Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering...Read more

Sleep apnea is a common sleep disorder that affects millions of people worldwide. It is a condition where the individual experiences brief and repeated interruptions in their breathing during sleep, which causes them to wake up frequently and feel tired during the day. While sleep apnea can have a significant impact on a person’s health, it can also impact their ability to secure life insurance. Many individuals with sleep apnea wonder if their condition will affect their life insurance rates.

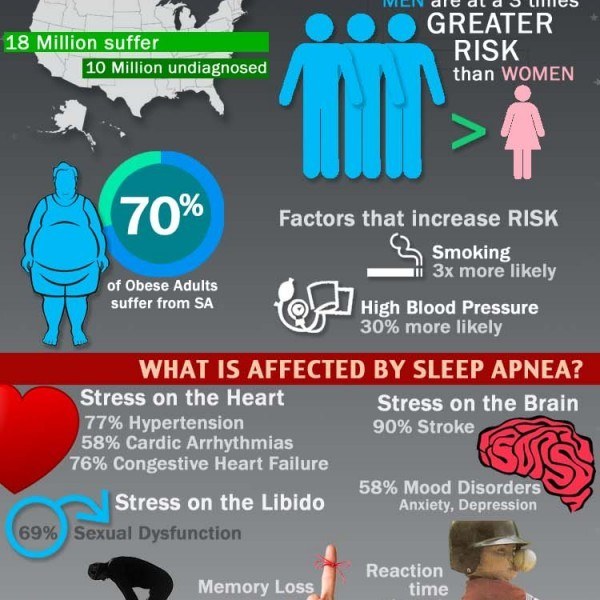

The answer is yes, sleep apnea can affect life insurance rates. Insurers view sleep apnea as a risk factor because it can lead to more serious health conditions such as high blood pressure, heart disease, and stroke. As a result, individuals with sleep apnea may experience higher life insurance premiums or even have their applications declined altogether. However, there are ways to manage sleep apnea and improve your chances of securing affordable life insurance rates.

Yes, sleep apnea can affect life insurance rates. Insurance companies consider sleep apnea a pre-existing medical condition that may increase the risk of an early death. The severity of the condition and the treatment being received are also taken into account. However, not all insurance companies have the same underwriting guidelines, so it’s important to shop around for the best rates.

Does Sleep Apnea Affect Life Insurance Rates?

Sleep apnea is a sleep disorder that affects millions of people worldwide. It is a condition that causes a person to stop breathing for short periods while sleeping. If left untreated, it can lead to serious health problems such as heart disease, high blood pressure, and stroke. Many individuals with sleep apnea wonder if this condition will affect their ability to obtain life insurance and if it will impact the rates they pay. In this article, we will explore the impact of sleep apnea on life insurance rates.

What is Sleep Apnea?

Sleep apnea is a sleep disorder that causes a person to stop breathing repeatedly during sleep. It is caused by the relaxation of muscles in the throat, which can block the airway. There are two types of sleep apnea: obstructive sleep apnea (OSA) and central sleep apnea (CSA). OSA is the most common type and occurs when the muscles in the throat relax, blocking the airway. CSA is less common and occurs when the brain fails to signal the muscles that control breathing.

If left untreated, sleep apnea can lead to serious health problems such as cardiovascular disease, high blood pressure, and stroke. It can also cause daytime fatigue, irritability, and difficulty concentrating, which can impact an individual’s quality of life.

How Does Sleep Apnea Affect Life Insurance Rates?

When applying for life insurance, the insurance company will ask a series of health-related questions to determine the risk of insuring the individual. If an individual has sleep apnea, they may be considered a higher risk due to the potential health complications associated with the condition.

Insurance companies will typically ask about the severity of the sleep apnea, if it is being treated, and if the individual has any other health conditions. If an individual has mild sleep apnea that is being treated and has no other health conditions, they may not see a significant impact on their life insurance rates. However, if the sleep apnea is severe and untreated or if the individual has other health conditions, they may see an increase in their rates.

Benefits of Treating Sleep Apnea

Treating sleep apnea can have several benefits, including improving overall health and reducing the risk of serious health complications. It can also improve an individual’s quality of life by reducing daytime fatigue and improving concentration and productivity.

For those applying for life insurance, treating sleep apnea may also help to reduce rates. If an individual can show that their sleep apnea is being treated and under control, they may be considered a lower risk by insurance companies.

Sleep Apnea vs Other Health Conditions

While sleep apnea can impact life insurance rates, it is important to note that other health conditions can also play a significant role. Conditions such as heart disease, cancer, and diabetes can all impact rates and may be considered a higher risk by insurance companies.

It is important to disclose all health conditions when applying for life insurance and to work with an insurance agent to find the best policy and rates based on individual circumstances.

Conclusion

Sleep apnea can impact life insurance rates, but it is not the only factor considered by insurance companies. If an individual has sleep apnea, it is important to disclose this information and work with an insurance agent to find the best policy and rates based on their individual circumstances.

Treating sleep apnea can have several benefits, including improving overall health and reducing the risk of serious health complications. If an individual can show that their sleep apnea is being treated and under control, they may be considered a lower risk by insurance companies, potentially resulting in lower rates.

Overall, it is important to prioritize good sleep hygiene and seek treatment for sleep apnea if necessary, not only for the potential impact on life insurance rates but also for overall health and well-being.

Contents

- Frequently Asked Questions

- What is Sleep Apnea?

- Does Sleep Apnea Affect Life Insurance Rates?

- What Information Will Insurance Companies Need About My Sleep Apnea?

- Can I Still Get Life Insurance If I Have Sleep Apnea?

- What Can I Do to Improve My Life Insurance Rates if I Have Sleep Apnea?

- Can I Keep Medicaid If My Job Offers Insurance?

- Does Smile Direct Club Take Medicaid Insurance?

- Does Life Insurance Payout Affect Medicaid?

Frequently Asked Questions

What is Sleep Apnea?

Sleep apnea is a disorder that causes a person to stop breathing while they sleep. It is usually caused by an obstruction in the airway, which can be the result of several factors, including excessive weight, smoking or alcohol use.

There are two types of sleep apnea: obstructive sleep apnea (OSA) and central sleep apnea (CSA). OSA is the more common form and occurs when the muscles in the throat relax, while CSA occurs when the brain fails to signal the muscles to breathe.

Does Sleep Apnea Affect Life Insurance Rates?

Yes, sleep apnea can affect life insurance rates. Insurance companies view sleep apnea as a risk factor because it increases the likelihood of other health problems, such as high blood pressure, heart disease, and stroke. In addition, untreated sleep apnea can lead to daytime sleepiness, which can increase the risk of accidents.

However, the severity of the sleep apnea and how well it is managed can also play a role in determining life insurance rates. If the sleep apnea is mild and well-controlled with treatment, such as a continuous positive airway pressure (CPAP) machine, the impact on life insurance rates may be minimal.

What Information Will Insurance Companies Need About My Sleep Apnea?

When applying for life insurance, the insurance company will typically ask for information about your sleep apnea diagnosis, including the severity of your condition and any treatment you are receiving. They may also ask for information about other health conditions that are associated with sleep apnea, such as high blood pressure or diabetes.

The insurance company may also require you to undergo a medical exam, which may include a sleep study, to determine the severity of your sleep apnea and how well it is being managed.

Can I Still Get Life Insurance If I Have Sleep Apnea?

Yes, you can still get life insurance if you have sleep apnea. However, you may be required to pay higher premiums than someone who does not have sleep apnea. The amount of the increase will depend on the severity of your sleep apnea and how well it is managed with treatment.

It is important to shop around and compare rates from different insurance companies to find the best policy for your needs. Some insurance companies may be more lenient than others when it comes to sleep apnea, so it is important to do your research.

What Can I Do to Improve My Life Insurance Rates if I Have Sleep Apnea?

If you have sleep apnea and are looking to improve your life insurance rates, there are several things you can do. First, make sure you are managing your sleep apnea with treatment, such as a CPAP machine, to reduce the risk of other health problems.

You should also make lifestyle changes, such as losing weight, quitting smoking, and reducing alcohol intake, to improve your overall health. Finally, shop around and compare rates from different insurance companies to find the best policy for your needs.

As a professional writer, I can attest that sleep apnea can have a significant impact on life insurance rates. This is because sleep apnea is a potentially serious medical condition that is associated with a range of health risks, such as high blood pressure, heart disease, and stroke. These risks can make it more expensive for life insurance companies to insure individuals with sleep apnea, as they may be more likely to make a claim on their policy.

However, it’s important to note that not all life insurance companies treat sleep apnea the same way. Some companies may be more willing to offer coverage at competitive rates, while others may charge significantly higher premiums or deny coverage altogether. This is why it’s important to work with an experienced agent who can help you find the right policy for your individual needs, taking into account your specific health history and risk factors. By doing so, you can ensure that you have the protection you need at a price you can afford, even if you have sleep apnea.

Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering individuals to make well-informed decisions. Guided by his passion, he has assembled a team of seasoned insurance professionals committed to simplifying the intricate world of insurance for you.

- Latest Posts by Rakibul Hasan

-

Can I Keep Medicaid If My Job Offers Insurance?

- -

Does Smile Direct Club Take Medicaid Insurance?

- -

Does Life Insurance Payout Affect Medicaid?

- All Posts