Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering...Read more

Whole life insurance policies are a popular option for many individuals looking to secure their financial future. These policies offer a range of benefits, such as lifelong coverage and the ability to accumulate cash value over time. However, as life circumstances change, you may find yourself in a position where you need to transfer your whole life insurance policy to another individual or entity.

But is it possible to transfer a whole life insurance policy, and if so, what are the steps involved? In this article, we will explore the ins and outs of transferring a whole life insurance policy. Whether you are looking to transfer the policy to a family member or a business partner, understanding the process is crucial to ensuring that your financial future remains secure. So, let’s dive in and explore the world of whole life insurance policy transfers!

Yes, you can transfer your whole life insurance policy to another person or entity, but it’s a complex process that requires the involvement of your insurance company. You can transfer ownership of your policy to another person or entity, but they will become responsible for paying the premiums and will be the beneficiary if you pass away. The process typically involves completing paperwork and obtaining consent from all parties involved, including the insurer. Contact your insurance company for more information on how to transfer your policy.

Contents

- Can You Transfer Whole Life Insurance Policy?

- What is Whole Life Insurance Policy?

- Why Would You Want to Transfer Your Whole Life Insurance Policy?

- How Do You Transfer Your Whole Life Insurance Policy?

- Benefits of Transferring Your Whole Life Insurance Policy

- Drawbacks of Transferring Your Whole Life Insurance Policy

- Whole Life Insurance Vs. Term Life Insurance

- Conclusion

- Frequently Asked Questions

- 1. Can you transfer a whole life insurance policy?

- 2. Can you transfer a whole life insurance policy to a trust?

- 3. Can you transfer a whole life insurance policy to a company?

- 4. Can you transfer a whole life insurance policy to a new insurer?

- 5. Can you sell a whole life insurance policy?

- Can I Keep Medicaid If My Job Offers Insurance?

- Does Smile Direct Club Take Medicaid Insurance?

- Does Life Insurance Payout Affect Medicaid?

Can You Transfer Whole Life Insurance Policy?

If you are considering transferring your whole life insurance policy, you may be wondering if it is even possible. The answer is yes, you can transfer whole life insurance policy, but it is not a simple process. Before you decide to transfer your policy, it is important to understand the process, the benefits, and the potential drawbacks.

What is Whole Life Insurance Policy?

Whole life insurance is a type of permanent life insurance that provides coverage for your entire life. It has a savings component that grows over time and can be used to pay for the policy premiums or taken out as a loan. The premiums for whole life insurance are typically higher than term life insurance, but the policy provides lifelong coverage and a guaranteed death benefit.

Why Would You Want to Transfer Your Whole Life Insurance Policy?

There are several reasons why you may want to transfer your whole life insurance policy. Some of the most common reasons include:

- You want to change the beneficiary on your policy.

- You want to change the ownership of your policy.

- You want to change the insured on your policy.

- You want to sell your policy for cash.

How Do You Transfer Your Whole Life Insurance Policy?

The process for transferring your whole life insurance policy will depend on the reason for the transfer. If you want to change the beneficiary, ownership, or insured on your policy, you will need to contact your insurance company and request a change of beneficiary form, change of ownership form, or change of insured form.

If you want to sell your policy for cash, you will need to work with a life settlement provider. The life settlement provider will evaluate your policy and offer you a cash payment in exchange for the rights to the death benefit.

Benefits of Transferring Your Whole Life Insurance Policy

There are several benefits to transferring your whole life insurance policy, including:

- You can change the beneficiary on your policy to ensure that your loved ones are taken care of.

- You can change the ownership of your policy to protect your assets from creditors.

- You can sell your policy for cash if you need money for retirement or other expenses.

Drawbacks of Transferring Your Whole Life Insurance Policy

There are also some potential drawbacks to transferring your whole life insurance policy, including:

- You may lose the tax benefits of your policy if you sell it for cash.

- You may need to pay surrender charges or fees if you surrender your policy.

- You may lose the death benefit of your policy if you transfer ownership to someone else.

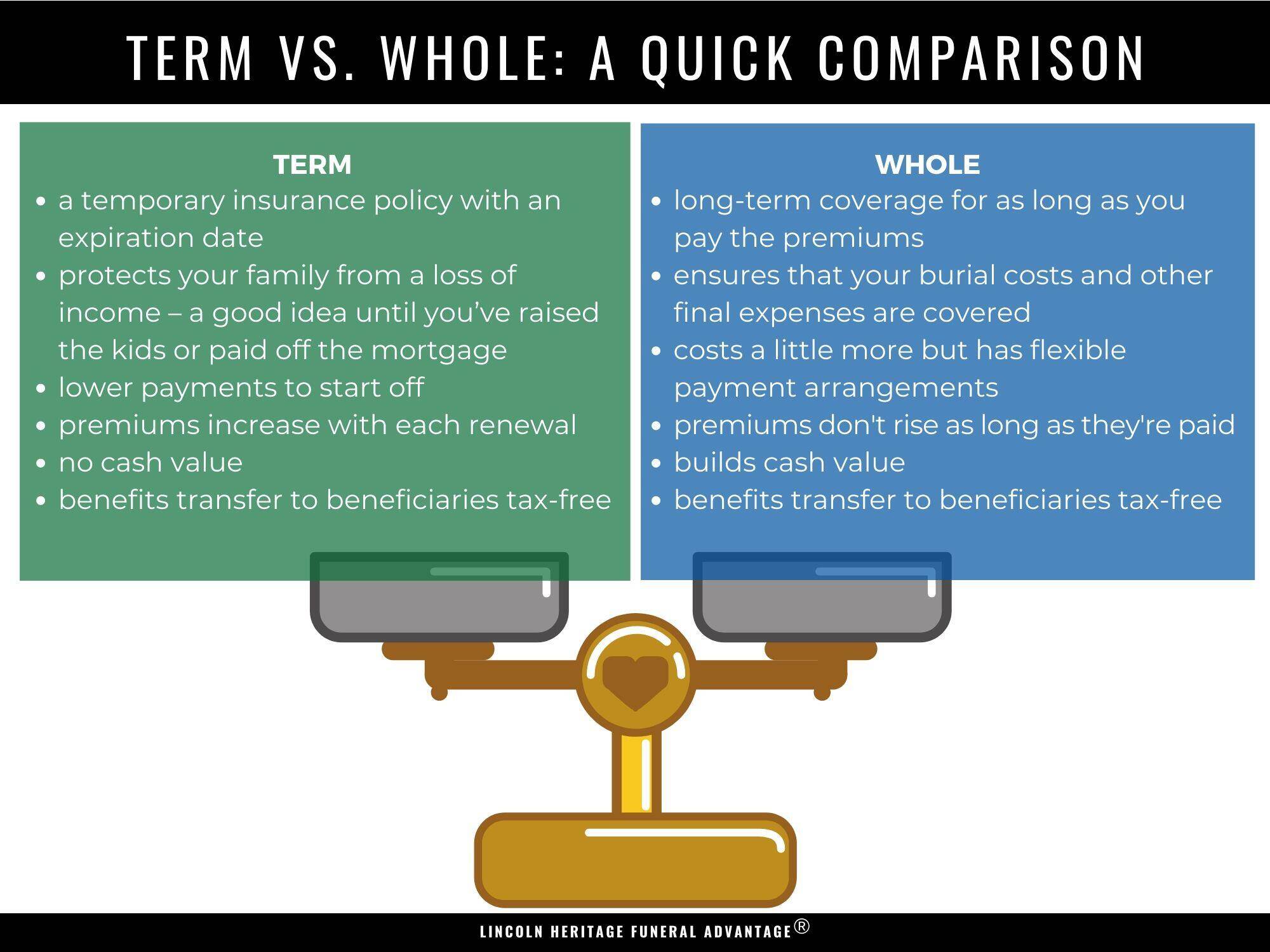

Whole Life Insurance Vs. Term Life Insurance

Whole life insurance and term life insurance are two of the most popular types of life insurance. Here are some of the key differences between the two:

| Whole Life Insurance | Term Life Insurance |

|---|---|

| Provides lifelong coverage | Provides coverage for a specific term, such as 10, 20 or 30 years |

| Has a savings component that grows over time | Does not have a savings component |

| Premiums are typically higher | Premiums are typically lower |

| Guaranteed death benefit | Death benefit is only paid if the insured dies during the term of the policy |

Conclusion

Transferring your whole life insurance policy can be a complicated process, but it can also provide several benefits. Before you decide to transfer your policy, it is important to understand the process, the benefits, and the potential drawbacks. Consider speaking with a financial advisor or insurance professional to help you make the best decision for your needs.

Frequently Asked Questions

Whole life insurance is a type of insurance policy that provides lifelong protection with an investment component. Many policyholders may decide to transfer their policies for various reasons. Here are some answers to common questions about transferring whole life insurance policies.

1. Can you transfer a whole life insurance policy?

Yes, you can transfer a whole life insurance policy to another person or entity. The transfer of ownership requires the consent of the policyholder and the recipient. The policyholder must complete the necessary paperwork, which includes a transfer of ownership form and a new beneficiary designation form. The new owner assumes all rights and responsibilities of the policy, including paying premiums and receiving benefits.

It is essential to consult with a financial advisor or attorney before transferring a whole life insurance policy to ensure that the transfer aligns with your financial goals and estate planning.

2. Can you transfer a whole life insurance policy to a trust?

Yes, you can transfer a whole life insurance policy to a trust. Transferring a policy to a trust can be a part of estate planning, as it may provide tax benefits and help manage the distribution of assets. The policyholder must complete the necessary paperwork, which includes a transfer of ownership form and a trust agreement.

It is crucial to consult with a financial advisor or attorney before transferring a whole life insurance policy to a trust to ensure that the transfer aligns with your financial goals and estate planning.

3. Can you transfer a whole life insurance policy to a company?

Yes, you can transfer a whole life insurance policy to a company. Transferring a policy to a company may occur when a business uses life insurance to fund a buy-sell agreement, key person insurance, or executive compensation. The policyholder must complete the necessary paperwork, which includes a transfer of ownership form and a new beneficiary designation form.

It is critical to consult with a financial advisor or attorney before transferring a whole life insurance policy to a company to ensure that the transfer aligns with business succession planning.

4. Can you transfer a whole life insurance policy to a new insurer?

Yes, you can transfer a whole life insurance policy to a new insurer. Transferring a policy to a new insurer may occur when a policyholder wants to change the policy’s terms or reduce premiums. The new insurer will evaluate the policyholder’s health and may require a new medical exam. The policyholder must complete the necessary paperwork, which includes a transfer of ownership form and a new beneficiary designation form.

It is essential to compare the new policy’s terms and premiums with the existing policy before transferring a whole life insurance policy to a new insurer.

5. Can you sell a whole life insurance policy?

Yes, you can sell a whole life insurance policy. Selling a policy is known as a life settlement. A life settlement involves selling the policy to a third-party investor for a lump sum payment. The investor becomes the policy’s owner and beneficiary and assumes all premium payments. The seller receives a cash payment that is typically more than the policy’s surrender value but less than the death benefit.

It is critical to consult with a financial advisor or attorney before selling a whole life insurance policy to ensure that it aligns with your financial goals and estate planning.

As a professional writer, I can confidently say that transferring a whole life insurance policy is possible. However, it’s essential to understand the terms and conditions of the policy before making any transfer decisions. Whole life insurance policies are designed to provide lifelong coverage, and they come with a cash value component that can be used to pay premiums or borrowed against.

If you’re considering transferring your whole life insurance policy, it’s crucial to consult with your insurance provider and a financial advisor to explore your options. A transfer may result in tax implications or loss of certain benefits, so it’s essential to make an informed decision. Ultimately, transferring a whole life insurance policy can be a beneficial move for those seeking more flexibility or better coverage options, but it’s important to do your research and weigh the pros and cons carefully.

Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering individuals to make well-informed decisions. Guided by his passion, he has assembled a team of seasoned insurance professionals committed to simplifying the intricate world of insurance for you.

- Latest Posts by Rakibul Hasan

-

Can I Keep Medicaid If My Job Offers Insurance?

- -

Does Smile Direct Club Take Medicaid Insurance?

- -

Does Life Insurance Payout Affect Medicaid?

- All Posts