Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering...Read more

Atrial fibrillation (AFib) is a common heart condition that affects millions of people worldwide. It is a type of arrhythmia that causes irregular heartbeats, which can lead to serious health complications. If you have AFib, you may be wondering if you can still get life insurance. The answer is yes, but it may depend on several factors.

Life insurance is a crucial investment for many people, as it provides financial security for their loved ones in the event of their death. However, if you have a pre-existing condition like AFib, you may be worried about your eligibility for life insurance. In this article, we will explore the various factors that insurance companies consider when evaluating an applicant with AFib and provide some tips to help you get the coverage you need.

Can I Get Life Insurance With Atrial Fibrillation?

If you have been diagnosed with atrial fibrillation (AFib), you may be wondering if it will affect your ability to obtain life insurance. AFib is a common heart condition that affects millions of people worldwide. It is characterized by an irregular heartbeat, which can increase the risk of stroke, heart failure, and other cardiovascular complications. In this article, we will explore the options available to individuals with AFib who are looking to purchase life insurance.

Understanding Atrial Fibrillation

Atrial fibrillation is a heart condition that affects the upper chambers (atria) of the heart. Instead of beating in a regular pattern, the atria can beat irregularly and rapidly, causing the heart to work less efficiently. This can lead to a variety of symptoms, including palpitations, shortness of breath, fatigue, and dizziness.

There are several factors that can increase the risk of developing AFib, including age, high blood pressure, heart disease, obesity, and a family history of the condition. AFib can also occur in individuals with no underlying health conditions.

Can You Get Life Insurance With Atrial Fibrillation?

The short answer is yes, it is possible to obtain life insurance if you have atrial fibrillation. However, the process may be more complex than it is for individuals without the condition. Life insurance companies will typically require a thorough medical examination and may request additional medical records to evaluate the severity of your condition.

Factors That Affect Your Ability to Get Life Insurance With Atrial Fibrillation

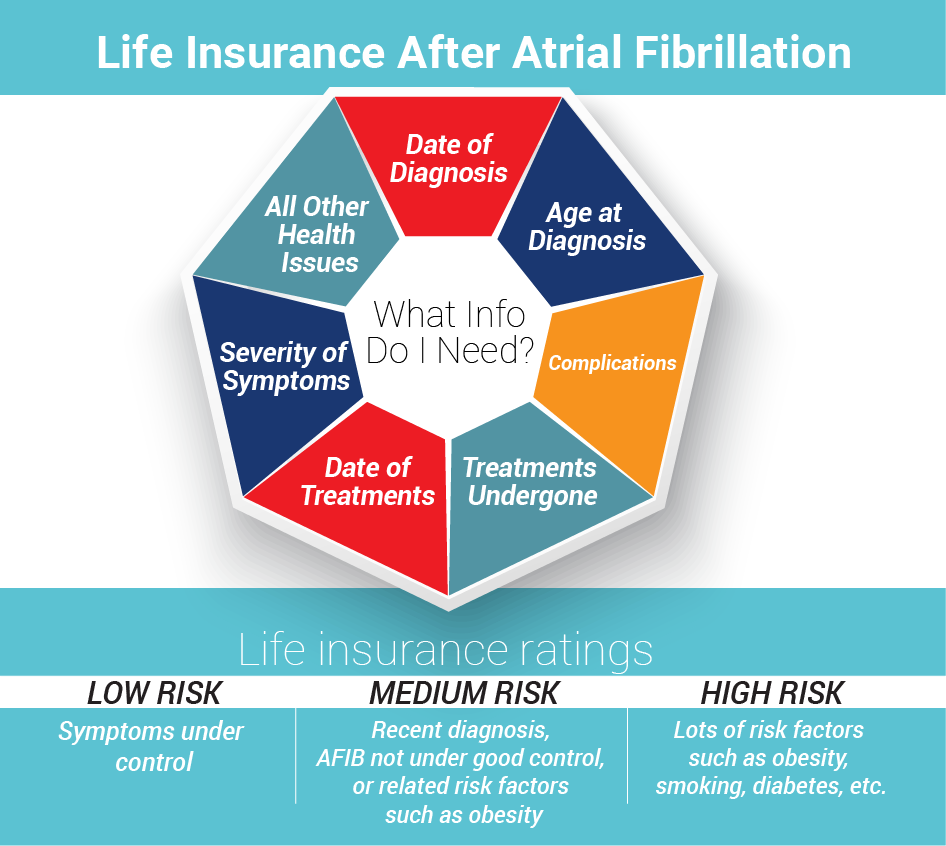

There are several factors that can impact your ability to obtain life insurance with atrial fibrillation. These include the severity of your condition, the age at which you were diagnosed, and any underlying health conditions you may have. In general, individuals with mild cases of AFib who are younger and in good health are more likely to be approved for life insurance than those with more severe cases or multiple underlying health conditions.

Types of Life Insurance Available to Individuals With Atrial Fibrillation

There are several types of life insurance available to individuals with atrial fibrillation, including term life insurance, whole life insurance, and guaranteed issue life insurance. Term life insurance provides coverage for a set period (usually 10-30 years) and is typically the most affordable option. Whole life insurance provides coverage for your entire life and includes a savings component that can accrue cash value over time. Guaranteed issue life insurance is available to individuals with pre-existing conditions and does not require a medical exam or health questionnaire.

How to Increase Your Chances of Being Approved for Life Insurance With Atrial Fibrillation

There are several steps you can take to increase your chances of being approved for life insurance with atrial fibrillation. These include:

- Maintaining a healthy lifestyle, including regular exercise and a balanced diet

- Taking medication as prescribed by your doctor

- Keeping your blood pressure and cholesterol levels under control

- Quitting smoking

- Working with an experienced insurance agent who can help you navigate the application process

Benefits of Getting Life Insurance With Atrial Fibrillation

Getting life insurance with atrial fibrillation can provide peace of mind for you and your loved ones. If something were to happen to you, your beneficiaries would receive a death benefit that could be used to cover expenses such as funeral costs, outstanding debts, and living expenses.

Life Insurance With Atrial Fibrillation vs. Without Atrial Fibrillation

Individuals with atrial fibrillation may pay higher premiums for life insurance than those without the condition. The exact cost will depend on several factors, including the severity of your condition, your age, and the type of policy you choose. However, having life insurance is still important for individuals with AFib, as it can provide financial security and peace of mind for you and your loved ones.

Conclusion

In conclusion, it is possible to obtain life insurance if you have atrial fibrillation. However, the process may be more complex than it is for individuals without the condition. Working with an experienced insurance agent and taking steps to maintain a healthy lifestyle can help increase your chances of being approved for coverage. Ultimately, having life insurance can provide peace of mind and financial security for you and your loved ones.

Contents

- Frequently Asked Questions

- Question 1: What is Atrial Fibrillation?

- Question 2: Can I get life insurance with atrial fibrillation?

- Question 3: How will atrial fibrillation affect my life insurance premiums?

- Question 4: What information do I need to provide when applying for life insurance with atrial fibrillation?

- Question 5: What can I do to improve my chances of getting life insurance with atrial fibrillation?

- Can I Keep Medicaid If My Job Offers Insurance?

- Does Smile Direct Club Take Medicaid Insurance?

- Does Life Insurance Payout Affect Medicaid?

Frequently Asked Questions

Can I Get Life Insurance With Atrial Fibrillation?

Question 1: What is Atrial Fibrillation?

Atrial fibrillation is a heart condition where the heart beats irregularly or too quickly. It is a common condition and affects millions of people worldwide. The condition can lead to other health problems, such as stroke, if left untreated.

Life insurance providers are aware of the risks that come with atrial fibrillation and may charge higher premiums or offer limited coverage. However, having atrial fibrillation does not necessarily mean you cannot get life insurance.

Question 2: Can I get life insurance with atrial fibrillation?

Yes, it is possible to get life insurance with atrial fibrillation. However, the cost and availability of coverage will depend on the severity of the condition, your age, and other health factors. If your atrial fibrillation is well-managed and you have no other major health issues, you may be able to get coverage at a reasonable cost.

It is important to disclose your medical history, including your atrial fibrillation, when applying for life insurance. Failing to do so could result in denial of coverage or cancellation of the policy later on.

Atrial fibrillation may increase the cost of your life insurance premiums or result in a higher risk classification. The insurance company will consider the severity of your condition, your age, and any other health issues when determining your premiums.

It is important to shop around and compare rates from different insurance providers to find the best coverage and rates for your situation.

Question 4: What information do I need to provide when applying for life insurance with atrial fibrillation?

When applying for life insurance with atrial fibrillation, you will be asked to provide information about your medical history, including the severity of your condition, any medications you are taking, and any other health issues you may have. You may also be asked to provide medical records and test results.

It is important to be honest and thorough when providing this information to ensure that you receive accurate quotes and appropriate coverage.

Question 5: What can I do to improve my chances of getting life insurance with atrial fibrillation?

To improve your chances of getting life insurance with atrial fibrillation, it is important to manage your condition properly. This may include taking medication as prescribed, maintaining a healthy lifestyle, and seeing your doctor regularly.

You may also want to work with an independent insurance agent who can help you find the best coverage and rates for your situation. Be sure to disclose your atrial fibrillation and any other health issues when applying for coverage to ensure that you receive accurate quotes and appropriate coverage.

In conclusion, Atrial Fibrillation is a condition that affects millions of people worldwide, and it is not uncommon for individuals diagnosed with this condition to worry about their eligibility for life insurance. However, the good news is that having Atrial Fibrillation does not necessarily disqualify you from getting life insurance. Although it may affect the type of policy you can get and the cost of the premiums, it is still possible to find an insurance provider that will offer you coverage at a reasonable price.

It is essential to disclose your medical history and diagnosis of Atrial Fibrillation accurately to the insurance provider to ensure that you receive the appropriate coverage. Additionally, working with a knowledgeable and experienced insurance agent can help you navigate the process and find the best policy that meets your needs and budget. So, if you have Atrial Fibrillation and are considering life insurance, don’t let your condition discourage you from seeking coverage. With the right approach, you can find the protection you need to safeguard your loved ones’ future.

Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering individuals to make well-informed decisions. Guided by his passion, he has assembled a team of seasoned insurance professionals committed to simplifying the intricate world of insurance for you.

- Latest Posts by Rakibul Hasan

-

Can I Keep Medicaid If My Job Offers Insurance?

- -

Does Smile Direct Club Take Medicaid Insurance?

- -

Does Life Insurance Payout Affect Medicaid?

- All Posts