Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering...Read more

As we go through life, we often encounter unexpected events that can have a significant impact on our loved ones. Ensuring that our family is financially stable in the event of our untimely passing is crucial. One way to do this is by purchasing a term life insurance policy. However, with so many options available, it can be overwhelming to determine how much coverage is necessary. Specifically, if you’re looking for a million-dollar term life insurance policy, you might be wondering how much it will cost and if it’s worth the investment.

A million-dollar term life insurance policy can provide significant financial protection for your loved ones in the event of your death. However, several factors can impact the cost of your policy, such as your age, health, and lifestyle. In this article, we’ll explore the factors that determine the cost of a million-dollar term life insurance policy and provide you with the information you need to make an informed decision about your coverage. So, if you’re considering purchasing a million-dollar term life insurance policy, read on to learn more about what you can expect to pay.

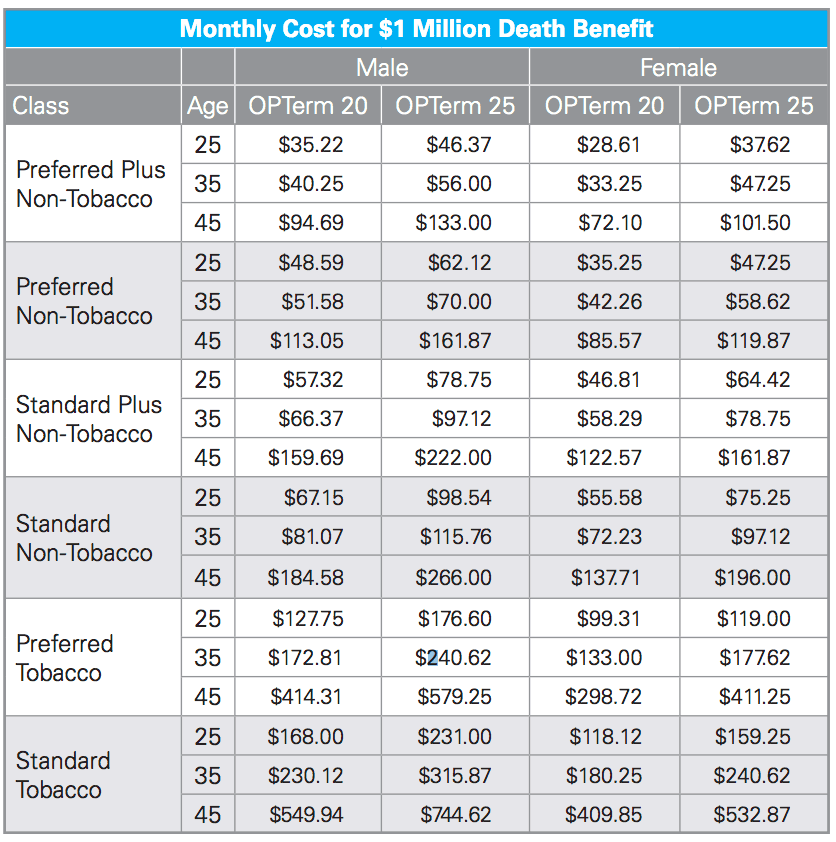

A million dollar term life insurance policy typically costs between $50 and $100 per month, depending on the age, health, and lifestyle of the insured. Factors such as smoking, high blood pressure, and a family history of medical conditions can increase the premium. However, term life insurance is usually more affordable than permanent life insurance policies, which can cost several hundred dollars per month.

How Much is a Million Dollar Term Life Insurance Policy?

If you are considering purchasing a life insurance policy, you may be wondering how much a million-dollar term life insurance policy costs. The truth is, the cost of a million-dollar term life insurance policy can vary depending on a variety of factors, such as your age, health, and lifestyle. In this article, we will explore the factors that can impact the cost of a million-dollar term life insurance policy and what you can expect to pay.

Factors that Impact the Cost of a Million-Dollar Term Life Insurance Policy

The cost of a million-dollar term life insurance policy can vary widely depending on several factors. Here are some of the factors that can impact the cost of your policy:

| Factor | Description |

|---|---|

| Age | The younger you are when you purchase your policy, the lower your premiums will be. |

| Health | Your overall health and any pre-existing conditions can impact your premiums. The healthier you are, the lower your premiums will be. |

| Lifestyle | If you engage in high-risk activities, such as skydiving or rock climbing, your premiums may be higher. |

| Term Length | The longer the term of your policy, the higher your premiums will be. |

In addition to these factors, the insurance company you choose and the type of policy you select can also impact the cost of your million-dollar term life insurance policy.

What You Can Expect to Pay for a Million-Dollar Term Life Insurance Policy

On average, a healthy 35-year-old non-smoking male can expect to pay around $35-$45 per month for a 20-year term life insurance policy with a million-dollar death benefit. However, as we mentioned earlier, the cost of your policy will depend on a variety of factors, so your premiums may be higher or lower than this estimate.

It’s important to note that while a million-dollar term life insurance policy may seem like a lot of coverage, it may not be enough for everyone. If you have a large family or significant debt, you may want to consider purchasing additional coverage.

The Benefits of a Million-Dollar Term Life Insurance Policy

There are several benefits to purchasing a million-dollar term life insurance policy. Here are some of the key benefits:

- Provides financial security for your loved ones if you were to pass away

- Can be used to pay off debts or cover expenses such as funeral costs

- May be more affordable than permanent life insurance policies

Term Life Insurance vs. Permanent Life Insurance

When it comes to life insurance, there are two main types to choose from: term life insurance and permanent life insurance. Here’s a quick breakdown of the differences between the two:

| Type of Policy | Description |

|---|---|

| Term Life Insurance | Provides coverage for a set period of time (e.g. 10, 20, or 30 years) |

| Permanent Life Insurance | Provides coverage for your entire life and includes a savings component |

While both types of policies have their benefits, term life insurance is generally more affordable and may be a better option for those who are looking for basic coverage.

Final Thoughts

A million-dollar term life insurance policy can provide valuable financial protection for your loved ones in the event of your untimely death. However, the cost of your policy will depend on a variety of factors, so it’s important to shop around and compare quotes from multiple insurance companies to find the best policy for your needs and budget.

Contents

- Frequently Asked Questions

- What is a million-dollar term life insurance policy?

- How much does a million-dollar term life insurance policy cost?

- How much coverage do I need?

- What are the benefits of a million-dollar term life insurance policy?

- How do I apply for a million-dollar term life insurance policy?

- Can I Keep Medicaid If My Job Offers Insurance?

- Does Smile Direct Club Take Medicaid Insurance?

- Does Life Insurance Payout Affect Medicaid?

Frequently Asked Questions

What is a million-dollar term life insurance policy?

A million-dollar term life insurance policy is a type of life insurance policy that provides a death benefit of one million dollars to the beneficiaries of the policyholder.

The policy is typically purchased for a specific term, such as 10, 20, or 30 years, and the premiums are paid annually or monthly. If the policyholder dies during the term of the policy, the beneficiaries receive the death benefit, which is usually tax-free.

How much does a million-dollar term life insurance policy cost?

The cost of a million-dollar term life insurance policy depends on several factors, including the age, health, and lifestyle of the policyholder. Generally, younger and healthier individuals will pay lower premiums than older or less healthy individuals.

On average, a 30-year-old non-smoking male in good health can expect to pay between $35 and $45 per month for a 20-year million-dollar term life insurance policy, while a 50-year-old non-smoking male in good health can expect to pay between $200 and $250 per month for the same policy.

How much coverage do I need?

The amount of life insurance coverage you need depends on several factors, including your income, debts, and dependents. A general rule of thumb is to have coverage that is 10-12 times your annual income.

If you are the primary breadwinner in your family, you may want to consider a million-dollar term life insurance policy to ensure your loved ones are financially secure in the event of your death.

What are the benefits of a million-dollar term life insurance policy?

A million-dollar term life insurance policy provides a substantial death benefit to your beneficiaries, which can help cover expenses such as mortgage payments, college tuition, and living expenses.

Additionally, term life insurance policies are generally more affordable than permanent life insurance policies, making them a popular choice for individuals who want to provide financial security for their loved ones without breaking the bank.

How do I apply for a million-dollar term life insurance policy?

To apply for a million-dollar term life insurance policy, you will typically need to complete an application and undergo a medical exam to determine your health status. The insurance company will also review your medical records and lifestyle habits to determine your risk level.

Once you are approved for coverage, you will need to pay the premiums on a regular basis to keep the policy in force. If you die during the term of the policy, your beneficiaries will receive the death benefit.

In today’s uncertain times, securing the future of our loved ones is more important than ever. A million-dollar term life insurance policy can provide a sense of financial security, allowing your family to maintain their standard of living in the event of an unexpected tragedy. But how much does such a policy cost?

The answer to this question varies depending on several factors such as your age, health, and lifestyle. Nevertheless, it’s worth noting that the price of term life insurance has become more affordable in recent years. With a little bit of research and comparison shopping, you can find a policy that fits your budget and provides the peace of mind that comes with knowing that your family will be taken care of. So, don’t delay – invest in a million-dollar term life insurance policy today to secure your family’s future tomorrow.

Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering individuals to make well-informed decisions. Guided by his passion, he has assembled a team of seasoned insurance professionals committed to simplifying the intricate world of insurance for you.

- Latest Posts by Rakibul Hasan

-

Can I Keep Medicaid If My Job Offers Insurance?

- -

Does Smile Direct Club Take Medicaid Insurance?

- -

Does Life Insurance Payout Affect Medicaid?

- All Posts