Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering...Read more

As a professional writer, I know that life insurance is an essential financial tool that helps protect individuals and their loved ones in the event of an unexpected death. However, there are many misconceptions surrounding life insurance, including whether Medicaid can be considered a form of life insurance. This topic has garnered significant attention in recent years, as many people are confused about whether Medicaid can help cover end-of-life costs or provide financial assistance to beneficiaries.

To understand whether Medicaid can be considered life insurance, it is crucial to explore the different types of Medicaid coverage available and how they are structured. While Medicaid is a government-funded healthcare program that provides medical coverage to eligible individuals, it does offer some financial assistance for end-of-life costs in certain situations. In this article, we will delve deeper into the nuances of Medicaid coverage and explore whether it can be classified as life insurance.

No, Medicaid is not life insurance. It is a government-sponsored healthcare program that provides medical coverage to eligible individuals and families with low income and limited resources. Medicaid covers a wide range of medical services, including doctor visits, hospital stays, prescription drugs, and more. However, it does not provide coverage for life insurance or end-of-life expenses. If you need life insurance, you will need to purchase a separate policy from a life insurance company.

Is Medicaid Life Insurance?

Medicaid is a government-sponsored healthcare program that provides medical coverage for individuals with limited income and resources. It is often confused with life insurance, but the two are entirely different. In this article, we will delve into the differences between Medicaid and life insurance.

What is Medicaid?

Medicaid is a government program that provides healthcare coverage for low-income families and individuals. It is jointly funded by the federal and state governments, and each state has its own eligibility requirements and coverage options. Medicaid covers a wide range of medical services, including doctor visits, hospital stays, prescription drugs, and long-term care.

To be eligible for Medicaid, individuals must meet certain income and asset requirements. The specific requirements vary by state, but generally, individuals must have an income below a certain level and have limited assets. Medicaid is not a cash benefit, but rather a program that pays for medical expenses directly.

Benefits of Medicaid

Medicaid is a critical program that provides healthcare coverage for millions of Americans who cannot afford private insurance. The program provides access to medical care that would otherwise be out of reach, improving overall health outcomes and reducing healthcare costs.

Some of the benefits of Medicaid include:

– Coverage for essential health services

– Financial protection against high medical expenses

– Preventive care services at no cost

– Access to critical medical care, including emergency services and long-term care

Medicaid vs. Life Insurance

Medicaid and life insurance are two entirely different things. While Medicaid provides healthcare coverage, life insurance is a financial product that pays out a sum of money to beneficiaries upon the policyholder’s death.

Life insurance is designed to provide financial protection to loved ones in the event of the policyholder’s death. It can be used to cover funeral expenses, pay off debts, and provide income replacement for dependents. Life insurance policies come in many different types and can be tailored to meet individual needs.

Benefits of Life Insurance

Life insurance provides several benefits, including:

– Financial protection for loved ones

– Peace of mind knowing that loved ones will be taken care of

– The ability to leave a legacy or charitable donation

Conclusion

In conclusion, Medicaid is not life insurance. Medicaid is a government program that provides healthcare coverage for low-income individuals and families, while life insurance is a financial product that pays out a sum of money to beneficiaries upon the policyholder’s death. Both serve important purposes, but they are not interchangeable. It is essential to understand the differences between Medicaid and life insurance and to plan accordingly to ensure adequate financial protection and access to healthcare.

Contents

- Frequently Asked Questions

- Is Medicaid Life Insurance?

- What Does Medicaid Cover?

- Who is Eligible for Medicaid?

- How Do I Apply for Medicaid?

- Can I Have Medicaid and Private Insurance?

- Is Life Insurance Counted as an Asset by Medicaid?

- Can I Keep Medicaid If My Job Offers Insurance?

- Does Smile Direct Club Take Medicaid Insurance?

- Does Life Insurance Payout Affect Medicaid?

Frequently Asked Questions

Is Medicaid Life Insurance?

No, Medicaid is not life insurance. Medicaid is a government-funded program that provides healthcare coverage to individuals and families with low income and limited resources. The program covers a range of medical services, including doctor visits, hospital stays, prescription drugs, and more.

It is important to note that Medicaid does not provide coverage for all medical services, and there may be limitations and restrictions on the types of services that are covered. Additionally, eligibility for Medicaid is based on a number of factors, including income, family size, and other criteria, and not everyone who applies for Medicaid will qualify for coverage.

What Does Medicaid Cover?

Medicaid covers a range of medical services, including doctor visits, hospital stays, prescription drugs, and more. The program is designed to provide healthcare coverage to individuals and families with low income and limited resources, and the types of services that are covered may vary depending on the state where you live.

In addition to medical services, Medicaid may also cover other types of healthcare-related expenses, such as transportation to and from medical appointments, medical equipment and supplies, and long-term care services. It is important to check with your state Medicaid office to find out what services are covered under the program.

Who is Eligible for Medicaid?

Eligibility for Medicaid is based on a number of factors, including income, family size, and other criteria. In general, individuals and families with low income and limited resources may be eligible for Medicaid, although the specific requirements may vary depending on the state where you live.

To qualify for Medicaid, you will need to submit an application and provide information about your income, assets, and other factors that may affect your eligibility. The application process can vary depending on the state where you live, and it is important to check with your state Medicaid office to find out what steps you need to take to apply for coverage.

How Do I Apply for Medicaid?

To apply for Medicaid, you will need to submit an application to your state Medicaid office. The application process can vary depending on the state where you live, but in general, you will need to provide information about your income, assets, and other factors that may affect your eligibility.

You may also need to provide documentation to support your application, such as tax returns, pay stubs, and other financial records. Once you have submitted your application, the state Medicaid office will review your information and determine whether you are eligible for coverage.

Can I Have Medicaid and Private Insurance?

Yes, it is possible to have both Medicaid and private insurance at the same time. If you have private insurance, Medicaid may help to cover some of your out-of-pocket expenses, such as copayments and deductibles.

However, it is important to note that Medicaid may not cover all of the same services that are covered by your private insurance, and there may be limitations and restrictions on the types of services that are covered. Additionally, if you have both Medicaid and private insurance, you will need to coordinate your coverage to ensure that you are not paying for services twice.

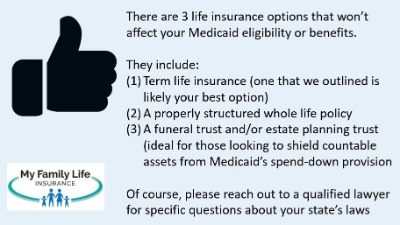

Is Life Insurance Counted as an Asset by Medicaid?

After a thorough examination of the Medicaid program, it is clear that Medicaid is not life insurance. While Medicaid does provide coverage for some medical expenses, it does not offer the same benefits as traditional life insurance policies. Life insurance policies are designed to provide financial support to loved ones in the event of a policyholder’s death, whereas Medicaid is a government-funded program that provides healthcare coverage for those who meet certain income and eligibility requirements.

Furthermore, Medicaid and life insurance serve different purposes and are not interchangeable. Life insurance policies allow individuals to choose their beneficiaries and determine the payout amount, while Medicaid does not offer the same level of customization. Additionally, life insurance policies are typically purchased by individuals or provided by employers, while Medicaid is a government-funded program. Ultimately, while both Medicaid and life insurance offer important benefits, they are not the same thing and should not be confused.

Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering individuals to make well-informed decisions. Guided by his passion, he has assembled a team of seasoned insurance professionals committed to simplifying the intricate world of insurance for you.

- Latest Posts by Rakibul Hasan

-

Can I Keep Medicaid If My Job Offers Insurance?

- -

Does Smile Direct Club Take Medicaid Insurance?

- -

Does Life Insurance Payout Affect Medicaid?

- All Posts