Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering...Read more

Gerber Life Insurance is a popular insurance company that many parents turn to when seeking coverage for their children. However, as life circumstances change, some may wonder if they can cash in their policy. The answer is yes, it is possible to cash in Gerber Life Insurance, but there are certain factors to consider before making the decision.

Before making the decision to cash in a Gerber Life Insurance policy, it’s important to understand the terms of the policy and what options are available. Gerber Life Insurance offers a variety of policies, including term life insurance and whole life insurance, each with their own terms and conditions. Additionally, the amount of money that can be received through cashing in the policy may vary depending on the length of time the policy has been in effect and the amount of premiums paid. This article will explore the options available to policyholders looking to cash in their Gerber Life Insurance policy, and provide an overview of the factors to consider before making the decision to do so.

Yes, you can cash in your Gerber Life Insurance policy. However, the amount you receive will depend on the type of policy you have and how long you’ve had it. If you have a term life policy, you won’t receive any cash value if you cancel it. If you have a whole life policy, you can surrender it for its cash value. To find out how much money you can receive, contact Gerber Life Insurance customer service.

Contents

- Can You Cash in Gerber Life Insurance?

- Frequently Asked Questions

- Can you cash in Gerber Life Insurance?

- What is the process of cashing in a Gerber Life Insurance policy?

- What happens to your coverage when you cash in your Gerber Life Insurance policy?

- Is there a penalty for cashing in a Gerber Life Insurance policy?

- Can you borrow against your Gerber Life Insurance policy instead of cashing it in?

- Lawsuit Says Those Gerber Life Insurance Plans Are Completely Worthless

- Can I Keep Medicaid If My Job Offers Insurance?

- Does Smile Direct Club Take Medicaid Insurance?

- Does Life Insurance Payout Affect Medicaid?

Can You Cash in Gerber Life Insurance?

Gerber Life Insurance is a popular choice for parents who want to ensure their children’s financial security. However, at some point, you may need to cash in the policy. But can you cash in Gerber Life Insurance? The answer is yes, but there are certain conditions you need to meet.

Understanding Gerber Life Insurance

Gerber Life Insurance offers various types of policies, including term life insurance, whole life insurance, and accident protection insurance. These policies are designed to provide financial protection to you and your loved ones in the event of an unexpected death or injury.

Term life insurance policies provide coverage for a specific period, while whole life insurance policies provide lifelong coverage. Accident protection insurance offers financial protection in the event of an accidental death or injury.

Cashing in Gerber Life Insurance Policy

If you decide to cash in your Gerber Life Insurance policy, you need to contact the company’s customer service department to request a surrender form. The surrender form is a legal document that you need to fill out and sign to initiate the policy’s cash value.

The cash value of your policy is the amount of money that has accumulated over the years, including interest and dividends. You can opt to receive the cash value in a lump sum or periodic payments. However, if you choose to receive periodic payments, you may be subject to taxes and fees.

Benefits of Cashing in Gerber Life Insurance Policy

Cashing in your Gerber Life Insurance policy can provide you with immediate cash when you need it the most. You can use the money to pay off debts, medical bills, or invest in other ventures.

Moreover, if you no longer need insurance coverage, cashing in your policy can free up some money that you can use for other purposes. Additionally, if you are struggling to pay the premiums, cashing in your policy can provide you with some financial relief.

Disadvantages of Cashing in Gerber Life Insurance Policy

Cashing in your Gerber Life Insurance policy can have some disadvantages. Firstly, you may lose the insurance coverage that you had in place, leaving you or your loved ones without any financial protection.

Secondly, if you cash in your policy before it reaches its maturity date, you may be subject to surrender fees and taxes. Surrender fees are charged to cover the administrative costs of terminating the policy, while taxes are levied on the interest earned on the policy.

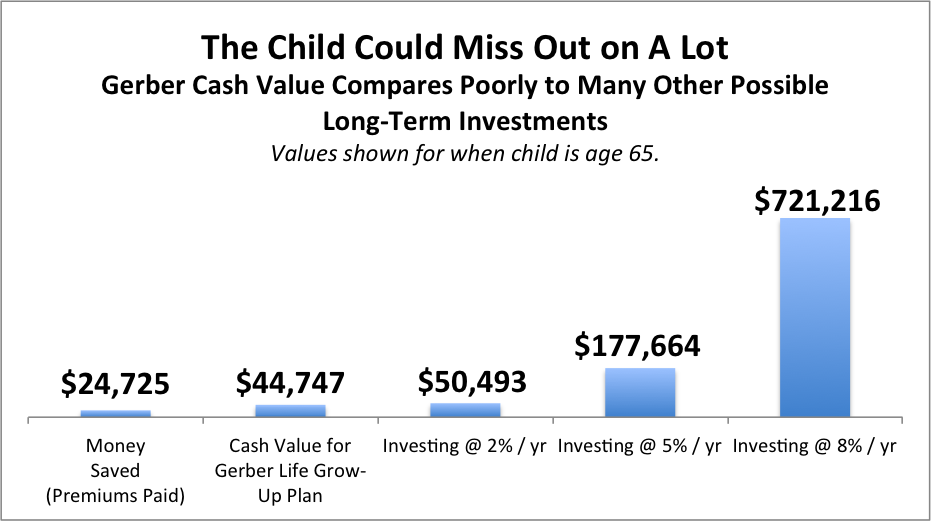

Gerber Life Insurance Policy Vs. Other Insurance Policies

Gerber Life Insurance policies offer several benefits that make them a popular choice for parents. For instance, the policies are affordable, with low premiums that can fit into most budgets. Additionally, the policies offer flexible payment options, enabling you to choose the payment schedule that suits your needs.

However, Gerber Life Insurance policies may not be the best option for everyone. For instance, if you need a policy that offers higher coverage, you may need to invest in a more comprehensive policy. Additionally, if you have pre-existing medical conditions, you may not qualify for coverage.

Conclusion

Cashing in your Gerber Life Insurance policy can provide you with immediate financial relief when you need it the most. However, before you make this decision, you need to consider the pros and cons carefully. Additionally, you may need to consult with a financial advisor to determine the best course of action for your unique situation.

Frequently Asked Questions

Gerber Life Insurance provides a variety of life insurance policies to suit the needs of individuals and families. However, many policyholders are unaware of the process of cashing in their Gerber Life Insurance policy. Here are some commonly asked questions and answers to help you understand the process of cashing in a Gerber Life Insurance policy.

Can you cash in Gerber Life Insurance?

Yes, it is possible to cash in a Gerber Life Insurance policy. This process is known as surrendering the policy. When you surrender your policy, you are essentially canceling it and receiving the cash value that has accumulated over time. The cash value is the amount of money that has been paid into the policy, minus any fees and charges.

However, it is important to note that surrendering your policy may result in a loss of coverage, and you may not be able to reinstate it in the future. Additionally, surrendering your policy may result in tax consequences, so it is recommended that you consult with a financial advisor or tax professional before making any decisions.

What is the process of cashing in a Gerber Life Insurance policy?

To cash in a Gerber Life Insurance policy, you will need to contact the company’s customer service department or your insurance agent. They will provide you with the necessary paperwork and instructions for surrendering your policy. You will need to fill out the paperwork, provide any required documentation, and submit it to the company.

Once the company receives your paperwork, they will review it and calculate the cash value of your policy. The cash value will be paid out to you in the form of a check or direct deposit to your bank account. It may take several weeks for the process to be completed, so it is important to plan accordingly.

What happens to your coverage when you cash in your Gerber Life Insurance policy?

When you cash in your Gerber Life Insurance policy, you are essentially canceling it. This means that you will no longer have coverage under the policy. If you still need life insurance coverage, you will need to purchase a new policy. Keep in mind that purchasing a new policy may be more expensive or difficult if you have any health issues or other risk factors.

It is also important to note that if you have a term life insurance policy, you will not be able to cash it in for its cash value. Term policies do not have a cash value, and they expire at the end of their term.

Is there a penalty for cashing in a Gerber Life Insurance policy?

There may be a penalty for cashing in a Gerber Life Insurance policy, depending on the type of policy you have and how long you have had it. Some policies have surrender charges or fees that are applied if you surrender the policy before a certain amount of time has passed. These charges may reduce the amount of cash value you receive.

Additionally, surrendering your policy may result in tax consequences. You may be subject to income taxes on the cash value of the policy, as well as any applicable penalties for early withdrawal. It is recommended that you consult with a financial advisor or tax professional before making any decisions.

Can you borrow against your Gerber Life Insurance policy instead of cashing it in?

Yes, it is possible to borrow against your Gerber Life Insurance policy instead of cashing it in. This process is known as taking a policy loan. When you take a policy loan, you are essentially borrowing money from the cash value of your policy. The loan must be paid back with interest, or it will be deducted from the death benefit paid to your beneficiaries.

Keep in mind that taking a policy loan may reduce the amount of cash value and death benefit available to you. Additionally, if you do not pay back the loan with interest, it may result in a reduction in the death benefit paid to your beneficiaries.

Lawsuit Says Those Gerber Life Insurance Plans Are Completely Worthless

Gerber Life Insurance is a popular choice for parents who want to secure their children’s future. However, many policyholders are unsure if they can cash in their Gerber Life Insurance policy. The good news is that Gerber Life Insurance policies come with a cash value that policyholders can access. The amount of cash value depends on the policyholder’s payments and the policy’s terms.

It is important to note that cashing in a Gerber Life Insurance policy may not be the best option for everyone. Before cashing in a policy, policyholders should consider if they still need the coverage or if they can afford to lose it. They should also be aware of any tax implications and surrender fees. It is recommended that policyholders speak with a financial advisor or Gerber Life Insurance representative to fully understand their options and make an informed decision. Overall, Gerber Life Insurance provides a valuable financial tool for families, with the option to cash in the policy if needed.

Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering individuals to make well-informed decisions. Guided by his passion, he has assembled a team of seasoned insurance professionals committed to simplifying the intricate world of insurance for you.

- Latest Posts by Rakibul Hasan

-

Can I Keep Medicaid If My Job Offers Insurance?

- -

Does Smile Direct Club Take Medicaid Insurance?

- -

Does Life Insurance Payout Affect Medicaid?

- All Posts