Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering...Read more

As we go through life, we all strive to provide the best for our loved ones. This often entails making sure that they are financially secure even after we’re gone. This is where life insurance comes in handy. One popular life insurance policy is the whole life insurance policy, which provides coverage for the entirety of your life. However, with a 1 million dollar policy, the question arises, how much does it cost?

The cost of a 1 million dollar whole life insurance policy varies depending on a variety of factors such as your age, health status, and lifestyle choices. Although it may seem like a hefty price tag, it can provide peace of mind for you and your loved ones knowing that they will be taken care of in the event of your untimely death. In this article, we will explore the different factors that influence the cost of a 1 million dollar whole life insurance policy, as well as the benefits of investing in such a policy.

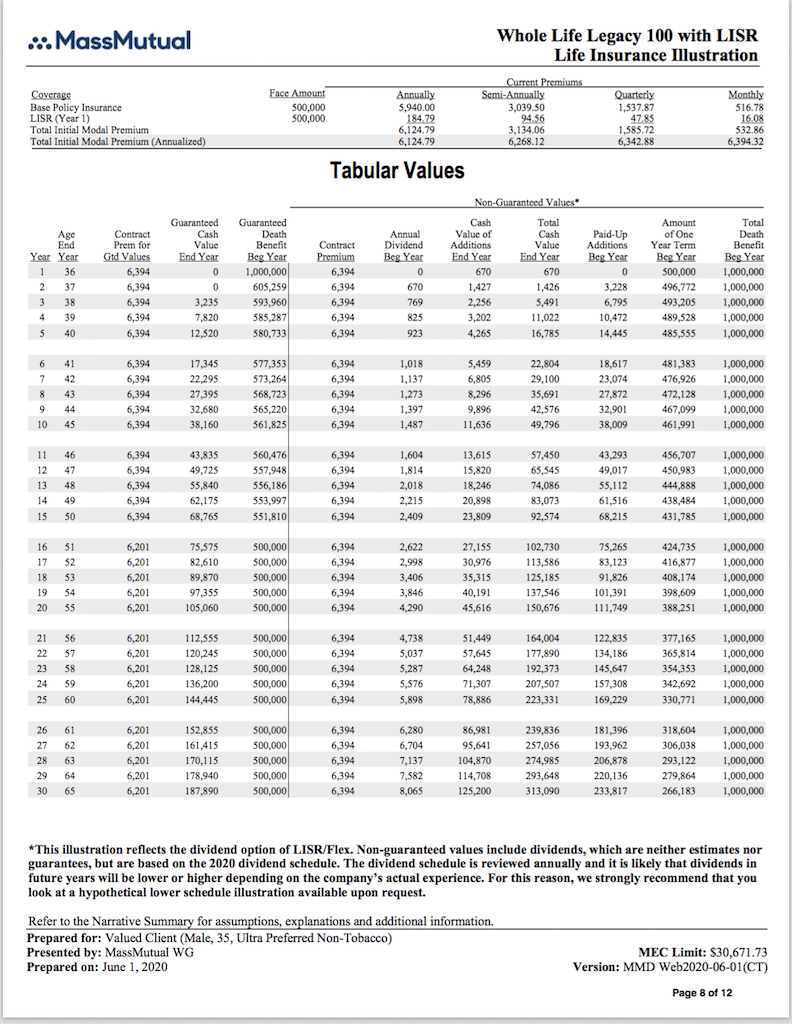

The cost of a 1 million whole life insurance policy varies depending on factors such as age, health, and lifestyle. On average, a healthy individual can expect to pay around $6,000 to $12,000 per year for a 1 million dollar policy. However, those who are older or have health issues may pay significantly more. It’s important to shop around and compare quotes from multiple insurance providers to find the best policy for your individual needs.

How Much is a 1 Million Whole Life Insurance Policy?

Whole life insurance policies are a popular choice for those who want long-term coverage that includes a death benefit and cash value accumulation. A 1 million dollar whole life insurance policy can provide financial security for your loved ones in the event of your unexpected death. However, the cost of such a policy can vary significantly depending on several factors.

Factors that Affect the Cost of a 1 Million Whole Life Insurance Policy

Several factors influence the cost of a 1 million whole life insurance policy. The following factors can impact the price you pay for a policy:

- Age: Younger individuals typically pay less for whole life insurance policies compared to older individuals.

- Health: Your overall health and medical history can impact the cost of your policy. Individuals with pre-existing medical conditions or a history of serious illnesses may pay more for a policy.

- Gender: Women generally pay less for whole life insurance policies compared to men because they have a longer life expectancy.

- Tobacco use: Smokers typically pay more for whole life insurance policies compared to non-smokers.

- Occupation: Some high-risk occupations may require individuals to pay more for a policy.

The above factors will play a significant role in determining the cost of your 1 million whole life insurance policy. It is important to understand how each of these factors can impact the cost of your policy before purchasing a policy.

How Much Does a 1 Million Whole Life Insurance Policy Cost?

The cost of a 1 million whole life insurance policy can vary significantly depending on the factors discussed above. Below are some estimated costs for a 1 million whole life insurance policy:

| Age | Monthly Premium |

|---|---|

| 25 | $750 |

| 35 | $1,200 |

| 45 | $2,250 |

| 55 | $4,250 |

It is important to note that the estimated costs above are just that- estimates. The actual cost of a 1 million whole life insurance policy may be higher or lower depending on the factors discussed above. It is best to speak with an insurance agent or broker to get a more accurate estimate based on your specific situation.

Benefits of a 1 Million Whole Life Insurance Policy

There are several benefits to having a 1 million whole life insurance policy. These benefits include:

- Death benefit: A 1 million dollar death benefit can provide financial security for your loved ones in the event of your unexpected death.

- Cash value accumulation: Whole life insurance policies accumulate cash value over time, which can be borrowed against or used to pay premiums.

- Tax advantages: The cash value accumulation and death benefit of a whole life insurance policy are tax-deferred, meaning you do not pay taxes on the growth until you withdraw it.

Whole Life Insurance vs Term Life Insurance

When considering life insurance, it is important to understand the difference between whole life insurance and term life insurance. Whole life insurance provides coverage for the entirety of an individual’s life and includes a cash value accumulation component. Term life insurance, on the other hand, provides coverage for a specific term, typically 10, 20, or 30 years.

The cost of a 1 million dollar term life insurance policy is typically lower than that of a 1 million whole life insurance policy. However, term life insurance policies do not have a cash value accumulation component and only provide coverage for a set term.

Ultimately, the decision between whole life insurance and term life insurance will depend on your unique situation and insurance needs. It is important to speak with an insurance agent or broker to determine which type of policy is right for you.

Conclusion

A 1 million whole life insurance policy can provide financial security for your loved ones in the event of your unexpected death. However, the cost of such a policy can vary significantly depending on several factors, including age, health, gender, tobacco use, and occupation. It is important to understand these factors and speak with an insurance agent or broker to determine the best policy for your unique situation.

Contents

- Frequently Asked Questions

- What is a 1 million whole life insurance policy?

- How much does a 1 million whole life insurance policy cost?

- What are the benefits of a 1 million whole life insurance policy?

- What are the drawbacks of a 1 million whole life insurance policy?

- How do I purchase a 1 million whole life insurance policy?

- Can I Keep Medicaid If My Job Offers Insurance?

- Does Smile Direct Club Take Medicaid Insurance?

- Does Life Insurance Payout Affect Medicaid?

Frequently Asked Questions

What is a 1 million whole life insurance policy?

A 1 million whole life insurance policy is a type of life insurance policy that provides coverage for the entire lifetime of the policyholder. The policy pays a death benefit of 1 million dollars to the designated beneficiary upon the death of the policyholder.

Unlike term life insurance policies, whole life insurance policies have a cash value component that accumulates over time. This means that the policyholder can borrow against the cash value or surrender the policy for its cash value if they no longer need the coverage.

How much does a 1 million whole life insurance policy cost?

The cost of a 1 million whole life insurance policy varies depending on several factors, including the age and health of the policyholder, the length of the coverage, and the insurance company’s underwriting guidelines.

Generally, whole life insurance policies are more expensive than term life insurance policies because they provide lifetime coverage and have a cash value component. The cost of a 1 million whole life insurance policy can range from a few thousand dollars per year to tens of thousands of dollars per year.

What are the benefits of a 1 million whole life insurance policy?

A 1 million whole life insurance policy provides several benefits, including lifetime coverage, a guaranteed death benefit of 1 million dollars, and a cash value component that accumulates over time.

The cash value component of a whole life insurance policy can be used to borrow against or surrender the policy for its cash value. Additionally, the death benefit is tax-free and can be used to pay for final expenses, provide income replacement for dependents, or leave a legacy for loved ones.

What are the drawbacks of a 1 million whole life insurance policy?

One of the main drawbacks of a 1 million whole life insurance policy is the cost. Whole life insurance policies are generally more expensive than term life insurance policies, which can make them difficult to afford for some people.

Additionally, the cash value component of a whole life insurance policy may not accumulate as quickly as other investment options, such as stocks or mutual funds. This means that the rate of return on the cash value may not be as high as other investment options.

How do I purchase a 1 million whole life insurance policy?

To purchase a 1 million whole life insurance policy, you will need to work with an insurance agent or broker. The agent or broker will help you determine the appropriate coverage amount and length, and will submit your application to the insurance company for underwriting.

During the underwriting process, the insurance company will review your application and medical history to determine your health status and risk. Based on the underwriting results, the insurance company will provide a premium quote for the policy.

In today’s world, we all need to ensure that our loved ones are financially secure in the event of our untimely demise. A 1 million whole life insurance policy can provide peace of mind to both you and your family. The cost of a policy will depend on various factors such as age, health, and lifestyle, but the benefits can be invaluable.

By investing in a 1 million whole life insurance policy, you can guarantee that your family will receive a lump sum payment in the event of your death. This payment can be used to cover expenses such as mortgage payments, education costs, or even funeral expenses. With a whole life policy, you also have the option to build up cash value over time, which can be borrowed against or used to pay premiums later in life. Ultimately, a 1 million whole life insurance policy is an investment in your family’s future, and one that can provide a sense of security for years to come.

Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering individuals to make well-informed decisions. Guided by his passion, he has assembled a team of seasoned insurance professionals committed to simplifying the intricate world of insurance for you.

- Latest Posts by Rakibul Hasan

-

Can I Keep Medicaid If My Job Offers Insurance?

- -

Does Smile Direct Club Take Medicaid Insurance?

- -

Does Life Insurance Payout Affect Medicaid?

- All Posts