Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering...Read more

Term life insurance is a topic that has been heavily debated in the Muslim community. Muslims who follow the teachings of Islam are often unsure if taking out a term life insurance policy is halal or not. Halal means permissible under the Islamic law, and this has caused many Muslims to question whether or not they should take out term life insurance policies.

The issue of term life insurance being halal or not is a complex matter that requires a deep understanding of Islamic law and the principles of insurance. While some argue that term life insurance is permissible under certain conditions, others argue that it goes against the principles of Islam. In this article, we will explore the arguments from both sides and delve deeper into the topic of whether term life insurance is halal or not.

Term life insurance is considered halal in Islam as it serves the purpose of financial protection for the family in case of the policyholder’s death. However, it is important to ensure that the insurance policy does not involve any interest-based transactions or investments in non-halal industries, such as gambling or alcohol. It is recommended to consult with a knowledgeable Islamic scholar or advisor before choosing an insurance policy to ensure it is compliant with Islamic principles.

Is Term Life Insurance Halal?

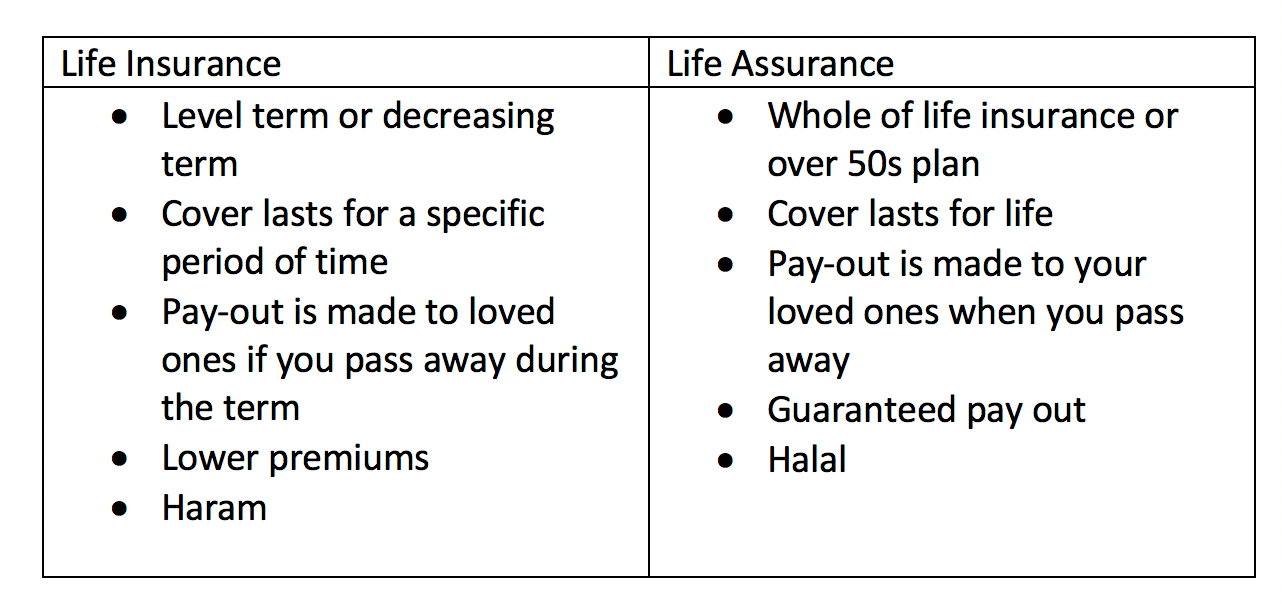

Term life insurance is a type of insurance policy that provides coverage for a specific period of time. The policyholder pays a premium to the insurance company for the duration of the policy, and if the policyholder dies during that time, the company will pay out a death benefit to the policyholder’s beneficiaries. However, there is a debate among Muslims about whether or not term life insurance is halal, or permissible under Islamic law. Let’s explore this topic further.

Understanding Halal Insurance

Halal insurance, also known as takaful, is insurance that is compliant with Islamic law. The concept of insurance in Islam is based on the principle of mutual cooperation and assistance. Muslims are encouraged to help each other in times of need, and insurance is seen as a way to do so. Halal insurance operates on a cooperative basis, where policyholders pay into a fund that is used to pay out claims. The key difference between halal insurance and conventional insurance is that the former is based on the principles of shariah law, which prohibits riba (interest), gharar (uncertainty), and maysir (gambling).

The Debate About Term Life Insurance

The debate about whether or not term life insurance is halal centers around the issue of interest. Term life insurance policies typically include a savings component, where a portion of the premium is invested by the insurance company. The policyholder may receive a portion of the investment returns in the form of interest. Some scholars argue that this interest is forbidden under Islamic law, as it is a form of riba. Others argue that the savings component of term life insurance policies is not significant enough to be considered riba.

Benefits of Term Life Insurance

Despite the debate about whether or not term life insurance is halal, there are many benefits to this type of insurance policy. One of the main benefits is that it provides financial protection for the policyholder’s beneficiaries in the event of their death. This can be especially important for those who have dependents or who have outstanding debts, such as a mortgage. Term life insurance can also be an affordable way to obtain coverage, as premiums are typically lower than those for permanent life insurance policies.

Term Life Insurance Vs Permanent Life Insurance

There are two main types of life insurance policies: term life insurance and permanent life insurance. The main difference between these two types of policies is that term life insurance provides coverage for a specific period of time, while permanent life insurance provides coverage for the policyholder’s entire life. Term life insurance is typically less expensive than permanent life insurance, as it does not include a savings component. However, permanent life insurance policies can provide additional benefits, such as a cash value that can be borrowed against.

Investing in Halal Funds

For those who are concerned about the halal status of term life insurance, another option is to invest in halal funds. Halal funds are investment funds that comply with Islamic law, and do not invest in companies involved in industries such as alcohol, tobacco, and gambling. By investing in halal funds, Muslims can ensure that their investments are in line with their religious beliefs.

Conclusion

In conclusion, the debate about whether or not term life insurance is halal is ongoing. While some scholars argue that the interest component of term life insurance policies is forbidden under Islamic law, others argue that it is not significant enough to be considered riba. Regardless of the debate, term life insurance can be a valuable tool for providing financial protection for the policyholder’s beneficiaries. For those who are concerned about the halal status of term life insurance, investing in halal funds may be a viable alternative.

Contents

- Frequently Asked Questions

- What is term life insurance?

- Is term life insurance halal?

- Are there halal alternatives to term life insurance?

- Can term life insurance be made halal?

- What should I consider when deciding whether to purchase term life insurance?

- Can I Keep Medicaid If My Job Offers Insurance?

- Does Smile Direct Club Take Medicaid Insurance?

- Does Life Insurance Payout Affect Medicaid?

Frequently Asked Questions

Term life insurance is a popular option for many people looking to protect their loved ones financially in case of an unexpected death. However, for those who follow Islamic principles, there may be concerns about whether term life insurance is halal, or permissible under Islamic law. Here are some frequently asked questions and answers about this topic.

What is term life insurance?

Term life insurance is a type of life insurance policy that provides coverage for a specified period of time, typically between 10 and 30 years. If the policyholder dies during the term of the policy, the death benefit is paid out to the beneficiaries. If the policyholder outlives the term, the policy expires and there is no payout.

Term life insurance is often used to provide financial protection for dependents, such as children or a spouse, in case the policyholder dies unexpectedly. It can be purchased in a variety of amounts and usually requires regular premium payments.

Is term life insurance halal?

There is no clear answer to whether term life insurance is halal, as it can depend on the specific terms and conditions of the policy. In general, life insurance is considered permissible under Islamic law as long as it meets certain conditions, such as not involving interest or gambling.

However, there may be concerns about whether the death benefit is a form of riba, or prohibited interest, as it is paid out in a lump sum. Some scholars argue that the death benefit is not riba, as it is a one-time payout rather than ongoing interest payments, while others believe it may be problematic.

Are there halal alternatives to term life insurance?

For those who are concerned about the halal status of term life insurance, there may be alternative options available. One possibility is takaful, which is a form of Islamic insurance that operates on the principle of mutual assistance and risk sharing.

In takaful, members of a group pool their resources to provide financial protection for each other in case of unexpected events. If a member experiences a loss, the funds are paid out from the pool. Takaful is based on the principles of cooperation, solidarity, and shared responsibility, and is considered to be halal by many Islamic scholars.

Can term life insurance be made halal?

Some insurance companies offer halal options for life insurance, which are designed to meet the requirements of Islamic law. These policies may involve different structures or investment strategies that are more in line with Islamic principles.

If you are interested in purchasing term life insurance but are concerned about its halal status, it may be worth looking into these halal options. However, it is important to carefully review the terms and conditions of any policy to ensure that it meets your needs and is in compliance with Islamic law.

What should I consider when deciding whether to purchase term life insurance?

If you are considering purchasing term life insurance, there are several factors to keep in mind. First, you should determine how much coverage you need to provide for your dependents in case of your unexpected death. This may involve calculating your current and future expenses, such as mortgage payments, living costs, and education expenses.

You should also consider the affordability of the policy premiums, as well as the terms and conditions of the policy. It may be helpful to speak with a financial advisor or insurance professional to determine the best options for your specific situation.

In today’s era, it is not uncommon to come across various questions regarding the permissibility of certain practices according to Islamic teachings. One such query that has gained momentum in recent times is whether term life insurance is halal or not. After considering multiple viewpoints and researching the subject matter, it can be concluded that term life insurance is permissible in Islam, given that it fulfills certain conditions.

Firstly, it is essential to understand that Islam encourages taking measures to protect oneself and one’s family from unforeseen circumstances. Term life insurance provides a means to secure one’s loved ones financially in case of the policyholder’s untimely demise. However, it is crucial to ensure that the insurance policy is free from any elements that are explicitly prohibited in Islam, such as riba (interest) or gharar (uncertainty). Therefore, it is recommended to opt for policies that are Shariah-compliant and adhere to the principles of Islamic finance.

In conclusion, the topic of whether term life insurance is halal or not can be a complex one, but it is essential to understand that Islam allows for measures to secure oneself and one’s family. However, it is necessary to ensure that the policy adheres to the principles of Islamic finance and is free from any prohibited elements. By doing so, individuals can safeguard their loved ones and have peace of mind knowing that they have taken the necessary steps to mitigate any financial risks.

Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering individuals to make well-informed decisions. Guided by his passion, he has assembled a team of seasoned insurance professionals committed to simplifying the intricate world of insurance for you.

- Latest Posts by Rakibul Hasan

-

Can I Keep Medicaid If My Job Offers Insurance?

- -

Does Smile Direct Club Take Medicaid Insurance?

- -

Does Life Insurance Payout Affect Medicaid?

- All Posts