Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering...Read more

As a young adult in your twenties, you may not have given much thought to life insurance. After all, you’re young, healthy, and have many years ahead of you. However, life insurance is an important financial tool that can provide peace of mind for you and your loved ones, even at this early stage of life.

While it may seem like an unnecessary expense, life insurance can provide protection for unexpected events such as accidents, illnesses, and even premature death. In this article, we’ll explore the reasons why you may need life insurance in your twenties, the types of policies available, and how to determine the right coverage for your individual needs. So, let’s dive in and discover why life insurance may be a wise investment for your future.

Do I Need Life Insurance in My 20s?

If you are in your 20s, you may think that there is no need to worry about life insurance. You are young, healthy, and have your entire life ahead of you. However, life is unpredictable, and it is always better to be prepared for the worst. In this article, we will discuss whether or not you need life insurance in your 20s.

What is Life Insurance?

Life insurance is a contract between an individual and an insurance company. The individual pays premiums in exchange for a lump-sum payment to their beneficiaries upon their death. Life insurance is designed to provide financial security to the beneficiaries during a difficult time.

There are two main types of life insurance: term life insurance and permanent life insurance. Term life insurance provides coverage for a specific period, while permanent life insurance provides coverage for the entire life of the insured.

Why Do You Need Life Insurance in Your 20s?

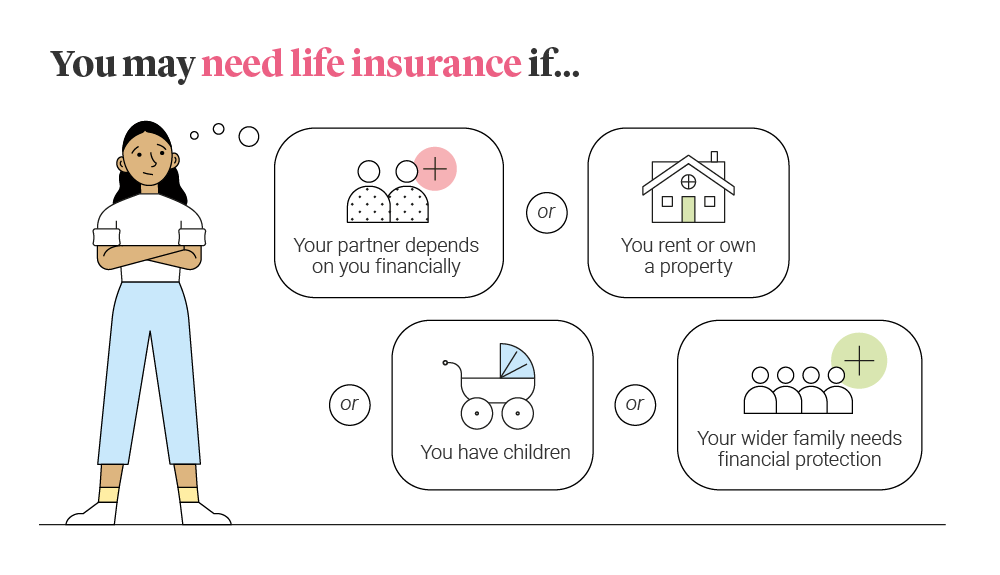

You may think that you do not need life insurance in your 20s because you are young and healthy. However, there are several reasons why you may want to consider life insurance at this stage in your life.

Firstly, if you have any debt, such as student loans, credit card debt, or a mortgage, life insurance can provide financial security to your beneficiaries in the event of your death. It can help them pay off your debts and avoid financial hardship.

Secondly, if you have dependents, such as children or elderly parents, life insurance can provide financial support to them in the event of your death. It can help them cover expenses such as childcare, education, and healthcare.

Benefits of Getting Life Insurance in Your 20s

There are several benefits of getting life insurance in your 20s. Firstly, premiums are generally lower when you are young and healthy. This means that you can get a higher coverage amount for a lower premium.

Secondly, if you develop any health conditions later in life, it may be difficult to get life insurance or the premiums may be significantly higher. By getting life insurance in your 20s, you can ensure that you have coverage in case of any future health issues.

Finally, life insurance can provide peace of mind to you and your loved ones. You know that if anything were to happen to you, your beneficiaries would be taken care of financially.

Term Life Insurance Vs Permanent Life Insurance

When it comes to life insurance, there are two main types: term life insurance and permanent life insurance. Here are the differences between the two:

- Term life insurance provides coverage for a specific period, such as 10, 20, or 30 years.

- Permanent life insurance provides coverage for the entire life of the insured.

- Term life insurance premiums are generally lower than permanent life insurance premiums.

- Permanent life insurance has a cash value component, which means that it can be used as an investment.

Which type of life insurance you choose depends on your individual needs and circumstances. Term life insurance may be a good option if you only need coverage for a specific period, such as until your children are grown or until you pay off your mortgage. Permanent life insurance may be a good option if you want coverage for your entire life and want to use it as an investment.

Conclusion

In conclusion, while you may think that you do not need life insurance in your 20s, it is always better to be prepared for the worst. Life insurance can provide financial security to your loved ones in the event of your death, especially if you have debt or dependents. Getting life insurance in your 20s can also provide several benefits, including lower premiums and peace of mind. Consider your individual needs and circumstances when deciding what type of life insurance to get.

Contents

- Frequently Asked Questions

- Do I Need Life Insurance in My 20s?

- What Type of Life Insurance is Best for Someone in Their 20s?

- How Much Life Insurance Do I Need in My 20s?

- Can I Change My Life Insurance Policy in My 20s?

- How Do I Choose a Life Insurance Provider in My 20s?

- Can I Keep Medicaid If My Job Offers Insurance?

- Does Smile Direct Club Take Medicaid Insurance?

- Does Life Insurance Payout Affect Medicaid?

Frequently Asked Questions

Do I Need Life Insurance in My 20s?

Many young adults in their 20s may not think that they need life insurance since they are young and healthy, and may not have dependents or large debts. However, there are several reasons why life insurance may still be important for someone in their 20s.

Firstly, if you have any debts or co-signed loans, such as student loans or a car loan, a life insurance policy can help ensure that your family or co-signer is not left with the burden of paying off your debts if something were to happen to you. Additionally, if you were to develop a health condition later in life, you may have difficulty getting life insurance at a reasonable rate. By getting a policy in your 20s, you can lock in a lower premium for the duration of the policy.

What Type of Life Insurance is Best for Someone in Their 20s?

For someone in their 20s, a term life insurance policy may be the best option. Term life insurance provides coverage for a specific period of time, such as 10, 20, or 30 years, and is generally more affordable than permanent life insurance.

Since someone in their 20s is likely to have a long life ahead of them, a term policy can provide coverage during the years when they have the most financial obligations, such as student loans, starting a family, or buying a home. Once those obligations are met, the policy can be allowed to expire.

How Much Life Insurance Do I Need in My 20s?

The amount of life insurance someone in their 20s needs can vary depending on their individual circumstances. A general rule of thumb is to have coverage that is 10-12 times your annual income.

However, if you have significant debts, such as a mortgage or student loans, or if you have dependents, you may need more coverage. It is important to consider your current and future financial obligations when deciding how much life insurance to get.

Can I Change My Life Insurance Policy in My 20s?

Yes, it is possible to change your life insurance policy in your 20s. If you have a term policy, you may have the option to renew or convert it to a permanent policy as you get older.

Additionally, if your financial situation changes, such as if you get married or have children, you may want to increase your coverage. It is important to review your policy regularly and make changes as needed to ensure that your coverage meets your current and future needs.

How Do I Choose a Life Insurance Provider in My 20s?

When choosing a life insurance provider in your 20s, it is important to consider factors such as the company’s financial stability, customer service, and reputation.

You may also want to compare quotes from multiple providers to ensure that you are getting the best coverage for your budget. Additionally, it can be helpful to talk to a financial advisor or insurance agent who can help guide you through the process and answer any questions you may have.

As a professional writer, I can say that life insurance is not something that most people in their 20s think about. After all, why worry about something that seems so far off in the future? However, it’s important to consider the benefits of having life insurance at a young age. Not only can it offer peace of mind, but it can also provide financial protection for your loved ones in the event of an unexpected tragedy.

One of the biggest advantages of getting life insurance in your 20s is the lower cost. Premiums are generally much more affordable when you’re young and healthy, which means you can lock in a lower rate for the duration of your policy. Additionally, some policies have a savings component that can accrue value over time, providing an additional financial benefit. Ultimately, while life insurance may not seem like a pressing concern in your 20s, it’s worth considering as a way to protect both yourself and your loved ones in the long run.

Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering individuals to make well-informed decisions. Guided by his passion, he has assembled a team of seasoned insurance professionals committed to simplifying the intricate world of insurance for you.

- Latest Posts by Rakibul Hasan

-

Can I Keep Medicaid If My Job Offers Insurance?

- -

Does Smile Direct Club Take Medicaid Insurance?

- -

Does Life Insurance Payout Affect Medicaid?

- All Posts