Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering...Read more

When it comes to life insurance, you have several options to choose from. One of them is the 15-year term life insurance policy. As the name suggests, this policy provides life insurance coverage for a period of 15 years. But what exactly is this type of policy, and how does it differ from other life insurance options?

A 15-year term life insurance policy is a type of life insurance policy that provides coverage for a specified period of 15 years. During this time, your beneficiaries will receive a death benefit if you pass away. This policy can be a good option for those who want coverage for a set period of time, such as until their children are grown or until their mortgage is paid off. In this article, we’ll explore the ins and outs of this policy, so you can decide if it’s the right choice for you and your loved ones.

A 15-year term life insurance policy is a type of life insurance that provides coverage for 15 years. During this time, the policyholder pays a premium to the insurer, and if the policyholder dies within the 15-year period, the death benefit is paid out to the policy’s beneficiaries. After the 15 years are up, the policy expires and the coverage ends. This type of policy is often used to provide temporary protection for individuals who have a specific financial goal, such as paying off a mortgage or supporting children until they reach adulthood.

What is a 15 Year Term Life Insurance Policy?

A 15-year term life insurance policy is a type of life insurance policy that provides coverage for a specific period of 15 years. This policy is ideal for individuals who need life insurance coverage for a specific period, such as the duration of a mortgage or until their children are grown up.

How does a 15 Year Term Life Insurance Policy work?

A 15-year term life insurance policy works by providing coverage for a specific period of 15 years. If the insured individual passes away during the coverage period, the death benefit is paid out to the beneficiaries.

The premiums for a 15-year term life insurance policy are fixed for the duration of the policy. This means that the premiums will not increase during the 15-year coverage period, making it easier for individuals to budget for their life insurance premiums.

Benefits of a 15 Year Term Life Insurance Policy

There are several benefits of a 15-year term life insurance policy, including:

1. Affordable premiums: The premiums for a 15-year term life insurance policy are typically lower than those of a permanent life insurance policy.

2. Fixed premiums: The premiums for a 15-year term life insurance policy are fixed for the duration of the policy, making it easier for individuals to budget for their life insurance premiums.

3. Coverage for a specific period: The 15-year coverage period is ideal for individuals who need life insurance coverage for a specific period, such as the duration of a mortgage or until their children are grown up.

4. Death benefit: If the insured individual passes away during the coverage period, the death benefit is paid out to the beneficiaries.

15 Year Term Life Insurance Policy vs Permanent Life Insurance Policy

There are several differences between a 15-year term life insurance policy and a permanent life insurance policy, including:

1. Coverage period: A 15-year term life insurance policy provides coverage for a specific period of 15 years, while a permanent life insurance policy provides coverage for the entire lifetime of the insured individual.

2. Premiums: The premiums for a 15-year term life insurance policy are typically lower than those of a permanent life insurance policy.

3. Cash value: A permanent life insurance policy has a cash value component, which allows the policyholder to accumulate savings over time.

4. Flexibility: A permanent life insurance policy is more flexible than a 15-year term life insurance policy, as it allows for changes in coverage and premiums over time.

Is a 15 Year Term Life Insurance Policy Right for You?

A 15-year term life insurance policy may be right for you if:

1. You need life insurance coverage for a specific period of time, such as the duration of a mortgage or until your children are grown up.

2. You are looking for an affordable life insurance option.

3. You want the security of knowing that your beneficiaries will receive a death benefit if you pass away during the coverage period.

Conclusion

A 15-year term life insurance policy is a great option for individuals who need life insurance coverage for a specific period of time. It provides affordable premiums, fixed premiums for the duration of the policy, and a death benefit for the beneficiaries. However, it may not be the best option for everyone, and it is important to consider your individual needs and circumstances when choosing a life insurance policy.

Contents

- Frequently Asked Questions

- What is a 15 Year Term Life Insurance Policy?

- How much coverage can I get with a 15 Year Term Life Insurance Policy?

- What are the benefits of a 15 Year Term Life Insurance Policy?

- Can I renew my 15 Year Term Life Insurance Policy?

- Can I convert my 15 Year Term Life Insurance Policy to a permanent life insurance policy?

- Can I Keep Medicaid If My Job Offers Insurance?

- Does Smile Direct Club Take Medicaid Insurance?

- Does Life Insurance Payout Affect Medicaid?

Frequently Asked Questions

Here are some commonly asked questions about 15-year term life insurance policies:

What is a 15 Year Term Life Insurance Policy?

A 15-year term life insurance policy is a type of life insurance that provides coverage for a specific period of time, usually 15 years. If the policyholder dies within the term of the policy, their beneficiaries receive a death benefit payout. The premiums for this type of policy are usually fixed, meaning they stay the same for the entire term of the policy.

This type of policy is typically used to provide coverage during a specific period of time, such as while a person is paying off a mortgage or while their children are young and dependent on their income. Once the policy expires, the policyholder can choose to renew the policy, convert it to a permanent life insurance policy, or let the coverage end.

How much coverage can I get with a 15 Year Term Life Insurance Policy?

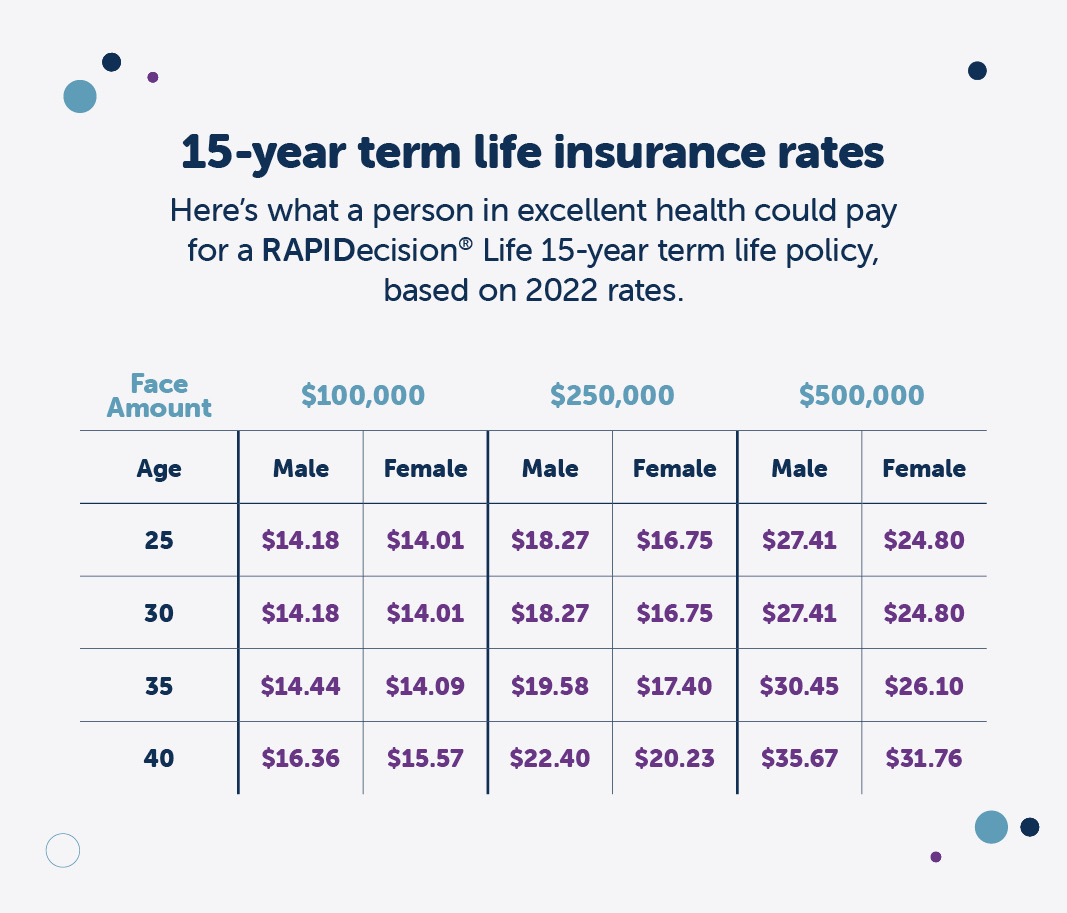

The amount of coverage you can get with a 15-year term life insurance policy depends on your individual needs and circumstances. Most insurance companies offer policies with coverage amounts ranging from $50,000 to several million dollars. When determining how much coverage you need, consider factors such as your income, debts, and expenses, as well as any future financial obligations you may have, such as college tuition for your children.

It’s important to choose a coverage amount that will adequately protect your loved ones in the event of your death. A financial advisor or insurance agent can help you determine how much coverage you need.

What are the benefits of a 15 Year Term Life Insurance Policy?

One of the main benefits of a 15-year term life insurance policy is that it provides affordable coverage for a specific period of time. The premiums for this type of policy are often lower than those for permanent life insurance policies, making it a good option for those on a budget.

Additionally, this type of policy can provide peace of mind for those who have specific financial obligations or dependents they want to protect. If the policyholder dies within the term of the policy, their beneficiaries will receive a death benefit payout that can be used to pay off debts, cover expenses, or provide for their family.

Can I renew my 15 Year Term Life Insurance Policy?

Most insurance companies allow policyholders to renew their 15-year term life insurance policy at the end of the term. However, the premiums for the renewed policy may be higher than those for the original policy, as the policyholder will be older and may have a higher risk of death or health issues.

It’s important to review your policy carefully and speak with your insurance agent before renewing your policy to ensure that it still meets your needs and provides adequate coverage for your current circumstances.

Can I convert my 15 Year Term Life Insurance Policy to a permanent life insurance policy?

Many insurance companies offer the option to convert a 15-year term life insurance policy to a permanent life insurance policy. This can be a good option for those who want to continue their coverage beyond the term of the policy without having to reapply for a new policy.

However, it’s important to note that the premiums for a permanent life insurance policy are typically higher than those for a term life insurance policy, as permanent policies provide coverage for the policyholder’s entire life. Additionally, the conversion option may only be available for a limited time, so it’s important to review your policy carefully and speak with your insurance agent to determine if this is the right option for you.

A 15 year term life insurance policy is a type of life insurance policy that provides coverage for a specific period of time, usually 15 years. This policy is ideal for those who want to provide financial protection for their loved ones during a specific time frame, such as until their children are grown or until a mortgage is paid off. It is also a more affordable alternative to permanent life insurance policies, as it typically has lower premiums.

Overall, a 15 year term life insurance policy can provide peace of mind and financial security for you and your loved ones. It is important to carefully consider your individual needs and circumstances before selecting a life insurance policy, and to work with a knowledgeable professional to help you make the best decision. With the right policy in place, you can rest assured that your loved ones will be taken care of in the event of an unexpected tragedy.

Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering individuals to make well-informed decisions. Guided by his passion, he has assembled a team of seasoned insurance professionals committed to simplifying the intricate world of insurance for you.

- Latest Posts by Rakibul Hasan

-

Can I Keep Medicaid If My Job Offers Insurance?

- -

Does Smile Direct Club Take Medicaid Insurance?

- -

Does Life Insurance Payout Affect Medicaid?

- All Posts