Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering...Read more

Health insurance is a crucial aspect of maintaining a healthy lifestyle. It covers medical expenses and provides financial security in case of emergencies. However, the question arises, can you get individual health insurance at any time? The answer is not as straightforward as one might think.

Individual health insurance policies are available throughout the year, but certain factors could affect the enrollment process. For instance, those who missed the open enrollment period may have to wait until the next enrollment period to apply for coverage. However, if you experience a qualifying event like getting married, having a baby, or losing your job, you may be eligible for a special enrollment period, allowing you to enroll in an individual health insurance plan outside the standard enrollment period. In this article, we will explore the different scenarios that impact when and how you can get individual health insurance, so you can make an informed decision about your healthcare coverage.

Yes, in most states, you can get individual health insurance at any time during the year. However, outside of the open enrollment period, you may need to experience a qualifying life event such as marriage, birth of a child, or loss of employer coverage to enroll in a plan. It’s always a good idea to check with your state’s insurance department or a licensed insurance agent to confirm the enrollment guidelines in your area.

Contents

- Can You Get Individual Health Insurance at Any Time?

- Frequently Asked Questions

- Can you get individual health insurance at any time?

- What is a qualifying life event?

- Is individual health insurance more expensive than employer-sponsored health insurance?

- What is a health insurance exchange?

- What is a high-deductible health plan?

- Can I Keep Medicaid If My Job Offers Insurance?

- Does Smile Direct Club Take Medicaid Insurance?

- Does Life Insurance Payout Affect Medicaid?

Can You Get Individual Health Insurance at Any Time?

Individual health insurance is a type of health insurance policy that provides coverage for individuals and their families. It can be purchased directly from a health insurance provider or through a health insurance marketplace. Many people wonder if they can get individual health insurance at any time. The answer is yes, but there are certain things to consider.

Open Enrollment Period

The open enrollment period is the time when you can enroll in or change your health insurance plan. This period typically lasts for a few weeks each year, usually in the fall. During this time, you can enroll in a new health insurance plan, renew your existing plan, or make changes to your coverage. If you miss the open enrollment period, you may not be able to enroll in a new plan until the next open enrollment period.

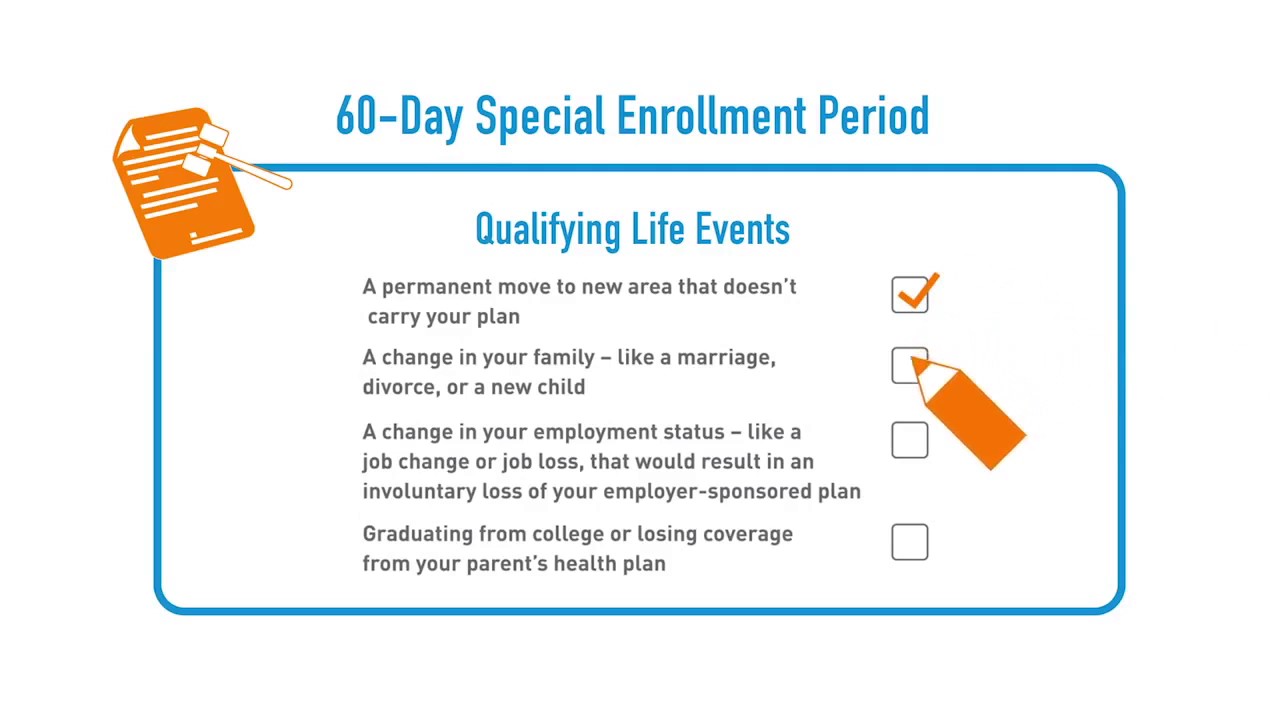

If you experience a qualifying life event, such as losing your job or getting married, you may be eligible for a special enrollment period. This allows you to enroll in a new health insurance plan outside of the open enrollment period.

Short-Term Health Insurance

Short-term health insurance is a type of health insurance policy that provides coverage for a limited period of time, usually from one to twelve months. This type of insurance can be useful if you need coverage for a short period of time, such as while you are between jobs or waiting for other coverage to begin.

Short-term health insurance plans may not provide the same level of coverage as long-term health insurance plans. They may also have exclusions for pre-existing conditions or other health issues.

Benefits of Individual Health Insurance

Individual health insurance has many benefits, including:

- Choice of doctors and hospitals

- Customizable coverage options

- Lower costs for healthy individuals

- Portability

Individual health insurance policies are customizable, which means you can choose the coverage options that best fit your needs and budget. You can also choose your own doctors and hospitals, which gives you more control over your healthcare.

Individual health insurance policies may also be less expensive than group health insurance policies, especially if you are young and healthy. This is because group health insurance policies typically charge the same premium to all employees, regardless of their health status.

Drawbacks of Individual Health Insurance

Individual health insurance also has some drawbacks, including:

- Higher costs for those with pre-existing conditions

- Limited coverage options

- No employer contribution

- Higher administrative costs

If you have a pre-existing condition, you may have difficulty finding affordable individual health insurance coverage. Some insurance companies may exclude coverage for pre-existing conditions or charge higher premiums.

Individual health insurance policies may also have limited coverage options, which means you may need to purchase additional coverage to get the coverage you need. Additionally, individual health insurance policies do not typically include an employer contribution, which means you will need to pay the entire premium yourself.

Group Health Insurance vs. Individual Health Insurance

Group health insurance is a type of health insurance policy that provides coverage to a group of individuals, usually employees of a company. Group health insurance policies typically have lower premiums and better coverage options than individual health insurance policies. They may also include an employer contribution.

Individual health insurance policies, on the other hand, provide coverage to individuals and their families. They are customizable and give you more control over your healthcare, but they may be more expensive than group health insurance policies.

Conclusion

In conclusion, you can get individual health insurance at any time, but there are certain things to consider. The open enrollment period is the best time to enroll in or change your health insurance plan, but you may be eligible for a special enrollment period if you experience a qualifying life event. Short-term health insurance can also provide coverage for a limited period of time.

Individual health insurance has many benefits, including choice of doctors and hospitals, customizable coverage options, and lower costs for healthy individuals. However, it also has some drawbacks, including higher costs for those with pre-existing conditions and limited coverage options.

Ultimately, the decision to choose group health insurance or individual health insurance depends on your individual needs and circumstances.

Frequently Asked Questions

Can you get individual health insurance at any time?

Yes, you can get individual health insurance at any time. You can enroll in a health insurance plan during the open enrollment period, which usually runs from November to December of each year. Outside of the open enrollment period, you may still be able to enroll if you experience a qualifying life event, such as losing your job or getting married.

If you miss the open enrollment period and do not experience a qualifying life event, you may have to wait until the next open enrollment period to enroll in a health insurance plan. However, some states have extended open enrollment periods or allow for year-round enrollment in individual health insurance plans.

What is a qualifying life event?

A qualifying life event is a major life change that allows you to enroll in a health insurance plan outside of the open enrollment period. Qualifying life events include losing your job, getting married or divorced, having a baby, moving to a new state, and aging off your parents’ health insurance plan. If you experience a qualifying life event, you have a limited amount of time to enroll in a health insurance plan.

It is important to note that not all life events qualify you for a special enrollment period. For example, quitting your job or voluntarily dropping your health insurance coverage does not qualify as a qualifying life event.

Is individual health insurance more expensive than employer-sponsored health insurance?

Individual health insurance can be more expensive than employer-sponsored health insurance because the cost is not being shared between the employer and employee. However, individual health insurance plans can be a good option if you are self-employed, work part-time, or do not have access to employer-sponsored health insurance.

There are many factors that can affect the cost of individual health insurance, such as your age, location, and health status. It is important to shop around and compare plans to find the best coverage at the most affordable price.

What is a health insurance exchange?

A health insurance exchange, also known as a health insurance marketplace, is a website where individuals and small businesses can shop for and compare health insurance plans. Health insurance exchanges were created as part of the Affordable Care Act (ACA) and offer a variety of health insurance plans, including individual and family plans and small business plans.

The health insurance exchange also provides information about financial assistance, such as tax credits and subsidies, that can help make health insurance more affordable for those who qualify.

What is a high-deductible health plan?

A high-deductible health plan (HDHP) is a type of health insurance plan that has a higher deductible than traditional health insurance plans. The deductible is the amount you pay out of pocket before your insurance coverage begins. HDHPs typically have lower monthly premiums than traditional health insurance plans, but you will pay more out of pocket when you receive medical care.

HDHPs are often paired with a health savings account (HSA), which is a tax-advantaged savings account that can be used to pay for qualified medical expenses. HSAs offer triple tax benefits: contributions are tax-deductible, earnings grow tax-free, and withdrawals for qualified medical expenses are tax-free.

As a professional writer, it is important to note that individual health insurance is a necessity for everyone. However, the question of whether or not you can get individual health insurance at any time has been a topic of concern for many individuals. The good news is that the answer is yes, you can get individual health insurance at any time.

It is important to note that there may be certain limitations and restrictions based on your state laws and regulations. However, in most cases, you can get individual health insurance outside of the open enrollment period if you experience a qualifying life event, such as losing your job, getting married, or having a baby. Additionally, there are options such as short-term health insurance plans that can provide you with coverage for a limited period of time while you wait for the next open enrollment period.

In conclusion, while there may be restrictions and limitations, it is possible to get individual health insurance at any time. It is important to educate yourself on your state laws and regulations, and to seek guidance from a professional insurance agent or broker to help you navigate the process. Remember, having health insurance can provide you with peace of mind and protect you from unforeseen medical expenses.

Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering individuals to make well-informed decisions. Guided by his passion, he has assembled a team of seasoned insurance professionals committed to simplifying the intricate world of insurance for you.

- Latest Posts by Rakibul Hasan

-

Can I Keep Medicaid If My Job Offers Insurance?

- -

Does Smile Direct Club Take Medicaid Insurance?

- -

Does Life Insurance Payout Affect Medicaid?

- All Posts