Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering...Read more

Term life insurance is one of the most popular types of insurance policies in the market. This is due to the fact that it provides a high level of coverage at an affordable premium cost. However, as life changes, so do our insurance needs. This begs the question, can you increase term life insurance coverage? The answer is yes, but it’s not as simple as just increasing your premium payments. In this article, we will dive deep into the factors that determine your term life insurance coverage and the steps you can take to increase it.

To begin with, it’s important to understand how term life insurance works. Term life insurance provides coverage for a specified period of time, usually between 10 to 30 years. During this period, the policyholder pays regular premiums to the insurance company, and in the event of their death, their beneficiaries receive a lump sum payout. The coverage amount is determined at the time of policy purchase and is based on factors such as age, health, and lifestyle habits. However, as life changes, some of these factors may improve or deteriorate, affecting your insurance needs. Stay with us as we explore how you can increase your coverage to match your changing needs.

Yes, you can usually increase your term life insurance coverage by purchasing additional coverage or converting to a permanent life insurance policy. However, increasing coverage may require undergoing another medical exam and could result in higher premiums. It’s best to speak with your insurance provider to determine your options and any potential costs involved.

Can You Increase Term Life Insurance Coverage?

Term life insurance is one of the most popular insurance policies that people buy to provide financial protection to their loved ones in the event of their untimely death. A term life insurance policy is designed to pay out a lump sum to your beneficiaries if you pass away during the term of the policy. But what if you find that the coverage amount of your term life insurance policy is not enough to meet the needs of your family in the future? Can you increase the coverage amount of your term life insurance policy? Let’s find out.

Understanding Term Life Insurance Coverage

Term life insurance is a type of life insurance policy that provides coverage for a specific period, usually ranging from 10 to 30 years. The premium of a term life insurance policy depends on various factors, such as your age, health condition, lifestyle, and the coverage amount. The coverage amount of a term life insurance policy is the amount of money that the beneficiary will receive if the policyholder passes away during the policy term.

How to Increase Your Term Life Insurance Coverage?

If you find that the coverage amount of your term life insurance policy is not enough to meet the financial needs of your family in the future, you can increase the coverage amount by following these steps:

- Review your current policy: Before you decide to increase your coverage amount, review your current policy to understand its terms and conditions.

- Contact your insurance company: Contact your insurance company and ask them about the options available to increase your coverage amount.

- Provide additional information: You may need to provide additional information about your health and lifestyle to the insurance company to qualify for an increase in coverage amount.

- Pay the premium: Increasing the coverage amount of your term life insurance policy will increase your premium amount. You will need to pay the additional premium to avail of the increased coverage amount.

Benefits of Increasing Your Term Life Insurance Coverage

Increasing the coverage amount of your term life insurance policy comes with several benefits, such as:

- Financial security: An increased coverage amount ensures that your family will have enough financial security to meet their needs in the future.

- Peace of mind: Knowing that your family is financially protected in your absence can give you peace of mind.

- Flexibility: You can increase your coverage amount as per your changing financial needs.

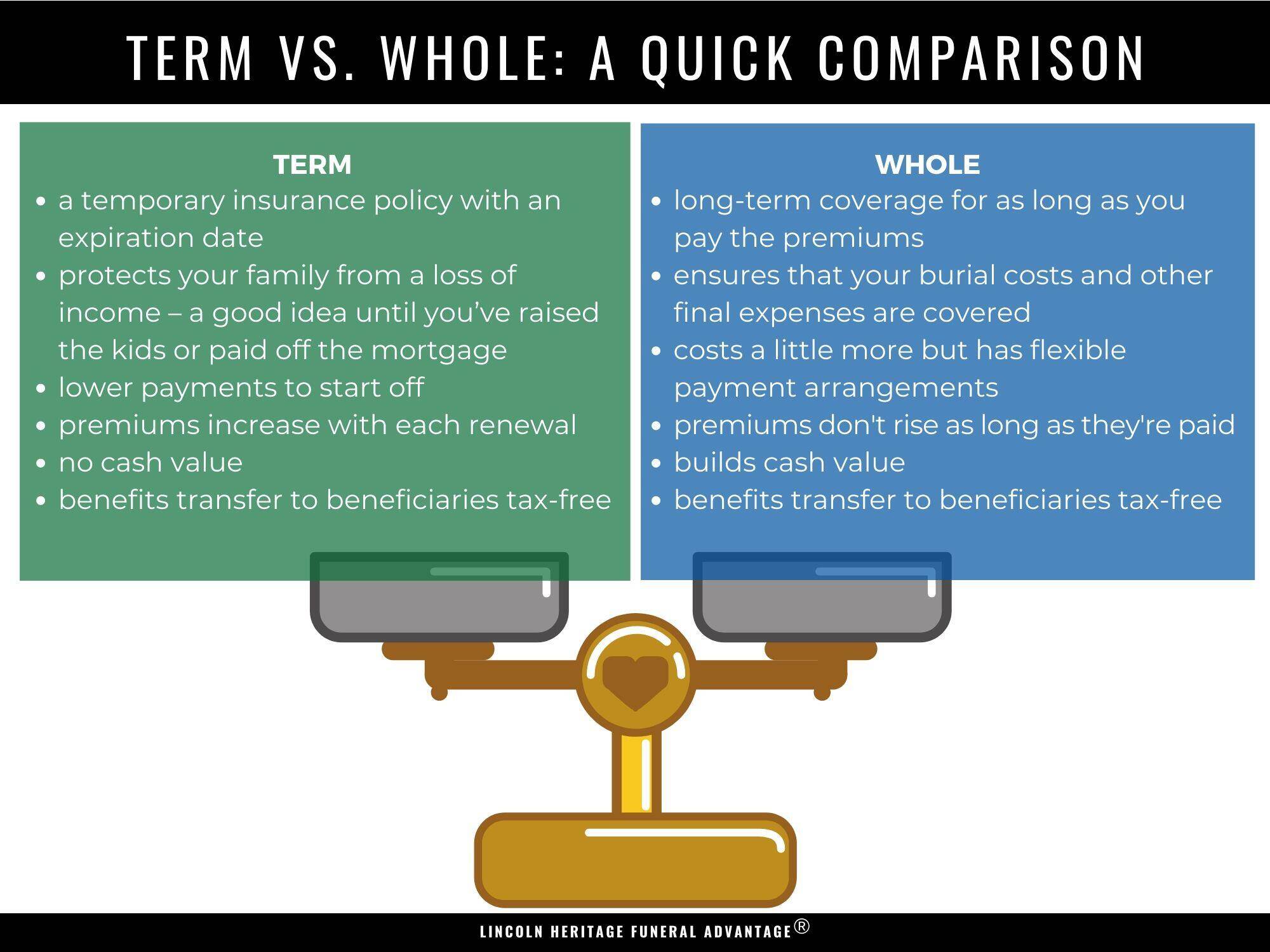

Term Life Insurance Coverage vs. Whole Life Insurance Coverage

When it comes to life insurance, there are two main types of policies: term life insurance and whole life insurance. Let’s compare the coverage of these two policies.

- Coverage amount: Term life insurance provides coverage for a specific period, whereas whole life insurance provides coverage for the lifetime of the policyholder.

- Premium: The premium of a term life insurance policy is generally lower than that of a whole life insurance policy.

- Cash value: Whole life insurance policies have a cash value component, which accumulates over time and can be used as a source of savings or an investment.

Conclusion

Increasing the coverage amount of your term life insurance policy is possible, but you need to follow the right steps to do so. Review your current policy, contact your insurance company, provide additional information, and pay the premium to increase your coverage amount. Increasing the coverage amount of your term life insurance policy comes with several benefits, such as financial security, peace of mind, and flexibility.

Contents

- Frequently Asked Questions

- Can You Increase Term Life Insurance Coverage?

- When Can You Increase Your Term Life Insurance Coverage?

- How Much Can You Increase Your Term Life Insurance Coverage?

- What Are the Benefits of Increasing Your Term Life Insurance Coverage?

- What Are the Drawbacks of Increasing Your Term Life Insurance Coverage?

- Can I Keep Medicaid If My Job Offers Insurance?

- Does Smile Direct Club Take Medicaid Insurance?

- Does Life Insurance Payout Affect Medicaid?

Frequently Asked Questions

Can You Increase Term Life Insurance Coverage?

Yes, you can increase your term life insurance coverage. However, the process can vary depending on your insurance provider and your specific policy. Typically, you will need to go through the underwriting process again, which means providing updated information about your health and lifestyle. Your insurance provider will use this information to determine whether they can approve your request for increased coverage and at what premium cost.

It’s important to note that increasing your coverage will likely result in higher premiums. However, if you have experienced a significant life change, such as the birth of a child or a new mortgage, it may be worth considering an increase to ensure your loved ones are adequately protected in the event of your unexpected death.

When Can You Increase Your Term Life Insurance Coverage?

You can typically increase your term life insurance coverage at any time during the life of your policy. However, keep in mind that the process will require additional underwriting and could result in higher premiums. If you have experienced a significant life change, such as the birth of a child or the purchase of a new home, it may be a good time to consider increasing your coverage to ensure your loved ones are properly protected.

Additionally, some insurance providers may have specific guidelines for when you can increase your coverage. For example, some may require you to wait a certain amount of time after purchasing your policy before you can request an increase. Be sure to check with your insurance provider to determine their specific policies and requirements for increasing your coverage.

How Much Can You Increase Your Term Life Insurance Coverage?

The amount you can increase your term life insurance coverage will depend on a variety of factors, including your current policy, your health and lifestyle, and your insurance provider’s guidelines. Some insurance providers may have limits on how much coverage you can increase at one time, while others may be more flexible.

When considering an increase in coverage, it’s important to assess your current financial situation and your future needs. Take into account any new debts, expenses, or dependents that may have arisen since you first purchased your policy. Once you have an understanding of your needs, work with your insurance provider to determine the appropriate amount of coverage to meet those needs.

What Are the Benefits of Increasing Your Term Life Insurance Coverage?

The primary benefit of increasing your term life insurance coverage is added protection for your loved ones in the event of your unexpected death. By increasing your coverage, you can ensure that your family has the financial resources they need to pay for expenses like funeral costs, outstanding debts, and future living expenses.

Additionally, increasing your coverage can provide peace of mind and help you feel more secure in your financial planning. Knowing that your loved ones are properly protected can alleviate stress and allow you to focus on other important aspects of your life.

What Are the Drawbacks of Increasing Your Term Life Insurance Coverage?

One of the main drawbacks of increasing your term life insurance coverage is the potential for higher premiums. When you increase your coverage, you are essentially taking on more risk, which can result in higher costs. However, if you have experienced a significant life change or have a greater need for coverage, the benefits of increasing your coverage may outweigh the added costs.

Additionally, increasing your coverage may require additional underwriting and medical exams, which can be time-consuming and inconvenient. If you are considering increasing your coverage, be sure to weigh the potential drawbacks against the benefits to determine if it’s the right decision for you and your family.

In today’s uncertain world, it’s important to have a solid financial plan in place. This includes adequate life insurance coverage to protect your loved ones in the event of your untimely passing. For many, term life insurance is an affordable option that provides a specified level of coverage for a designated period of time. But what if your circumstances change and you need more coverage? Can you increase your term life insurance policy?

The good news is that in many cases, you can increase your term life insurance coverage. This may involve applying for a new policy or adding a rider to your existing policy. It’s important to work with a knowledgeable insurance professional to assess your needs and determine the best course of action. With the right guidance, you can ensure that your loved ones are protected and your financial future is secure.

Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering individuals to make well-informed decisions. Guided by his passion, he has assembled a team of seasoned insurance professionals committed to simplifying the intricate world of insurance for you.

- Latest Posts by Rakibul Hasan

-

Can I Keep Medicaid If My Job Offers Insurance?

- -

Does Smile Direct Club Take Medicaid Insurance?

- -

Does Life Insurance Payout Affect Medicaid?

- All Posts