Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering...Read more

Gerber Life Insurance is a popular option for parents looking to secure their children’s future. However, as with any insurance policy, there may come a time when you need to cash out your Gerber Life Insurance. Whether you’re looking to pay for your child’s college education or simply need some extra cash, understanding the process for cashing out your policy is crucial.

In this article, we’ll guide you through the steps you need to take in order to cash out your Gerber Life Insurance policy. From understanding the different types of policies available to knowing the tax implications of cashing out, we’ll provide you with all the information you need to make an informed decision about your insurance policy. So whether you’re a new parent looking to secure your child’s future or a long-time policyholder looking for some extra cash, read on to learn how to cash out your Gerber Life Insurance.

To cash out your Gerber Life Insurance policy, you need to contact their customer service department. They will guide you through the process and provide you with the necessary forms to fill out. You can then submit the forms along with any required documents to initiate the cash-out process. The funds will be sent to you either through direct deposit or a check in the mail.

Contents

- How Do I Cash Out My Gerber Life Insurance?

- Frequently Asked Questions

- How Do I Cash Out My Gerber Life Insurance?

- Can I Cash Out My Gerber Life Insurance Policy If I Am Still Alive?

- What Are My Options If I Don’t Want To Cash Out My Gerber Life Insurance Policy?

- How Long Does It Take To Cash Out My Gerber Life Insurance Policy?

- What Happens To My Gerber Life Insurance Policy If I Die?

- Can I Keep Medicaid If My Job Offers Insurance?

- Does Smile Direct Club Take Medicaid Insurance?

- Does Life Insurance Payout Affect Medicaid?

How Do I Cash Out My Gerber Life Insurance?

Gerber Life Insurance is a reliable and trusted provider of life insurance policies. If you have a Gerber Life Insurance policy, you may want to know how to cash out your policy. There are several options available to you, depending on your needs and circumstances.

Understanding Gerber Life Insurance Policies

Before you can cash out your Gerber Life Insurance policy, it’s important to understand the type of policy you have. Gerber Life Insurance offers several types of policies, including whole life insurance, term life insurance, and accidental death insurance.

Whole life insurance policies provide coverage for the duration of your life, while term life insurance policies provide coverage for a specific length of time. Accidental death insurance policies provide coverage in the event of an accidental death.

Benefits of Gerber Life Insurance Policies

One of the main benefits of Gerber Life Insurance policies is that they offer guaranteed coverage regardless of your health status. This means that even if you have a pre-existing medical condition, you can still obtain coverage.

Another benefit of Gerber Life Insurance policies is that they offer affordable premiums. This makes it easier for individuals and families to obtain the coverage they need without breaking the bank.

How to Cash Out Your Gerber Life Insurance Policy

If you need to cash out your Gerber Life Insurance policy, there are several options available to you. The first option is to surrender your policy. This means that you will receive the cash value of your policy, minus any surrender fees.

Another option is to take out a loan against your policy. This means that you will borrow money from the policy’s cash value, and you will need to pay back the loan with interest.

Benefits of Surrendering Your Gerber Life Insurance Policy

Surrendering your Gerber Life Insurance policy can provide you with immediate cash that you can use for any purpose. This can be especially helpful if you are facing financial difficulties or unexpected expenses.

Additionally, surrendering your policy can eliminate the need to continue paying premiums. This can be beneficial if you no longer need the coverage provided by the policy.

Benefits of Taking Out a Loan Against Your Gerber Life Insurance Policy

Taking out a loan against your Gerber Life Insurance policy can provide you with cash that you can use for any purpose. This can be helpful if you need to pay for unexpected expenses or if you need to supplement your income.

Additionally, taking out a loan against your policy does not require you to surrender your coverage. This means that you can continue to receive the benefits of the policy while also accessing cash.

Gerber Life Insurance Policy Vs Other Life Insurance Policies

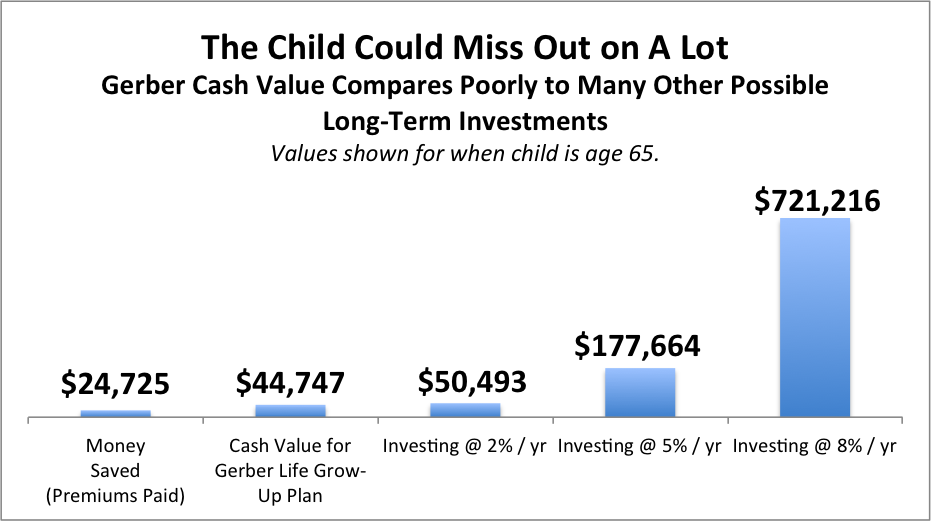

Gerber Life Insurance policies offer several benefits that make them stand out from other life insurance policies. For example, Gerber Life Insurance policies offer guaranteed coverage regardless of your health status, while many other policies require a medical exam or may deny coverage based on pre-existing conditions.

Additionally, Gerber Life Insurance policies offer affordable premiums that make it easier for individuals and families to obtain the coverage they need.

Benefits of Other Life Insurance Policies Vs Gerber Life Insurance Policies

While Gerber Life Insurance policies offer many benefits, there are also benefits to other types of life insurance policies. For example, some policies offer higher coverage amounts or more flexible terms.

Additionally, some policies may offer more investment options or may allow you to change your coverage as your needs change.

Conclusion

Cashing out your Gerber Life Insurance policy can provide you with immediate cash that you can use for any purpose. Whether you choose to surrender your policy or take out a loan against it, it’s important to understand your options and the benefits of each.

If you’re considering cashing out your Gerber Life Insurance policy, it’s also important to understand the type of policy you have and the benefits it provides. With the right information and guidance, you can make an informed decision that meets your needs and helps you achieve your financial goals.

Frequently Asked Questions

How Do I Cash Out My Gerber Life Insurance?

To cash out your Gerber Life Insurance policy, you will need to contact the company directly. You can do this by calling their customer service line or visiting their website. Once you have made contact, you will need to provide them with your policy number and other relevant information. They will then be able to guide you through the process of cashing out your policy.

It is important to note that cashing out your Gerber Life Insurance policy may result in fees and taxes. These can vary depending on the policy and the amount being cashed out. It is recommended that you speak with a financial advisor or tax professional before making any decisions regarding your Gerber Life Insurance policy.

Can I Cash Out My Gerber Life Insurance Policy If I Am Still Alive?

Yes, it is possible to cash out your Gerber Life Insurance policy while you are still alive. This is known as a surrender or a policy buyout. To do this, you will need to contact Gerber Life Insurance directly and request a surrender form. You will then need to fill out this form and return it to the company along with any other requested documentation.

It is important to consider the consequences of cashing out your policy before making any decisions. Depending on the policy and the amount being cashed out, there may be fees and taxes associated with this process. Additionally, cashing out your policy may impact your beneficiaries and their ability to receive a payout in the future.

What Are My Options If I Don’t Want To Cash Out My Gerber Life Insurance Policy?

If you do not want to cash out your Gerber Life Insurance policy, there are a few options available to you. One option is to simply continue paying your premiums and keeping the policy in force. This will ensure that your beneficiaries will receive a payout in the event of your death.

Another option is to sell your policy to a third-party buyer. This is known as a life settlement and can be a good option if you no longer need the coverage provided by your Gerber Life Insurance policy. However, it is important to consider the potential drawbacks of this option, including the fact that you may receive less money than the policy is worth.

How Long Does It Take To Cash Out My Gerber Life Insurance Policy?

The amount of time it takes to cash out your Gerber Life Insurance policy can vary depending on a number of factors. These can include the policy itself, the amount being cashed out, and any documentation that needs to be completed.

In general, it can take several weeks or even months to complete the process of cashing out your policy. It is important to be patient and to communicate regularly with Gerber Life Insurance to ensure that the process is moving forward as smoothly as possible.

What Happens To My Gerber Life Insurance Policy If I Die?

If you pass away while your Gerber Life Insurance policy is still in force, your beneficiaries will be entitled to receive a payout. The amount of this payout will depend on the policy itself and the amount of coverage you have.

To ensure that your beneficiaries receive this payout in a timely manner, it is important to keep your policy up to date and to inform your beneficiaries of its existence. You may also want to consider naming a primary and secondary beneficiary to ensure that the payout goes to the right people.

In a nutshell, Gerber Life Insurance is an excellent investment for your future as it ensures your family’s financial security in case of an unfortunate event. However, if you’re wondering how to cash out your Gerber Life Insurance, there are several options available. You can either surrender or cancel the policy, withdraw a partial amount, or sell the policy to a third party. It’s essential to evaluate each option carefully to make an informed decision that suits your financial needs.

In conclusion, cashing out your Gerber Life Insurance policy is a straightforward process that requires careful consideration of your financial goals. Whether you choose to surrender, withdraw, or sell your policy, it’s essential to weigh the pros and cons and consult with a financial advisor. Your Gerber Life Insurance policy can provide a crucial financial safety net for you and your loved ones, and cashing it out can help you achieve your financial goals.

Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering individuals to make well-informed decisions. Guided by his passion, he has assembled a team of seasoned insurance professionals committed to simplifying the intricate world of insurance for you.

- Latest Posts by Rakibul Hasan

-

Can I Keep Medicaid If My Job Offers Insurance?

- -

Does Smile Direct Club Take Medicaid Insurance?

- -

Does Life Insurance Payout Affect Medicaid?

- All Posts