Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering...Read more

As we grow older, the likelihood of facing a disability increases. While disability insurance can provide some financial relief for individuals facing such challenges, it can be difficult to navigate the various coverage options available. For those who rely on Medicare for their healthcare needs, the question arises: does Medicare cover disability insurance?

The answer to this question is not straightforward. Medicare is a federal health insurance program that provides coverage for individuals who are 65 years or older, as well as certain individuals with disabilities. However, it does not provide coverage for disability insurance, which is a separate type of insurance that provides income replacement in the event that an individual becomes disabled and is unable to work. In this article, we will explore the relationship between Medicare and disability insurance, and what options are available for those who need coverage for both.

Contents

- Does Medicare Cover Disability Insurance?

- Frequently Asked Questions

- Does Medicare Cover Disability Insurance?

- What is Social Security Disability Insurance?

- What is Supplemental Security Income?

- Can I receive both SSDI and SSI benefits?

- Do all states offer disability insurance?

- Medicare Disability – Medicare Under Age 65

- Can I Keep Medicaid If My Job Offers Insurance?

- Does Smile Direct Club Take Medicaid Insurance?

- Does Life Insurance Payout Affect Medicaid?

Does Medicare Cover Disability Insurance?

If you are unable to work due to a disability, you may be wondering if Medicare covers disability insurance. The answer is not a simple yes or no, as there are various factors that can impact your eligibility for disability insurance benefits through Medicare. In this article, we will explore the different aspects of Medicare coverage for disability insurance.

What is Disability Insurance?

Disability insurance is designed to provide financial assistance to individuals who are unable to work due to a disability. It can help cover expenses such as medical bills, rent, and other living costs while you are unable to work. Disability insurance is available through private insurance companies, and some employers offer group disability insurance plans.

Types of Disability Insurance

There are two main types of disability insurance: short-term disability (STD) and long-term disability (LTD). STD typically provides coverage for a period of up to six months, while LTD provides coverage for longer periods, sometimes up to age 65. LTD policies may have waiting periods before benefits start, and the amount of coverage can vary based on the policy.

Eligibility for Disability Insurance

To be eligible for disability insurance, you must have a qualifying disability that prevents you from working. The definition of a qualifying disability varies depending on the insurance policy, but typically it refers to a medical condition that prevents you from performing your job duties. Disability insurance may also have requirements regarding the length of time you have been employed, the number of hours you work, and other factors.

Does Medicare Cover Disability Insurance?

Medicare itself does not provide disability insurance benefits, but it may cover some of the medical expenses associated with a qualifying disability. If you are eligible for disability insurance benefits through Social Security, you may also be eligible for Medicare coverage.

Medicare Coverage for Disability

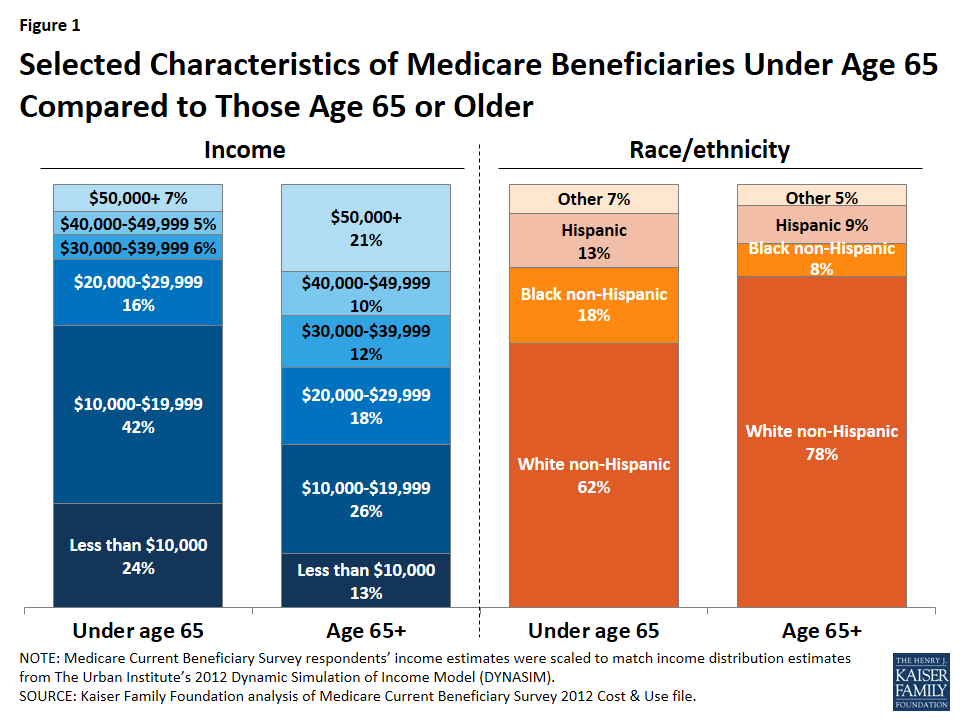

If you are under 65 and have been receiving disability insurance benefits for at least two years, you may be eligible for Medicare coverage. Medicare Part A (hospital insurance) and Part B (medical insurance) are available to individuals who meet certain criteria. In some cases, individuals may also be eligible for Medicare Advantage plans or Medicare Supplement Insurance (Medigap).

Medicare Advantage Plans

Medicare Advantage plans are offered by private insurance companies and provide an alternative to Original Medicare. These plans must provide at least the same level of coverage as Original Medicare, but may also offer additional benefits such as prescription drug coverage or dental and vision care. Some Medicare Advantage plans may also offer coverage for disability-related expenses.

Medigap

Medigap policies are sold by private insurance companies and can help cover some of the out-of-pocket costs associated with Medicare. These policies may cover expenses such as copayments, deductibles, and coinsurance. However, Medigap policies do not provide coverage for long-term care or custodial care.

Benefits of Disability Insurance

Disability insurance can provide financial security and peace of mind in the event that you are unable to work due to a disability. It can help cover expenses such as medical bills, rent, and other living costs, which can be especially important if you have a family to support. Disability insurance can also help protect your retirement savings, as you may not be able to contribute to a retirement account while you are unable to work.

VS

While disability insurance can provide valuable benefits, it is important to understand the limitations of your policy. Disability insurance may not cover all of your living expenses, and some policies have waiting periods before benefits start. Additionally, disability insurance can be expensive, especially if you have a pre-existing medical condition. It is important to carefully consider your options and choose a policy that provides the coverage you need at a price you can afford.

Conclusion

While Medicare itself does not provide disability insurance benefits, it may cover some of the medical expenses associated with a qualifying disability. If you are unable to work due to a disability, it is important to explore your options for disability insurance and determine if you are eligible for benefits through Social Security or private insurance. Understanding your coverage options can help provide financial security and peace of mind in the event of a disability.

Frequently Asked Questions

Does Medicare Cover Disability Insurance?

Medicare is a federal health insurance program that provides coverage for people who are 65 years of age or older or who have certain disabilities. However, it’s important to note that Medicare does not provide coverage for disability insurance. Disability insurance is designed to replace a portion of your income if you become disabled and are unable to work.

While Medicare doesn’t cover disability insurance, there are other programs that may be able to help. For example, Social Security Disability Insurance (SSDI) and Supplemental Security Income (SSI) are both federal programs that provide benefits to people with disabilities. Additionally, some states offer their own disability insurance programs.

What is Social Security Disability Insurance?

Social Security Disability Insurance (SSDI) is a federal program that provides benefits to people who are unable to work due to a disability. To be eligible for SSDI, you must have worked long enough and paid Social Security taxes. The amount of benefits you receive is based on your past earnings.

It’s important to note that SSDI is different from Supplemental Security Income (SSI). While both programs provide benefits to people with disabilities, SSI is a needs-based program that is available to people who have limited income and resources. SSDI, on the other hand, is based on your work history and the amount of Social Security taxes you have paid.

What is Supplemental Security Income?

Supplemental Security Income (SSI) is a federal program that provides benefits to people with disabilities who have limited income and resources. Unlike Social Security Disability Insurance (SSDI), which is based on your work history and the amount of Social Security taxes you have paid, SSI is a needs-based program.

To be eligible for SSI, you must have a disability that prevents you from working and be able to demonstrate financial need. The amount of benefits you receive is based on your income and resources. Additionally, some states offer a supplement to SSI benefits to help cover the cost of living expenses.

Can I receive both SSDI and SSI benefits?

It is possible to receive both Social Security Disability Insurance (SSDI) and Supplemental Security Income (SSI) benefits. This is known as “concurrent benefits.” To be eligible for concurrent benefits, you must meet the eligibility requirements for both programs.

It’s important to note that the amount of your SSDI benefits may affect your eligibility for SSI benefits. Additionally, some states offer a state supplement to SSI benefits, which may also be affected by your SSDI benefits.

Do all states offer disability insurance?

While Social Security Disability Insurance (SSDI) and Supplemental Security Income (SSI) are federal programs, not all states offer their own disability insurance programs. However, some states do offer short-term or long-term disability insurance programs that provide benefits to people with disabilities.

If you are interested in disability insurance, it’s important to check with your state’s Department of Labor or Department of Insurance to see what programs are available. Additionally, you may want to consult with an insurance agent or financial planner to help you choose the right disability insurance coverage for your needs.

Medicare Disability – Medicare Under Age 65

As a professional writer, it is important to understand the complexities of Medicare coverage and how it relates to disability insurance. While Medicare does provide coverage for individuals who are disabled and meet certain criteria, it is important to note that this coverage may not be sufficient for all individuals. For those who require additional coverage, it may be necessary to explore other options such as private disability insurance or Medicaid.

Ultimately, the decision to pursue disability insurance should be based on an individual’s unique circumstances and needs. It is important to consult with a knowledgeable healthcare professional or insurance agent to determine the best course of action. Regardless of the path chosen, it is essential to prioritize one’s health and well-being and ensure that adequate coverage is in place to provide peace of mind and financial security in the event of disability.

Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering individuals to make well-informed decisions. Guided by his passion, he has assembled a team of seasoned insurance professionals committed to simplifying the intricate world of insurance for you.

- Latest Posts by Rakibul Hasan

-

Can I Keep Medicaid If My Job Offers Insurance?

- -

Does Smile Direct Club Take Medicaid Insurance?

- -

Does Life Insurance Payout Affect Medicaid?

- All Posts