Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering...Read more

Banks are often associated with providing loans and managing financial transactions, but there is a lesser-known aspect of their operations that has been gaining attention in recent years. That is, the investment of banks in life insurance policies. While it may seem surprising for banks to delve into the insurance industry, this practice has become increasingly common, and it has significant implications for both banking and insurance sectors.

The question of whether banks invest in life insurance is not a simple one to answer. There are various ways in which banks can participate in the life insurance market, ranging from offering life insurance policies to their customers to investing directly in life insurance companies. The motivations behind this investment strategy can be diverse, ranging from diversifying their portfolios to generating higher returns on investment. In this article, we will explore the relationship between banks and life insurance and delve into the potential benefits and risks associated with this practice.

Yes, banks invest in life insurance policies. They offer various life insurance products and services, such as term insurance, whole life insurance, and universal life insurance. Banks also act as intermediaries between the policyholder and the insurance company, facilitating the purchase and management of the policy. However, it is important to note that banks do not directly invest in life insurance policies, instead they earn a commission for selling them.

Contents

- Do Banks Invest in Life Insurance?

- Frequently Asked Questions

- Do banks invest in life insurance?

- Why do banks offer life insurance policies?

- What are the benefits of purchasing life insurance through a bank?

- Are there any downsides to purchasing life insurance through a bank?

- Should I purchase life insurance through a bank?

- Why Banks Invest Your Deposits In Life Insurance – #BankingShorts

- Can I Keep Medicaid If My Job Offers Insurance?

- Does Smile Direct Club Take Medicaid Insurance?

- Does Life Insurance Payout Affect Medicaid?

Do Banks Invest in Life Insurance?

Life insurance is an important tool for providing financial security and peace of mind to individuals and families. It is often purchased by individuals to protect their loved ones in the event of their premature death. However, life insurance is not just for individuals. Banks also invest in life insurance. In this article, we will explore why banks invest in life insurance and the benefits of this investment.

What is Life Insurance?

Life insurance is a contract between an individual and an insurance company. The individual pays premiums to the insurance company, and in return, the insurance company pays a death benefit to the individual’s beneficiaries upon the individual’s death. There are two main types of life insurance: term life insurance and permanent life insurance.

Term life insurance provides coverage for a specified period of time, such as 10, 20, or 30 years. If the individual dies during the term of the policy, the insurance company pays the death benefit to the beneficiaries. If the individual outlives the term of the policy, the coverage ends, and no death benefit is paid.

Why Do Banks Invest in Life Insurance?

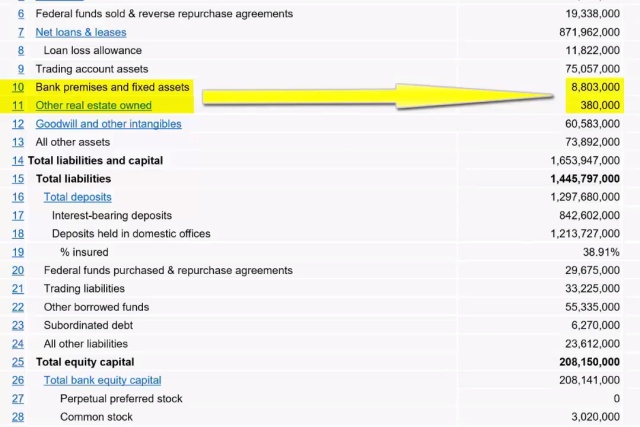

Banks invest in life insurance for several reasons. One reason is to manage their risk. When a bank makes a loan to an individual or business, it is taking on risk. If the borrower dies before the loan is repaid, the bank may not be able to recover the full amount of the loan. By investing in life insurance on the borrower, the bank can protect itself from this risk.

Another reason banks invest in life insurance is to provide benefits to their employees. Banks often offer life insurance as an employee benefit. By investing in life insurance on their employees, banks can provide this benefit at a lower cost than if they were to purchase individual policies for each employee.

Benefits of Banks Investing in Life Insurance

One benefit of banks investing in life insurance is that it can help them manage their risk. By investing in life insurance on borrowers, banks can protect themselves from the risk of losing money if a borrower dies before a loan is repaid. This can help banks maintain their financial stability.

Another benefit of banks investing in life insurance is that it can provide benefits to their employees. By offering life insurance as an employee benefit, banks can attract and retain talented employees. This can help the bank succeed in a competitive marketplace.

Life Insurance vs. Other Investments

Life insurance is often compared to other investments, such as stocks, bonds, and real estate. While life insurance may not provide the same returns as these other investments, it does offer unique benefits. Life insurance provides financial protection to individuals and their loved ones in the event of the individual’s premature death. It can also provide benefits to banks and their employees, as we have discussed.

Additionally, life insurance can provide tax benefits. The death benefit paid to beneficiaries is generally not subject to income tax. This can make life insurance an attractive investment for individuals and banks alike.

Conclusion

Banks invest in life insurance for several reasons, including managing risk and providing employee benefits. Investing in life insurance can help banks maintain their financial stability and attract talented employees. While life insurance may not provide the same returns as other investments, it does offer unique benefits, such as financial protection and tax benefits. Overall, life insurance is an important tool for individuals and banks alike.

Frequently Asked Questions

Do banks invest in life insurance?

Yes, banks do invest in life insurance. Banks offer their customers the option to purchase life insurance policies through them. These policies are usually term life insurance policies, which means they are for a specific period of time, such as 10 or 20 years. The premiums are paid on a regular basis and if the policyholder dies during the term of the policy, the beneficiaries receive a death benefit.

However, it is important to note that banks do not actually invest in life insurance policies themselves. Instead, they act as intermediaries between their customers and insurance companies. Banks earn a commission on the policies they sell, but they do not have any ownership in the policies themselves.

Why do banks offer life insurance policies?

Banks offer life insurance policies as a way to provide additional financial services to their customers. By offering life insurance policies, banks can attract new customers and retain existing ones. Life insurance can also be a way for banks to generate additional revenue, as they earn a commission on the policies they sell.

From the customer’s perspective, purchasing a life insurance policy through a bank can be convenient. It allows them to manage all of their financial needs in one place and can simplify the process of purchasing a policy. Additionally, banks may offer discounts or other incentives for customers who purchase policies through them.

What are the benefits of purchasing life insurance through a bank?

One benefit of purchasing life insurance through a bank is convenience. Customers can manage all of their financial needs in one place and may be able to take advantage of discounts or other incentives offered by the bank.

Another benefit is that banks may offer their customers access to a variety of insurance products from different providers. This can allow customers to compare policies and find one that meets their specific needs.

Finally, purchasing life insurance through a bank can provide customers with peace of mind. Knowing that they have a policy in place can provide financial security for their loved ones in the event of their death.

Are there any downsides to purchasing life insurance through a bank?

One potential downside to purchasing life insurance through a bank is that the policies may be more expensive than those offered by other providers. Banks earn a commission on the policies they sell, which can drive up the cost for the customer.

Another potential downside is that the bank may not have access to the same range of policies as an independent insurance broker. This could limit the options available to customers and may make it more difficult to find a policy that meets their specific needs.

Finally, some customers may prefer to work with an independent insurance broker who can provide unbiased advice and help them find the best policy for their needs.

Should I purchase life insurance through a bank?

The decision to purchase life insurance through a bank ultimately depends on your individual needs and preferences. If you value convenience and are comfortable with the policies offered by your bank, purchasing life insurance through them may be a good option.

However, it is always a good idea to shop around and compare policies from different providers to ensure that you are getting the best coverage at the best price. Additionally, you may want to consider working with an independent insurance broker who can provide unbiased advice and help you find the best policy for your needs.

Why Banks Invest Your Deposits In Life Insurance – #BankingShorts

In the end, the answer to the question of whether banks invest in life insurance is a resounding yes. Banks have recognized the potential of life insurance as an investment vehicle and have been actively investing in it for many years. The benefits of such investments are numerous, including the ability to diversify their portfolios, generate stable returns, and provide a valuable service to their customers.

However, it is important to note that the decision to invest in life insurance is not one to be taken lightly. As with any investment, there are risks involved, and banks must carefully weigh the potential benefits against the potential downsides. Moreover, banks must also ensure that they are operating within the bounds of the law and that their investments are aligned with their overall strategy and objectives. Despite these challenges, many banks have successfully integrated life insurance into their investment portfolios and are reaping the rewards of doing so.

Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering individuals to make well-informed decisions. Guided by his passion, he has assembled a team of seasoned insurance professionals committed to simplifying the intricate world of insurance for you.

- Latest Posts by Rakibul Hasan

-

Can I Keep Medicaid If My Job Offers Insurance?

- -

Does Smile Direct Club Take Medicaid Insurance?

- -

Does Life Insurance Payout Affect Medicaid?

- All Posts