Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering...Read more

As a professional writer, I understand the importance of financial security and peace of mind that comes with having life insurance. However, for undocumented immigrants, navigating the world of insurance can be overwhelming and confusing. The question remains: can an undocumented person get life insurance?

The short answer is yes, undocumented individuals can obtain life insurance. However, the process may be more challenging compared to a documented individual. In this article, we will explore the options available for undocumented immigrants seeking life insurance and the challenges they may face in the process. We will also discuss the benefits of having life insurance and why it is essential to consider for everyone, regardless of immigration status.

Yes, undocumented persons can get life insurance in the United States. However, they may face some challenges in finding a provider willing to offer them coverage. Some companies may require a social security number or a valid visa, but there are also insurance companies that offer policies without these documents. It’s important to shop around and work with a licensed insurance agent to find the best options available.

Contents

- Can an Undocumented Person Get Life Insurance?

- Frequently Asked Questions

- Can an undocumented person get life insurance?

- What documentation do undocumented persons need to get life insurance?

- Will an undocumented person have to pay higher premiums for life insurance?

- Can an undocumented person name a beneficiary for their life insurance policy?

- Can an undocumented person purchase life insurance online?

- Life insurance with living benefits for undocumented immigrants

- Can I Keep Medicaid If My Job Offers Insurance?

- Does Smile Direct Club Take Medicaid Insurance?

- Does Life Insurance Payout Affect Medicaid?

Can an Undocumented Person Get Life Insurance?

Life insurance is an essential financial tool that provides security and peace of mind to individuals and their loved ones. However, many undocumented immigrants in the United States may be hesitant to apply for life insurance due to their legal status. This article will explore whether an undocumented person can get life insurance and what options are available.

Understanding Life Insurance

Life insurance is a contract between an individual and an insurance company that pays out a lump sum of money upon the death of the insured person. This money can be used to cover funeral expenses, pay off debts, or provide for the deceased person’s family. There are two main types of life insurance: term life insurance and permanent life insurance.

Term Life Insurance

Term life insurance provides coverage for a specific period, usually 10, 20, or 30 years. If the insured person dies during the term of the policy, the beneficiaries receive a payout. However, if the insured person outlives the term of the policy, there is no payout.

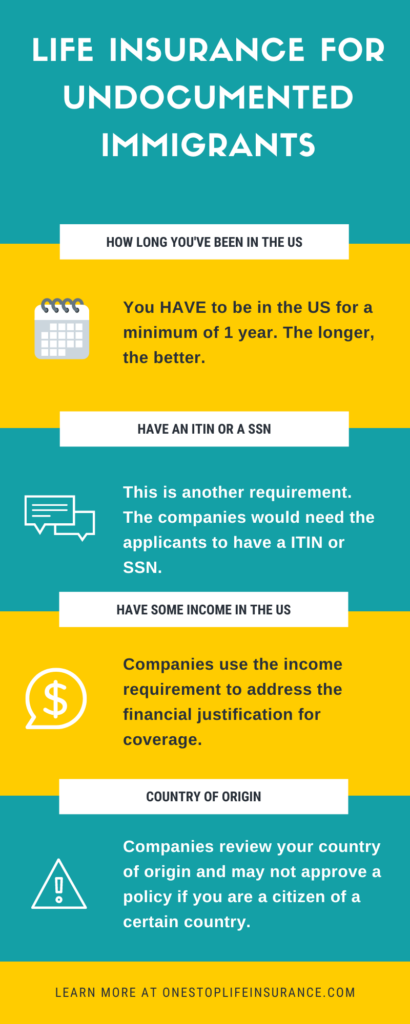

Undocumented immigrants can typically qualify for term life insurance as long as they have a valid Social Security number or Individual Taxpayer Identification Number (ITIN). Some insurance companies may require additional documentation, such as a valid driver’s license or passport.

Permanent Life Insurance

Permanent life insurance provides coverage for the entire life of the insured person, as long as premiums are paid. There are several types of permanent life insurance, including whole life, universal life, and variable life.

Undocumented immigrants may have more difficulty qualifying for permanent life insurance, as these policies often require a higher level of documentation, such as proof of residency or citizenship. However, some insurance companies may offer simplified issue policies that do not require a medical exam or extensive documentation.

Benefits of Life Insurance for Undocumented Immigrants

Undocumented immigrants can benefit greatly from having life insurance, just like anyone else. Here are a few reasons why:

Protect Your Family

If an undocumented immigrant passes away, their family may be left without a source of income to support themselves. Life insurance can provide a financial safety net to help cover funeral expenses and other costs, as well as provide ongoing support for the family.

Build Credit

Life insurance policies can also be used to build credit. Some policies have a cash value that grows over time, which can be used as collateral for loans or to make premium payments.

Peace of Mind

Knowing that your family is taken care of in the event of your passing can provide peace of mind for both the insured person and their loved ones.

Alternatives to Traditional Life Insurance

For undocumented immigrants who may have difficulty qualifying for traditional life insurance, there are alternative options available.

Group Life Insurance

Some employers offer group life insurance as part of their benefits package. Undocumented immigrants who are employed by these companies may be eligible for coverage.

Burial Insurance

Burial insurance is a type of life insurance that provides coverage specifically for funeral expenses. These policies are typically easier to qualify for and have lower face values than traditional life insurance policies.

Guaranteed Issue Life Insurance

Guaranteed issue life insurance is a type of policy that does not require a medical exam or extensive documentation. However, these policies often have lower face values and higher premiums than traditional life insurance policies.

The Bottom Line

Undocumented immigrants can qualify for life insurance, but the process may be more difficult than it is for citizens or legal residents. However, having life insurance can provide important financial protection for both the insured person and their loved ones. Alternatives to traditional life insurance, such as group life insurance and burial insurance, may be viable options for undocumented immigrants who have difficulty qualifying for traditional policies. Ultimately, it is important to do your research and work with a reputable insurance agent to find the best policy for your needs.

Frequently Asked Questions

Life insurance is an important consideration for everyone, regardless of their immigration status. This article aims to answer some common questions about whether undocumented persons can obtain life insurance.

Can an undocumented person get life insurance?

Yes, an undocumented person can get life insurance. However, the process may be more difficult than it is for a citizen or legal resident. Life insurance companies may require more documentation or proof of identity before issuing a policy to an undocumented person. Additionally, some companies may not offer policies to undocumented persons at all.

It is important to note that being undocumented does not disqualify a person from getting life insurance. However, it may limit their options and make the process more complicated.

What documentation do undocumented persons need to get life insurance?

The documentation required to obtain life insurance as an undocumented person can vary depending on the insurance company. However, it is common for companies to require proof of identity and proof of income. This may include a passport or other government-issued identification, as well as tax returns or pay stubs.

Undocumented persons may also be required to provide additional documentation, such as proof of residency or a driver’s license. It is important to research different insurance companies and their requirements to find the best option for your specific situation.

It is possible that an undocumented person may have to pay higher premiums for life insurance than a citizen or legal resident. This is because insurance companies may see undocumented persons as a higher risk due to their lack of legal status and potential for deportation.

However, not all insurance companies will charge higher premiums for undocumented persons. It is important to shop around and compare rates from different companies to find the best option for your individual circumstances.

Can an undocumented person name a beneficiary for their life insurance policy?

Yes, an undocumented person can name a beneficiary for their life insurance policy. The beneficiary is the person or entity that will receive the death benefit if the policy holder passes away. This can be a spouse, child, family member, or even a charity or organization.

It is important to note that naming a beneficiary is a crucial part of the life insurance process, even for undocumented persons. Without a named beneficiary, the death benefit may be paid to the policy holder’s estate, which can result in additional legal and financial complications.

Can an undocumented person purchase life insurance online?

Yes, it is possible for an undocumented person to purchase life insurance online. However, the process may be more difficult as many insurance companies may require additional documentation or proof of identity before issuing a policy to an undocumented person.

It is important to research different insurance companies and their online application processes to find the best option for your specific situation. Additionally, it may be helpful to consult with an insurance agent or financial advisor to ensure that you are making the best decisions for your individual needs.

Life insurance with living benefits for undocumented immigrants

In today’s society, life insurance is a vital financial tool that provides peace of mind to individuals and their families. Unfortunately, many undocumented immigrants are uncertain whether they are eligible to purchase life insurance. The good news is that, under certain circumstances, undocumented persons can obtain life insurance policies.

While it is true that some insurance companies may refuse to sell life insurance policies to undocumented persons, there are still many companies that offer policies to this population. Some of these policies may require additional paperwork or documentation, but they are still available. Additionally, some states have laws that prohibit insurance companies from discriminating against undocumented immigrants. Therefore, it is important for undocumented individuals to research their options and find a reputable insurance company that can provide them with the coverage they need.

In conclusion, while it may be more challenging for undocumented immigrants to obtain life insurance policies, it is not impossible. There are still many options available to this population, and it is important for individuals to do their due diligence and research their options thoroughly. Ultimately, life insurance is a critical financial tool that can provide peace of mind to individuals and their families, regardless of their immigration status.

Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering individuals to make well-informed decisions. Guided by his passion, he has assembled a team of seasoned insurance professionals committed to simplifying the intricate world of insurance for you.

- Latest Posts by Rakibul Hasan

-

Can I Keep Medicaid If My Job Offers Insurance?

- -

Does Smile Direct Club Take Medicaid Insurance?

- -

Does Life Insurance Payout Affect Medicaid?

- All Posts