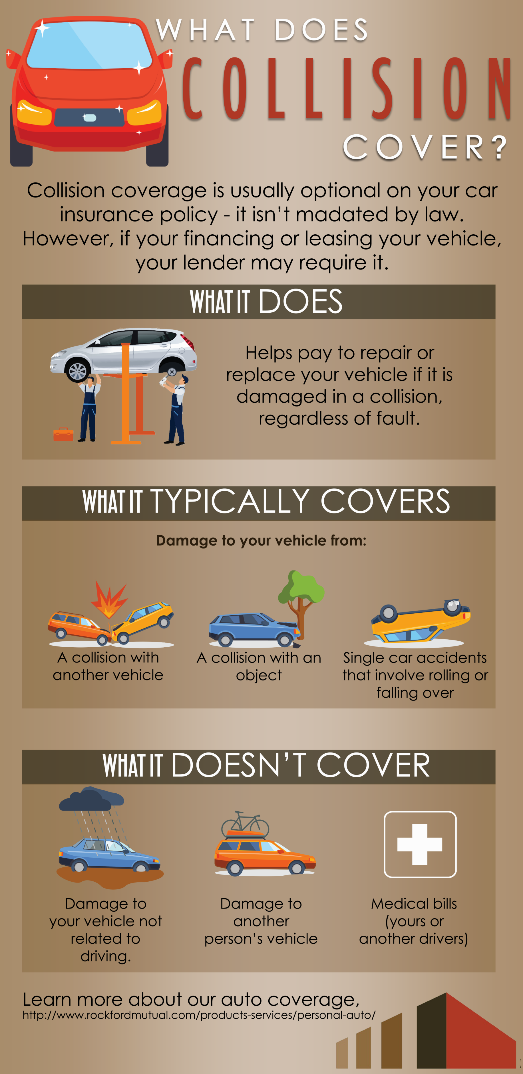

Collision auto insurance provides protection for your car in case of damage caused by a collision with another vehicle or object. This can include accidents with other cars, hitting a stationary object like a tree, or rolling your car. Collision insurance is not required by law, but it may be required by your lender or leasing company if you have a loan or lease on your car.

Collision auto insurance is beneficial because it covers damage to your car in case of an accident, regardless of who is at fault. It can also provide peace of mind knowing that you’re protected in case of an unexpected collision. However, like comprehensive insurance, collision insurance typically has a deductible that you’ll have to pay out of pocket before your insurance kicks in.

Do I Need Comprehensive and Collision Auto Insurance?

Whether or not you need comprehensive and collision auto insurance depends on a few factors, including the value of your car, your budget, and your personal situation. If you have a newer car or a car that is worth a significant amount of money, comprehensive and collision insurance may be a good idea to protect your investment.

However, if you have an older car that is worth less than the cost of the insurance premiums, it may not be worth it to carry comprehensive and collision insurance. In this case, you may want to consider liability insurance, which is typically less expensive and covers damage that you cause to other people and their property.

The Benefits of Comprehensive and Collision Auto Insurance

While comprehensive and collision auto insurance may not be necessary for everyone, there are some benefits to having this type of coverage. First and foremost, it provides financial protection in case of an unexpected event like theft, vandalism, or an accident. This can save you thousands of dollars in repairs or replacement costs.

Comprehensive and collision auto insurance also provides peace of mind knowing that you’re protected in case of an unexpected event. You can drive with confidence, knowing that you have coverage in case something happens to your car.

Comprehensive and Collision Auto Insurance Vs Liability Auto Insurance

Liability auto insurance is a type of insurance that covers damage that you cause to other people and their property. It does not cover damage to your own car. While liability insurance is required by law in most states, it may not be enough to protect you in case of an accident.

Comprehensive and collision auto insurance, on the other hand, provides protection for your own car in case of damage caused by non-collision events or collisions. While it may be more expensive than liability insurance, it can provide more comprehensive coverage and peace of mind.

The Bottom Line

Whether or not you need comprehensive and collision auto insurance depends on your personal situation and the value of your car. While these types of coverage can provide financial protection and peace of mind, they may not be necessary for everyone. It’s important to weigh the benefits and costs of each type of coverage and choose the one that makes the most sense for you.

Remember, auto insurance is a necessary expense for anyone who owns a car. By understanding your coverage options and choosing the right coverage for your needs, you can protect yourself and your investment in case of an unexpected event.

Frequently Asked Questions

What is Comprehensive and Collision Auto Insurance?

Comprehensive and collision auto insurance are two types of coverage that can protect you from financial loss in the event of an accident or other incident involving your vehicle. Comprehensive coverage typically covers damage to your vehicle that is not caused by a collision, such as theft, vandalism, or weather-related damage. Collision coverage, on the other hand, covers damage to your vehicle that is caused by a collision with another vehicle or object, such as a tree or a fence.

Both types of coverage are considered optional, but they can provide valuable protection and peace of mind for drivers who want to be prepared for the unexpected.

Do I Need Comprehensive and Collision Auto Insurance?

Whether or not you need comprehensive and collision auto insurance depends on a variety of factors, including the value of your vehicle, your driving habits, and your overall financial situation. If you have a newer or more expensive vehicle, it may be a good idea to invest in both types of coverage to protect your investment. Similarly, if you frequently drive in areas with a high risk of accidents or theft, comprehensive and collision coverage can provide important protection.

Ultimately, the decision to purchase comprehensive and collision auto insurance is up to you. However, it’s important to weigh the potential costs and benefits of these types of coverage carefully to make an informed decision.

How Much Does Comprehensive and Collision Auto Insurance Cost?

The cost of comprehensive and collision auto insurance can vary widely depending on a number of factors, including the make and model of your vehicle, your driving record, and the level of coverage you choose. In general, comprehensive and collision coverage tends to be more expensive than liability coverage alone, but the exact cost will depend on your individual circumstances.

To get an accurate idea of how much you can expect to pay for comprehensive and collision auto insurance, it’s a good idea to get quotes from several different insurance providers and compare the costs and coverage options carefully.

What Are the Benefits of Comprehensive and Collision Auto Insurance?

The primary benefit of comprehensive and collision auto insurance is that it can protect you from financial loss in the event of an accident or other incident involving your vehicle. Without these types of coverage, you could be left paying for expensive repairs or replacement costs out of pocket.

In addition to providing financial protection, comprehensive and collision auto insurance can also provide peace of mind for drivers who want to be prepared for any situation. Knowing that you have coverage in place can help you feel more confident and secure on the road.

How Can I Get Comprehensive and Collision Auto Insurance?

If you’re interested in purchasing comprehensive and collision auto insurance, the best place to start is by researching different insurance providers and comparing the costs and coverage options available. You can also ask for recommendations from friends and family members, or work with a licensed insurance agent who can help you find the right coverage for your needs and budget.

When shopping for comprehensive and collision auto insurance, be sure to ask about any discounts or special offers that may be available, and don’t be afraid to negotiate for a better rate or more comprehensive coverage. With a little effort and research, you can find the right coverage at a price you can afford.

Collision Vs Comprehensive Car Insurance – Full Guide

After weighing the pros and cons of comprehensive and collision auto insurance, the answer to whether or not you need this type of coverage ultimately depends on your personal circumstances. If you have a newer or more expensive car, live in an area with high rates of accidents or theft, or cannot afford to pay for repairs or a replacement vehicle out of pocket, then comprehensive and collision insurance may be worth the investment. However, if you have an older or less valuable car, live in a low-risk area, or have the financial means to cover potential damages yourself, then skipping these coverages may be a viable option.

Ultimately, the decision to purchase comprehensive and collision auto insurance is not one to be taken lightly. It requires careful consideration of your individual needs and budget. By taking the time to assess your situation and compare insurance options, you can make an informed decision that provides you with the peace of mind and financial protection you need on the road.

Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering individuals to make well-informed decisions. Guided by his passion, he has assembled a team of seasoned insurance professionals committed to simplifying the intricate world of insurance for you.

- Latest Posts by Rakibul Hasan

-

Can I Keep Medicaid If My Job Offers Insurance?

- -

Does Smile Direct Club Take Medicaid Insurance?

- -

Does Life Insurance Payout Affect Medicaid?

- All Posts