Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering...Read more

Medicaid is a government-funded healthcare program that provides medical assistance to individuals and families with low-income or limited resources. This program is designed to help those who cannot afford healthcare services on their own. However, for individuals who own their own business, the eligibility criteria for Medicaid can be a little more complex. Many business owners wonder whether they are eligible for Medicaid and how their business ownership might affect their eligibility.

If you are a business owner and are struggling to afford healthcare services, you may be wondering if you can qualify for Medicaid. The answer is not always straightforward. While owning a business does not automatically disqualify you from Medicaid, there are certain eligibility requirements that you must meet. In this article, we will explore the eligibility criteria for Medicaid for business owners and help you understand whether you can get Medicaid if you own a business.

Contents

- Can You Get Medicaid if You Own a Business?

- Frequently Asked Questions

- Can You Get Medicaid if You Own a Business?

- What Counts as Income for Medicaid Eligibility?

- Can You Get Medicaid if You Have Business Assets?

- Can You Get Medicaid if You Are Self-Employed?

- What Other Options Are Available for Business Owners Who Cannot Get Medicaid?

- How to qualify for Medicaid even if you’re rich.

- Can I Keep Medicaid If My Job Offers Insurance?

- Does Smile Direct Club Take Medicaid Insurance?

- Does Life Insurance Payout Affect Medicaid?

Can You Get Medicaid if You Own a Business?

Medicaid is a program that provides healthcare coverage for people who have limited income and resources. If you own a business, you may wonder if you are eligible for Medicaid. The answer is that it depends on several factors, including your income, the type of business you own, and the state you live in. In this article, we will explore the eligibility requirements for Medicaid and how owning a business can affect your eligibility.

Income Limits for Medicaid

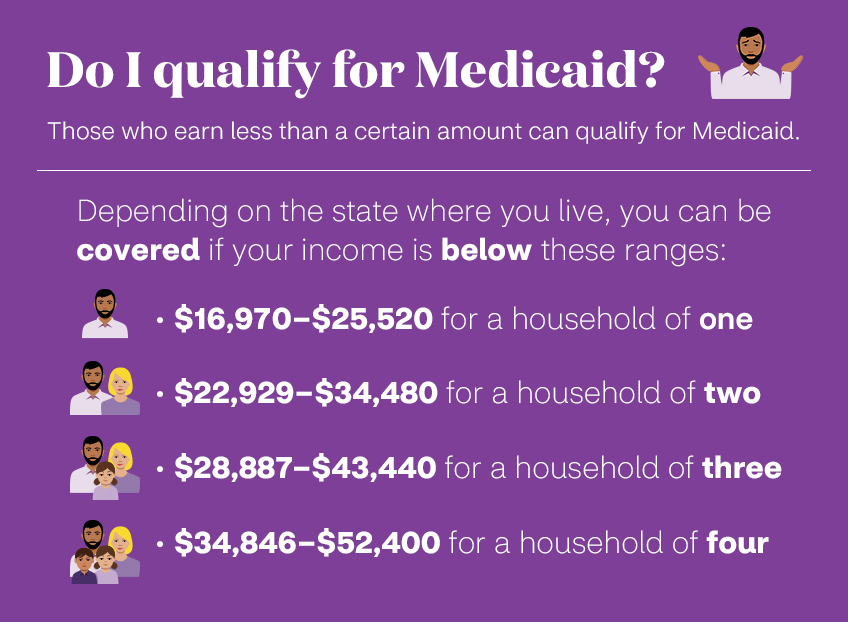

One of the primary factors that determine your eligibility for Medicaid is your income. Medicaid is designed to help people who have limited income and resources, so the income limits are relatively low. The income limit varies by state, but in general, you must have an income below 138% of the federal poverty level (FPL) to qualify for Medicaid. For a family of four, this means an annual income of around $36,000.

If you own a business, your income may be higher than the Medicaid income limit. However, you may still be eligible for Medicaid if your income is below the limit after deducting certain business expenses. These expenses may include the cost of goods sold, business expenses, and depreciation. You should consult with a Medicaid eligibility specialist or an accountant to determine if you qualify based on your income.

Type of Business Ownership

Another factor that can affect your eligibility for Medicaid is the type of business you own. If you are a sole proprietor or a partner in a business, your income from the business is considered personal income for Medicaid purposes. This means that your income from the business will be counted towards the income limit for Medicaid.

If you own a corporation, your income from the business is not considered personal income for Medicaid purposes. Instead, the income is considered a dividend or a distribution. This means that your income from the business may not be counted towards the income limit for Medicaid.

Asset Limits for Medicaid

In addition to income limits, Medicaid also has asset limits. This means that you must have limited resources to qualify for Medicaid. The asset limit varies by state, but in general, you must have less than $2,000 in countable assets to qualify for Medicaid. Countable assets may include cash, bank accounts, stocks, and bonds.

If you own a business, the value of the business may be counted towards the asset limit for Medicaid. However, there are certain exemptions for business assets. For example, the value of tools and equipment that are necessary for your business may be exempt from the asset limit. You should consult with a Medicaid eligibility specialist to determine how your business assets will affect your eligibility for Medicaid.

Benefits of Medicaid for Business Owners

If you are eligible for Medicaid as a business owner, there are several benefits that you may receive. These benefits may include:

– Healthcare coverage for you and your family

– Lower healthcare costs, including copays and deductibles

– Access to preventive care and screenings

– Coverage for pre-existing conditions

– Long-term care coverage for nursing homes and other facilities

These benefits can be particularly valuable for business owners who may not have access to employer-sponsored health insurance or who may have limited financial resources.

Drawbacks of Medicaid for Business Owners

While there are many benefits to Medicaid, there may also be some drawbacks for business owners. These drawbacks may include:

– Limited choice of healthcare providers

– Limited coverage for certain treatments or procedures

– Stigma or negative perceptions associated with Medicaid

– Potential impact on your credit score or finances

It is important to weigh the benefits and drawbacks of Medicaid carefully before deciding whether to apply for the program.

Medicaid vs. Private Health Insurance

As a business owner, you may also be considering private health insurance as an alternative to Medicaid. There are several differences between Medicaid and private health insurance, including:

– Medicaid has lower income and asset limits than most private health insurance plans

– Medicaid may have more limited provider networks than private health insurance

– Medicaid may have lower costs for premiums, copays, and deductibles than private health insurance

– Private health insurance may offer more comprehensive benefits than Medicaid

Ultimately, the decision between Medicaid and private health insurance will depend on your individual circumstances and needs.

Conclusion

In conclusion, owning a business does not necessarily disqualify you from receiving Medicaid. However, your eligibility will depend on several factors, including your income, the type of business you own, and the state you live in. If you are considering applying for Medicaid as a business owner, it is important to consult with a Medicaid eligibility specialist or an accountant to determine if you qualify based on your income and assets. Weighing the benefits and drawbacks of Medicaid carefully can help you make an informed decision about your healthcare coverage.

Frequently Asked Questions

Medicaid is a government-funded healthcare program that provides medical coverage to people with low income. If you own a business, you may wonder if you are eligible for Medicaid. Here are some common questions and answers to help you understand how Medicaid works for business owners.

Can You Get Medicaid if You Own a Business?

Yes, you can get Medicaid if you own a business, but your eligibility depends on your income and the size of your household. Medicaid is designed for people with low income, so if your income is too high, you may not qualify for the program. However, if your income is within the eligibility limits, you can enroll in Medicaid and receive medical coverage for yourself and your family.

As a business owner, you may have to provide proof of your income and assets to determine your eligibility for Medicaid. The eligibility requirements vary by state, so it is important to check with your state’s Medicaid office to find out if you qualify.

What Counts as Income for Medicaid Eligibility?

For Medicaid eligibility, income includes any money you receive, such as wages, tips, self-employment income, rental income, and investment income. However, not all income is counted towards Medicaid eligibility. Some types of income may be excluded, such as child support payments, veterans’ benefits, and tax refunds.

If you are a business owner, your business income may also be counted towards Medicaid eligibility. This includes any profits you earn from your business, as well as any salary or wages you pay yourself. However, some business expenses may be deductible, which can reduce your income for Medicaid purposes.

Can You Get Medicaid if You Have Business Assets?

Business assets, such as equipment, inventory, and property, are not counted towards Medicaid eligibility. However, if you have personal assets, such as a home or a car, they may be counted towards Medicaid eligibility. The asset limits for Medicaid vary by state, so it is important to check with your state’s Medicaid office to find out if your assets make you eligible for the program.

As a business owner, you may also have to provide information about your business assets, such as the value of your business and any investments or savings you have. This information may be used to determine your eligibility for Medicaid.

Can You Get Medicaid if You Are Self-Employed?

Yes, you can get Medicaid if you are self-employed, but your eligibility depends on your income and the size of your household. If you have low income, you may be eligible for Medicaid, even if you are self-employed. However, if your income is too high, you may not qualify for the program.

As a self-employed person, you may have to provide proof of your income and expenses to determine your eligibility for Medicaid. You may also have to provide information about your business, such as the type of work you do and how much time you spend on your business each week.

What Other Options Are Available for Business Owners Who Cannot Get Medicaid?

If you cannot get Medicaid as a business owner, there may be other options available to you. You may be able to purchase health insurance through the Health Insurance Marketplace or through a private insurance company. You may also be eligible for tax credits or subsidies to help you pay for your health insurance premiums.

Additionally, some states offer health insurance programs for small businesses or self-employed individuals. These programs may provide affordable health insurance options that are not available through the traditional insurance market.

How to qualify for Medicaid even if you’re rich.

Navigating the world of healthcare can be confusing, especially when it comes to understanding Medicaid eligibility. For business owners, the question of whether or not they can qualify for Medicaid can be particularly complex. However, the good news is that it is possible to receive Medicaid benefits even if you own a business.

While owning a business may impact your Medicaid eligibility, there are options to explore. For example, if you have a low income or meet other eligibility requirements, you may still be able to receive benefits. Additionally, depending on the structure of your business, it may be possible to separate your personal income from your business income, which could impact your eligibility. Overall, it’s important to consult with a professional who can help guide you through the process of determining your eligibility and navigating the application process. With the right support, you can access the care you need and continue to grow your business with confidence.

Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering individuals to make well-informed decisions. Guided by his passion, he has assembled a team of seasoned insurance professionals committed to simplifying the intricate world of insurance for you.

- Latest Posts by Rakibul Hasan

-

Can I Keep Medicaid If My Job Offers Insurance?

- -

Does Smile Direct Club Take Medicaid Insurance?

- -

Does Life Insurance Payout Affect Medicaid?

- All Posts