Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering...Read more

The topic of life insurance for illegal immigrants raises a number of important questions about the rights and protections available to undocumented individuals in the United States. Many people are unsure whether or not it is even possible for an illegal immigrant to obtain life insurance, and if so, what the process entails and what restrictions might apply.

On the one hand, life insurance is a fundamental financial tool that can provide peace of mind and security for individuals and their families in the face of unexpected events. On the other hand, undocumented immigrants face a unique set of challenges and legal barriers that can make it difficult to access basic services and protections. In this article, we will explore the complex issues surrounding life insurance for illegal immigrants, and examine some of the options that may be available to those who are seeking to protect their loved ones and plan for the future.

Yes, it is possible for illegal immigrants to get life insurance. However, the process may be more challenging compared to legal residents or citizens. Some insurance companies may require proof of legal status, while others may offer limited coverage options. It is recommended to work with an experienced insurance agent who can guide you through the process and help you find the best coverage options available.

Contents

- Can an Illegal Immigrant Get Life Insurance?

- Frequently Asked Questions

- Can an illegal immigrant get life insurance?

- What types of life insurance policies are available to illegal immigrants?

- How can an illegal immigrant apply for life insurance?

- What happens if an illegal immigrant dies without life insurance?

- Are there any risks or legal implications for an illegal immigrant applying for life insurance?

- Can I Keep Medicaid If My Job Offers Insurance?

- Does Smile Direct Club Take Medicaid Insurance?

- Does Life Insurance Payout Affect Medicaid?

Can an Illegal Immigrant Get Life Insurance?

Life insurance is an essential financial planning tool that provides financial security to the loved ones of a policyholder in the event of their untimely demise. However, many illegal immigrants living in the United States are unsure whether they are eligible to purchase a life insurance policy. In this article, we will explore whether an illegal immigrant can get life insurance and what options are available to them.

Legal Requirements for Life Insurance

To purchase life insurance in the United States, an individual must have an insurable interest in the policyholder’s life. This means that the purchaser must have a reasonable expectation of financial loss if the policyholder dies. For example, a spouse, child, or business partner would have an insurable interest in the policyholder’s life.

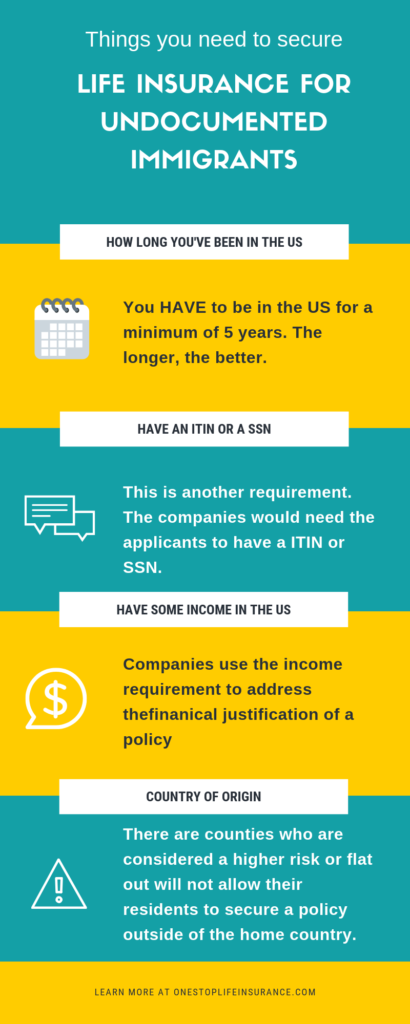

In addition, the policyholder must provide proof of identity and legal residency. This requirement applies to both citizens and non-citizens living in the United States. Therefore, an illegal immigrant may face challenges in meeting the legal requirements for purchasing life insurance.

Options for Illegal Immigrants to Get Life Insurance

Despite the legal obstacles, there are still options for illegal immigrants to obtain life insurance. One option is to purchase a policy from an insurance company that does not require proof of legal residency. These companies may offer simplified issue policies that do not require a medical exam or extensive underwriting.

Another option is to purchase a policy through a life insurance agent who specializes in working with non-citizens. These agents may have access to policies that are specifically designed for non-citizens or may be able to negotiate with insurance companies on behalf of their clients.

The Benefits of Life Insurance for Illegal Immigrants

Despite the challenges of obtaining life insurance, there are many benefits for illegal immigrants to consider. Life insurance can provide financial security to their loved ones in the event of their unexpected death. This can be especially important for illegal immigrants who are the primary breadwinners for their families.

In addition, some life insurance policies may provide benefits for the policyholder while they are still alive. For example, some policies may offer cash value accumulation or the option to borrow against the policy.

The Cost of Life Insurance for Illegal Immigrants

The cost of life insurance for illegal immigrants may be higher than for citizens or legal residents due to the increased risk of death associated with their status. Insurance companies may also require a higher premium or limit the amount of coverage available to non-citizens.

However, the cost of life insurance may still be affordable for many illegal immigrants. By working with a specialized agent or purchasing a simplified issue policy, they may be able to find a policy that fits their budget.

Life Insurance vs. Other Financial Planning Tools

While life insurance can provide financial security to the loved ones of a policyholder, it is not the only financial planning tool available. Illegal immigrants may also consider other options such as savings accounts, retirement accounts, and investments.

However, life insurance can provide unique benefits that other financial planning tools cannot. For example, life insurance can provide an immediate cash benefit to the policyholder’s beneficiaries in the event of their death, while other tools may take longer to access.

The Bottom Line

In conclusion, while it may be more challenging for illegal immigrants to obtain life insurance, it is still possible. By working with a specialized agent or purchasing a simplified issue policy, they may be able to find a policy that meets their needs and fits their budget. Ultimately, life insurance can provide financial security and peace of mind to the loved ones of a policyholder, regardless of their legal status.

Frequently Asked Questions

Here are some frequently asked questions about whether illegal immigrants can get life insurance.

Can an illegal immigrant get life insurance?

The short answer is yes, but it can be more difficult for an illegal immigrant to obtain life insurance than it is for a legal resident or citizen. Life insurance companies typically require applicants to provide a social security number or individual taxpayer identification number (ITIN) to apply for a policy. However, illegal immigrants are not eligible for a social security number and may not have an ITIN.

Some life insurance companies may still be willing to offer coverage to illegal immigrants, but the premiums may be higher and the coverage may be limited. Before applying for life insurance as an illegal immigrant, it is important to research different providers and policies to find the best option for your needs.

What types of life insurance policies are available to illegal immigrants?

Illegal immigrants may be able to apply for both term and permanent life insurance policies. Term life insurance offers coverage for a set period of time, whereas permanent life insurance provides coverage for the duration of the policyholder’s life.

However, as mentioned earlier, the premiums for life insurance policies for illegal immigrants may be higher than for legal residents or citizens. In addition, some policies may have exclusions or limitations on coverage for certain medical conditions or activities.

How can an illegal immigrant apply for life insurance?

To apply for life insurance as an illegal immigrant, you will need to find a provider that is willing to offer coverage to non-citizens without a social security number or ITIN. You may also need to provide additional documentation, such as a passport or other identification, to verify your identity.

It is important to be honest and upfront about your immigration status when applying for life insurance. Providing false information or misrepresenting your status could result in the denial of your application or the cancellation of your policy.

What happens if an illegal immigrant dies without life insurance?

If an illegal immigrant dies without life insurance, their family members or dependents may be responsible for covering funeral expenses and other end-of-life costs. Depending on their financial situation, they may be able to seek assistance from government or community organizations to help with these expenses.

However, having a life insurance policy in place can provide peace of mind and financial security for your loved ones in the event of your unexpected death.

Are there any risks or legal implications for an illegal immigrant applying for life insurance?

In general, there are no legal implications for an illegal immigrant applying for life insurance. However, it is important to note that providing false information or misrepresenting your immigration status on an application could result in the denial of your claim or the cancellation of your policy.

Additionally, some life insurance providers may require applicants to have a valid visa or other documentation to apply for coverage. It is important to research different providers and policies to find the best option for your needs as an illegal immigrant.

As a professional writer, I can confidently say that illegal immigrants can obtain life insurance in the United States. While it may seem like a daunting task, there are insurance companies that offer coverage to individuals who do not have legal status in the country. However, it is important to note that the process of obtaining life insurance as an illegal immigrant may be more complicated than for someone who is a U.S. citizen.

One of the main challenges that illegal immigrants face when trying to obtain life insurance is proving their insurability. Insurance companies typically require applicants to provide certain personal information, such as a social security number, which may not be available to someone who is in the country illegally. However, there are still options available, such as providing an Individual Taxpayer Identification Number (ITIN) or using a trusted friend or family member as a co-applicant. With the right guidance and assistance, illegal immigrants can navigate the process of obtaining life insurance and secure coverage for themselves and their loved ones.

Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering individuals to make well-informed decisions. Guided by his passion, he has assembled a team of seasoned insurance professionals committed to simplifying the intricate world of insurance for you.

- Latest Posts by Rakibul Hasan

-

Can I Keep Medicaid If My Job Offers Insurance?

- -

Does Smile Direct Club Take Medicaid Insurance?

- -

Does Life Insurance Payout Affect Medicaid?

- All Posts